SAnngeri Categories Screeners

Do read it completely to understand the stance and the plan.

This thread will present a highly probable scenario of markets for the upcoming months. Will update the scenario too if there is a significant change in view in between.

— Aakash Gangwar (@akashgngwr823) May 15, 2022

1/n https://t.co/jfWOyEgZyd

1. The moving average structure - Many traders just look at the 200 ma test or closing above/below it regardless of its slope. Let's look at all the interactions with 200 ma where price met it for the first time after the trend change but with 200 ma slope against it

One can clearly sense that currently it is one of those scenarios only. I understand that I might get trolled for this, but an unbiased mind suggests that odds are highly against the bulls for making fresh investments.

But markets are good at giving surprises. What should be our stance if price kept on rising? Let's understand that through charts. The concept is still the same. Divergent 200 ma and price move results in 200 ma test atleast once which gives good investment opportunities.

2. Zig-Zag bear market- There are two types of fall in a bear market, the first one is vertical fall which usually ends with ending diagonals (falling wedges) and the second one is zig zag one which usually ends with parabolic down moves.

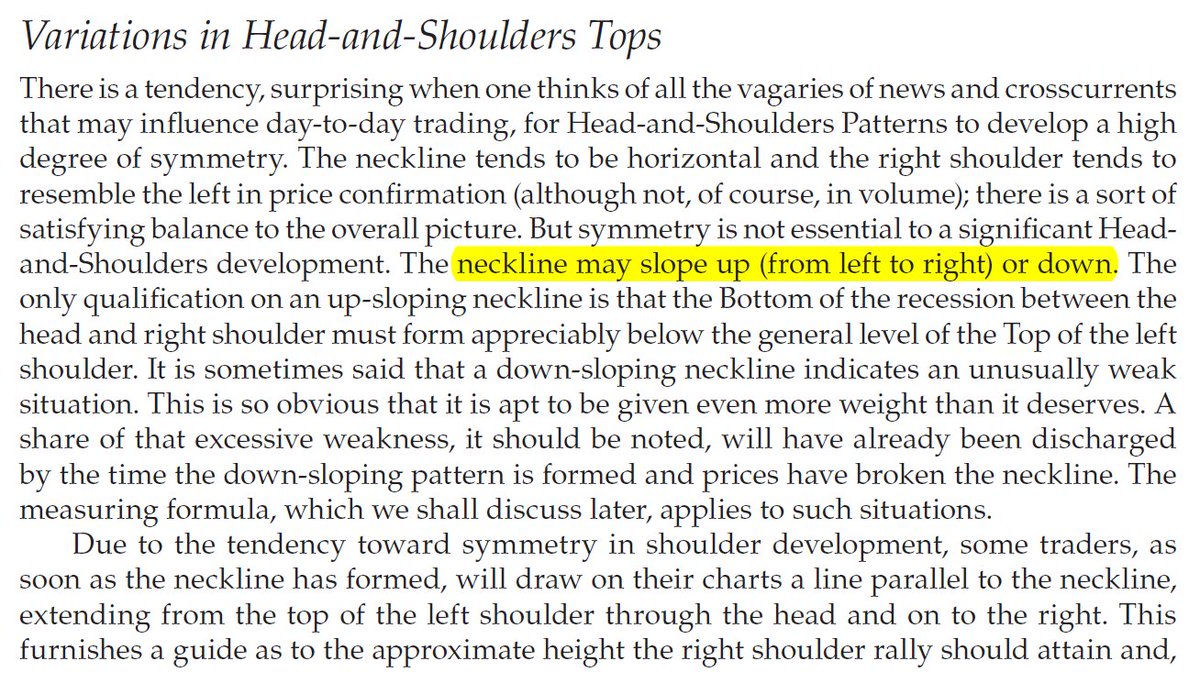

Sir Edwards & Magee discussed sloping necklines in H&S in their classical work. I am considering this breakdown by Affle as an H&S top breakdown with a target open of 770.

— The_Chartist \U0001f4c8 (@charts_zone) May 25, 2022

The target also coincides with support at the exact same level. pic.twitter.com/n84kSgkg4q

1/ Who: @10kdiver

What: The Magic of Compounding

Tweet:

1/

— 10-K Diver (@10kdiver) January 22, 2022

Get a cup of coffee.

In this thread, I'll walk you through the "magic of retained earnings".

This is the basic theory behind why stocks grow exponentially over long periods of time.

As investors, we'd do well to understand this theory -- and the assumptions it's based on. pic.twitter.com/YkBPzvZdbp

2/ Who: @naval

What: Principles to wealth creation

Tweet:

How to Get Rich (without getting lucky):

— Naval (@naval) May 31, 2018

3/ Who: @SteadyCompound

What: The Warren Buffet way of Investing

Tweet:

Buffett's letters taught me more about investing than any business school ever could.

— Thomas Chua (@SteadyCompound) January 1, 2022

Even after investing for 14 years, I uncover new insights every time I reread his letters.

Recently, I reread his letters from 1977 to 2020 for a third time.

Here are my key insights: pic.twitter.com/ZmIjUNbfqz

4/ Who: @Akshat_World

What: Understanding Inflation

Tweet:

If you stay at your job, your average wage growth would be around 5%-7% in India.

— Akshat Shrivastava (@Akshat_World) February 23, 2022

The usual inflation in India is around 6%.

This means that a large segment of folks working at their jobs become poorer in real terms each year.

[A thread]

Take small cap index for example

Whenever Monthly RSI is below or around 40, the index bottoms out

We are getting there.

If I had 50% cash, I would have deployed some in beaten down stocks where earnings growth is intact. https://t.co/t5WwgH1V5o

I have more than 50% cash but still worried if this is a good time. Will invest 20% by EoY

— Tamil Metaverse (@TamilMetaverse) June 21, 2022

I have made some minor tweakings to this timing model since this tweet but it still will give you an idea and primer 👇

Trading 101 with SmallCap Index

— Ravi Sharma (@StocksNerd) August 20, 2019

1. Swing trades when bullish divergence in MACD-H forms

2. Breakout trades if Index closes above 22-Day high

3. Pullback/Pocket Pivot trades if Index consolidates constructively while13-EMA>22-EMA

4. Sell, go cash if Index breaches 10-Day low, NQA pic.twitter.com/u8VjXrU0Re