Categories Bitcoin

This isn't another opinion piece on #Bitcoin , in-fact, it's exactly the opposite. 👇🏼

This thread is a list of resources I have found to be useful and insightful when it comes to understanding the pros and cons of #Bitcoin .

Below, you'll find knowledgeable people 👩🏽💻, articles/essays 📝, podcasts 🎧 and videos 📹 about #Bitcoin . Enjoy!

/2 People 👩🏽💻

These individuals are valuable to listen to, whilst they are bullish, they justify their stance:

@RaoulGMI

@michael_saylor

@DTAPCAP

@APompliano

@VentureCoinist

@AlexSaundersAU

@danheld

@aantonop

@jchervinsky

@real_vijay

@lawmaster

@LynAldenContact

/3 Resources 🏢

A video library of interviews from various Bitcoin enthusiasts. 👇🏼

https://t.co/CJJvHavSOn

A great guide for new investors to Bitcoin. 👇🏼

https://t.co/fOoSfTlWr5

A portal for people to go from zero knowledge to intermediate level.

/4 Tweet threads 🐦

A great thread on rebuttals from common #Bitcoin queries/criticisms. 👇🏼

https://t.co/tPEpFMMPhH

Why companies are starting to put BTC on the balance sheet. 👇🏼

https://t.co/lL71M1A3NF

“A double-spend broke Bitcoin" debunked.

1/ Fear and Bitcoin.

— Dan Held (@danheld) January 10, 2021

Whenever Bitcoin has a bull run, naysayers try to cope with missing the boat by rationalizing why it will fail through \u201cFear, Uncertainty, and Doubt\u201d or what we Bitcoiners have nicknamed \u201cFUD.\u201d

As each asset class goes on-chain, it can be stored in a digital wallet. And it can be traded against other such assets. Not just cryptocurrencies, but national digital currencies, personal tokens, etc.

We’re about to enter an age of global monetary competition.

The defi matrix is the table of all pair wise trades. It’s the fiat/stablecoin pairs, the fiat/crypto pairs, the crypto/crypto pairs, and much more besides.

Uniswap-style automatic market making for everything. Every possession you have, constantly marked to market by ~2040.

More liquidity, less currency?

This is an interesting point. Cash doesn’t make you money. In fact, it can lose you money in an inflating environment.

Reliable, 24/7 mark-to-market on everything is hard — but if achieved, means less % of assets in cash.

Thus less use for currencies as people can more easily store their wealth into assets and easily trade them.

— Pierre-Yves Gendron (@pierreyvesg7) February 24, 2021

AMMs boost BTC. Here's why.

- All assets trade against all assets in the defi matrix

- Automated market makers give liquidity for rare pairs

- Everything is marked-to-market 24/7

- Value of cash drops, as you can liquidate instantly

- The new no-op is to keep your assets in BTC

Basically, automated market makers like @Uniswap boost BTC in the long term, because they allow *everything* to be priced in BTC terms, and *anyone* to switch out of BTC into their asset of choice.

Though in practice this may mean WBTC/RenBTC [or ETH!] rather than BTC itself.

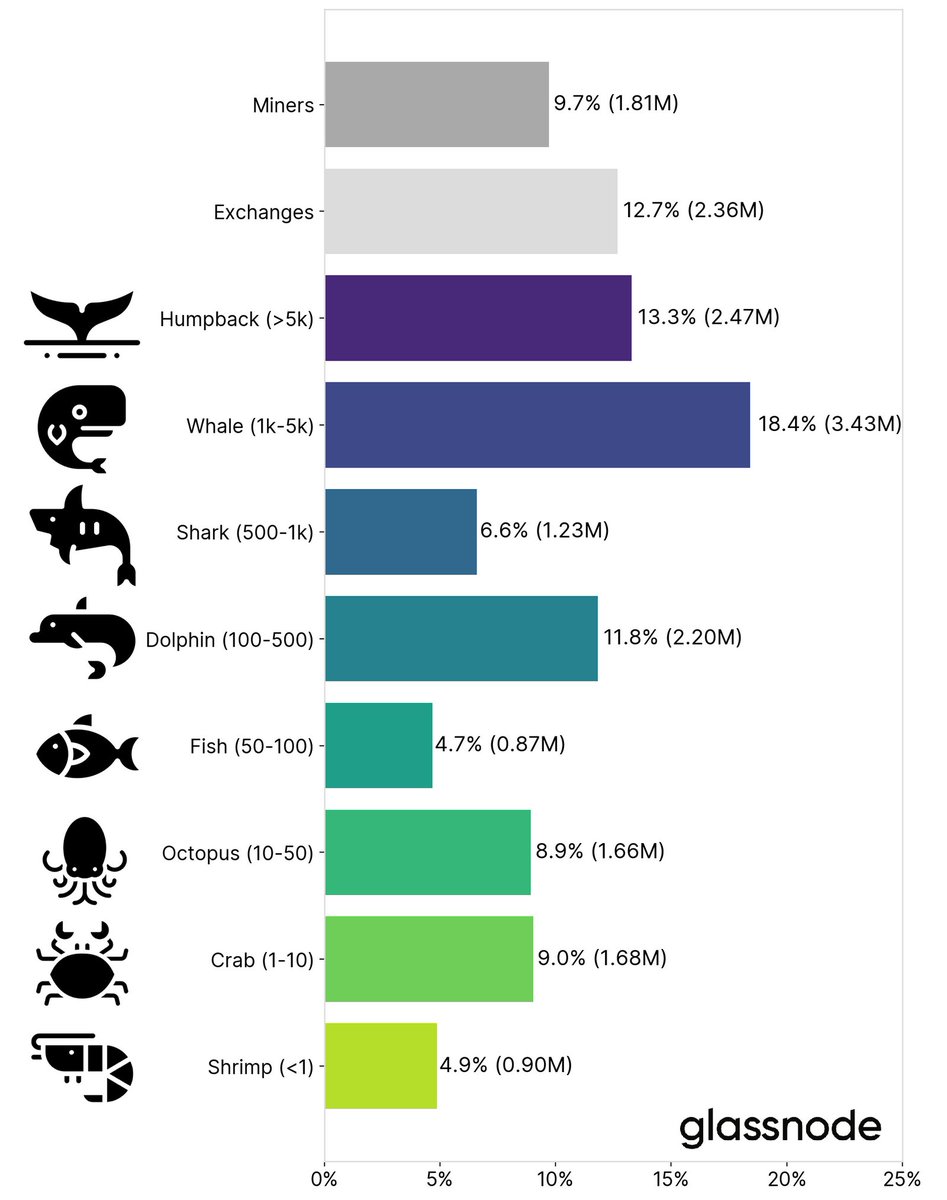

claim: bitcoin ownership is heavily concentrated.

@business published an article claiming "2% of accounts control 95% of all Bitcoin" 🤣

truth: the facts, my friends, simple don't line up. let's dive in!

2/ interrogating on-chain addresses is tricky.

address =/ account.

one person can control multiple addresses.

one address can hold bitcoin belonging to multiple ppl.

exchanges and trading firms will have addresses with large balances that represent client funds.

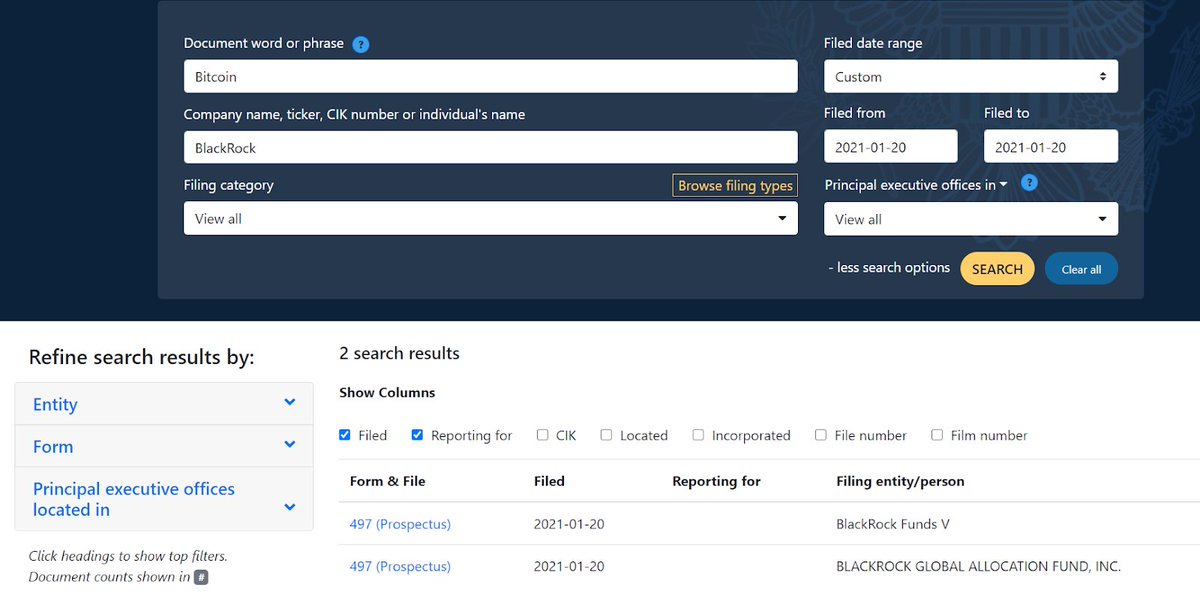

3/ the fine folks @glassnode published an excellent analysis of on-chain address balances in January

the ownership distribution of bitcoin among wallets is actually much more diverse than one might expect.

full piece here:

https://t.co/n5IdIQdNoA

4/ 31% of BTC is held in addresses not identified as exchange wallets.

these are likely institutions, funds, custodians, and OTC desks.

our analysis at @CoinSharesCo indicates >15% of all bitcoin is held in third party custody, including @coinbase and our own @KomainuCustody

5/ in fact, between asset managers @Grayscale ($36B in BTC) and our @xbtprovider ($4B in BTC), 4% of bitcoin is locked up by fund providers and asset managers!

our @CoinSharesCo research team publishes an EXCELLENT weekly report on fund flows and AUMs -

-Most of DeFi falling 50-80%

-CFTC charging BitMEX

-POTUS contracting Covid

-Delayed stimulus talks

-FCA announcing a derivative ban for retail

Why? Let’s see what we can find on-chain

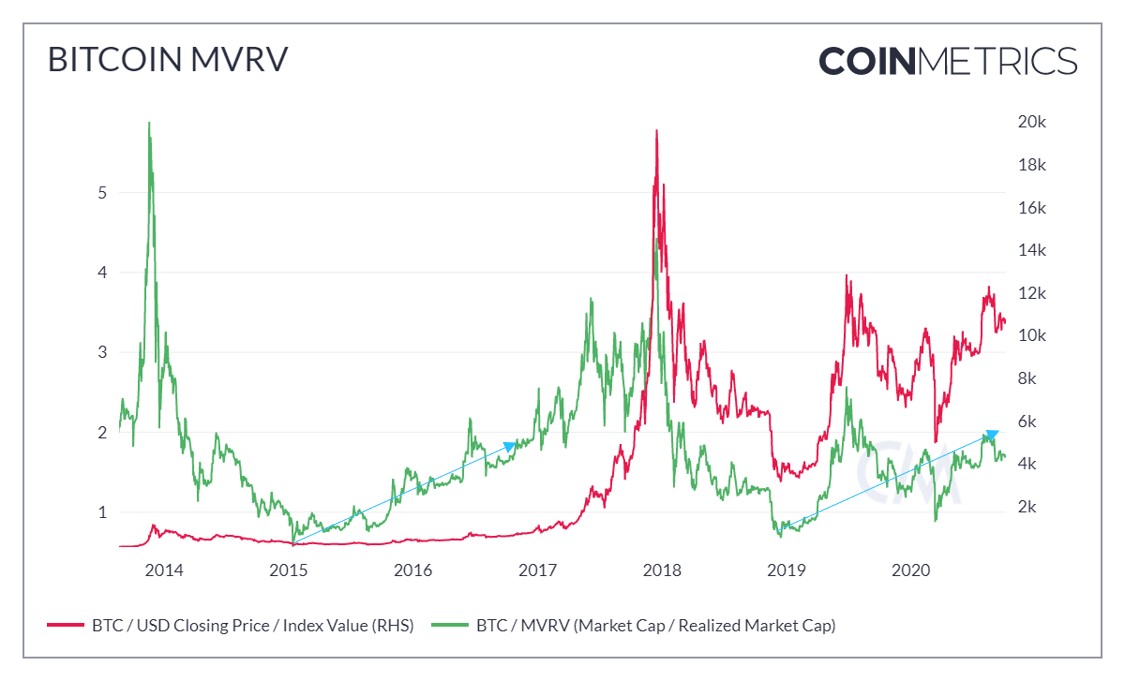

2/9 Bitcoin’s Realized Cap has been steadily increasing just as it did before the 2017 bull market took off. If it continues as it did in 2017, 2021 should be an interesting year.

https://t.co/nqgX7vTMDV

3/9 Bitcoin MVRV, whilst more volatile this market cycle, is also is holding the same trajectory it did during the 2016/17 bull market

https://t.co/jadbn6nCOB

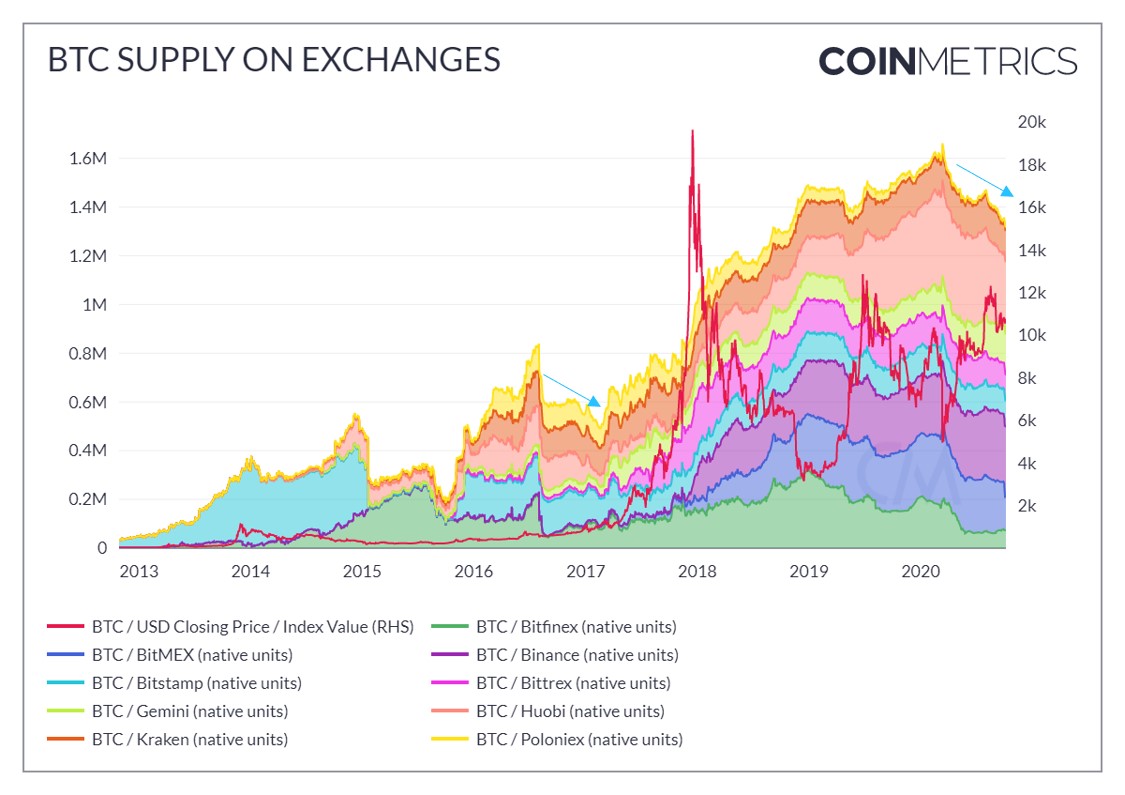

4/9 Looking at the supply of Bitcoin on exchanges is a good indication as to whether or not users are increasing trading activity, or increasing hodl activity. With supply reducing it looks like the tendency recently has been driven by hodlers

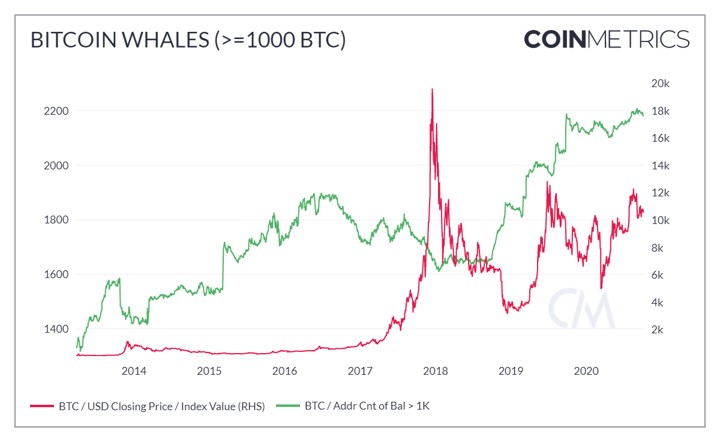

5/9 Despite the recent volatility, the number of Bitcoin whales continues to increase, indicating the growing number of large holders that have positive expectations for the future of Bitcoin

I wanted to take some time to cover some resources I use in my daily $BTC trading. This will be a longer thread, so bear with it you will hopefully find something that will help you also. I will try to keep it concise so if there are any questions please DM me.

11. Portfolio Management & Trade Diary- https://t.co/KAig84dOsk

3Commas gives you the ability to see your full portfolio, mapping your balance and asset breakdown. You have access to all your trade history across all exchange in a single trade diary, saving time extracting taxes

Back with another #FreeLoveFriday. Last time, we covered how Mastercoin/@Omni_Layer pioneered digital asset issuance on blockchains. Today, let\u2019s discuss @Chainlink and the vital role it plays in connecting blockchains to the real world. https://t.co/0poYIBtGrt

— Emin G\xfcn Sirer (@el33th4xor) January 22, 2021

In my thread about Mastercoin, I briefly touched on the vital role fiat-backed stablecoins play in crypto markets, but there’s a catch with them:

The counterparty risk of a third-party holding fiat in reserves.

Enter MakerDAO, which set out to create a decentralized, collateral-backed cryptocurrency, DAI, that would be “soft-pegged” to the U.S. Dollar using the power of algorithms. In crypto tradition, its supporters said trust game theory, not operators.

In 2017, MakerDAO published a whitepaper describing a system where anyone could create DAI by leveraging ETH as collateral to create Collateralized Debt Positions. Essentially, you take out a digital USD loan against your crypto.

The game theory of the system is structured such that DAI issuance is controlled to keep the price pegged to $1.00. In essence, it buffers the fluctuations of the underlying collateral to create a synthetic dollar bill.

Price needs to let volatility wear off before its next big move. Thinking 30K-40K range for the next 1-2 weeks. Then either 50K straight or after piercing 30K and bouncing back above 30K within 1-2 days.

My $BTC short-term view after long deliberation and some flip flopping is rangebound in 30K-40K until the curve and vols come off a further. Then, 50K. I wouldn't be surprised if 30K is briefly breached but the risk is to the upside. Those calling for 20K missing the big picture.

— Alex (@classicmacro) January 12, 2021

$27500-$27000 is the key area. If price heads back down to 30K, expect 30K to be breached, fall to that area, and bounce back. FAST. All very fast.

What do I do with this information?

Simple.

I'm trading the range against a core position. Buying when price pushes lower, selling when higher. It's like playing the achordeon. There's always air left inside.

Where exactly?

Nowhere.

I don't use limits for that. $BTC is liquid enough to trade at market without issues.

I'm watching PA, volume and rates for buying and euphoria as reflected in rates for reducing.

Decision making is dynamic. Nothing is set in stone. But most likely if price heads back down to 30K 'll be holding off next time. The gameplan is to have ammo to buy the dip (to redeploy). If 30K breaks absolutely no buying until down to 27Ks or back above 30K.

1. China PlusToken FUD: Old news. Please see linked thread.

2. U.S. Treasury FUD: Read thread below...

$BTC:

— David Puell (@kenoshaking) November 27, 2020

1/ So here's the deal with all the PlusToken news we've been seeing recently in the crypto media. Thing is, tho it's just being reported now after the Chinese government put out official balances, @ErgoBTC blew this story open for the on-chain community over a year ago... https://t.co/epNjZaNcJ1

1/ These news are much more relevant, as they imply severe trade-offs for people who want to keep their bitcoins undoxxed, with the cost and risks of doing so. I would not disqualify the tweet as mere FUD in the sense that what he posted is false. It should be taken seriously.

2/ For all we know, his decision of making it public before TG weekend may come out of the urgency of informing CT of a poignant anti-Bitcoin move by a Trump administration trying to cut lose ends before leaving office—not just "price manipulation" as I've seen suggested around.

3/ It implies the acceleration of a process already planned for for months in advance, not something he just came up with to "crash the market."

4/ In practicality, assuming this passes, it will have two major consencuences:

a. Armstrong's analysis is correct. And I would go further in saying, this regulation would leave the U.S. severely handicapped to continue to be the leader in the cryptocurrency industry worldwide.

https://t.co/cv4UqsaVAK

That being said I hold some Doge @blockio in an "A-" address myself after 0. 1. "9-" versions :). Don't believe Bitcoin Core the Coin (Utility) is the only visible value on Core chain. Color me crazy. I believe in script. And FOSS that is used to export📜

And that's just a guy @MeniRosenfeld who put his identity and ideas out in the public to build a Web of Trust back when the web was much less of a safe place. His identity at stake and the implementation of a branch in source code by another unsung hero @killerstorm reveals value

Some of those who set up our bright future quietly implemented it in a branch on the main source code before it was officially the Bitcoin Core main repository, before a "Bitcoin Core" entity existed

Just because Bitcoin Core nodes dominate and do not read "smart" colored satoshis or display them, doesn't mean they do not exist on chain. The example of recreating P2WSH-over-P2SH address from BTC https://t.co/ZWSP2MO5bY wallets in Bitcoin Core Gold I shared proves -rescan's $