Authors Kumar saurabh

#No 1 #Shreedigvijaycement

#AR2021 #Shreedigvijay cement. Started this year annual report reading with Digvijay cement. First time read a cement company AR. Some interesting comments on overall economy. Watch it herehttps://t.co/AQM2snbcHG pic.twitter.com/JL4lx26LlC

— kumar saurabh (@suru27) June 1, 2021

#No 2 #Bajajconsumer

#AR2021 #Bajajconsumer. 2nd company. Highlights - Rs 30 cr cost cutting sustainable ? Who gets Rs 8-9 Cr royalty benefit ? Who owns brand ? Why infra subsidiary with losses, intangible asset complexity ? Industry grown fat 2% in volume n 8% in value at 10 yr cagr pic.twitter.com/W4C0H2h8aV

— kumar saurabh (@suru27) June 7, 2021

> 40% correction : 6 to 7%

> 30% correction : 18 to 21%

> 20% correction : 45 to 57%

Bulk of correction between 20-30% from highs

So, above Rs 250 Cr market cap (thats where I like to play mostly), out of 1168 companies:

— kumar saurabh (@suru27) November 22, 2021

> 40% correction : 6% companies

> 30% correction : 18% companies

> 20% correction : 45% companies

Not bad. So, almost evey second company is down by 20% from life time high

An extended analysis of the morning tweet is in this Youtube video. Like and retweet for wider reach

morning tweet on NASDAQ

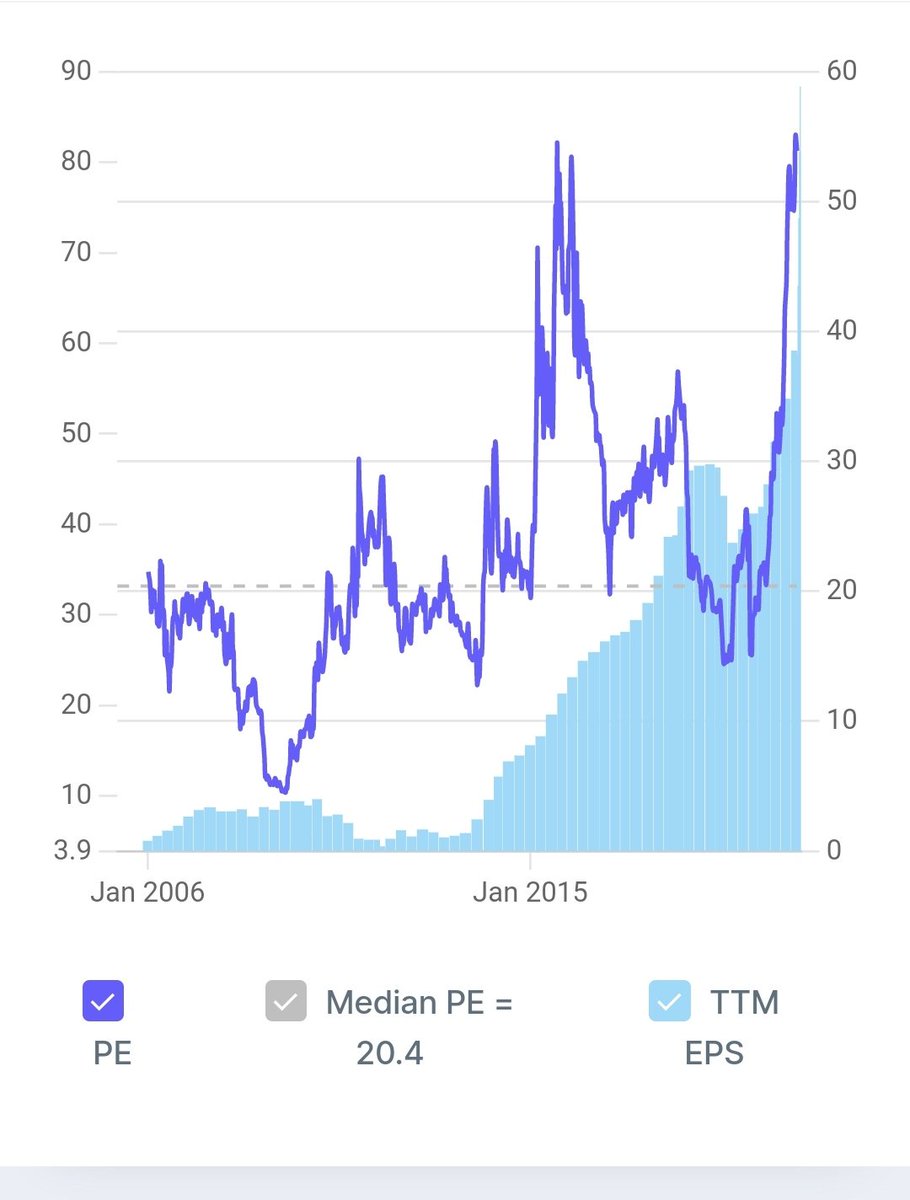

#NASDAQ How much NASDAQ can fall?

— kumar saurabh (@suru27) June 14, 2022

Since 2000, this is the 3rd worst fall in NASDAQ

2000: 77% fall from peak

2008: 55% fall from peak

2022: 34% fall from peak pic.twitter.com/MO8KNtzQez

At scientific investing, we ve "ghoomega" strategy n currently 4 stocks. UFO was one example shared

The least to do is observe all charts of @VVVStockAnalyst @charts_zone @Accuracy_Invst n u will get their pattern

Many were telling me that's stocks move after my post

— Volatility Volume and Value (@VVVStockAnalyst) April 18, 2022

Didn't post nahar cap today when I bought and now it's 10% higher

This shows we surf the move and don't make the move \u270c\ufe0f