- Barter system, you give me a cow and I give you 100 kgs of rice (2/n)

𝐀 𝐩𝐫𝐢𝐦𝐞𝐫 𝐨𝐧 𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧 & 𝐂𝐫𝐲𝐩𝐭𝐨𝐬 🧵

I still everyday meet investors who think Bitcoin & Blockchain are the same & this thread is specifically for them

Do re-tweet & help us educate more invetsors ☺

#Investing #Cryptos #Bitcoin (1/n)

- Barter system, you give me a cow and I give you 100 kgs of rice (2/n)

- It was difficult to transact in fractions

- What if I want only 50 kgs of rice? I cant give you half a cow right?

- This is the prime reason for the introduction of smaller units of payment method we now call as coins (3/n)

- It was malleable & portable

- It was non corrosive, could be stored for a long time

- It was a perfect combination of abundance & rare

- Plus it was eye catching & visually appealing (4/n)

a) When paper currencies were introduced, it was decided that a country could only print as much currency as the gold reserves they have but this was withdrawn in 1971 bcoz of which the central banks could then print as much money as they wanted

(c) To solve the above problem, Bitcoin was invented. (6/n)

(a) It claims to be a Store of value (like Gold is) & a payment method (Like $ is) (7/n)

(a) Assume split wise. Friends go out, sometimes someone pays and sometime someone else. At the end of the year, there is a ledger mentioning how much does who owes whom. (9/n)

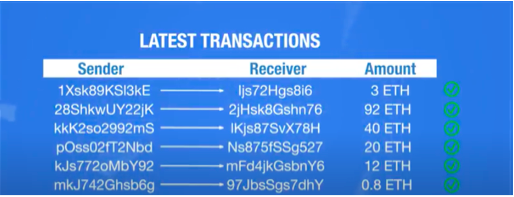

(c) Currently, banks do this verification when you transact through the bank. Banks maintain transaction record of credits & debits (10/n)

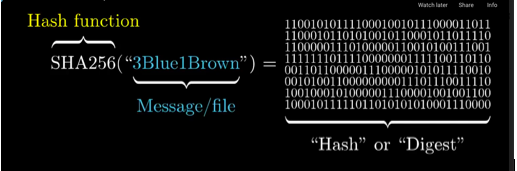

(e) But what can you do to decentralize? No banks, no NSE/BSE/CDSL/NSDL? To verify the transactions, you use computational work (replacing intermediaries (Banks) with computational work), let me explain (11/n)

(a) There are multiple computers also called as miners or NODEs are connected to each other on open source software (12/n)

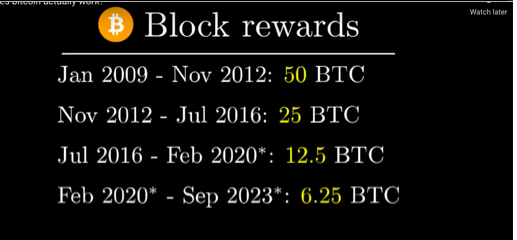

(a) It is called Bitcoin Halving

(b) It reduces the bitcoin reward for the miners by half every time 2,10,000 blocks are verified (18/n)

(d) This is the bitcoin reward 4 solving the block & no new bitcoins after 2,10,00,000 bitcoin are released

(a) Altcoins - Anything other than a Bitcoin is called the Altcoin. Example – Ethereum, Cardano, Polkadot (20/n)

(c) Meme-Coins - Made for fun, have no logic. Example – Doge, Shiba (21/n)

(a) Blockchain is a brilliant technology & has multiple use cases in various industries

(b) But on Bitcoin, I am not sure if it will be able to replace paper currencies as a medium of transaction or gold as a store of value. (22/n)

(d) Altcoins with use cases like De-fi will evolve over time & we will talk about it in the next thread. Will also talk about the fancy around NFT's & Metaverse going forward (23/24)

@KirtanShahCFP

Have earlier written on,

-Sector Analysis

-Macro

-Debt Markets

-Equity

-Gold

-Personal Finance etc. You can find them all in the link below https://t.co/UrRt87xIJF…………… (END)

Here\u2019s a compilation of Personal Finance threads I have written so far. Thank you for motivating me to do it.

— Kirtan A Shah (@KirtanShahCFP) December 13, 2020

Hit the 're-tweet' and help us educated more investors

More from Kirtan A Shah

Personal Finance 101 – My learning’s about investing

This topic is for everyone, whether you manage your money yourself or through your advisor, it will go a long way in managing your finances.

Do re-tweet & help us educate retail investors (1/n)

Subscribe to our YouTube for some interesting educational content around Personal Finance - https://t.co/jvgNEDWiAZ

And you can also join our Telegram channel for regular updates – https://t.co/Ekz6I8pDGt (2/n)

(1) Lets start with Life Insurance

Term Insurance is the best way to take an insurance cover & probably the only product to buy in life insurance. Make sure u disclose all the necessary information before taking the insurance. Smoking, Alcohol, any pre-existing deceases etc(3/n)

Have atleast 10-15 times of your annual income as insurance cover

But there are variants of term insurance that you should avoid (4/n)

(A) Term plan with return of premium

For a non-smoker born on the 1st Jan 1985 & policy term 39 years (till age 75), the regular premium for a 1-cr term insurance is 22,157 (inclusive of GST) but with returns of premium is 42670 (inclusive of GST). An increase of 20,513 (5/n)

This topic is for everyone, whether you manage your money yourself or through your advisor, it will go a long way in managing your finances.

Do re-tweet & help us educate retail investors (1/n)

Subscribe to our YouTube for some interesting educational content around Personal Finance - https://t.co/jvgNEDWiAZ

And you can also join our Telegram channel for regular updates – https://t.co/Ekz6I8pDGt (2/n)

(1) Lets start with Life Insurance

Term Insurance is the best way to take an insurance cover & probably the only product to buy in life insurance. Make sure u disclose all the necessary information before taking the insurance. Smoking, Alcohol, any pre-existing deceases etc(3/n)

Have atleast 10-15 times of your annual income as insurance cover

But there are variants of term insurance that you should avoid (4/n)

(A) Term plan with return of premium

For a non-smoker born on the 1st Jan 1985 & policy term 39 years (till age 75), the regular premium for a 1-cr term insurance is 22,157 (inclusive of GST) but with returns of premium is 42670 (inclusive of GST). An increase of 20,513 (5/n)

More from Bitcoin

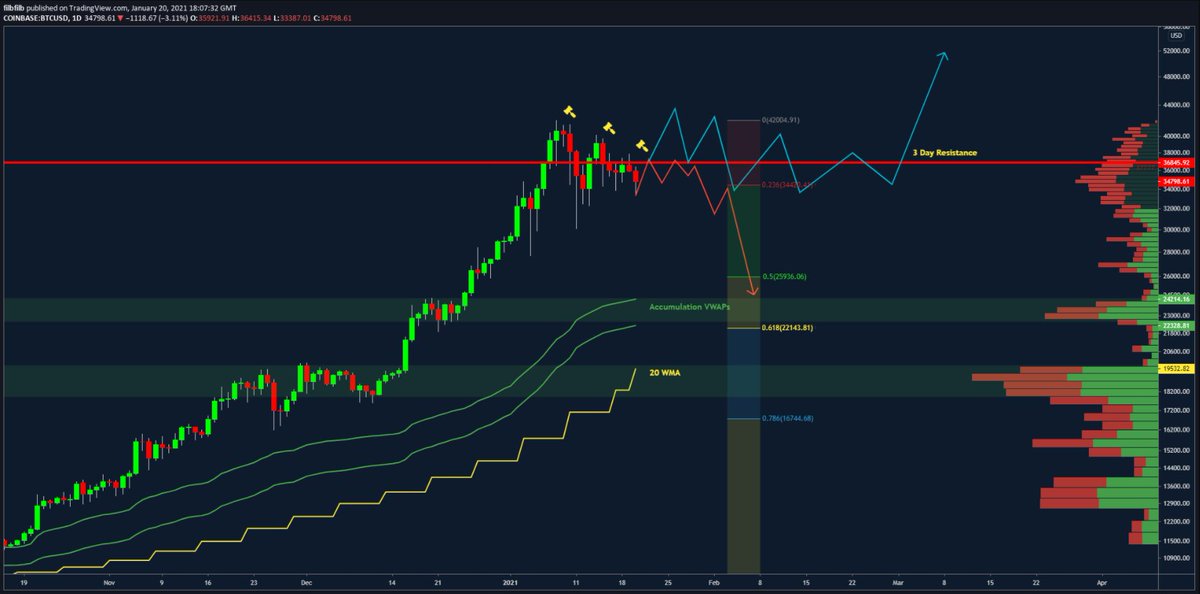

#Bitcoin update:

- Trapped in consolidation between $30 and $38k

- Lower highs and supply above c$38k

- Buying interest on the books £30-33k

- Meme consolidation triangle

- 20 wma @ $19.5k

- Accumulation VWAPs in the 20s

- underlying tether fud

- 61.8% retracement c. $22k

- 3 Day predator unconfirmed Orange candle

- Demand at low $30s was tested today and has since bounced & Coinbase led price on the drop

- Market structure is complex - Triangle is misleading

- Lots of orders stacked @ 30-33k.

- Market is fearful in the demand zone as shown by funding; i do not think we are ready to drop quite yet; Expecting longer consolidation.

- New Tether output has been on hold but new money came today

- Tether case request for 30 more days; could be indicative of consolidation

- Breakdown in price deeper than high $20s / lower $30s would IMO most likely require FUD induced event

- If stars align 20 WMA is catching up fast and will probably be resting in with the accumulation VWAPs, 61.8% retracement &d drives into big buy orders.

- Why did we stop @ $40k?

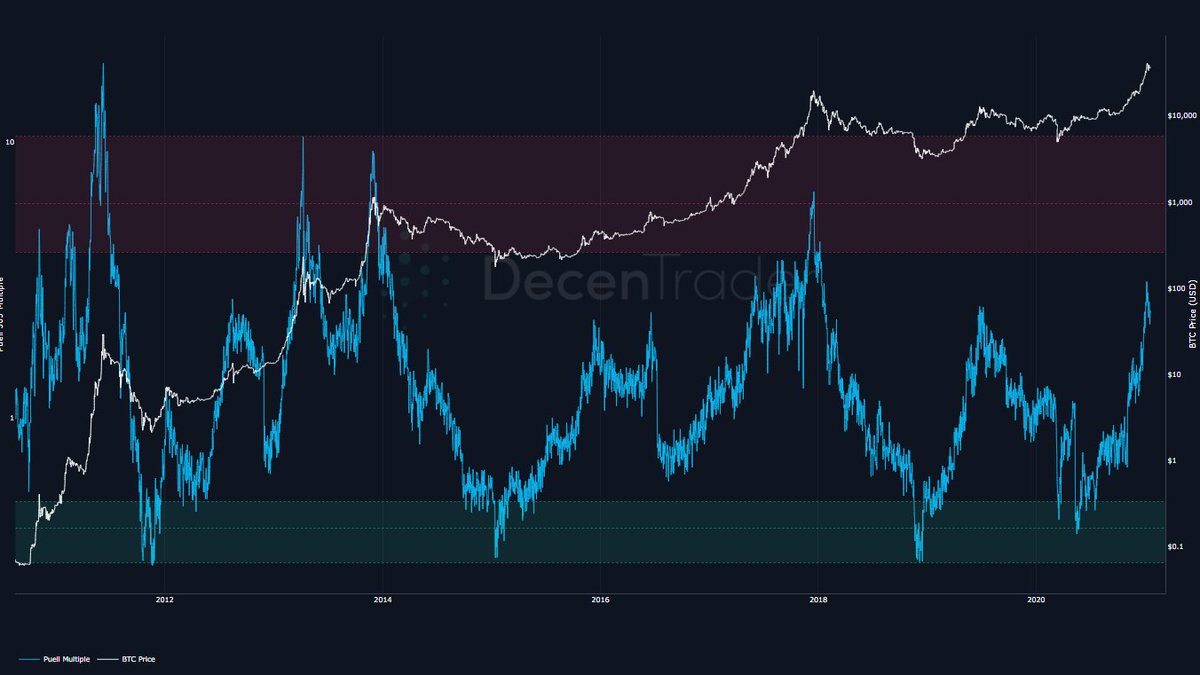

- Miners deep in profit vs. 654 average; time to tp

- SImilar response in other cycles

https://t.co/Iurd68NnZZ

- Trapped in consolidation between $30 and $38k

- Lower highs and supply above c$38k

- Buying interest on the books £30-33k

- Meme consolidation triangle

- 20 wma @ $19.5k

- Accumulation VWAPs in the 20s

- underlying tether fud

- 61.8% retracement c. $22k

- 3 Day predator unconfirmed Orange candle

- Demand at low $30s was tested today and has since bounced & Coinbase led price on the drop

- Market structure is complex - Triangle is misleading

- Lots of orders stacked @ 30-33k.

- Market is fearful in the demand zone as shown by funding; i do not think we are ready to drop quite yet; Expecting longer consolidation.

- New Tether output has been on hold but new money came today

- Tether case request for 30 more days; could be indicative of consolidation

- Breakdown in price deeper than high $20s / lower $30s would IMO most likely require FUD induced event

- If stars align 20 WMA is catching up fast and will probably be resting in with the accumulation VWAPs, 61.8% retracement &d drives into big buy orders.

- Why did we stop @ $40k?

- Miners deep in profit vs. 654 average; time to tp

- SImilar response in other cycles

https://t.co/Iurd68NnZZ

1/THREAD: WHEN WAS IT CLEAR?

Oct. 8, 2020: The purpose of this thread is to document and timestamp when it first became clear that #Bitcoin was likely to become a major reserve asset for public corporations, and eventually states, with Square's purchase of $50M in BTC.

The purpose is to give something to cite when ppl later claim "But there was NO WAY OF KNOWING..."

h/t @ErikSTownsend who used the same format to call out the impact of Covid on Feb 8 and made me personally aware of the looming shutdown of the country https://t.co/opuiNgSeqC !

Bitcoiners smarter than me have been predicting the takeover of the dollar by Bitcoin for many years.

In 2014 with Bitcoin barely at $1B, @pierre_rochard wrote https://t.co/EGHa58KqHq, covering all the incorrect narratives of Bitcoin and stating it will overtake the dollar.

"[skeptics] misunderstand how strong currencies like bitcoin overtake weak currencies like the dollar: it is through speculative attacks and currency crises caused by investors, not through the careful evaluation of tech journalists and 'mainstream consumers'" - @pierre_rochard

I first became bullish on Bitcoin in the summer of 2016, around a $3B market cap, but it was still a toy project at that time in the eyes of most in the financial world, while many technologists thought of it as a v1 technology to be improved on.

Oct. 8, 2020: The purpose of this thread is to document and timestamp when it first became clear that #Bitcoin was likely to become a major reserve asset for public corporations, and eventually states, with Square's purchase of $50M in BTC.

The purpose is to give something to cite when ppl later claim "But there was NO WAY OF KNOWING..."

h/t @ErikSTownsend who used the same format to call out the impact of Covid on Feb 8 and made me personally aware of the looming shutdown of the country https://t.co/opuiNgSeqC !

1/THREAD: WHEN WAS IT CLEAR?

— Erik Townsend \U0001f6e2\ufe0f (@ErikSTownsend) February 8, 2020

Feb. 8, 2020: The purpose of this thread is to document and timestamp when it first became clear that nCov was likely to lead to a global pandemic.

The purpose is to give something to cite when ppl later claim "But there was NO WAY OF KNOWING..."

Bitcoiners smarter than me have been predicting the takeover of the dollar by Bitcoin for many years.

In 2014 with Bitcoin barely at $1B, @pierre_rochard wrote https://t.co/EGHa58KqHq, covering all the incorrect narratives of Bitcoin and stating it will overtake the dollar.

"[skeptics] misunderstand how strong currencies like bitcoin overtake weak currencies like the dollar: it is through speculative attacks and currency crises caused by investors, not through the careful evaluation of tech journalists and 'mainstream consumers'" - @pierre_rochard

I first became bullish on Bitcoin in the summer of 2016, around a $3B market cap, but it was still a toy project at that time in the eyes of most in the financial world, while many technologists thought of it as a v1 technology to be improved on.

You May Also Like

1/x Fort Detrick History

Mr. Patrick, one of the chief scientists at the Army Biological Warfare Laboratories at Fort Detrick in Frederick, Md., held five classified US patents for the process of weaponizing anthrax.

2/x

Under Mr. Patrick’s direction, scientists at Fort Detrick developed a tularemia agent that, if disseminated by airplane, could cause casualties & sickness over 1000s mi². In a 10,000 mi² range, it had 90% casualty rate & 50% fatality rate

3/x His team explored Q fever, plague, & Venezuelan equine encephalitis, testing more than 20 anthrax strains to discern most lethal variety. Fort Detrick scientists used aerosol spray systems inside fountain pens, walking sticks, light bulbs, & even in 1953 Mercury exhaust pipes

4/x After retiring in 1986, Mr. Patrick remained one of the world’s foremost specialists on biological warfare & was a consultant to the CIA, FBI, & US military. He debriefed Soviet defector Ken Alibek, the deputy chief of the Soviet biowarfare program

https://t.co/sHqSaTSqtB

5/x Back in Time

In 1949 the Army created a small team of chemists at "Camp Detrick" called Special Operations Division. Its assignment was to find military uses for toxic bacteria. The coercive use of toxins was a new field, which fascinated Allen Dulles, later head of the CIA

Mr. Patrick, one of the chief scientists at the Army Biological Warfare Laboratories at Fort Detrick in Frederick, Md., held five classified US patents for the process of weaponizing anthrax.

2/x

Under Mr. Patrick’s direction, scientists at Fort Detrick developed a tularemia agent that, if disseminated by airplane, could cause casualties & sickness over 1000s mi². In a 10,000 mi² range, it had 90% casualty rate & 50% fatality rate

3/x His team explored Q fever, plague, & Venezuelan equine encephalitis, testing more than 20 anthrax strains to discern most lethal variety. Fort Detrick scientists used aerosol spray systems inside fountain pens, walking sticks, light bulbs, & even in 1953 Mercury exhaust pipes

4/x After retiring in 1986, Mr. Patrick remained one of the world’s foremost specialists on biological warfare & was a consultant to the CIA, FBI, & US military. He debriefed Soviet defector Ken Alibek, the deputy chief of the Soviet biowarfare program

https://t.co/sHqSaTSqtB

5/x Back in Time

In 1949 the Army created a small team of chemists at "Camp Detrick" called Special Operations Division. Its assignment was to find military uses for toxic bacteria. The coercive use of toxins was a new field, which fascinated Allen Dulles, later head of the CIA