7 days

30 days

All time

Recent

Popular

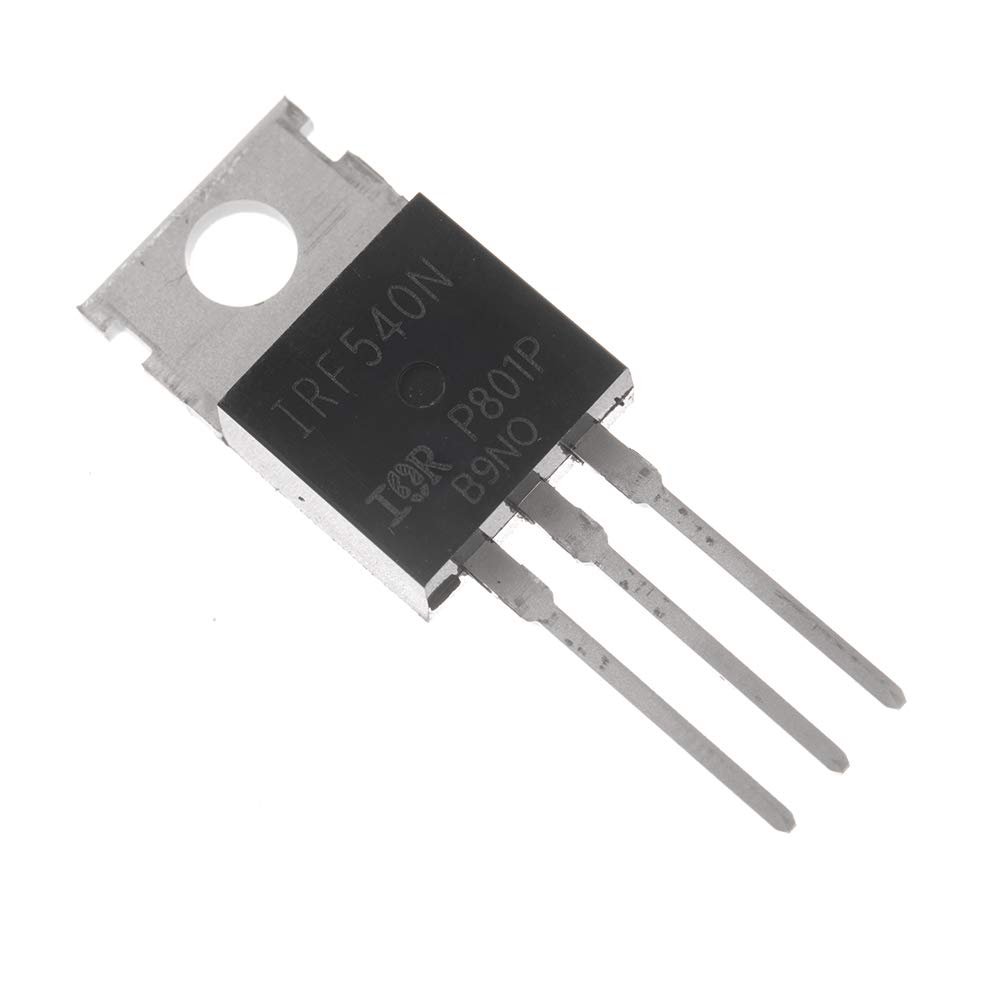

A fun fact on the wikipedia page for the metal–oxide–semiconductor field-effect transistor:

it is the most frequently manufactured device in history, and the total number manufactured from 1960-2018 is 13 sextillion.

That's 13,000,000,000,000,000,000,000.

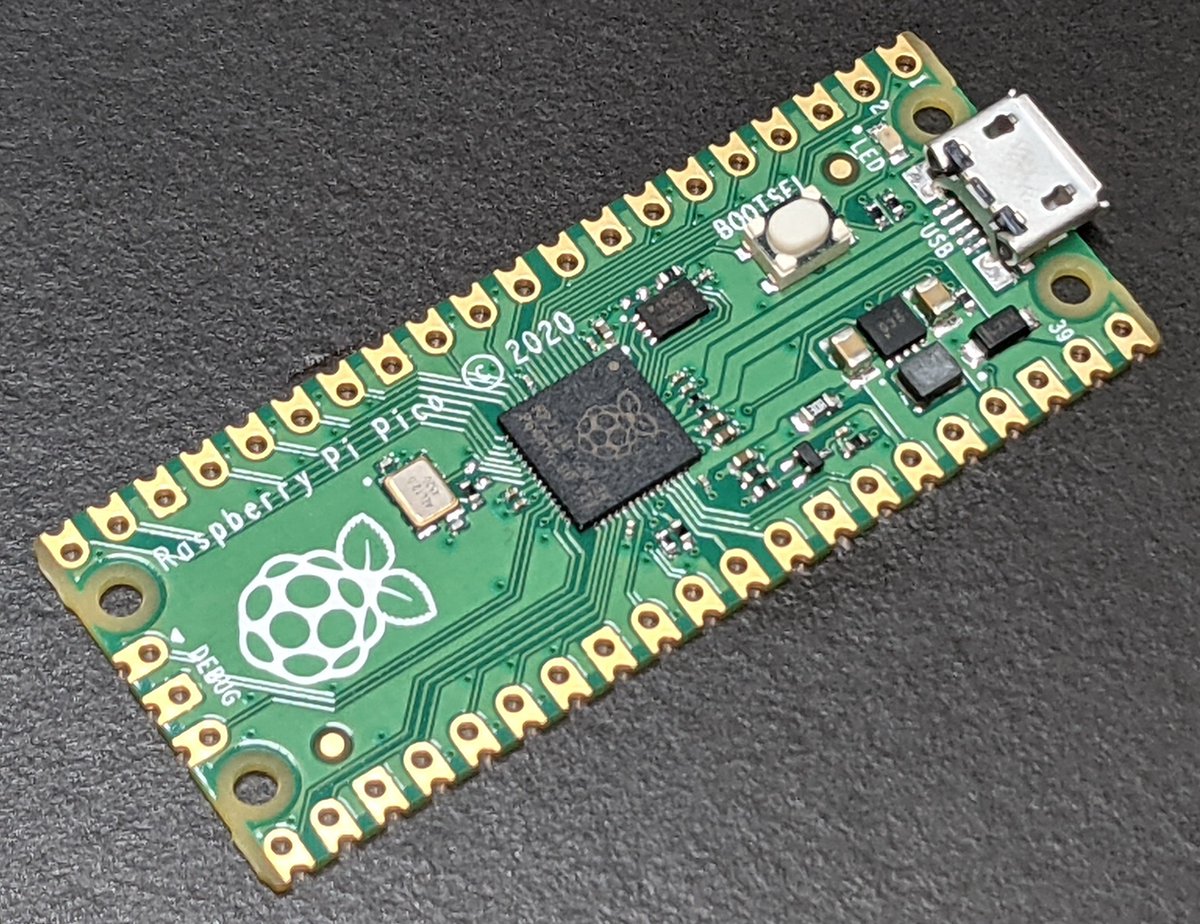

Though this picture is a bit misleading.

Even with devices this small, we couldn't make 13 sextillion of them in 60 years.

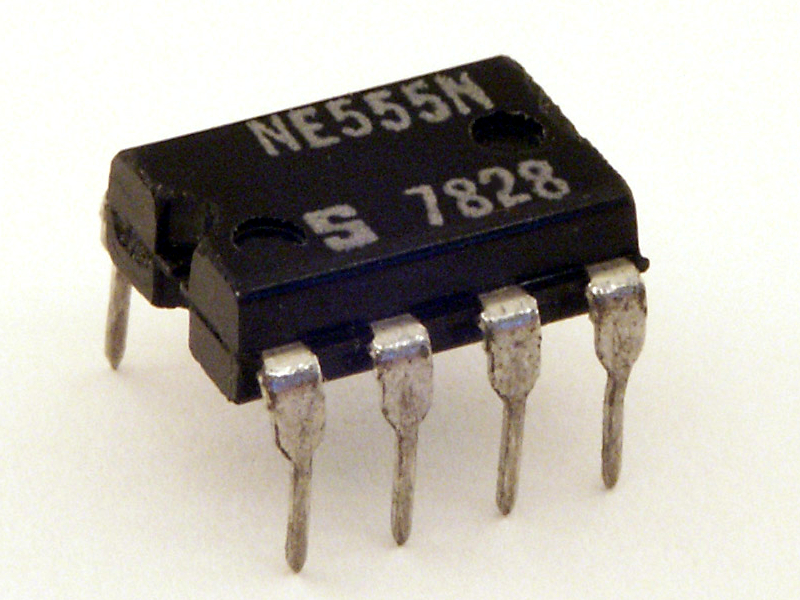

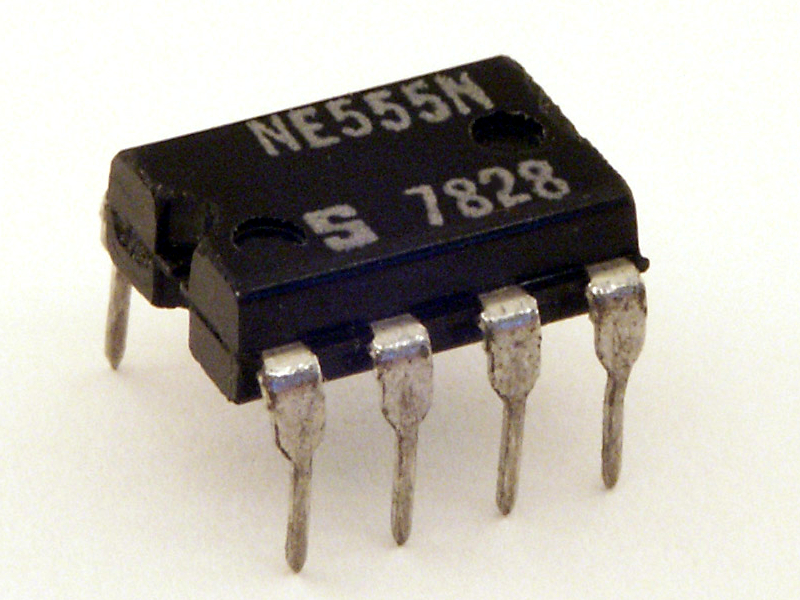

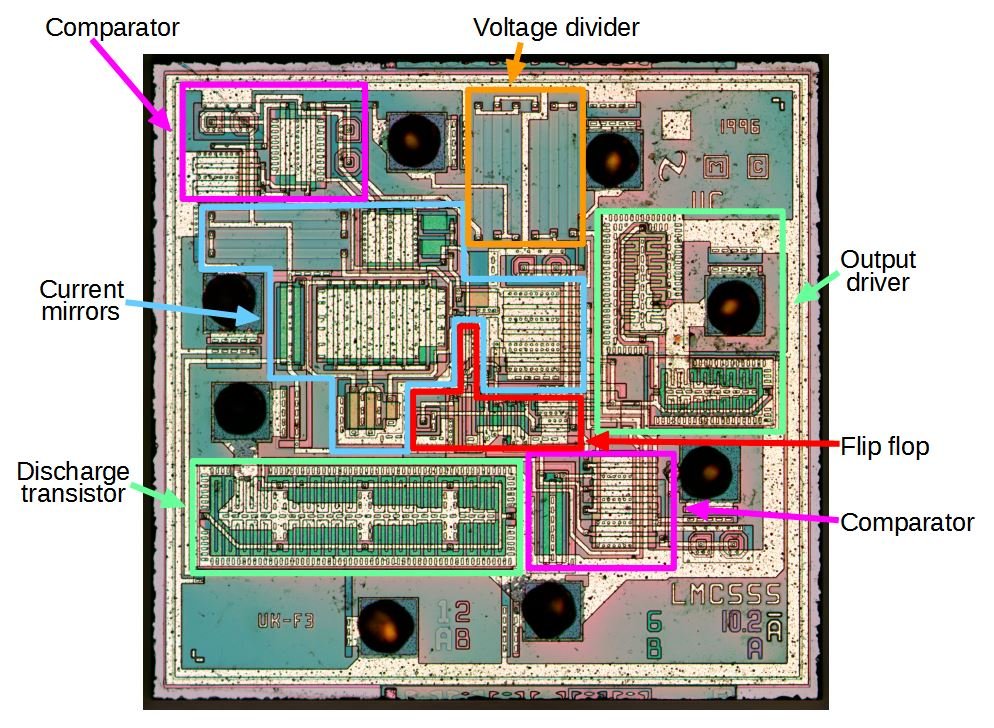

So imagine a chip like this. It's the 555 timer, which is one of the most popular integrated circuits ever made.

In 2017, it was estimated a billion are made every year.

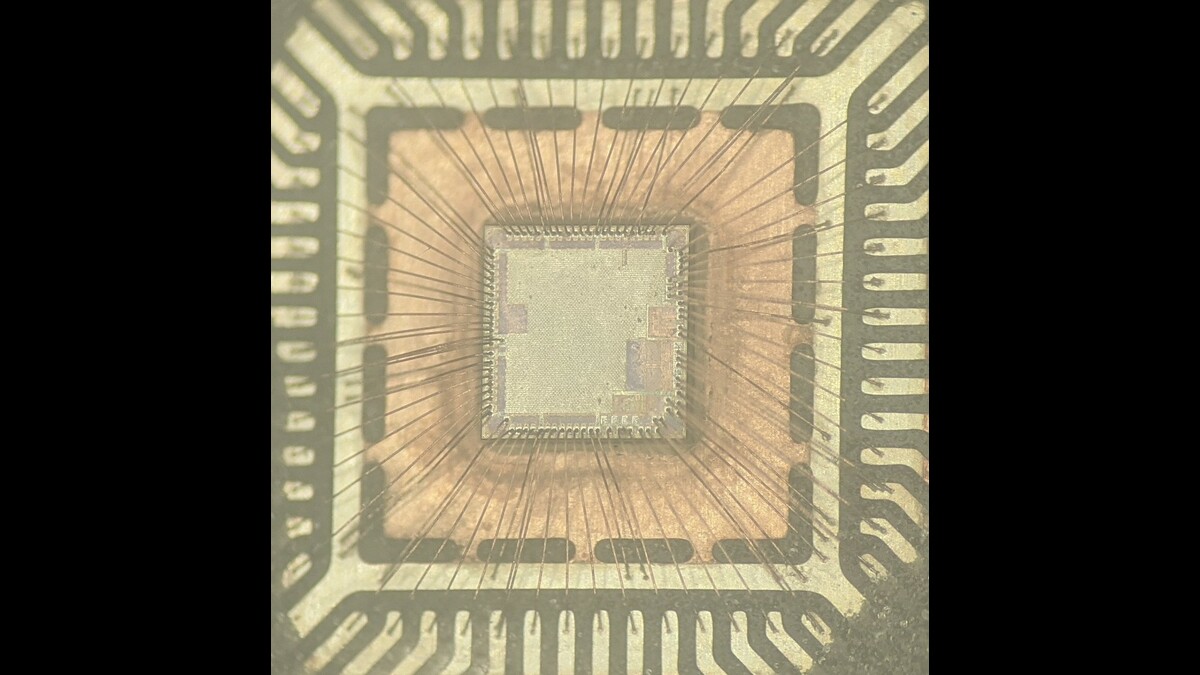

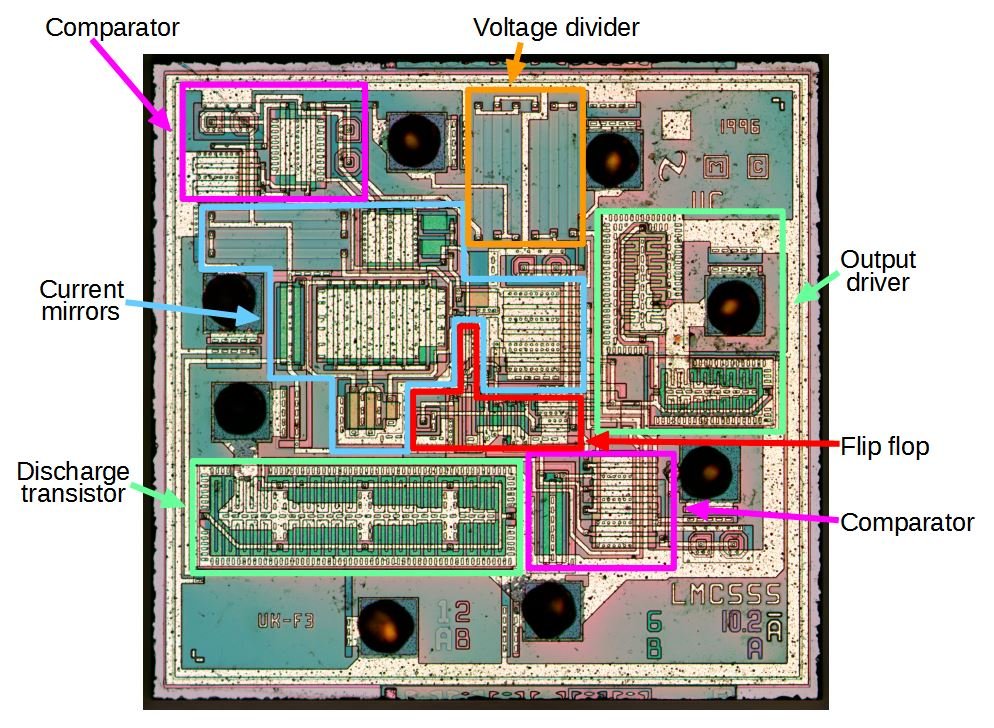

And at the heart of it is the die, which looks like this:

(from Ken Shirriff's blog)

https://t.co/mz5PQDjYqF

And that's fundamentally a bunch of CMOS transistors (along with some diodes and resistors), which are a type of MOSFET. How many of them are on a 555?

about 25. Not many, but it's a very simple chip.

it is the most frequently manufactured device in history, and the total number manufactured from 1960-2018 is 13 sextillion.

That's 13,000,000,000,000,000,000,000.

Though this picture is a bit misleading.

Even with devices this small, we couldn't make 13 sextillion of them in 60 years.

So imagine a chip like this. It's the 555 timer, which is one of the most popular integrated circuits ever made.

In 2017, it was estimated a billion are made every year.

And at the heart of it is the die, which looks like this:

(from Ken Shirriff's blog)

https://t.co/mz5PQDjYqF

And that's fundamentally a bunch of CMOS transistors (along with some diodes and resistors), which are a type of MOSFET. How many of them are on a 555?

about 25. Not many, but it's a very simple chip.

What an amazing presentation! Loved how @ravidharamshi77 brilliantly started off with global macros & capital markets, and then gradually migrated to Indian equities, summing up his thesis for a bull market case!

@MadhusudanKela @VQIndia @sameervq

My key learnings: ⬇️⬇️⬇️

First, the BEAR case:

1. Bitcoin has surpassed all the bubbles of the last 45 years in extent that includes Gold, Nikkei, dotcom bubble.

2. Cyclically adjusted PE ratio for S&P 500 almost at 1929 (The Great Depression) peaks, at highest levels except the dotcom crisis in 2000.

3. World market cap to GDP ratio presently at 124% vs last 5 years average of 92% & last 10 years average of 85%.

US market cap to GDP nearing 200%.

4. Bitcoin (as an asset class) has moved to the 3rd place in terms of price gains in preceding 3 years before peak (900%); 1st was Tulip bubble in 17th century (rising 2200%).

@MadhusudanKela @VQIndia @sameervq

My key learnings: ⬇️⬇️⬇️

Bubble or Bull Market? Join us for a short presentation and candid one on one on 27th Jan, 4pm with Shri \u2066@MadhusudanKela\u2069. \u2066@VQIndia\u2069 \u2066@sameervq\u2069 #bubbleorbullmarket pic.twitter.com/LBvlBrz6mS

— Ravi Dharamshi (@ravidharamshi77) January 24, 2021

First, the BEAR case:

1. Bitcoin has surpassed all the bubbles of the last 45 years in extent that includes Gold, Nikkei, dotcom bubble.

2. Cyclically adjusted PE ratio for S&P 500 almost at 1929 (The Great Depression) peaks, at highest levels except the dotcom crisis in 2000.

3. World market cap to GDP ratio presently at 124% vs last 5 years average of 92% & last 10 years average of 85%.

US market cap to GDP nearing 200%.

4. Bitcoin (as an asset class) has moved to the 3rd place in terms of price gains in preceding 3 years before peak (900%); 1st was Tulip bubble in 17th century (rising 2200%).