Mollyycolllinss Categories Trading

7 days

30 days

All time

Recent

Popular

Seeing a lot of popular names down big today, so let’s have a little chat.

What do you do when your hot stock is falling fast?

💥 (a thread)

Check your goals.

When do you need this money?

Now? In a few days? In a few years?

If you have time to wait, then it could make sense to hold on for now.

Remember your why.

Stocks rise and fall. It’s the nature of the market, and swings are the price of investing (h/t @morganhousel).

Just think about Apple. Amazing rally over the past few decades…with a lot of big

Back to the why. If your why behind buying this stock hasn’t changed, then it might be best to wait this drop out.

What do you do when your hot stock is falling fast?

💥 (a thread)

Check your goals.

When do you need this money?

Now? In a few days? In a few years?

If you have time to wait, then it could make sense to hold on for now.

Remember your why.

Stocks rise and fall. It’s the nature of the market, and swings are the price of investing (h/t @morganhousel).

Just think about Apple. Amazing rally over the past few decades…with a lot of big

What they tell you:

— Callie Cox (@callieabost) September 24, 2020

If you invested $100 in Apple's IPO and and held shares until today, that investment would be worth about $100,000.

What they don't tell you:

If you invested $100 in Apple's IPO and held shares until today, you would've endured 23 declines of 20% or more.

Back to the why. If your why behind buying this stock hasn’t changed, then it might be best to wait this drop out.

The is a tech bubble in the stock market, and it will burst soon. The question is, which of the #NGS companies below will come out stronger from the stock market tech bubble bursting? $ILMN $PACB @nanopore @MGI_BGI

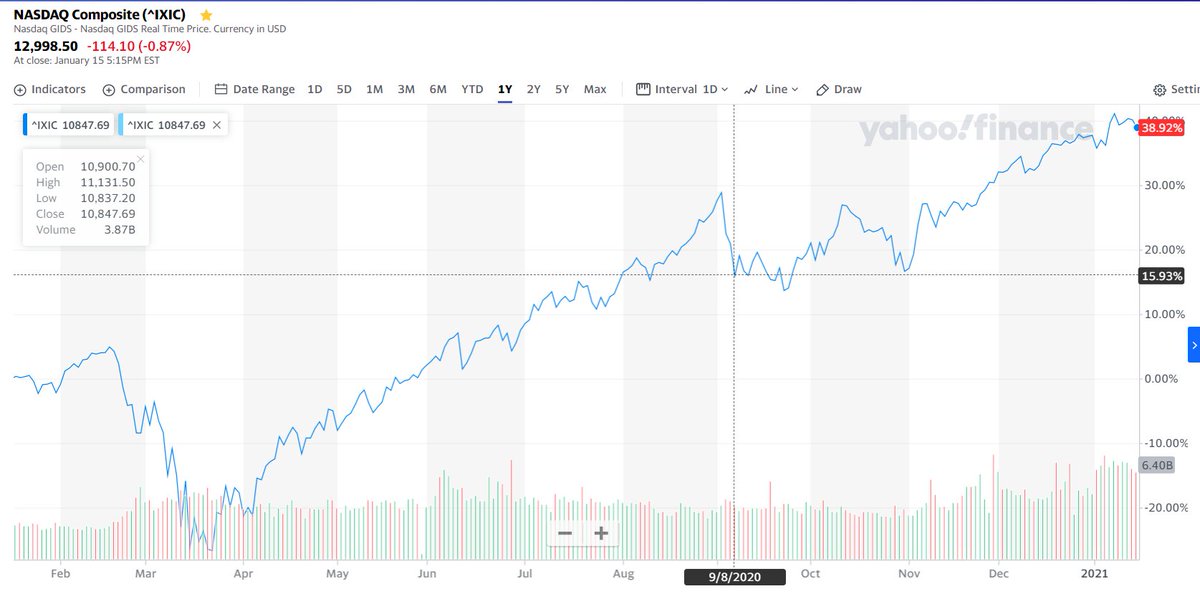

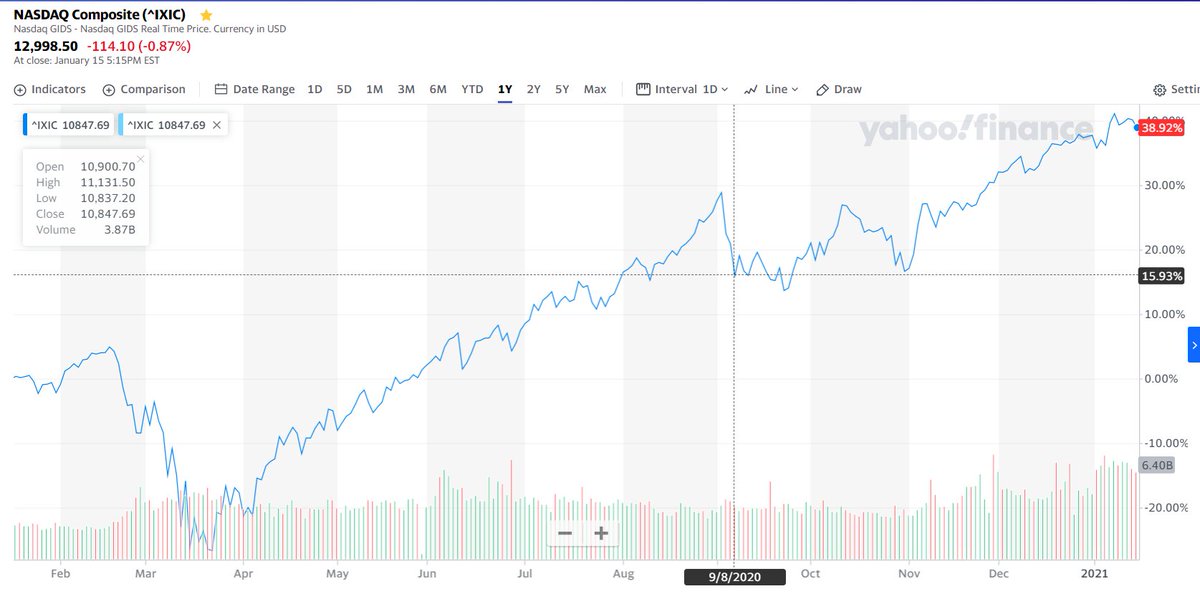

Looking at the NASDAQ for the last 5 years, there was a big drop in March 2020, triggered by the first wave of worldwide #COVID19. The tech bubble was already inflated back then. But the market recovered with a matter of weeks, and kept climbing up.

By 9/8/2020 there was another attempt of a correction, mostly #COVID19 related, but again, with a highly inflated tech bubble, the market recovered and quickly jumped another 1,000 points (around 11,800):

Who will come out stronger from the stock market tech bubble in #NGS? https://t.co/TDn5J0glhi

— Albert Vilella (@AlbertVilella) January 11, 2021

Looking at the NASDAQ for the last 5 years, there was a big drop in March 2020, triggered by the first wave of worldwide #COVID19. The tech bubble was already inflated back then. But the market recovered with a matter of weeks, and kept climbing up.

By 9/8/2020 there was another attempt of a correction, mostly #COVID19 related, but again, with a highly inflated tech bubble, the market recovered and quickly jumped another 1,000 points (around 11,800):

1/ I love learning about the markets. There are some brilliant people I’ve found on Twitter who have provided great insights (among others):

@JeffSnider_AIP

@LynAldenContact

@LukeGromen

But this thread is (mostly) about @profplum99

👇👇👇👇👇

2/ Mike has an encyclopedic knowledge of market history. This interview by @DiMartinoBooth (who I also have a lot of respect for) puts that on clear display.

https://t.co/4hSd2TG4du

Mike’s explanation of passive investing and its effects on the markets was eye-opening.

3/ According to research conducted by Anadu et al for the Federal Reserve Bank of Boston, passive funds made up 48% of US equity assets under management in March 2020. That number was just 14% in 2005. Meaning 8.6% annualized growth over 15

4/ Per Mike, “passive funds have this really simple algorithm: if you give me cash, I buy.” No fundamental valuation, just buying the current market-weighted index, which means a stock gets greater representation in your fund the higher its current market value.

5/ Employers and pension fund managers are predictably contributing to IRAs through fixed salary percentages on a monthly basis. And passive funds typically hold tens of basis points of cash on the sidelines because, per Mike, “it’s toxic to their business model.”

@JeffSnider_AIP

@LynAldenContact

@LukeGromen

But this thread is (mostly) about @profplum99

👇👇👇👇👇

2/ Mike has an encyclopedic knowledge of market history. This interview by @DiMartinoBooth (who I also have a lot of respect for) puts that on clear display.

https://t.co/4hSd2TG4du

Mike’s explanation of passive investing and its effects on the markets was eye-opening.

3/ According to research conducted by Anadu et al for the Federal Reserve Bank of Boston, passive funds made up 48% of US equity assets under management in March 2020. That number was just 14% in 2005. Meaning 8.6% annualized growth over 15

4/ Per Mike, “passive funds have this really simple algorithm: if you give me cash, I buy.” No fundamental valuation, just buying the current market-weighted index, which means a stock gets greater representation in your fund the higher its current market value.

5/ Employers and pension fund managers are predictably contributing to IRAs through fixed salary percentages on a monthly basis. And passive funds typically hold tens of basis points of cash on the sidelines because, per Mike, “it’s toxic to their business model.”