Categories Economy

7 days

30 days

All time

Recent

Popular

1. "ThE gReAt rEplAcEMeNt iS A cOnSpiRaCy tHEorY" https://t.co/BXdtcNxrVf

2. "ThE gReAt rEplAcEMeNt iS A cOnSpiRaCy tHEorY"

3. "ThE gReAt rEplAcEMeNt iS A cOnSpiRaCy tHEorY"

4. "ThE gReAt rEplAcEMeNt iS A cOnSpiRaCy tHEorY"

5. "ThE gReAt rEplAcEMeNt iS A cOnSpiRaCy tHEorY"

The great replacement isn't a conspiracy theory, it is the inevitable outcome of non-stop immigration of populations whom do not wish to assimilate and have way higher birth rates than the native population... It's purely a mathematical reality.

— Angelo John Gage (@AngeloJohnGage) December 30, 2020

2. "ThE gReAt rEplAcEMeNt iS A cOnSpiRaCy tHEorY"

3. "ThE gReAt rEplAcEMeNt iS A cOnSpiRaCy tHEorY"

4. "ThE gReAt rEplAcEMeNt iS A cOnSpiRaCy tHEorY"

5. "ThE gReAt rEplAcEMeNt iS A cOnSpiRaCy tHEorY"

On Jan 6, 2021, the always stellar Mr @deepakshenoy tweeted, this:

https://t.co/fa3GX9VnW0

Innocuous 1 sentence, but its a full economic theory at play.

Let me break it down for you. (1/n)

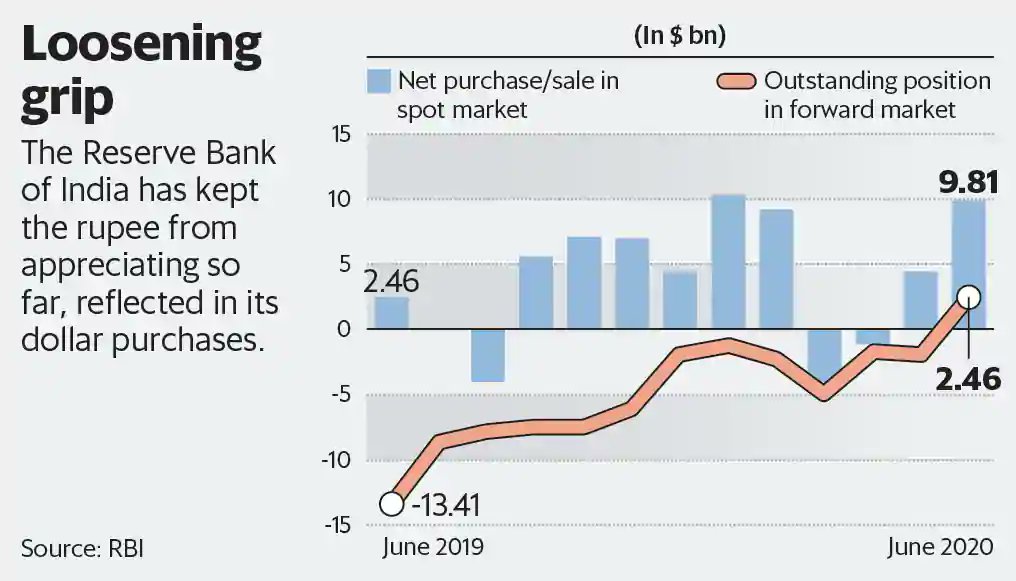

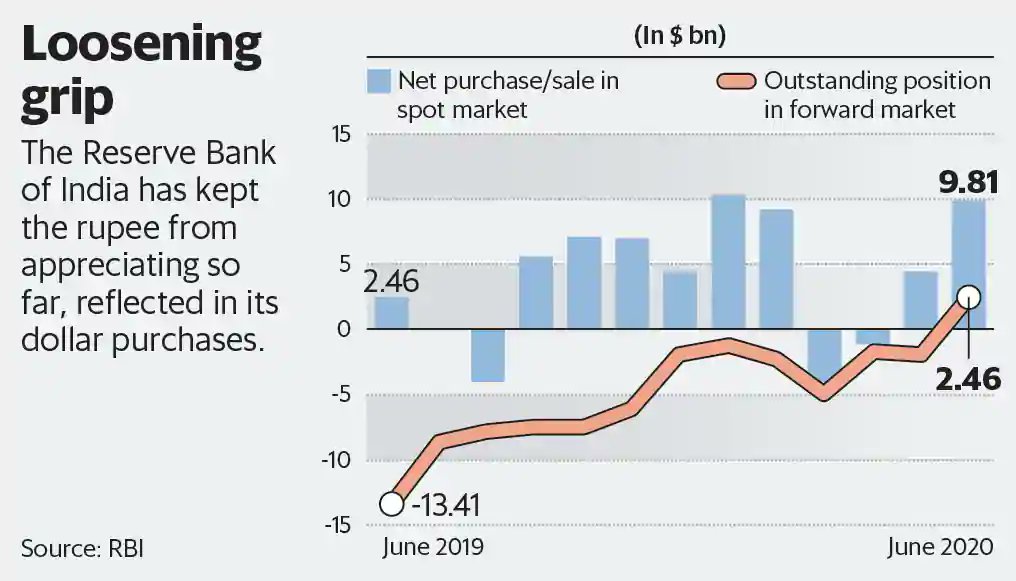

On September 30, 2020, I wrote an article for @CFASocietyIndia where I explained that RBI is all set to lose its ability to set interest rates if it continues to fiddle with the exchange rate (2/n)

What do I mean, "fiddle with the exchange rate"?

In essence, if RBI opts and continues to manage exchange rate, then that is "fiddling with the exchange rate"

RBI has done that in the past and has restarted it in 2020 - very explicitly. (3/n)

First in March 2020, it opened a Dollar/INR swap of $2B with far leg to be unwound in September 2020.

Implying INR will be bought from the open markets in order to prevent INR from falling vis a vis USD (4/n)

The Second aspect is now, that dollar inflow is happening, and the forex reserves swelled -> implying the rupee is appreciating, RBI again intervened from September, by selling INR in spot markets. (5/n)

https://t.co/9kpWP7ovyM

https://t.co/fa3GX9VnW0

Innocuous 1 sentence, but its a full economic theory at play.

Let me break it down for you. (1/n)

91 day TBills at 3.03%. Interest rates are even lower than RBI has them.

— Deepak Shenoy (@deepakshenoy) January 6, 2021

On September 30, 2020, I wrote an article for @CFASocietyIndia where I explained that RBI is all set to lose its ability to set interest rates if it continues to fiddle with the exchange rate (2/n)

What do I mean, "fiddle with the exchange rate"?

In essence, if RBI opts and continues to manage exchange rate, then that is "fiddling with the exchange rate"

RBI has done that in the past and has restarted it in 2020 - very explicitly. (3/n)

First in March 2020, it opened a Dollar/INR swap of $2B with far leg to be unwound in September 2020.

Implying INR will be bought from the open markets in order to prevent INR from falling vis a vis USD (4/n)

The Second aspect is now, that dollar inflow is happening, and the forex reserves swelled -> implying the rupee is appreciating, RBI again intervened from September, by selling INR in spot markets. (5/n)

https://t.co/9kpWP7ovyM

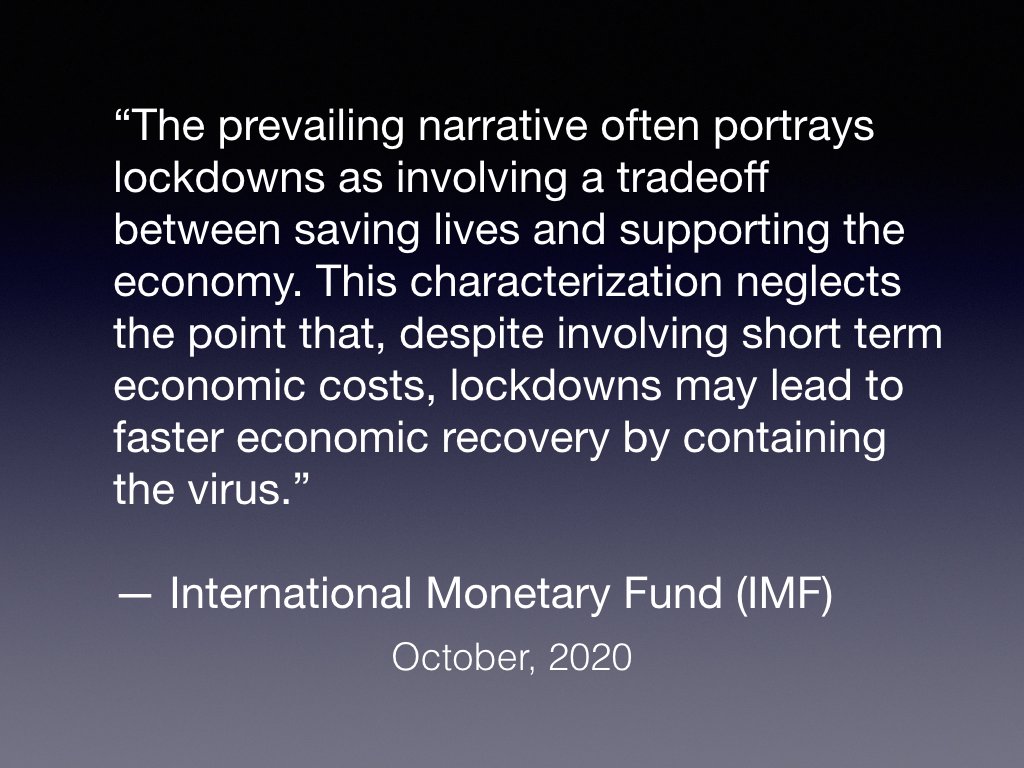

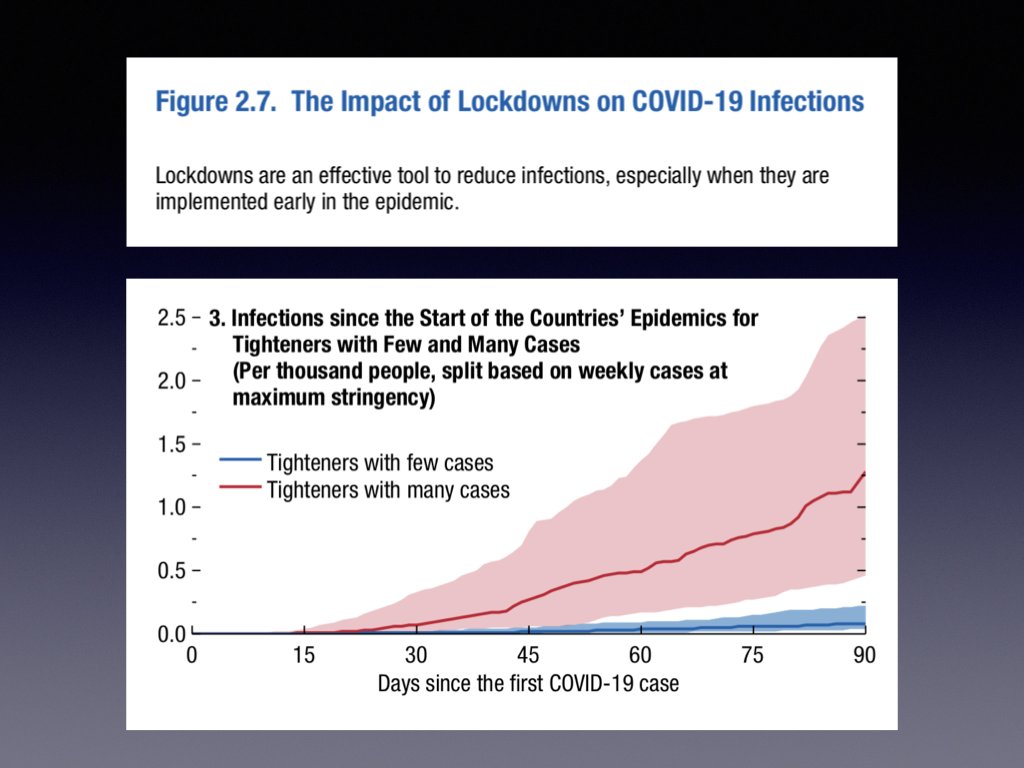

The International Monetary Fund (IMF) is analyzing damage due to COVID and projecting further severe consequences if current policies persist. They state “despite involving short term economic costs, lockdowns may lead to faster economic recovery by containing the virus”

1/

Note: This report doesn’t do a dynamic analysis that makes things much clearer, but it does a thoughtful statistical analysis based upon increasingly available data.

https://t.co/5Xmt8y7lCL

A few more quotes:

2/

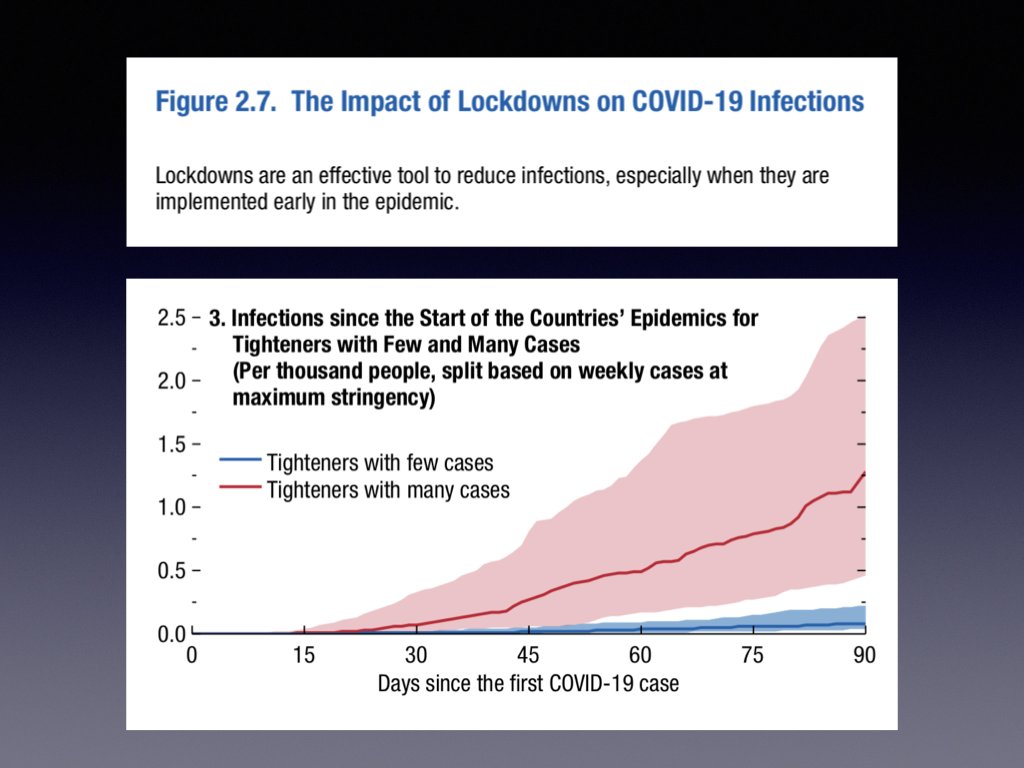

“The analysis also finds that lockdowns are powerful instruments to reduce infections, especially when they are introduced early in a country’s epidemic and when they are sufficiently stringent.”

3/

“lockdowns become progressively more effective in reducing COVID-19 cases when they become sufficiently stringent. Mild lockdowns appear instead ineffective at curbing infections.”

4/

“The results suggest that to achieve a given reduction in infections, policymakers may want to opt for stringent lockdowns over a shorter period rather than prolonged mild lockdowns...

5/

1/

Note: This report doesn’t do a dynamic analysis that makes things much clearer, but it does a thoughtful statistical analysis based upon increasingly available data.

https://t.co/5Xmt8y7lCL

A few more quotes:

2/

“The analysis also finds that lockdowns are powerful instruments to reduce infections, especially when they are introduced early in a country’s epidemic and when they are sufficiently stringent.”

3/

“lockdowns become progressively more effective in reducing COVID-19 cases when they become sufficiently stringent. Mild lockdowns appear instead ineffective at curbing infections.”

4/

“The results suggest that to achieve a given reduction in infections, policymakers may want to opt for stringent lockdowns over a shorter period rather than prolonged mild lockdowns...

5/

Thread on eminent people supporting farm laws:

Dr. Gita Gopinath, Chief Economist at IMF says "Farm bills are in right

Dr. Surjit Bhalla, executive director at IMF support farm

Godrej Agrovet Chairman Nadir Godrej tells Bloomberg that agriculture reforms are important for

Prof Ashok Gulati supports new farm

Vice-Chairman of Bharti Enterprises Rajan Bharti Mittal supports the new farm

Dr. Gita Gopinath, Chief Economist at IMF says "Farm bills are in right

Dr. Surjit Bhalla, executive director at IMF support farm

Godrej Agrovet Chairman Nadir Godrej tells Bloomberg that agriculture reforms are important for

Godrej Agrovet Chairman Nadir Godrej tells Bloomberg that agriculture reforms are important for India. pic.twitter.com/N6rnelLn0E

— BloombergQuint (@BloombergQuint) December 11, 2020

Prof Ashok Gulati supports new farm

Vice-Chairman of Bharti Enterprises Rajan Bharti Mittal supports the new farm