Authors Ravi Sharma

1) Volatility, Volume & daily range compression scanner

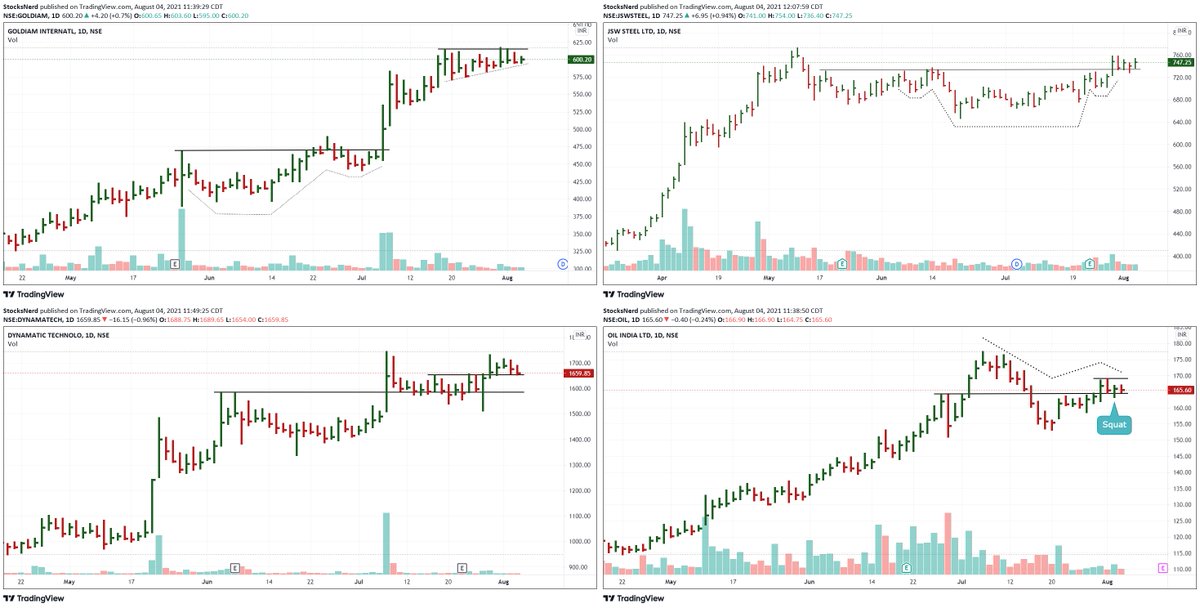

2) Punch-Drunk-Love

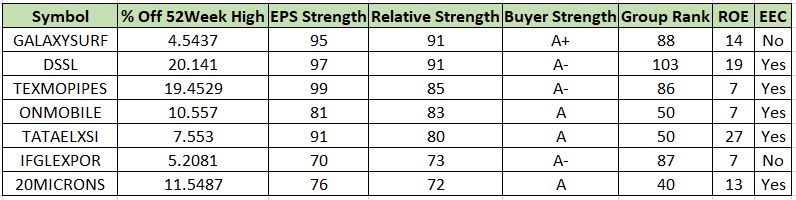

3) GE Ratio - to track fundamentally strong stocks

4) Recently created one to track Power Play setups.

I get around 150-200 stocks daily & choose the ones with the most potential.

Sir, How do u find a set up - Do you track chart of each stock daily ? Or do u have filters , that lead you to a number of stocks , after which you scan them.

— AKASH GUPTA (@lockdownmurti) August 25, 2021

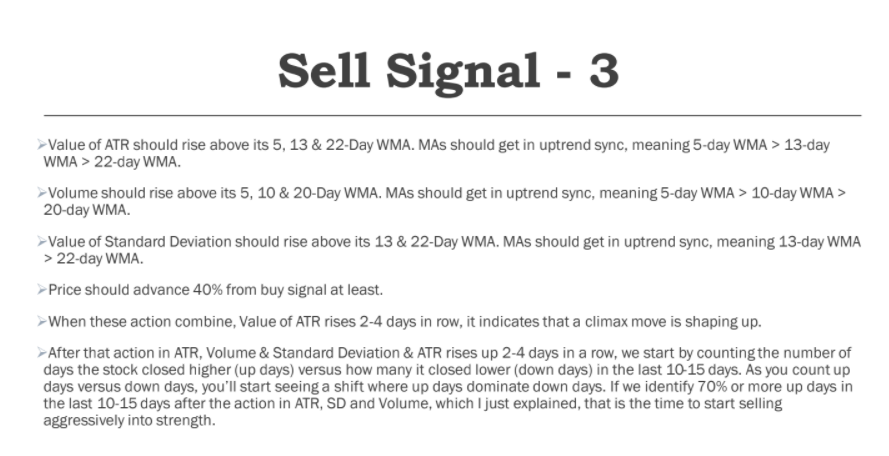

Since market cap of IRCTC is good, I reduced the move rule from 40% to 30% in this case. https://t.co/qzL5rgmtg8

Just a small doubt . I sold Yesterday thinking it was a climax 6% move . How did you decide to sell today ?

— Volatility and Volume Trader (@VolVolatTrader) September 7, 2021

Any rules where you sell positions . Just to learn

While buying breakouts, your odds will improve a lot when you prefer the following:

1. Strong Relative Strength.

2. Tight price range on low Volume and a pattern which is easy on eyes. https://t.co/CprKpAfgtj

#BAJAJFINSV

— Ravi Sharma (@StocksNerd) August 14, 2021

Setting up in a tight base. Volume has been drying up.

Waiting for the breakout. pic.twitter.com/KWoGZAwkLO

1) 50 WMA > 100 WMA > 150 WMA > 200 WMA

2) Price is within 25% range of its 52-Week High and above 30% or more from its 52-Week Low.

Just one question , how do u differentiate stage 2 from 1 , apart from volume , what else do u look ?

— Priyanshu (@Priyans48107837) August 6, 2021

You would find the roots of all patterns, especially the trend/momentum following ones in their methods.

Once you get the dynamics of Price/Volume, any good book on chart patterns will do.

Any book in which we can read such patterns and the knowledge you have?

— Krish (@MasculinityMon1) August 13, 2021

But I can give you some pointers-

1) Choose stocks in Stage 2 with RS > 75

2) Identify these setups - Cup with Handle, High Tight Flag, Rectangle, VCP, Squat, Low Cheat, 3-C.

2) Wait for the significant contraction in daily range, volatility & Volume.

How do u screen stocks???

— \u2206bhishek Jain (@AbhishekTMM) August 6, 2021

I highly recommend this book to all the beginners in stock market.

Sir, if not wrong you taught MACD -H in your elearn webinar also? From where you have learned it?

— Prakhar (@Indiantrader101) August 23, 2021

* Trading for a Living

For my trading strategy, 13-day & 22-day EMAs are more suitable.

If SmallCap dips below these MAs & they get into the bearish sync, I get cautious & reduce my position size.

Sir as you follow the smallcap index,do you take full positions when it\u2019s trading below its key moving averages or wait for some confirmation? pic.twitter.com/ph6HTJ9rbD

— Dhanesh Gianani (@dhanesh500) November 30, 2021

Signs are all over the place, you just needed to read them. https://t.co/17bwpa1psj

#TATAPOWER is consolidating nicely around 50 & 10-DMA.

— Ravi Sharma (@StocksNerd) April 1, 2022

3 Pocket Pivot days in the last couple of weeks are signaling the interest of buyers.

4 months long base.

Steady growth in Earnings & Sales in the last 3 quarters.

Relative Strength: 77

Group Rank: 22 pic.twitter.com/2WFeUGiV1z

I have made some minor tweakings to this timing model since this tweet but it still will give you an idea and primer 👇

Trading 101 with SmallCap Index

— Ravi Sharma (@StocksNerd) August 20, 2019

1. Swing trades when bullish divergence in MACD-H forms

2. Breakout trades if Index closes above 22-Day high

3. Pullback/Pocket Pivot trades if Index consolidates constructively while13-EMA>22-EMA

4. Sell, go cash if Index breaches 10-Day low, NQA pic.twitter.com/u8VjXrU0Re