SAnngeri Categories Screeners

See this now and compare it with the associated tweet to identify extended stocks that could potentially prevent u from entering . RS is now negative and at rock bottom levels.

#FreeTip#Positional

— ScorpioManoj (@scorpiomanojFRM) June 11, 2021

How to assess if a stock is too extended? Many find it difficult to assess the matured stage of a very strong uptrending stock.

1 easy way is avoid entering in the 5th base onwards during Stage 2 of the stock. For eg, Base count of #Intellect is in pic. pic.twitter.com/MCxK6vzjT4

Some went into the watchlist and some were actionable where my few long positions are already open.

— The_Chartist \U0001f4c8 (@charts_zone) December 25, 2021

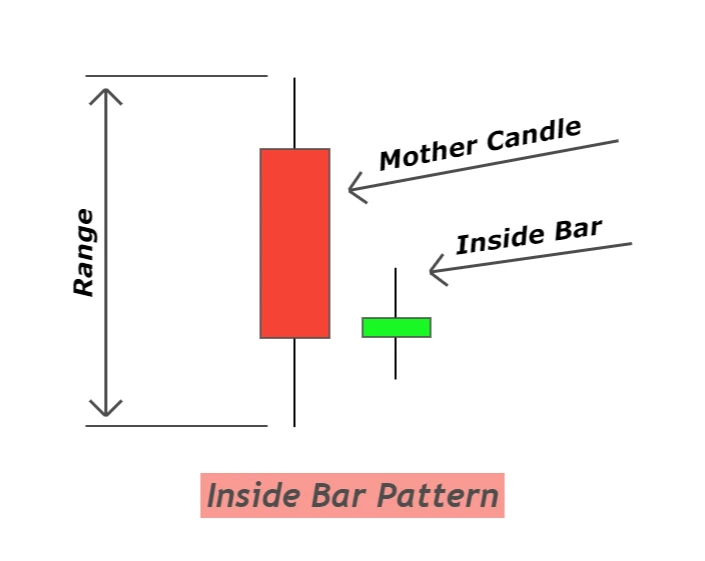

What am I looking at in the charts? Flat base formation breakouts/Pullbacks/Trendline support. Keep it simple. Ex attached.

29/95 for further funda scans. P<100 (I don't trade) https://t.co/y4PKUBrA44 pic.twitter.com/e9cvcrKsnu

1. Darvas Box System

2. ATR based trailing

3. PSAR based trailing

4. EMA Crossover based trailing

Okay sir but dusre konse method se exit ya profit book kar sakte hai sir sry apako bohot pareshan kar raha hu but sry sir

— learner \u2600\ufe0f\u2600\ufe0f (@darvaxfan1845) March 12, 2022

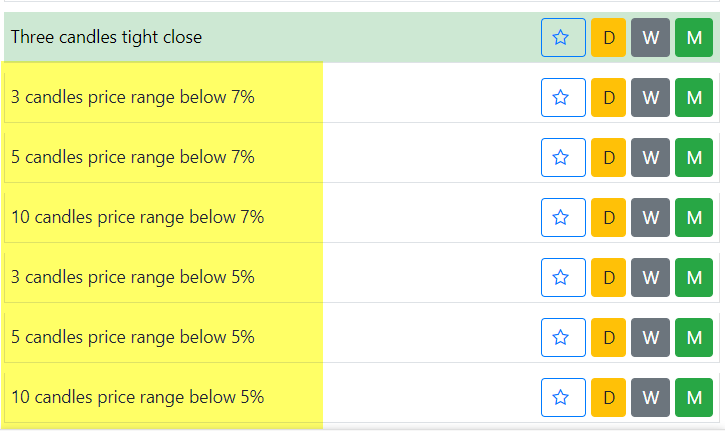

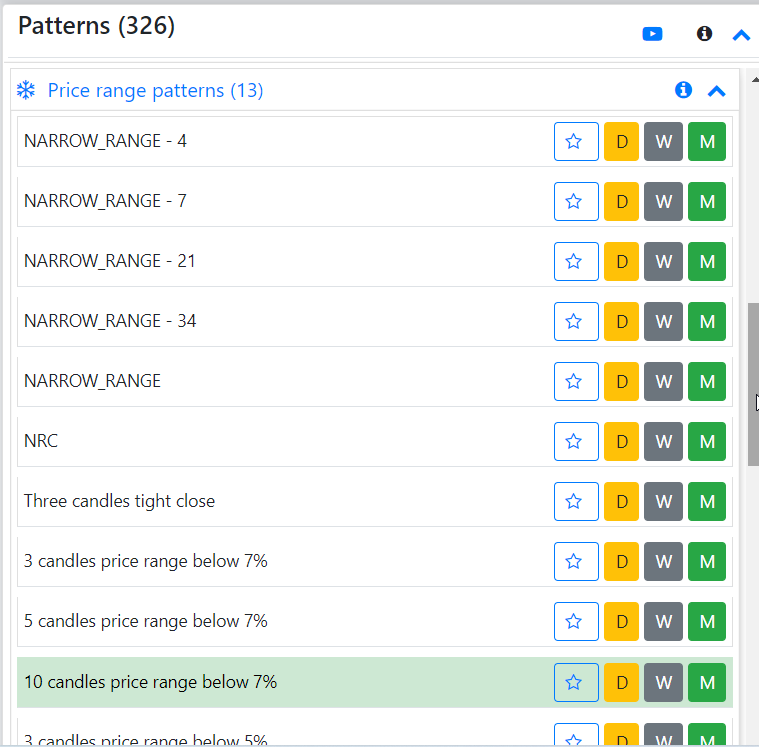

#Sssnewfeature

We have implemented the Price range scans to identify which are in the tight price range for the last few days. Use these scans along with the other scans like the Mark Minervini pattern(High momentum).

@krishchess @Techtrades365

1/n

- These scans can help to find out the stocks whose range is < 5% or 7%.

1. 3 candles price range below 7%

2. 5 candles price range below 7%

3. 10 candles price range below 7%

4. 3 candles price range below 5%

5. 5 candles price range below 5%

6. 10 candles price range below 5%

Why range is important?

When you enter into a trade, for setting up a stop loss if we get the stocks within the 7% price range then we can keep our sl with less than 7%.

- As per Mark Minervini, don't keep the SL with more than 8%.

https://t.co/RkaOwvfBaq

Scans => price range

Only 2 signals - Buy & Sell

There is no stop loss in this system.

There could be some wild swings in prices like on "Budget Day" - In such a scenario, Keep 30 - 50 points below 21Sma to avoid big DD

It's a SAR system

how to take stop loss..? low of prev candle?

— ABHINAV JAIN (@abhijain017) February 9, 2022

I m watching your posts... amazing sir.... thanks for sharing.... can you share what is your trade set up

— Sahasra (@h_shanmugavelu) March 21, 2022