Categories Tech

At the heart of this lies the most important technique in modern deep learning - transfer learning.

Let's analyze how it

THREAD: Can you start learning cutting-edge deep learning without specialized hardware? \U0001f916

— Radek Osmulski (@radekosmulski) February 11, 2021

In this thread, we will train an advanced Computer Vision model on a challenging dataset. \U0001f415\U0001f408 Training completes in 25 minutes on my 3yrs old Ryzen 5 CPU.

Let me show you how...

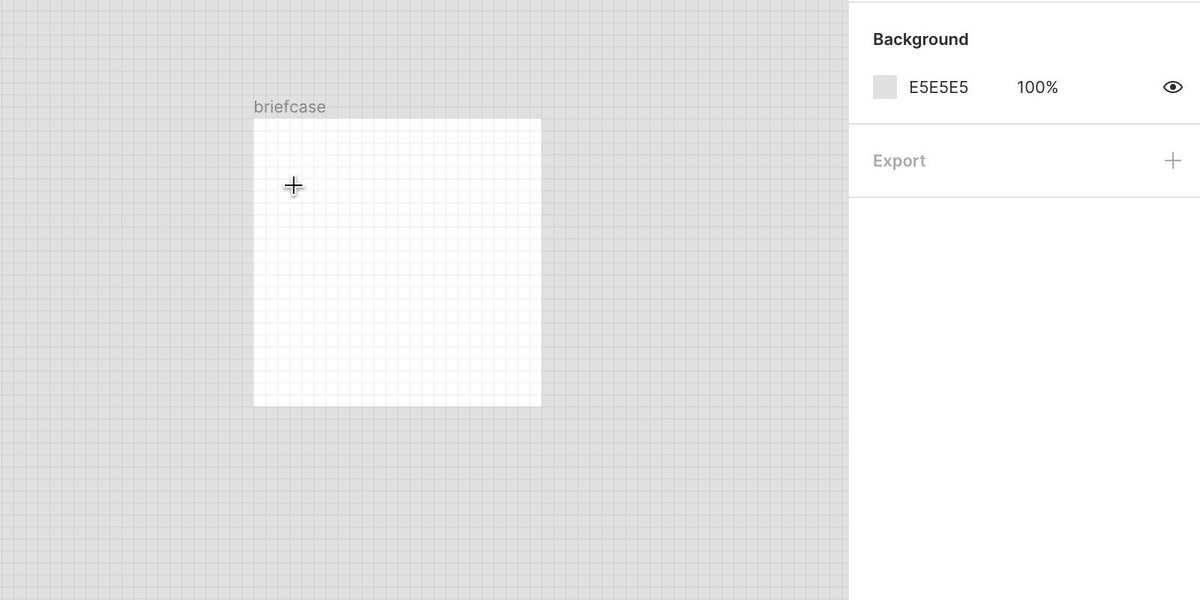

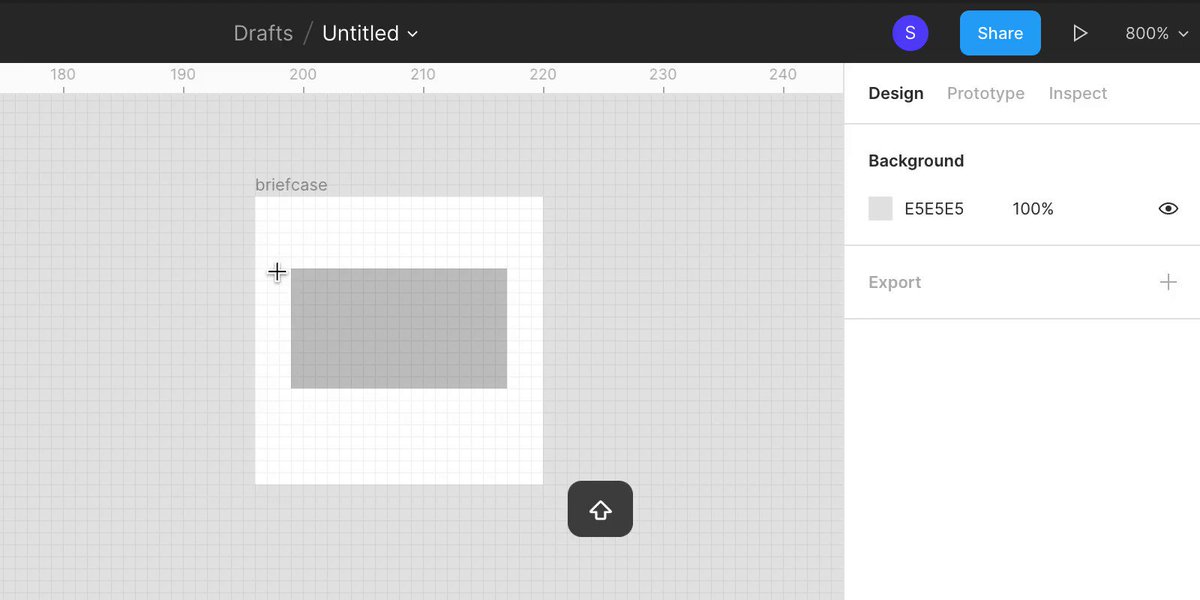

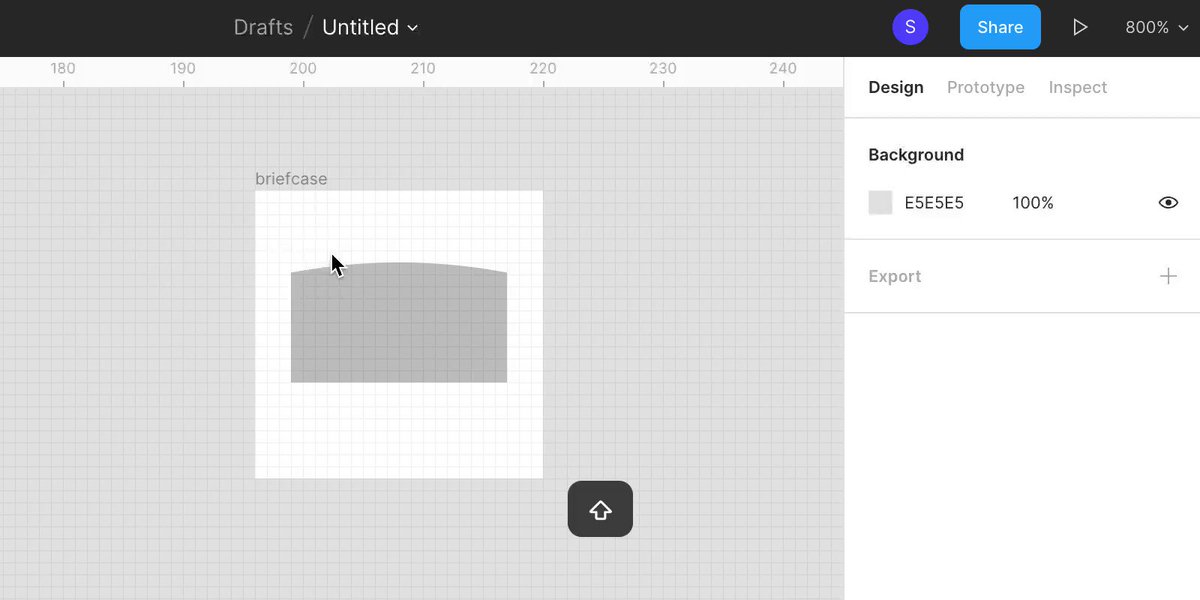

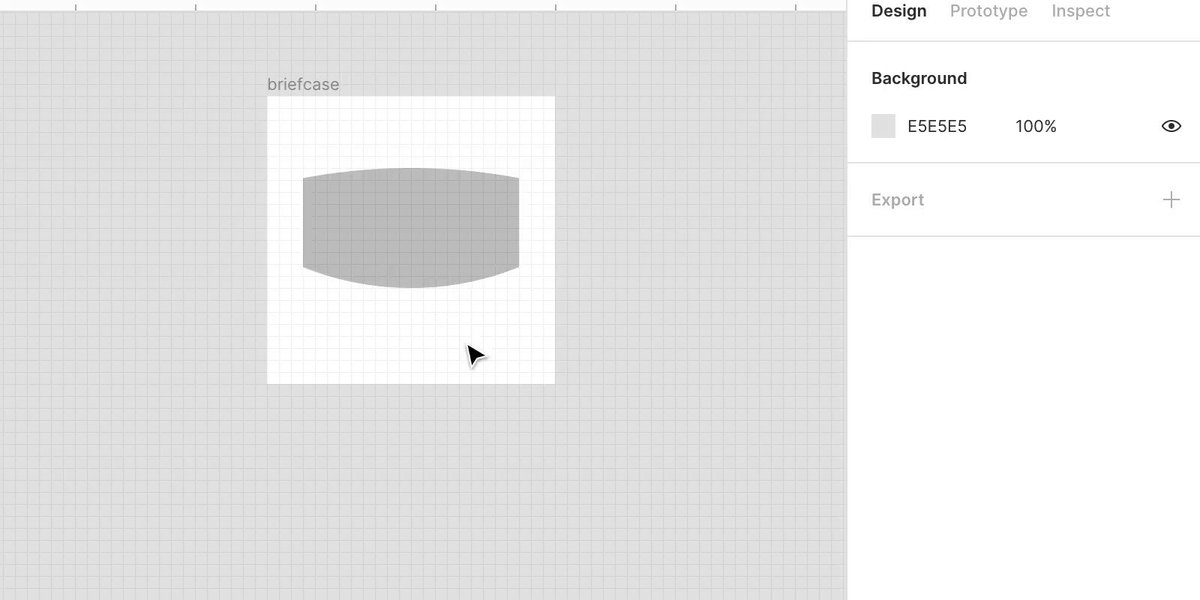

2/ For starters, let's look at what a neural network (NN for short) does.

An NN is like a stack of pancakes, with computation flowing up when we make predictions.

How does it all work?

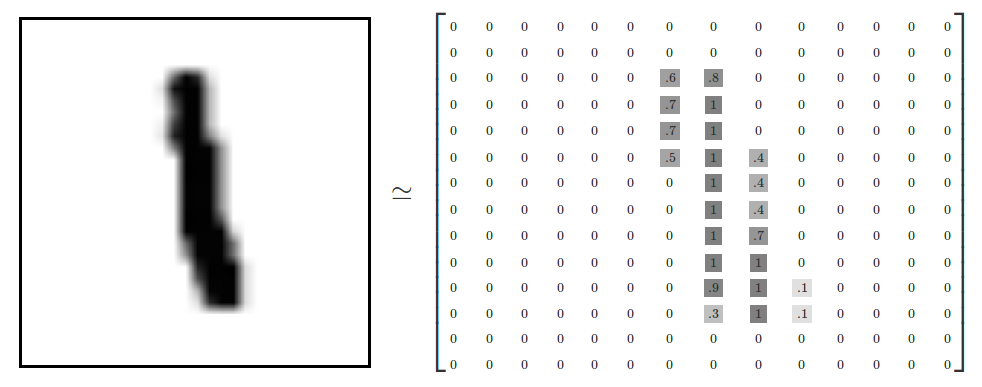

3/ We show an image to our model.

An image is a collection of pixels. Each pixel is just a bunch of numbers describing its color.

Here is what it might look like for a black and white image

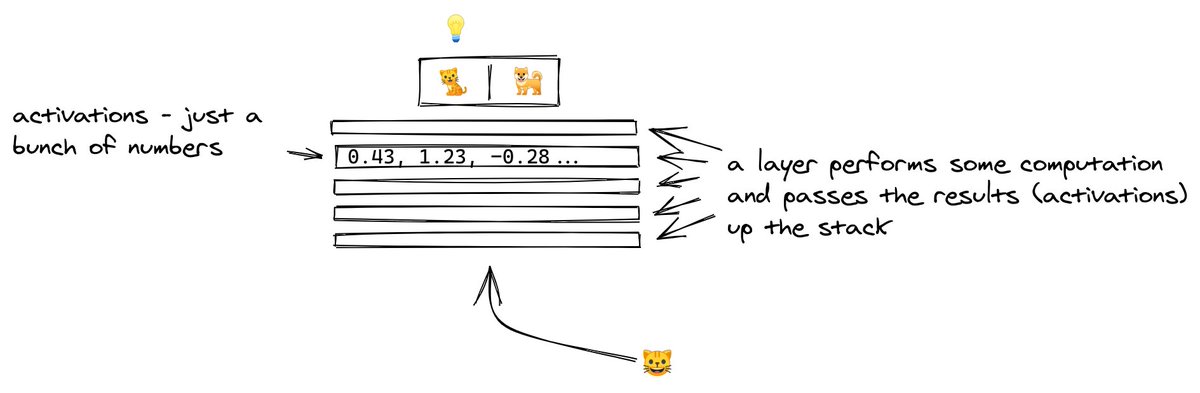

4/ The picture goes into the layer at the bottom.

Each layer performs computation on the image, transforming it and passing it upwards.

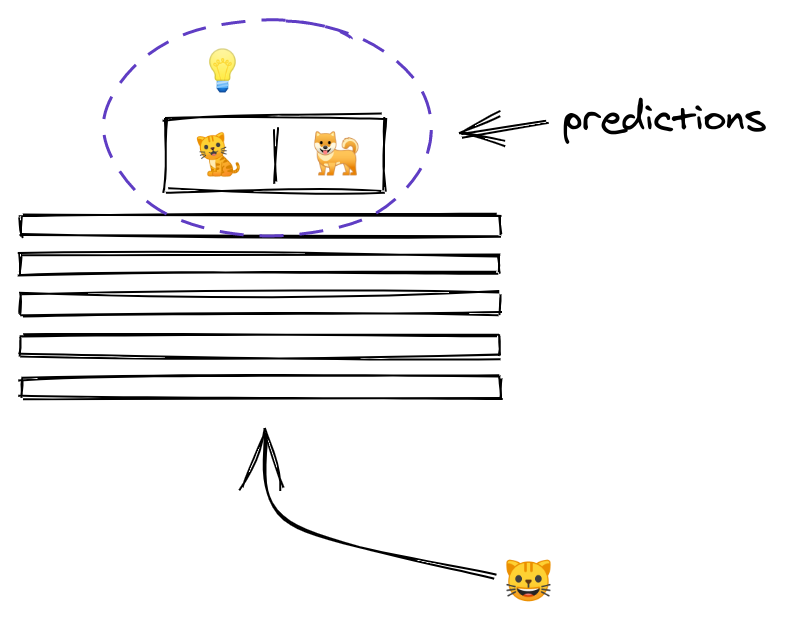

5/ By the time the image reaches the uppermost layer, it has been transformed to the point that it now consists of two numbers only.

The outputs of a layer are called activations, and the outputs of the last layer have a special meaning... they are the predictions!

1) Get yourself on the official Sorare Discord group https://t.co/1CWeyglJhu, the forum is always full of interesting debate. Got a question? Put it on the relevant thread & it's usually answered in minutes. This is also a great place to engage directly with the @SorareHQ team.

2) Bury your head in @HGLeitch's @SorareData & get to grips with all the collated information you have to hand FOR FREE! IMO it's vital for price-checking, scouting & S05 team building plus they are hosts to the forward thinking SO11 and SorareData Cups 🏆

3) Get on YouTube 📺, subscribe to @Qu_Tang_Clan's channel https://t.co/1ZxMsQR1kq & engross yourself in hours of Sorare tutorials & videos. There's a good crowd that log in to the live Gameweek shows where you get to see Quinny scratching his head/ beard over team selection.

4) Make sure to follow & give a listen to the @Sorare_Podcast on the streaming service of your choice 🔊, weekly shows are always insightful with great guests. Worth listening to the old episodes too as there's loads of information you'll take from them.

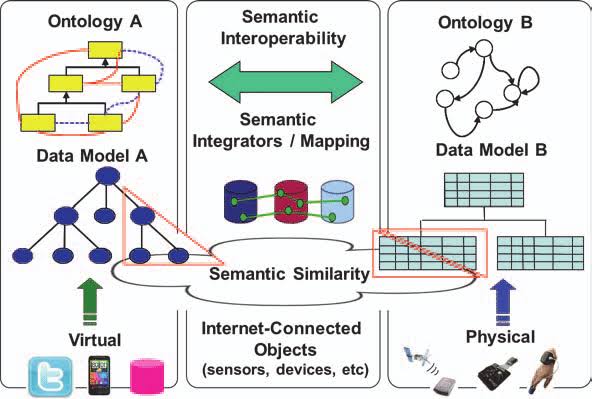

So I have been studying this entire communication layer as its relevance is ever growing with more devices coming online, staying connected, and relying on real-time communication. Not that this domain under penetrated, but there is a change underway.

— Ameya (@Finstor85) February 10, 2021

This thread is inspired by one of the articles I read on the-ken about #postman API & how they are transforming & expediting software product delivery & consumption, leading to enhanced developer productivity.

We all know that #Twilio offers host of APIs that can be readily used for faster integration by anyone who wants to have communication capabilities. Before we move ahead, let's get a few things cleared out.

Can anyone build the programming capability to process payments or communication capabilities? Yes, but will they, the answer is NO. Companies prefer to consume APIs offered by likes of #Stripe #twilio #Shopify #razorpay etc.

This offers two benefits - faster time to market, of course that means no need to re-invent the wheel + not worrying of compliance around payment process or communication regulations. This makes entire ecosystem extremely agile

@MadhusudanKela @VQIndia @sameervq

My key learnings: ⬇️⬇️⬇️

Bubble or Bull Market? Join us for a short presentation and candid one on one on 27th Jan, 4pm with Shri \u2066@MadhusudanKela\u2069. \u2066@VQIndia\u2069 \u2066@sameervq\u2069 #bubbleorbullmarket pic.twitter.com/LBvlBrz6mS

— Ravi Dharamshi (@ravidharamshi77) January 24, 2021

First, the BEAR case:

1. Bitcoin has surpassed all the bubbles of the last 45 years in extent that includes Gold, Nikkei, dotcom bubble.

2. Cyclically adjusted PE ratio for S&P 500 almost at 1929 (The Great Depression) peaks, at highest levels except the dotcom crisis in 2000.

3. World market cap to GDP ratio presently at 124% vs last 5 years average of 92% & last 10 years average of 85%.

US market cap to GDP nearing 200%.

4. Bitcoin (as an asset class) has moved to the 3rd place in terms of price gains in preceding 3 years before peak (900%); 1st was Tulip bubble in 17th century (rising 2200%).