Authors Eric Basmajian

What is going on and does this mean inflation is coming?

Shorter Answer: No

Longer Answer: Not from the monetary channel

1)

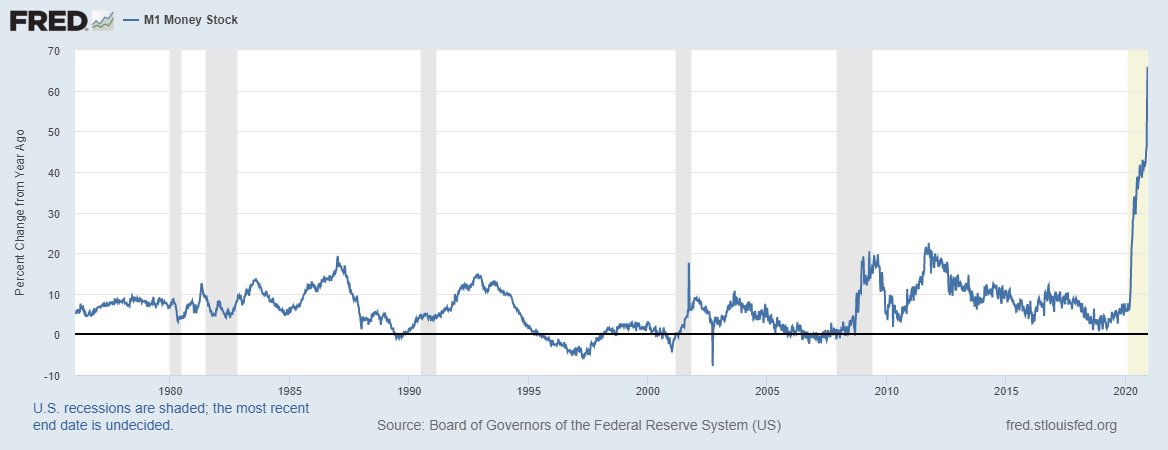

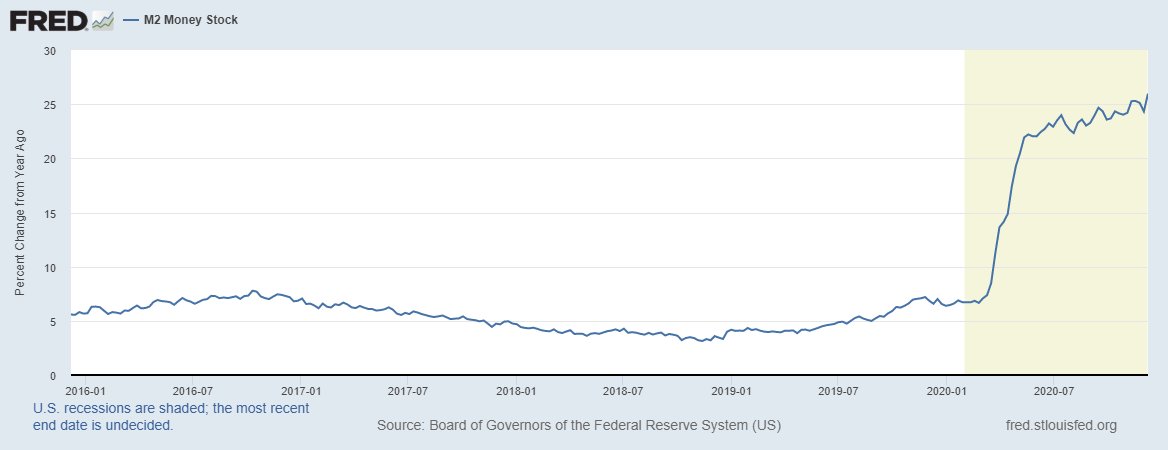

Money supply started to accelerate at the end of March, almost 9 months ago

Inflation was the concern at the time.

"Not in the short-term" but over the long-run was the phrase

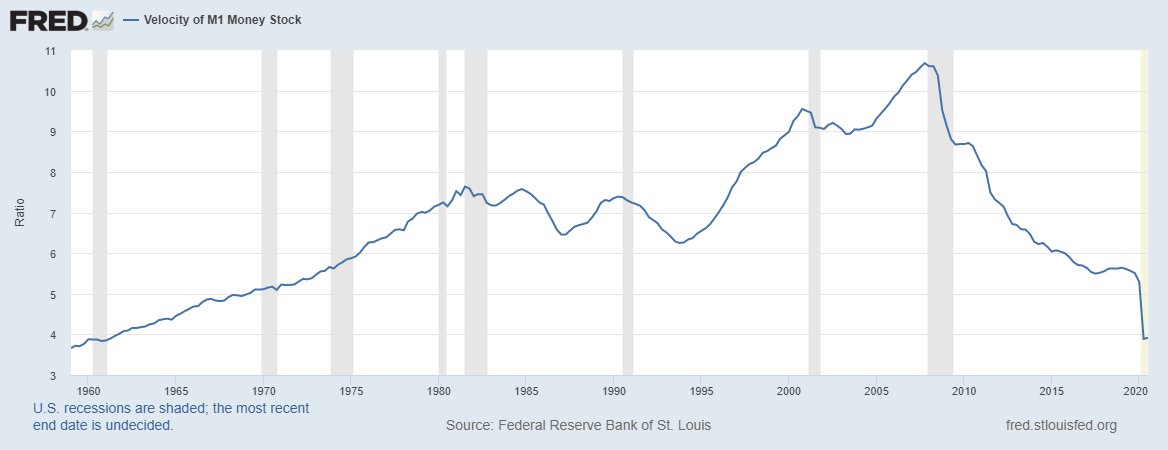

9 months later & inflation is lower than when the pandemic started because velocity collapsed

2)

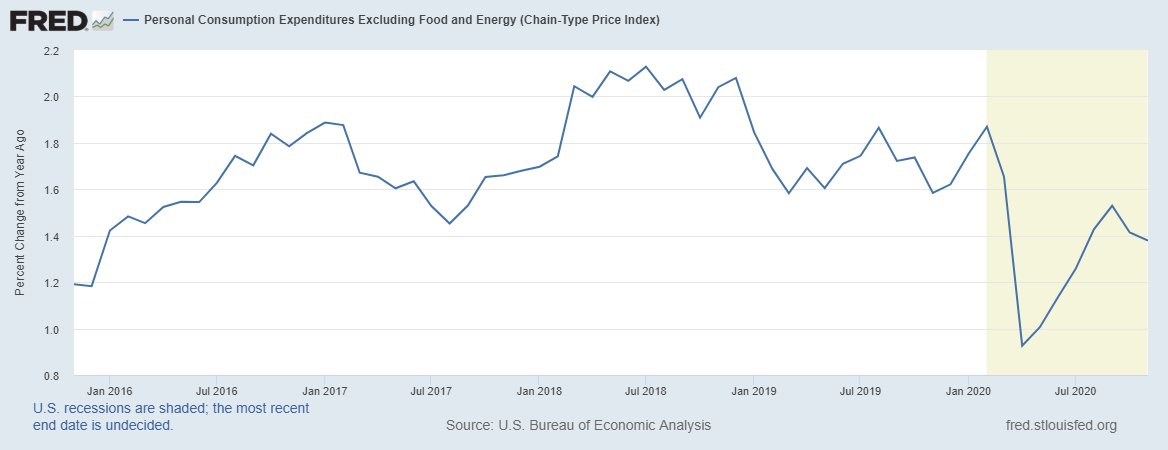

There is a cyclical upturn ongoing in the manufacturing sector which is giving rise to "goods" inflation but that is wholly separate from the (lack of) inflation emerging from the monetary channel that many fear with posts of M1 or M2 money growth.

Goods inflation (manufacturing upturn)

— Eric Basmajian (@EPBResearch) December 7, 2020

vs.

Services disinflation (social distance rules / changing consumer behavior). pic.twitter.com/mXEoI7OvEL

For inflation to emerge from the monetary channel, we need to see rising money growth with *at least* stable velocity and increasing bank loans.

Right now, only condition #1 is satisfied which is why inflation is declining with record money growth.

4)

M1 money supply is rising nearly 70% year over year compared to M2 growth which is rising about 25% year over year.

5)

Last month I wrote about the distinction between long-term secular inflation and shorter-term cyclical inflation

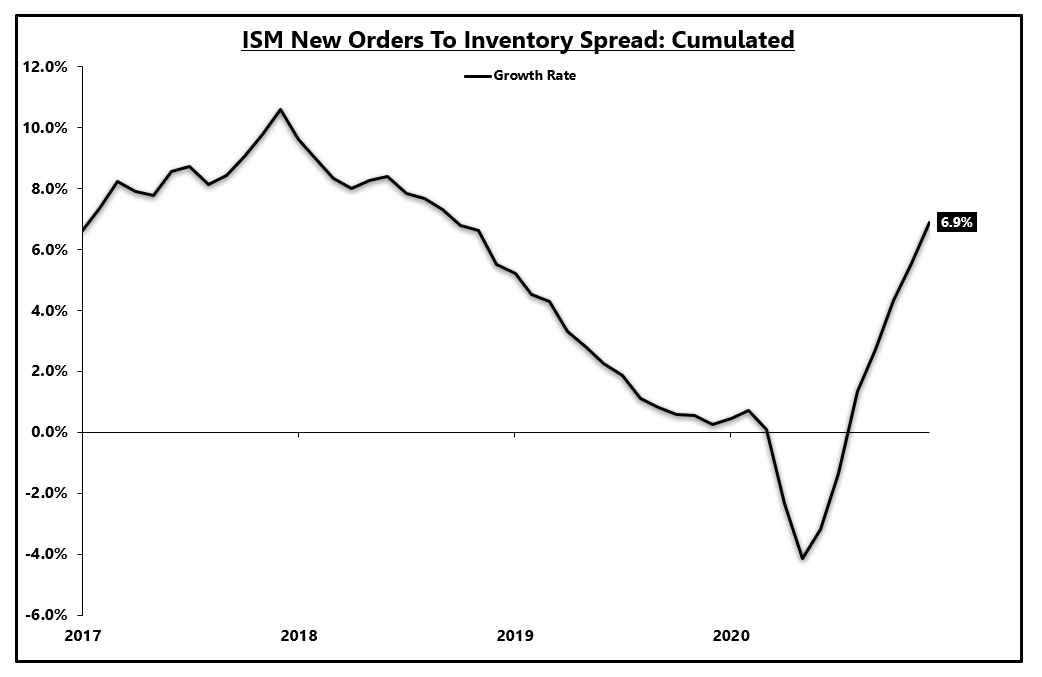

It has been clear for several months that we are in the middle of a cyclical rise in

Now, in the short-term, the manufacturing sector is red hot, driven by a pent-up demand rebound in goods consumption.

— Eric Basmajian (@EPBResearch) January 4, 2021

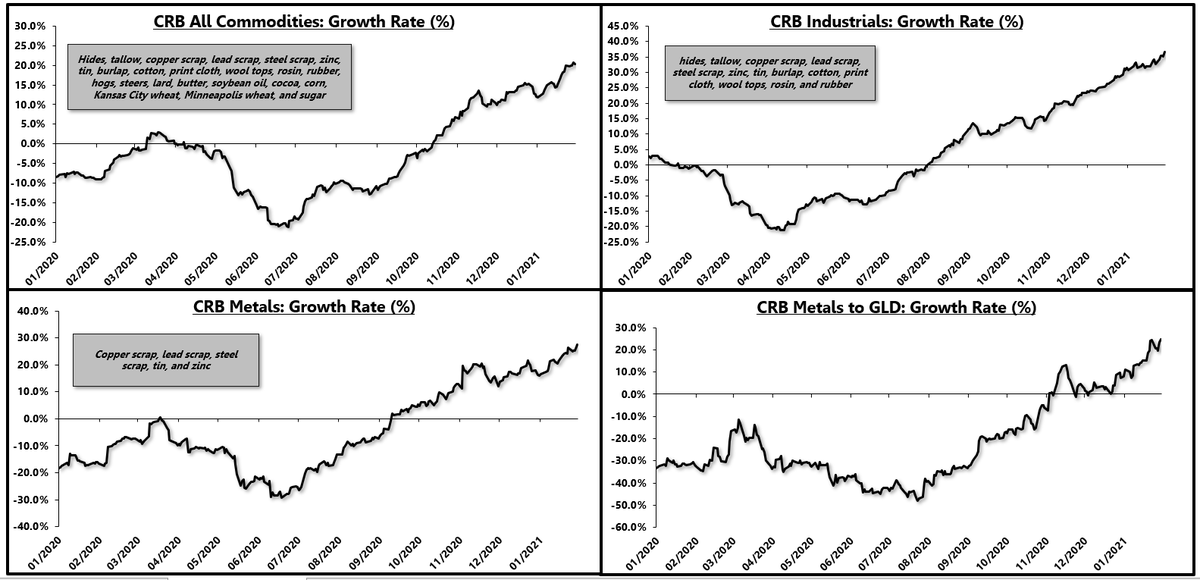

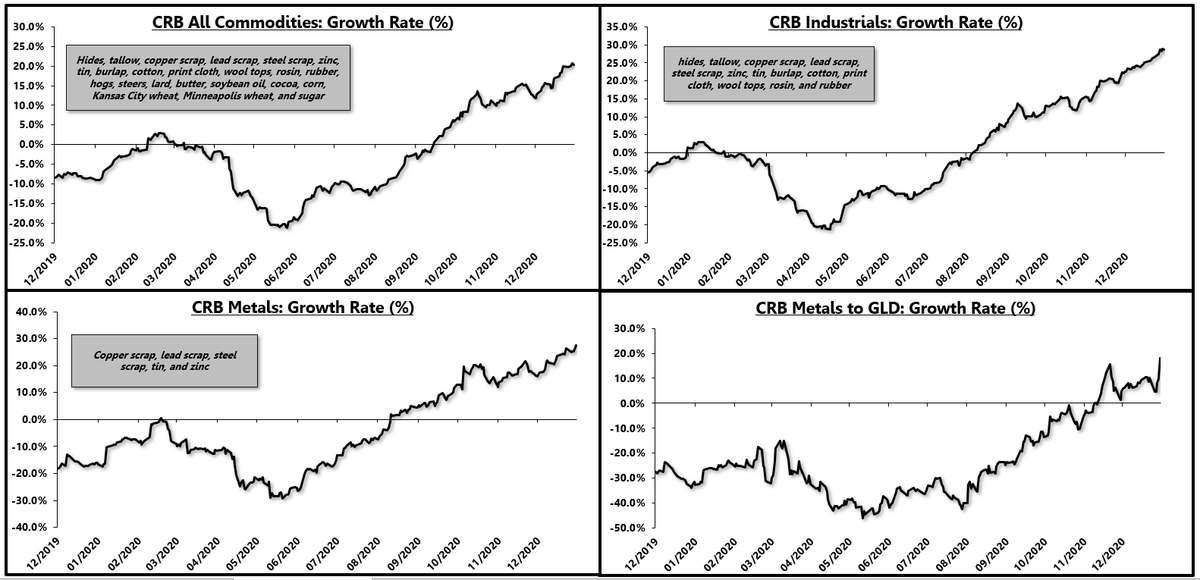

Commodity prices are screaming which gives legs to "goods" inflation in the short-term.

8) pic.twitter.com/rQcqHf1OD0

The full thread can be reviewed here:

Consensus continues to conflate the inflation story, mixing and matching long-term and short-term charts to fit what is generally a secular inflation narrative.

— Eric Basmajian (@EPBResearch) January 4, 2021

Here are my two cents to make the distinction clear.

1)

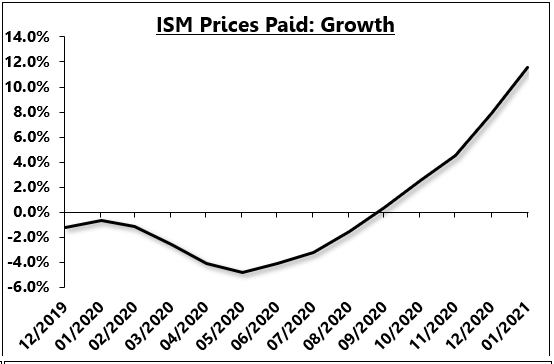

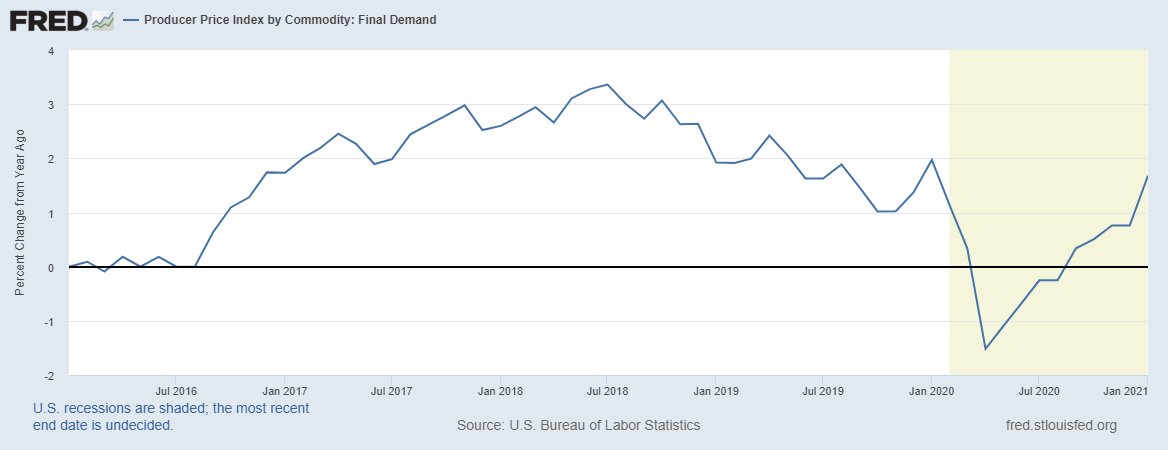

Today's PPI report should have been expected to surprise to the upside as the leading indicators of inflation have been screaming to the upside for months!

Here is the ISM prices paid index, cumulated into a growth rate

3/

Industrial commodity prices have also seen a major acceleration for months.

4/

So today's PPI report was in line with the leads, suggesting that we have a cyclical upturn in inflation that is * primarily concentrated in the manufacturing sector *

This is a key point.

5/

Long-term expectations do not change as frequently as daily market fluctuations would make it seem.

A quick update on Treasury rates through the lens of the DKW model

*As of Dec. 31*

1/

In previous threads, I made the distinction between long-term secular trends in growth and inflation and shorter-term (2-6 quarters) trends in nGDP

Consensus continues to conflate the inflation story, mixing and matching long-term and short-term charts to fit what is generally a secular inflation narrative.

— Eric Basmajian (@EPBResearch) January 4, 2021

Here are my two cents to make the distinction clear.

1)

Right now, the long-term trends are unaltered because long-term trends just don't change that fast but we have a very strong cyclical upturn in the economy, centered primarily on the shift to goods consumption bolstering the manufacturing sector and industrial commodities.

3/

As long as the industrial sector continues to roar, TSY rates will have an upward bias as rates generally follow the trend in nGDP growth

A 10yr TSY has longterm expectations embedded in the rate so several qrters, while important, won't necessarily change the longterm trend

4/

This is confirmed by the Dec update to the DKW model which breaks down *actual* inflation expectations, the expected real short-term rate (real growth), term premium, liquidity premium etc.

The DKW model is one of many models that is useful but has many limitations.

5/

There is both good news and bad news buried in the report.

Most often, too much attention is paid to the headline month on month numbers.

1)

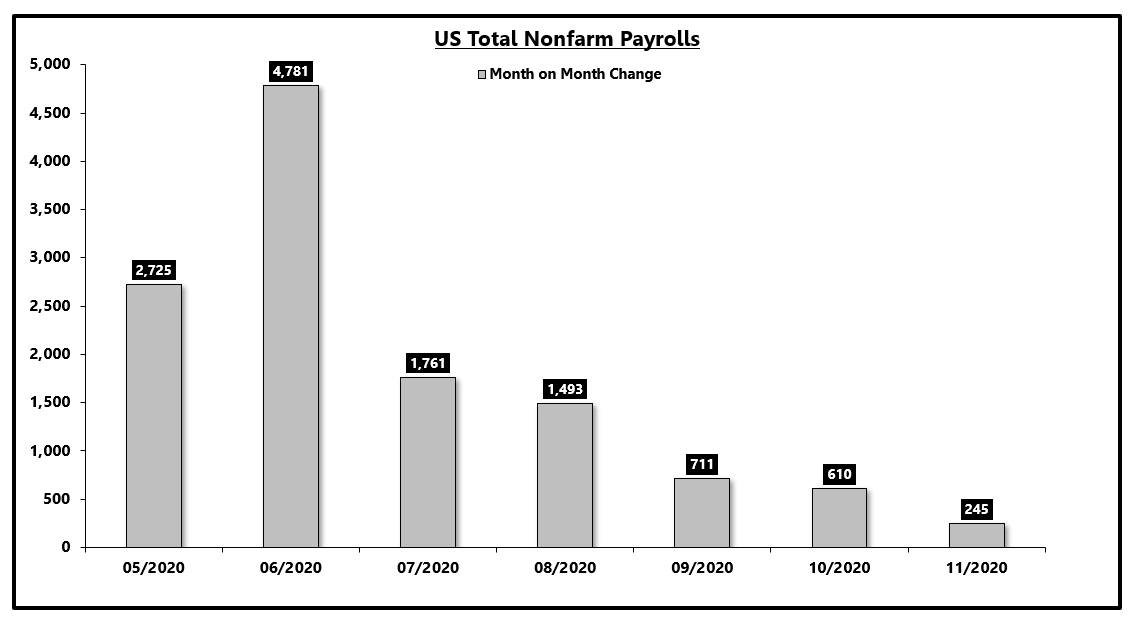

2) In year over year terms, total nonfarm payrolls did not increase for the first time since the pandemic. Generally, this is a negative.

3) Under the hood, most of the decline was in the government sector so it makes more sense to look at private payrolls in this context.

4) Private payroll growth continues to increase but the gains are clearly slowing down - this is to be expected.

5) The troubling part of the report was the labor force participation rate which remains stubbornly low.

As @R_Perli highlighted, if the LFPR does not increase back to pre-COVID levels, we're going to struggle with weaker trend potential growth.

https://t.co/zw7fCZ2gfY

The worst part of the employment report is the stall in the labor force participation rate (-0.2% today and about 2% lower than pre-#COVID19).

— Roberto Perli (@R_Perli) December 4, 2020

The longer participation stays depressed, the harder it will be to bring those workers back, and the lower potential growth will be. pic.twitter.com/7u966oxBME