Categories Tradingthread

1. https://t.co/cWGjheFrdL

I\u2019m going to do a thread on \u201cDD\u201d. Due diligence is everything about investing. There\u2019s no wrong way to do DD, but I\u2019m going to show a few things I do in order to finding a company that I believe in. Also mix in what others do as well!

— Yates Investing (@yatesinvesting) May 16, 2020

2. https://t.co/tgJO7riEYH

Tonight I want to discuss \u201cGap Fills\u201d I was asked the other day what I meant, so I decided to do this thread.

— Yates Investing (@yatesinvesting) May 14, 2020

3. OFFERINGS

Alright, so tonight i\u2019m going to discuss offerings. I\u2019m also going to discuss why I think offerings are easy money makers. It\u2019s one of my trading strategies, but don\u2019t think that means you need to go buy every stock that has an offering. This might be long. Let\u2019s get started....

— Yates Investing (@yatesinvesting) May 12, 2020

4. OPTIONS and WARRANTS

Let\u2019s learn the difference between stock options and stock warrants real quick.

— Yates Investing (@yatesinvesting) May 12, 2020

Also want to go over option trading more.

"Reading the Tape" / Level 2 / Time and

Thread on "Reading the Tape" / Level 2 / Time and Sales

— Ace (@LunarAces) May 29, 2021

EMAs /

No one explains EMAs either, so here are my 9/20 EMA rules. I have to give credit to @MullinsMomentum for introducing me to these. I adopted some stuff from him, and the rest I developed my own way of using them. Here's a thread of how I use them:

— Ace (@LunarAces) May 30, 2021

Supply and

Why and how 90% of retail traders lose and how you can join the 10% that win. This is by far the most important thread I've made. I truly hope this helps change your lives.

— Ace (@LunarAces) June 14, 2021

Position sizing, risk management and trading around your

Position sizing, risk management, and trading around your core thread:

— Ace (@LunarAces) June 28, 2021

1. Successful Investing starts with Education

2. Psychology of Trading & General Rules

3. Essentials of Fundamental Analysis

4. Master Technical Analysis

5. Screening for Stocks

6. Making a Watchlist

7. Money Management

8. Diversification of Accounts

1 // Successful Investing starts with Education

Following 2000-2002, I realized that I needed an education to help me understand many of the topics mentioned in this thread.

So, I started to educated myself using books. Seek mentors as well.

Then

**16 Must Read Stock Market Books**

— Chris Perruna (@cperruna) November 20, 2019

Gifts for the Holidays!

Reminiscences of a Stock Operator

by Edwin Lef\xe8vrehttps://t.co/DozMNFmvZI pic.twitter.com/b6wEhzMp8n

2 // Psychology of Trading & General Rules

Develop a working SYSTEM (for you)

Preservation of capital

Consistent profitability

Cutting losses short

Superior returns

Understanding “You”:

What is your general personality?

What influences your decisions?

What is your lifestyle?

3a // Essentials of Fundamental Analysis

Earnings Per Share:

1. % Change in Latest Qtr EPS vs. Same QTR Prior Year

2. % Increase in Next Year’s EPS Estimate vs Prior Year’s Actual EPS

3. % Change in Latest EPS, trend past several qtrs

4. Annual % EPS Growth Rate of Last 3 Years

3b // Essentials of Fundamental Analysis

Sales / Revenues

1. % Change Latest Qtr’s Sales vs. Same Qtr Prior Year

2. % Change Latest Reported Fiscal Year Sales vs. Prior Year

3. % Change in Latest Sales, trend past several qtrs

4. Annual % Sales Growth Rate of Last 3 Years

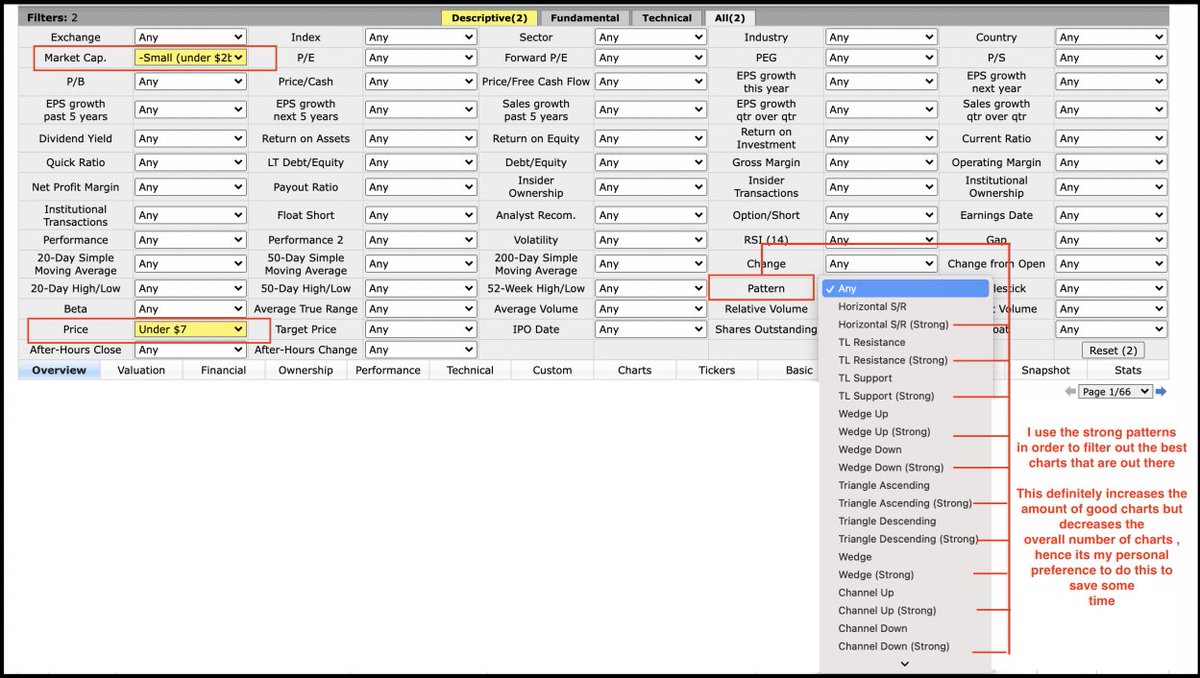

In this thread I will be revealing to you guys my step by step process on how I do my due diligence on any ticker along with the process of how I find good setups and what resources and websites do I use to do it.

Step 1: Finding Good Chart Setups (continued)

Attached below is my personal finviz screener settings which I use to look at charts and how I

change some of the settings to my own preferences.

Site Reference: https://t.co/liI2ktnHhz

PS: Sometimes I don't even select any pattern

My favorite bullish chart setups that I personally look out for initiating swing positions:

1-) Falling Wedge Pattern

2-) Ascending Triangle Pattern

3-) Fish Hook / Oversold Bounce Pattern

4-) Channel Up Pattern

5-) Descending Triangle Breakout Pattern ( Towards Upside)

Step 2: Checking for Offerings

Once I have found a good chart, with a high risk reward ratio, the immediate first thing that I

do is to look out for any signs of upcoming offering. Since I don’t want to get caught in

offerings , these are the two things that I lookout for.

Step 2: Checking for Offerings (continued)

1-) Firstly, I look for whether the company had made any recent offerings in the last two months, if yes then there are less chances of new offerings.

I'll link new threads to this post as I tweet them. Don't go off my work alone, use content by others as well!

🟥 Support/Resistance Flips -

Here\u2019s a little thread on my bread and butter in trading $ETH and $BTC. I base 80% of my trades around simple S/R flips.

— Jelle (@CryptoJelleNL) February 5, 2021

Many traders and investors on here use all kinds of complicated methods, I use a few horizontal lines. pic.twitter.com/Av1Fgdop6L

🟥 Divergences - CHEAT

Morning gents, here's a quick cheat sheet to help you spot divergences while trading $BTC, $ETH and other $ALTS.

— Jelle (@CryptoJelleNL) February 6, 2021

Enjoy, let me know if you want cheat sheets on anything else in the comments below \u2b07\ufe0f\u2b07\ufe0f pic.twitter.com/yjZ43CTHkJ

🟥 BTC Pairs -

Here's a little infographic on why $BTC pairs matter in a bull market.

— Jelle (@CryptoJelleNL) January 16, 2021

Grow your BTC holdings by simply re-balancing spot $ETH and $BTC.

Example below: pic.twitter.com/8JbK6sqjVD

🟥 Funding - THREAD + CHEAT

I've seen many people talk $BTC, $ETH and $ALTS funding and its implications without fully understanding the concept. Here's a quick thread that explains what funding is, how it works and what it can tell you, along with a simple cheat sheet. pic.twitter.com/Hil815E99q

— Jelle (@CryptoJelleNL) February 7, 2021

This contains some of the best threads and articles on various topics related to trading, that I have posted till now.

Enjoy!😊

A thread on closing basis Stop

I have been asked many times about my views on Closing basis Stop loss.

— Trader knight (@Traderknight007) November 5, 2021

So here's a thread on the same. pic.twitter.com/qFgujKAFqS

A thread on

Experience don't count in trading IMO, i can show you people who are trading from last 20 years and still losing money and i can also show you people who are in market since 3-4 years and are Profitable.

— Trader knight (@Traderknight007) June 25, 2021

What matters is how much time do you take to learn from a mistake,

Position

90% of the difference between the performance of a super trader and a normal joe is due to the position sizing.

— Trader knight (@Traderknight007) July 3, 2021

In this article, we will learn why position sizing is important and how we can implement it by learning 3 effective position sizing techniques.https://t.co/gWS4Ifi4OJ

Trading

The biggest trading mistakes that cost me lakhs of Rupees.

— Trader knight (@Traderknight007) July 17, 2021

And the lessons that I learned from them. \U0001f447https://t.co/NCwMM8SVYz

1. Overview

https://t.co/p2gjgPvhHG

2. Investing Process

https://t.co/ZpJeN0JiSV

3. Tools I use and

4. Market Analysis https://t.co/Ol9POhXMiV

5. Due diligence and deep dives on stocks

https://t.co/0oTNNsXuwr

6. General

7. My ongoing

8. List of about 20+ email newsletters in investing / technology and self help that I would

9. I do a lot of writing about IPOs and like to research new companies.

You can follow my writing and subscribe (Free) at

[THREAD]

A process is just a set of rituals you complete consistently every single day to achieve a certain outcome (profit).

A process requires an edge which is simply a statistical advantage you have over other players. A strong psychological state can be considered a bonus edge.

I believe that trading can be split into three elements:

1) Knowledge and idea generation

2) Method and trade execution

3) Risk management and mindset

Each element is necessary and it builds a solid foundation in your trading process.

These factors make up the trading trinity.

MY SCANNING PROCESS:

In PM, I look for:

- Top gainers (40%+)

- Notable volume on gappers

- News or catalysts (to justify gap)

- Float (<50M)

- Market cap (<500M)

- Range (check daily)

- Price (<25)

- Stock personality (check daily)

- Filings (cash on hand and offering potential)

I like to use websites such as:

- https://t.co/dGrDjwtOR8

- https://t.co/Vc256oZCre

- https://t.co/AFrA2ebGr6

- https://t.co/N9nDmqz54E

- https://t.co/0aEt36amzx

- https://t.co/K5b5oercFQ

- https://t.co/VogPh4QNHM

-

Below YOU will find a thread to ALL my #InestrTradesCrashCourse!

Please ❤️Like, 🔁Retweet & ✅Follow if you want more videos!

I Will continue to add content to this as I create more crash courses for you guys!

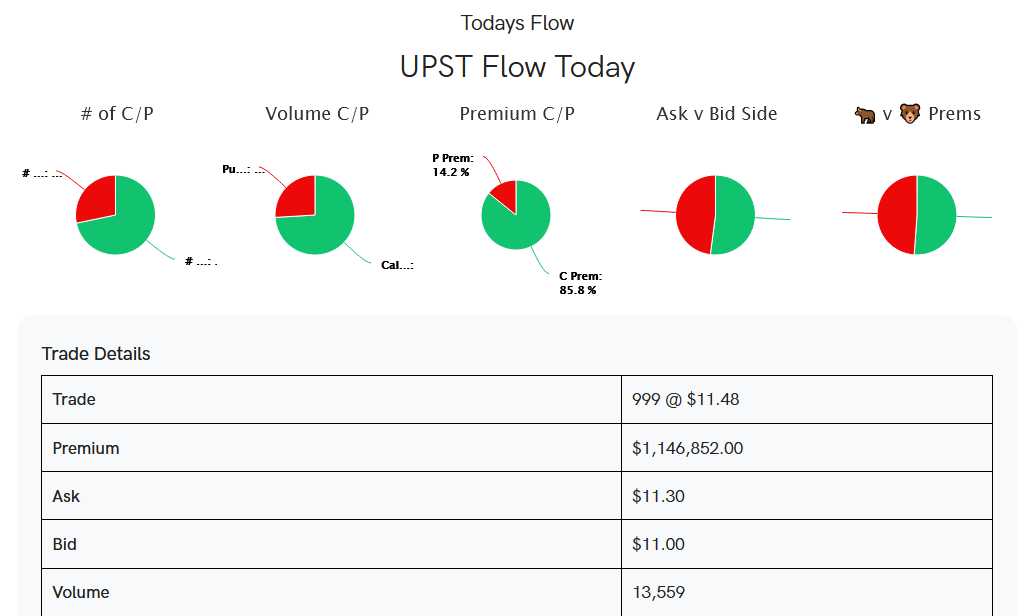

Tools Used:

@unusual_whales

https://t.co/6HpP0YeJoj

\U0001f6a8SWING TRADE CRASH COURSE\U0001f6a8

— InvestrTrades (@InvestrTrades) November 13, 2021

Beginners Guide to Swing Trading

\u2705How to find setups

\u2705How to use @unusual_whales to build conviction

\u2705Which Options Strike to Choose

Please \u2764\ufe0fLike, \U0001f501Retweet & \u2705Follow if you want more videos!

https://t.co/It3cOSqxkj

\U0001f6a8OPTIONS CRASH COURSE\U0001f6a8

— InvestrTrades (@InvestrTrades) October 30, 2021

Beginners Guide to Options + Trading Options With Unusual Whales & How!!

So Many of you have been asking about the basics of options so you can use @unusual_whales for day/swing trading.

Please \u2764\ufe0fLike, \U0001f501Retweet & \u2705Follow if you want more videos!

https://t.co/lc7HAXqXKz

\U0001f6a8OPTIONS CRASH COURSE PART 2\U0001f6a8

— InvestrTrades (@InvestrTrades) November 20, 2021

We will discuss

\u2705Day Trade? Swing Trade?

\u2705What Strike/Exp To Choose

\u2705How to Put in Options Order

\u2705How to use @unusual_whales to Get Conviction

\u2705When All Combined. Choose Strike/Exp

Please \u2764\ufe0fLike, \U0001f501Retweet & \u2705Follow if you want more videos!