Categories Economy

Most Western countries are already starting to reconsider whether Hong Kong will remain a viable trading centre.

— Isaac Cheung | \U0001f1ed\U0001f1f0 | (@SoAlive0513) February 15, 2021

When the entire world stops trading with HK, how will HK be the financial center of the world?

I doubt tourism would be any better in the next few years either lol

https://t.co/6wuRzXGkYZ The West propaganda seems to make people think we are cracking down on 🇭🇰 people because we no longer need them and we will inevitably suppress their rights. Every now and then, I talk with people in 🇭🇰 who think the Great Firewall will extend to 🇭🇰

🇺🇸-led liberal order is very strong to come across 🇭🇰 people and make them believe what they want. Brainwashed people don't think rationally and fall for the lies and propaganda. This guy is one among so many others I met in 🇭🇰 who told me the same thing, that the city is doomed

They couldn't be more ignorant ! Unfortunately they will end up leaving the city and missing out on incredible opportunities... But they don't know that nothing will eventually change after 2047 ? 🙃Let me explain you why

I bet even after 2047 🇭🇰 will still enjoy a high degree of autonomy and freedoms that its mainland counterpart can’t enjoy : an independent legal and financial system, English as one of the official language, an access to the West internet, its traditional medias, etc.

I can't tell if I'm agreeing or disagreeing with @jc_econ.

There is no relationship b/w deficits & interest rates in the US & many other advanced economies. Centuries of dynamic institution building underpin our reserve currency status that allows rates to be a function of economic fundamentals, flows & policy not credit risk 1/3

— Dr. Julia Coronado (@jc_econ) January 26, 2021

Increasing government spending or reducing taxes increases demand (or reduces saving). This raises the price of loanable funds or the interest rate.

In a dynamic context, more demand means a stronger economy, the central bank raises interest rates sooner, and long rates rise.

(As an aside, we are not close to the United States needing to worry about credit risk and the risks are more overstated than understated in most other advanced economies too. But credit risk is not always & everywhere irrelevant, just look at the UK in 1976 or Canada in 1994.)

Interest rates have fallen over the last 20 yrs while debt has risen. This does not necessarily mean that debt rising causes interest rates to fall. It could also mean that other things have happened at he same time that pushed down interest rates more than debt pushed them up.

The suspects for these "other things" include slower productivity growth, slower popln growth, higher inequality, less investment, etc. All of which either increase the supply of saving or reduce the demand for investment, reducing the equilibrium interest rate.

THREAD/

https://t.co/1lFaJM52RX

https://t.co/i5HOfZ19r7

https://t.co/DuPSrrqnzz

https://t.co/0ANveWdvFO

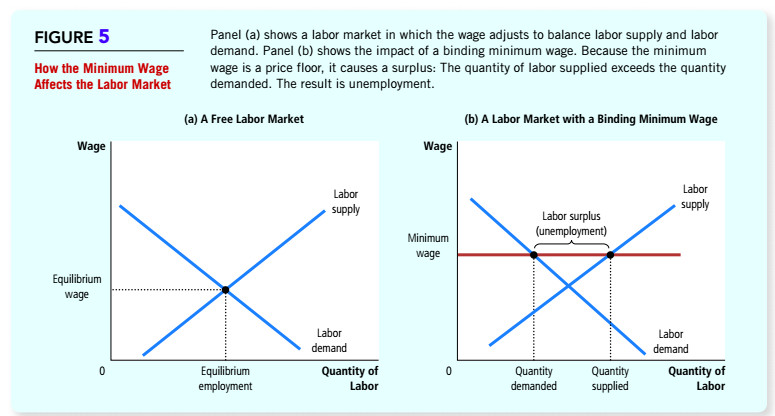

The min wage is a wedge that threatens to undermine all of orthodox economic theory.

1/4 Most people, especially academic economists, think that the controversy over the minimum wage is a contest over facts. It's not. It's a contest over power, status, and wealth. It is just like the contest over racial and gender justice.

— Nick Hanauer (@NickHanauer) January 17, 2021

2/ Orthodox economics is grounded in two fundamental models: a systems model that describes the market as a closed equilibrium system, and a behavioral model that describes humans as rational, self-interested utility-maximizers. The modern min wage debate undermines both models.

3/ The assertion that a min wage kills jobs is so central to orthodox economics that it is often used as the textbook example of the Supply/Demand curve. Raise the cost of labor and businesses will buy less of it. It's literally Econ 101!

4/ Econ 101 insists that markets automatically set an efficient "equilibrium price" for labor & everything else. Mess with this price and bad things happen. Yet decades of empirical research has persuaded a majority of economists that this just isn't

5/ How can this be? Well, either the market is not a closed equilibrium system in which if you raise the price of labor employers automatically purchase less of it... OR the market is not automatically setting an efficient and fair equilibrium wage. Or maybe both. #FAIL

Let’s do an update and go through some exciting developments. In short, the picture for NatGas continues to improve from all angles.

A thread.

Time for a thread about US NatGas and why it will surprise to the upside...

— BVDDY (@BvddyCorleone) October 22, 2020

There\u2019s an exceptional opportunity setting up in the energy space, in particular for US NatGas and related equities.

I\u2019ll explain the setup in this thread and also reveal my top pick. \U0001f920