Mollyycolllinss Categories Trading

7 days

30 days

All time

Recent

Popular

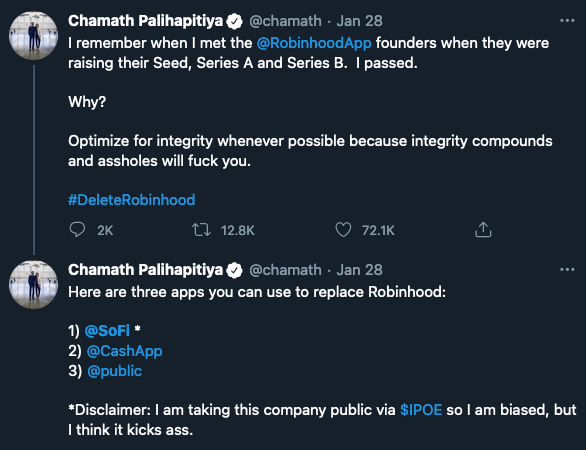

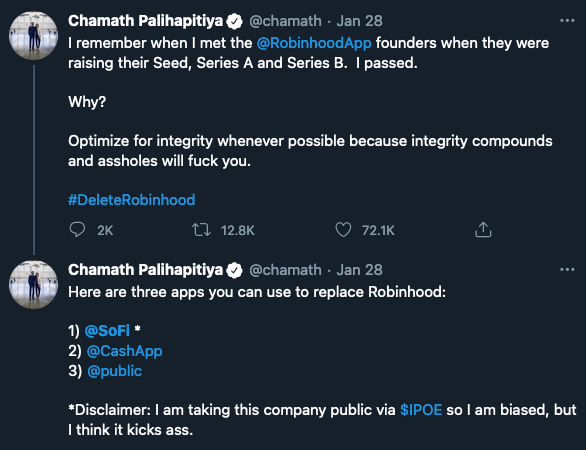

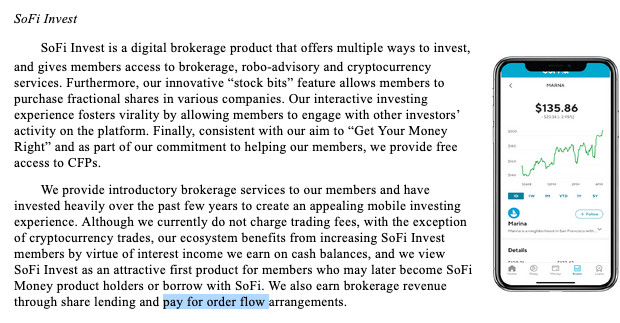

So Chamath has been making a lot of noise attacking Robinhood and implying there's a conspiracy because it sells retail transaction data (payment for order flow) to Ken Griffin's Citadel.

He wants you use his platform sofi, but it turns out, they literally do the same thing? 1/n

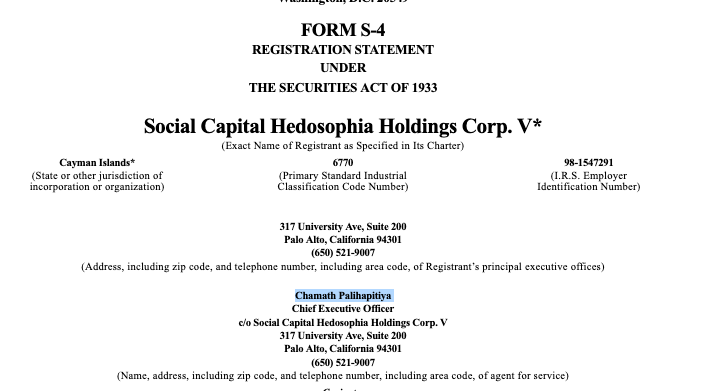

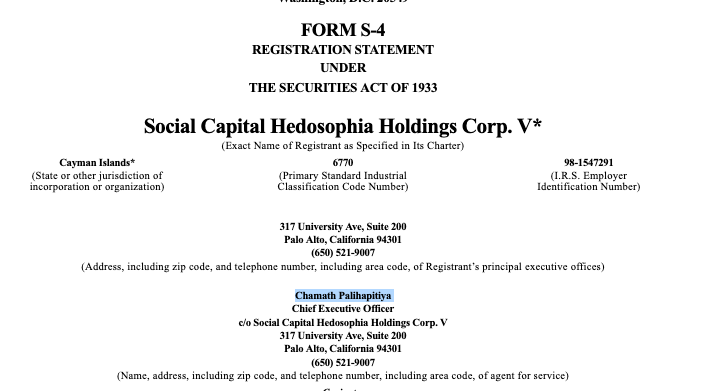

Here's Chamath's S-4 to take SoFi Public via his SPAC (patriotically incorporated in the cayman islands).

These basically have to be filed as part of any merger or acquisition by a public company.

So lots of details about SoFi's business!

https://t.co/Rs7gYPU9Ao

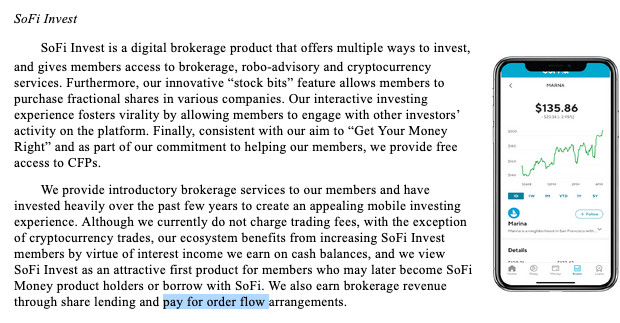

What do we see? Well it turns out SoFi, like RH, says it earns a good chunk of change from selling payment for order flow!

On SoFi's website, they claim this is in the "best interest of consumers" because it allows commission free trading. Huh!

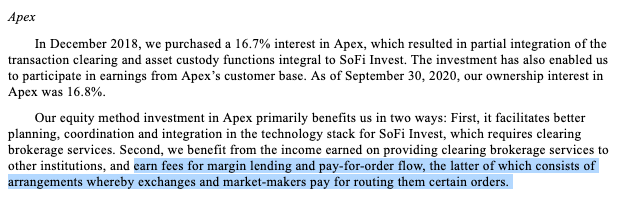

Notice their execution partner is the clearinghouse Apex, which also restricted $GME and $AMC trades like RH. But it goes farther!

https://t.co/4TLPGMfy7v

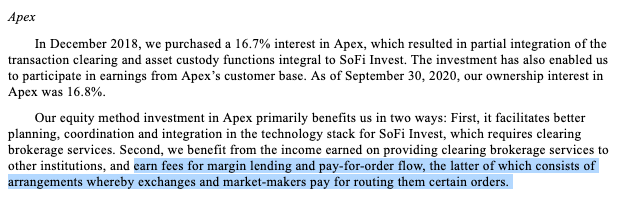

Back to the S-4: Apex isn't just their partner, SoFi literally owns 16.8% of Apex!

That means, as they're happy to tell you, SoFi benefits from Apex earning fees for pay-for-order flows from all sorts of exchanges and market makers! (not just the ones on SoFi itself!)

He wants you use his platform sofi, but it turns out, they literally do the same thing? 1/n

Here's Chamath's S-4 to take SoFi Public via his SPAC (patriotically incorporated in the cayman islands).

These basically have to be filed as part of any merger or acquisition by a public company.

So lots of details about SoFi's business!

https://t.co/Rs7gYPU9Ao

What do we see? Well it turns out SoFi, like RH, says it earns a good chunk of change from selling payment for order flow!

On SoFi's website, they claim this is in the "best interest of consumers" because it allows commission free trading. Huh!

Notice their execution partner is the clearinghouse Apex, which also restricted $GME and $AMC trades like RH. But it goes farther!

https://t.co/4TLPGMfy7v

Back to the S-4: Apex isn't just their partner, SoFi literally owns 16.8% of Apex!

That means, as they're happy to tell you, SoFi benefits from Apex earning fees for pay-for-order flows from all sorts of exchanges and market makers! (not just the ones on SoFi itself!)

🚨 BUY ALERT $CDON +23% 🚨

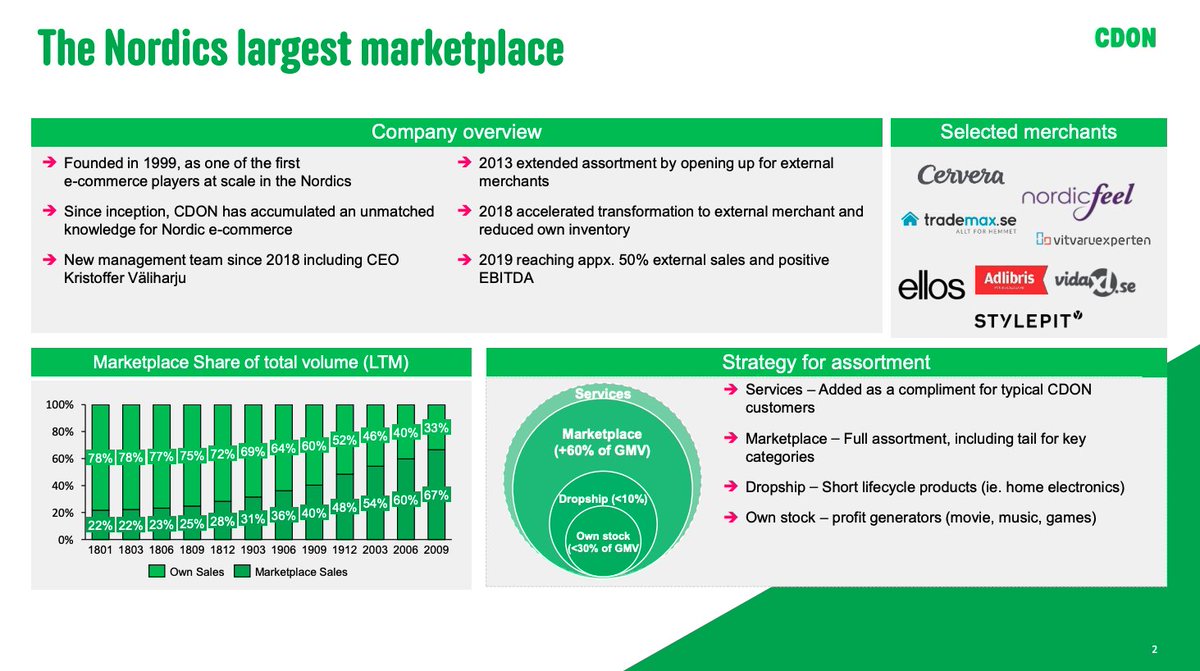

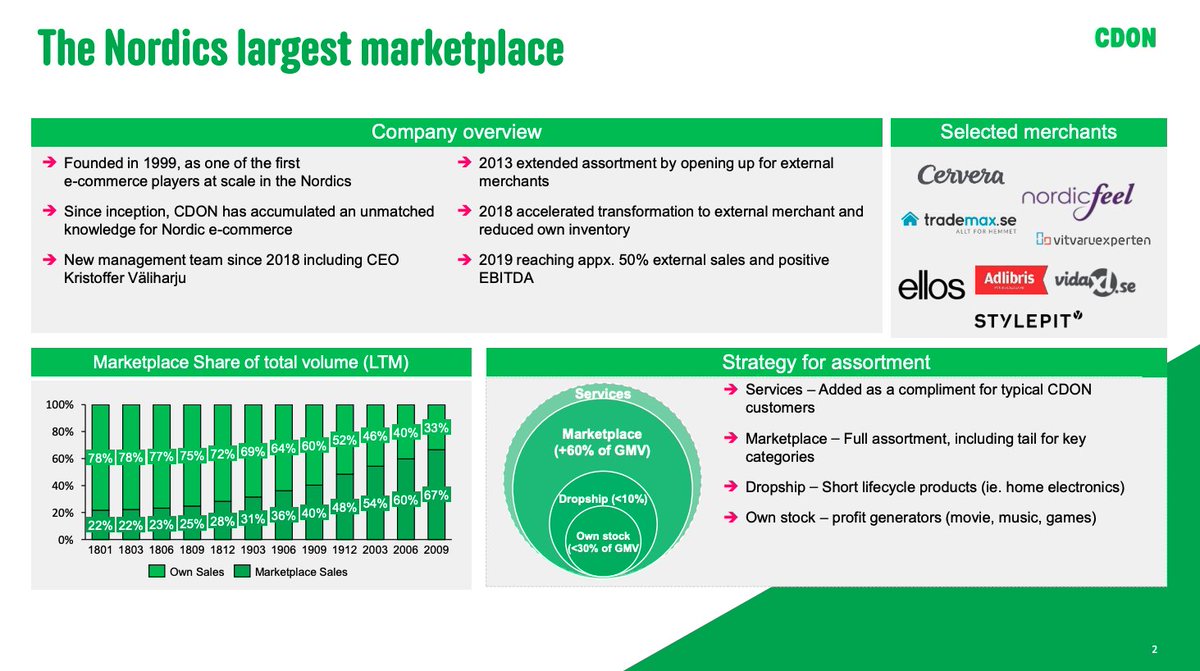

$CDON was founded in 1999 and was part of the Qliro group until September 2020

⭐️ It was then spun out at started operating as a fully independent retailer

🌐 It is now a leading e-commerce player, but is still valued as a brick & mortar retailer

The company generated most of its revenue from its own sales (first party sales)

🛍 It is now moving towards an “e-commerce platform” / marketplace positioning where merchants retail products and send these to clients

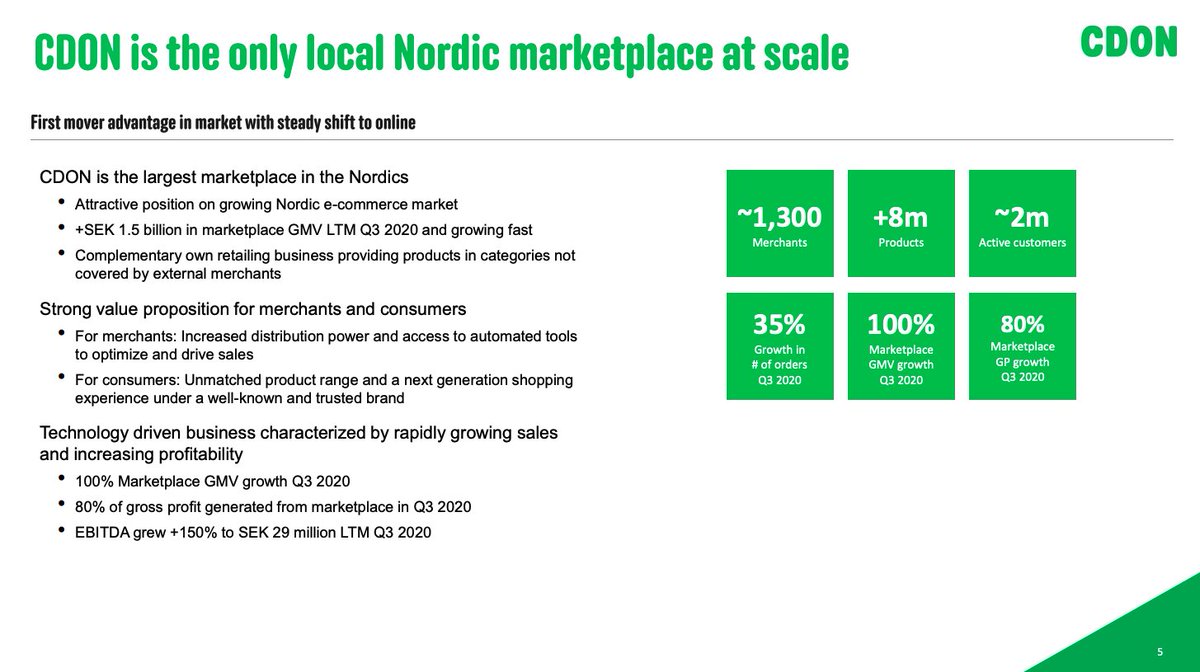

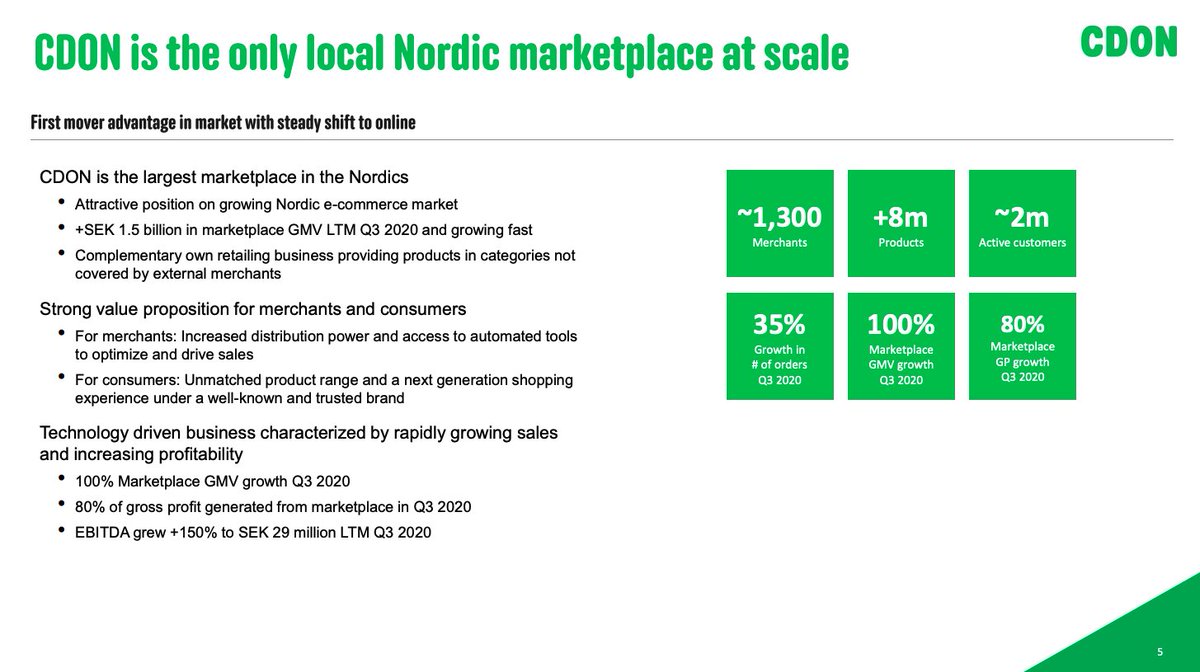

$CDON is the leading e-commerce player in the Nordics, it counts 2m active customers and over 1,300 merchants

💸 It retails over 8m products and scored a Gross Merchandise Value of SEK 2.4B ($ 288m) in the 12 months leading to Q3 ’20

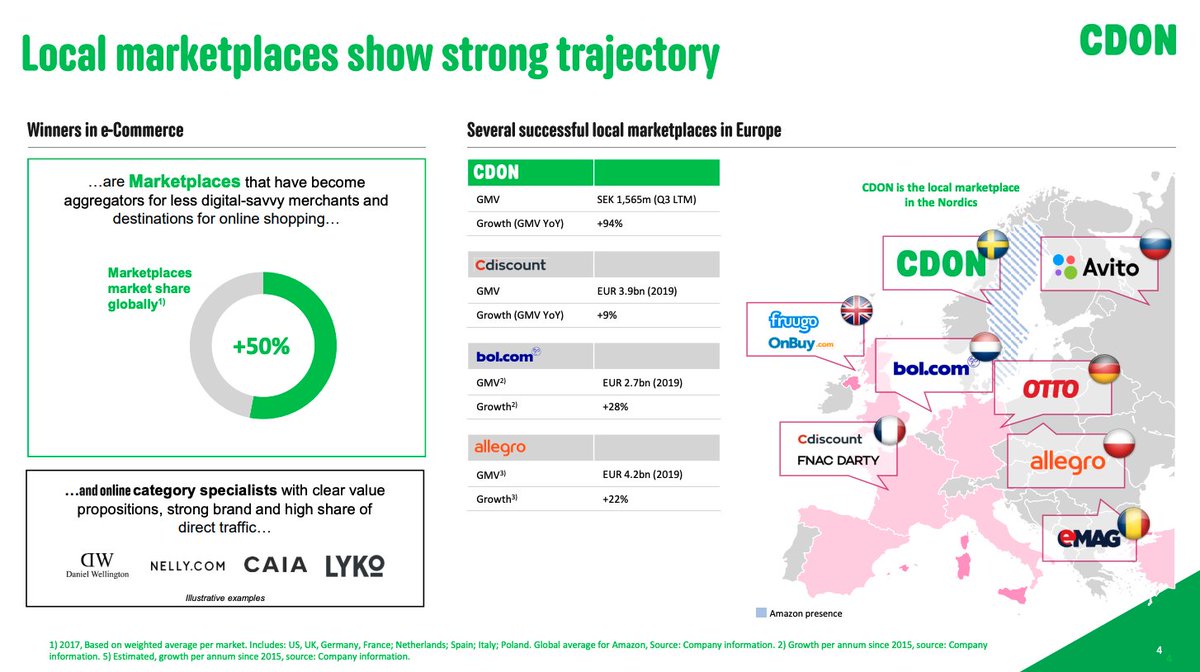

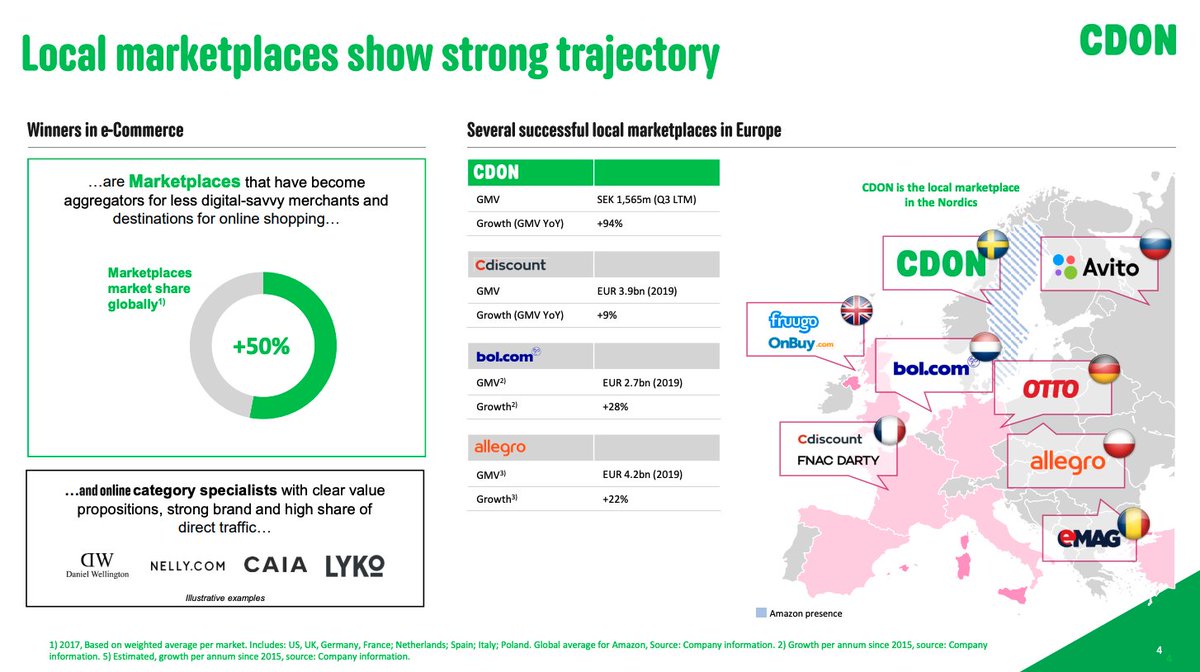

$CDON belongs to a cohort of local e-commerce player which have successfully managed to fight $AMZN’s dominance

🇳🇱 https://t.co/jUdtPRTkdU in the Netherlands is the leading e-commerce player with 111m website visits (+30% in H2 ’20) vs 33m for $AMZN (+67% in H2 ’20)

🇫🇷 https://t.co/r9rdGvrx9d in France is the N°2 e-commerce player with 84m visits (+21% in H2 ’20) vs 270m for $AMZN (+42% in H2 ’20)

🇸🇪 https://t.co/m8OyFnNYNJ in Sweden scored 7m visits (+27% in H2 ’20) vs 10.3m for $AMZN (entered market in 2020)

$CDON was founded in 1999 and was part of the Qliro group until September 2020

⭐️ It was then spun out at started operating as a fully independent retailer

🌐 It is now a leading e-commerce player, but is still valued as a brick & mortar retailer

The company generated most of its revenue from its own sales (first party sales)

🛍 It is now moving towards an “e-commerce platform” / marketplace positioning where merchants retail products and send these to clients

$CDON is the leading e-commerce player in the Nordics, it counts 2m active customers and over 1,300 merchants

💸 It retails over 8m products and scored a Gross Merchandise Value of SEK 2.4B ($ 288m) in the 12 months leading to Q3 ’20

$CDON belongs to a cohort of local e-commerce player which have successfully managed to fight $AMZN’s dominance

🇳🇱 https://t.co/jUdtPRTkdU in the Netherlands is the leading e-commerce player with 111m website visits (+30% in H2 ’20) vs 33m for $AMZN (+67% in H2 ’20)

🇫🇷 https://t.co/r9rdGvrx9d in France is the N°2 e-commerce player with 84m visits (+21% in H2 ’20) vs 270m for $AMZN (+42% in H2 ’20)

🇸🇪 https://t.co/m8OyFnNYNJ in Sweden scored 7m visits (+27% in H2 ’20) vs 10.3m for $AMZN (entered market in 2020)

It is difficult to change a 10-year trend.

Long-term expectations do not change as frequently as daily market fluctuations would make it seem.

A quick update on Treasury rates through the lens of the DKW model

*As of Dec. 31*

1/

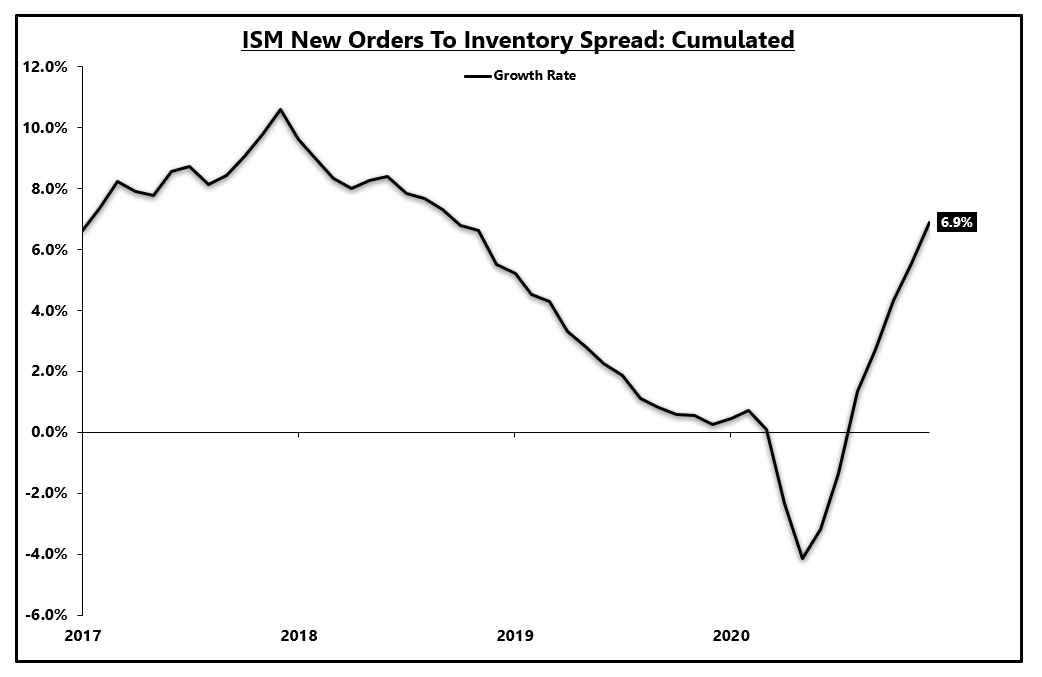

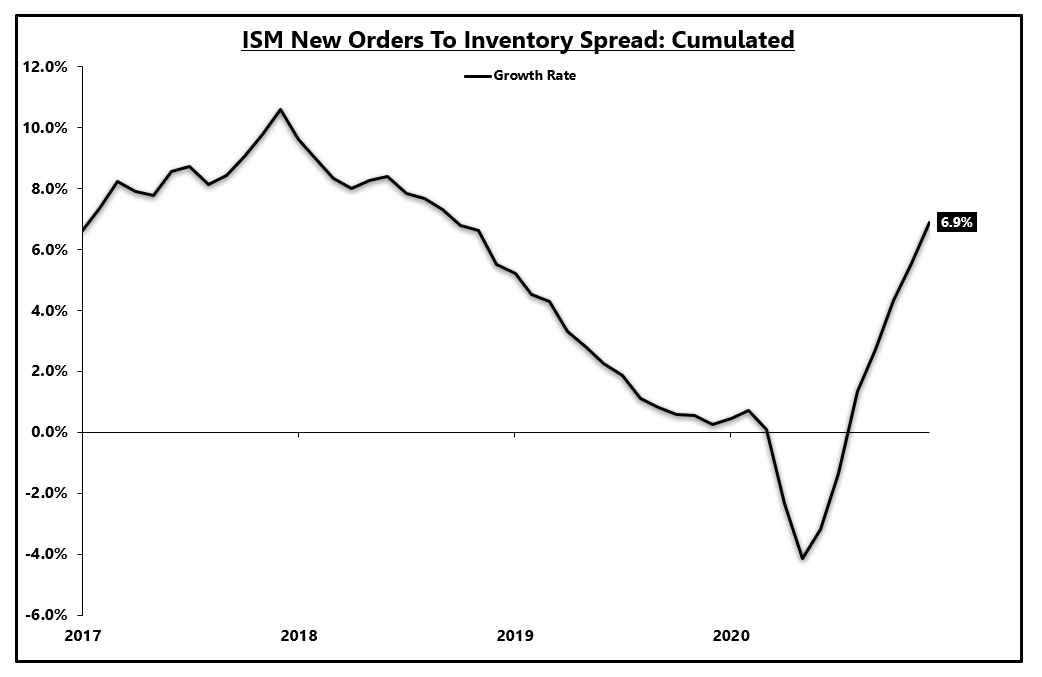

In previous threads, I made the distinction between long-term secular trends in growth and inflation and shorter-term (2-6 quarters) trends in nGDP

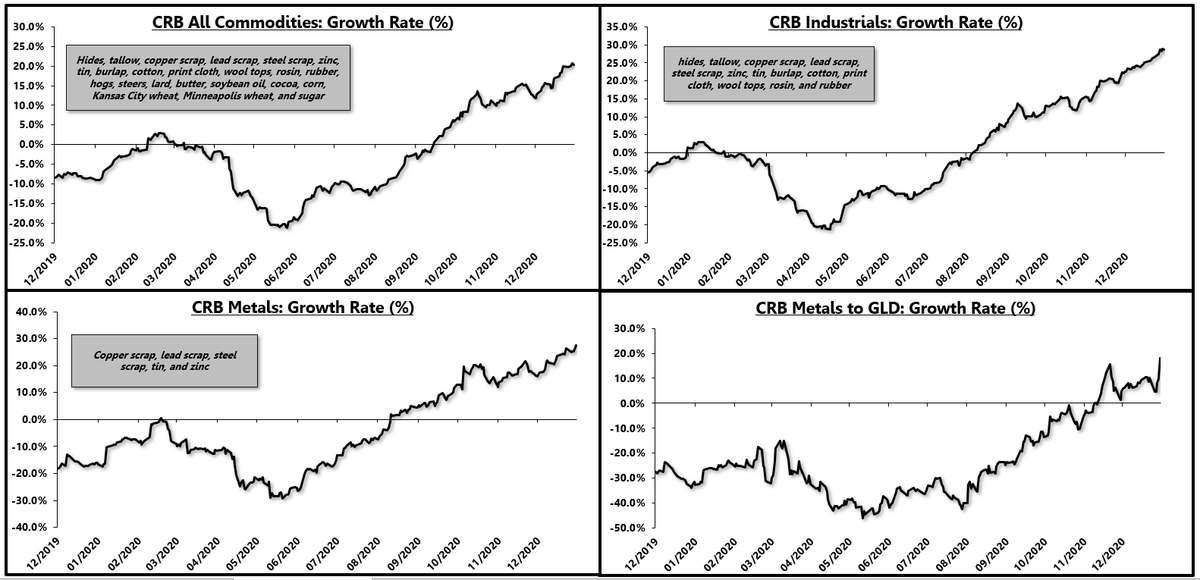

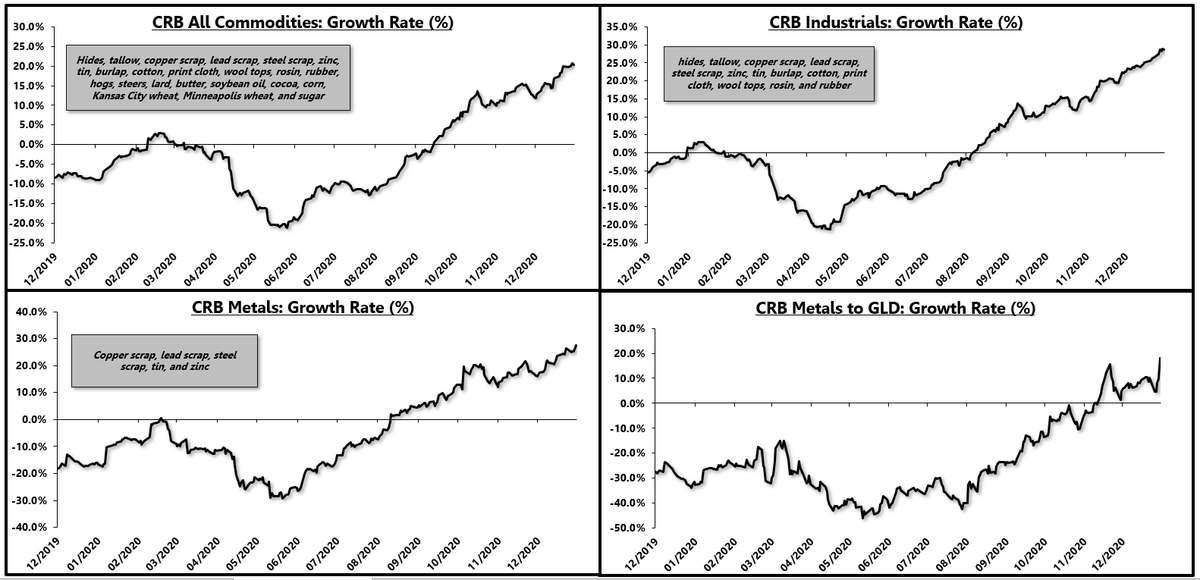

Right now, the long-term trends are unaltered because long-term trends just don't change that fast but we have a very strong cyclical upturn in the economy, centered primarily on the shift to goods consumption bolstering the manufacturing sector and industrial commodities.

3/

As long as the industrial sector continues to roar, TSY rates will have an upward bias as rates generally follow the trend in nGDP growth

A 10yr TSY has longterm expectations embedded in the rate so several qrters, while important, won't necessarily change the longterm trend

4/

This is confirmed by the Dec update to the DKW model which breaks down *actual* inflation expectations, the expected real short-term rate (real growth), term premium, liquidity premium etc.

The DKW model is one of many models that is useful but has many limitations.

5/

Long-term expectations do not change as frequently as daily market fluctuations would make it seem.

A quick update on Treasury rates through the lens of the DKW model

*As of Dec. 31*

1/

In previous threads, I made the distinction between long-term secular trends in growth and inflation and shorter-term (2-6 quarters) trends in nGDP

Consensus continues to conflate the inflation story, mixing and matching long-term and short-term charts to fit what is generally a secular inflation narrative.

— Eric Basmajian (@EPBResearch) January 4, 2021

Here are my two cents to make the distinction clear.

1)

Right now, the long-term trends are unaltered because long-term trends just don't change that fast but we have a very strong cyclical upturn in the economy, centered primarily on the shift to goods consumption bolstering the manufacturing sector and industrial commodities.

3/

As long as the industrial sector continues to roar, TSY rates will have an upward bias as rates generally follow the trend in nGDP growth

A 10yr TSY has longterm expectations embedded in the rate so several qrters, while important, won't necessarily change the longterm trend

4/

This is confirmed by the Dec update to the DKW model which breaks down *actual* inflation expectations, the expected real short-term rate (real growth), term premium, liquidity premium etc.

The DKW model is one of many models that is useful but has many limitations.

5/

In which Chamath quite literally says Robinhood “should go to fucking jail” for obeying legal collateral requirement

Like he actually connects the two and mentions collateral requirements and says RH should go to jail

This is maybe the worst discussion I’ve heard of GME from people who clearly know better. They’re encouraging people to “watch billions” to understand how hedge funds work.

Oh just got to the point where they call for a short term transaction tax to REPLACE the capital gains tax.

Chamath calls lowering the cap gains tax “genius”

Oh now Chamath believes the class actions will work because of the “implied losses,” because users clearly lost tens of billions theoretical gains!

The solution is to move accounts to other brokers (like sofi)

E19 is HERE \U0001f4a7\U0001f426\U0001f4a7

— The All-In Podcast \U0001f4a7\U0001f426 (@theallinpod) January 30, 2021

Breaking down & debating Robinhood's decision:

-- understanding the full WSB saga

-- how/why it happened

-- how it can be prevented in the future & more

\U0001f447\U0001f447

\U0001f50a: https://t.co/w8QSGBUQSi

\U0001f4fa: https://t.co/OU5W2qn7JN

Like he actually connects the two and mentions collateral requirements and says RH should go to jail

This is maybe the worst discussion I’ve heard of GME from people who clearly know better. They’re encouraging people to “watch billions” to understand how hedge funds work.

Oh just got to the point where they call for a short term transaction tax to REPLACE the capital gains tax.

Chamath calls lowering the cap gains tax “genius”

Oh now Chamath believes the class actions will work because of the “implied losses,” because users clearly lost tens of billions theoretical gains!

The solution is to move accounts to other brokers (like sofi)