SAnngeri Categories Screeners

For new followers ...

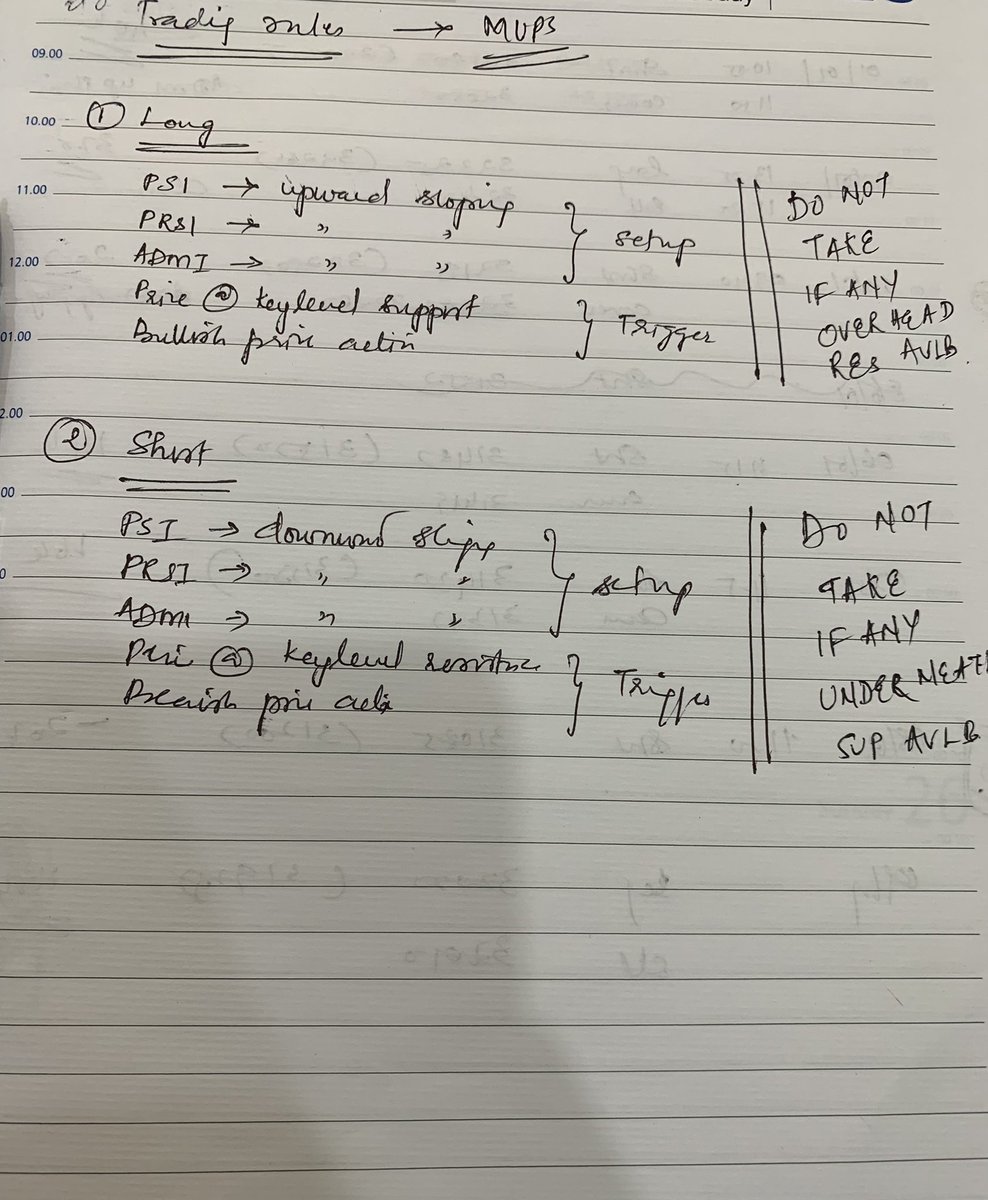

If u r a pivot based intraday trader, u should have this cheat sheet. Follow this and C. Your wrong trades will reduce considerably. Good luck.

#FREETIPS

— ScorpioManoj (@scorpiomanojFRM) April 1, 2022

Pivot Rules snapshot

A free one page cheat sheet for pivot based trading that could probably be sold for a hefty price ....

Rem: This is just a broad set of rules. There are many advance rules more than this. pic.twitter.com/FnzmGGKx0P

• Creative enough to look beyond the obvious

• Covering another unique set up: Rating Houses Contra Trades or as he calls it "Moody-no-so-Moody indicator"

🧵 to learn from @iManasArora

• Usually international rating agencies come with a downgrade only after a massive correction in the stock

• Similarly these rating agencies come with an upgrade report post a sharp rise in the stock

• Don't take them on face value and DYOR!

• How Ultra Bullish articles from rating/broker houses is used to dump the stock to retail

• New traders provide liquidity for BIG players to offload their stocks

#HEG

• Example 1: BofAML sees 100% rise

• Read this thread to know in detail

Next 2-4 weeks are crucial for #HEG. If it does not hold up the current level plus minus 5%, there will be an 80% chance of a 20% drop which could extend to up to 50% drop.

— Manas Arora (@iManasArora) October 19, 2018

News based rally on a low volume could turn into a classic case of late stage base fail. pic.twitter.com/eh3ncaSxoy

USDINR - a breakout that will not bode well for the equities

78+ https://t.co/AWqZxF5B1L

Can you anticipate a breakout? Yes

— The_Chartist \U0001f4c8 (@charts_zone) June 10, 2022

the attached tweet.

now the chart is for USDINR https://t.co/Vb2wKaCvTB pic.twitter.com/INo0GC4fGY

• 8 powerful ways to use Twitter

• Power of Stocks

• 14 Trading Strategies

• Basics of Derivatives (3 parts)

• Technical Analysis for all sectors

• Tweets of the week

• Books on Futures

All the Top 10 tweets threads I have ever posted to date:

Every week, I post a thread with the top ten tweets.

— Aditya Todmal (@AdityaTodmal) January 7, 2022

People seem to enjoy these a lot.

\U0001f9f5 Here's a list of all of them in order of appearance: \U0001f9f5

Basics of Derivatives Part 1:

\U0001d401\U0001d41a\U0001d42c\U0001d422\U0001d41c\U0001d42c \U0001d428\U0001d41f \U0001d403\U0001d41e\U0001d42b\U0001d422\U0001d42f\U0001d41a\U0001d42d\U0001d422\U0001d42f\U0001d41e\U0001d42c

— Nikita Poojary (@niki_poojary) January 8, 2022

\u2022 What is a derivative

\u2022 Various derivative products

\u2022 Participants in derivatives market

\u2022 Uses of derivative instruments

\u2022 Beta & hedge ratio

\u2022 Option Greeks

Time for a Thread \U0001f9f5

Curated in collaboration with @AdityaTodmal pic.twitter.com/x6IHoQubOT

8 powerful ways to use Twitter:

Most of the Trading community doesn\u2019t know how to use Twitter effectively.

— Aditya Todmal (@AdityaTodmal) January 15, 2022

Here are 8 powerful ways to use Twitter: \U0001f9f5

Collaborated with @niki_poojary pic.twitter.com/TuZt72PIzd

Basics of Derivatives Part 2:

\U0001d401\U0001d41a\U0001d42c\U0001d422\U0001d41c\U0001d42c \U0001d428\U0001d41f \U0001d403\U0001d41e\U0001d42b\U0001d422\U0001d42f\U0001d41a\U0001d42d\U0001d422\U0001d42f\U0001d41e\U0001d42c - \U0001d40f\U0001d41a\U0001d42b\U0001d42d \U0001d408\U0001d408

— Nikita Poojary (@niki_poojary) January 15, 2022

\u2022 How options can be used

\u2022 How to trade in options & exit strategy- buyers

\u2022 Imp of theta decay

\u2022 How to trade in options & exit strategy -sellers

Time for a Thread\U0001f9f5

Curated in collaboration with@AdityaTodmal pic.twitter.com/Ebd99afDKB

The 3 most important rules which I follow in spotting a major trend reversal laid out in this stock, 'as it is'.

1. Trend reversal

2. Price patterns

3. Indicator confirmation

Perfect TA chart.

All boxes ticked !!

Do comment, like and share !!!

#DRREDDY https://t.co/4JGg71GenE

Today at 2 pm:

— Kunal Bothra (@kbbothra) July 5, 2022

I will bring to you one of the SUPER FINEST TECHNICAL CHART setup on a largecap name.

Agar yeh nahi chal paya toh kuch nahi chal paayega\u2026

Retweeet tsunami has to come for this one\u2026 #stock #breakout #technical

Is Nifty bullish, or bearish?

— AP (@ap_pune) March 19, 2022

Replies MUST be ONLY with charts, not just 'views', no Russia Ukraine, crude, gold etc.

Can be levels....abv/below

Just technicals....maybe with trend lines, indicators or any other study (EW, harmonics etc)

Charts can be daily, weekly or monthly.

Everyone knows the HH-HL or LH-LL as per Dow theory. This can be a bit confusing on how one marks the Highs and Lows. Long back, I picked up this trick from one of the neo-Dow theorists on what to do in scenarios like this

Simply plot a 5 period exponential moving average on a different panel. A 5-EMA simply shows you a running weekly perspective and kind of smoothens the price where a single spike high/low is not of that much importance

You will see this 5-ema also making HH.HL.LH.LL. So now, rather than focusing on the highs/lows on the charts, focusing on highs/lows on the 5-ema gives a cleaner perspective

As per this charts, unless the 5-ema now closes above 17540 ( the ema, not Nifty price) I will not play this as a bull market. I will deal with this market as a counter move against the major bear trend