Weird feeling. After 10.5 years and roughly £21,000 of debt- I finally paid off the last instalment of my student loan today.

Next month, for the first time- I’ll receive my full post tax salary, for the first time since I graduated.

Indeed IFS forecasts that 83% of students from PST 2012 reforms won’t fully pay back their loan.

Of course, HE has to be paid for and graduates pay according to their ability to do so (as their salary goes up). But as I say, important to see the system for what it is and how it works in practice.

The rest will likely have it hovering over them, in one form or another, until their 50s.

...from family to reduce (or eliminate) their loans. With George Osborne\u2019s abolition of the maintenance grant (and replacement with another loan) that inequity has become greater. Poorer students start working life as poorer graduates...

— Lewis Goodall (@lewis_goodall) February 15, 2021

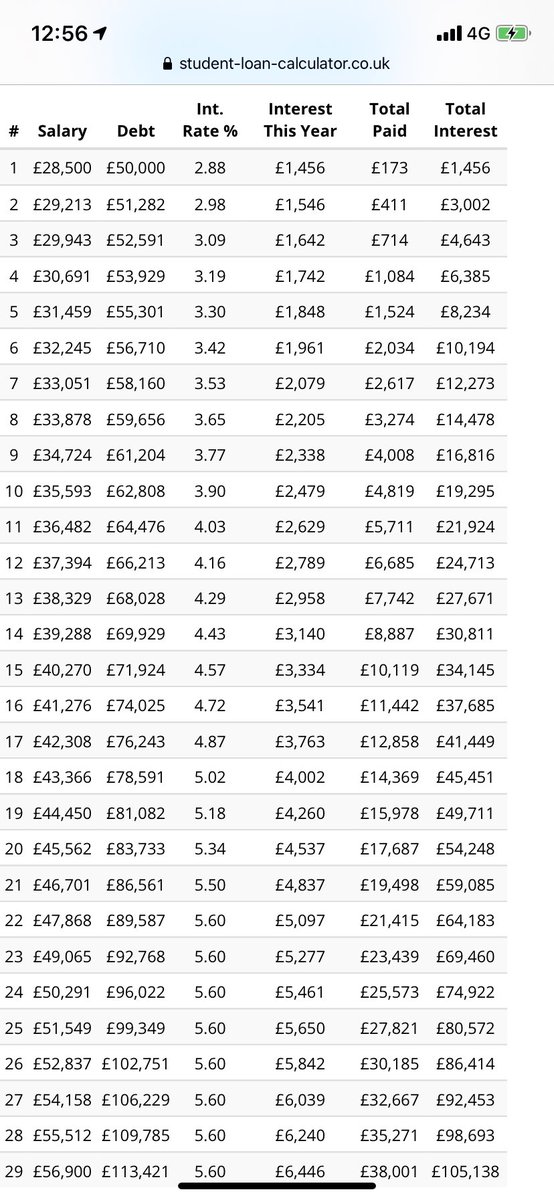

So let’s take a graduate on Plan 2 with a debt of £50k and a v respectable starting salary of £28,500.

Despite a good, rising salary their debt *never goes down*. Rises to £113k.

For Plan 2 (since 2012) those things are no longer the case.

More from Lewis Goodall

Some quick thoughts on what we just saw

Firstly hardly a unique insight but hard to overstimate the difference between the two last inaugurals. America has meandered sharply along its political arc.

Biden's rhetoric reached high. Every sentence seemed purposefully...

...constructed to negate every political and personal characteristic of his predecessor.

And insofar as he's not Trump, that he does accept, cherish and understand democratic norms, institutions and conventions in a way that Trump never could, Biden will make a real difference.

He will change the tone and tenor of politics, not only in America but across the West. As I've said before, just replacing Trump is a substantial victory for him and will earn him praise from historians.

But that aura will disappear quickly. A governing project it will not make

But how much praise he receives and stature conferred by posterity will depend on what happens next.

Because the big overarching question for me, watching this, is which of those two inaugurals, Trump or Biden's, is going to seem unusual in the future.

The relief that many are feeling is predicated on a type of politics ending. But it is at least as possible that it is Biden ..not Trump who is the last gasp of something. Is it Trump who is the dying embers of a dying, increasingly powerless old white America...

Firstly hardly a unique insight but hard to overstimate the difference between the two last inaugurals. America has meandered sharply along its political arc.

Biden's rhetoric reached high. Every sentence seemed purposefully...

BREAK: Joe Biden is inaugurated as the 46th President of the United States.

— Lewis Goodall (@lewis_goodall) January 20, 2021

The Trump administration is over.

...constructed to negate every political and personal characteristic of his predecessor.

And insofar as he's not Trump, that he does accept, cherish and understand democratic norms, institutions and conventions in a way that Trump never could, Biden will make a real difference.

He will change the tone and tenor of politics, not only in America but across the West. As I've said before, just replacing Trump is a substantial victory for him and will earn him praise from historians.

But that aura will disappear quickly. A governing project it will not make

But how much praise he receives and stature conferred by posterity will depend on what happens next.

Because the big overarching question for me, watching this, is which of those two inaugurals, Trump or Biden's, is going to seem unusual in the future.

The relief that many are feeling is predicated on a type of politics ending. But it is at least as possible that it is Biden ..not Trump who is the last gasp of something. Is it Trump who is the dying embers of a dying, increasingly powerless old white America...

More from Finance

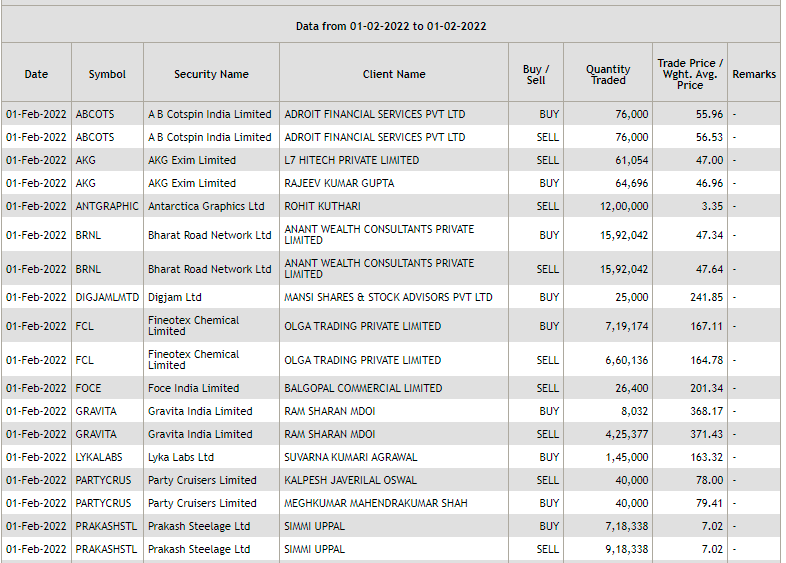

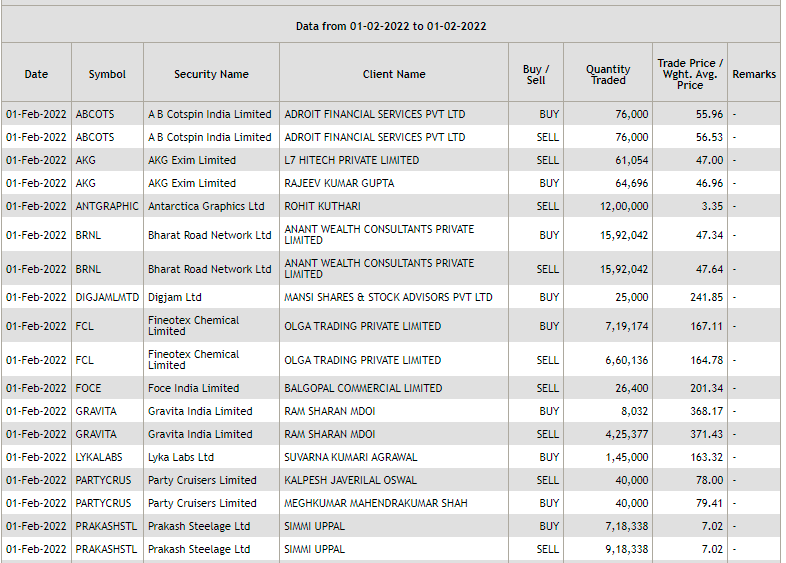

A 🧵on the basics of block and bulk deals.

Block and bulk deals are large purchases of stocks by investment banks, mutual funds, hedge funds, pension funds, FIIs, and promoters. Tracking block and bulk deals can help give you a sense of what these large players are thinking.

A single transaction where shares more than Rs 10 crores or the number of shares traded are more than 5 lakh is considered a block deal.

Block deals are carried out in separate trading windows. This trading window operates in two shifts of 15 minutes each:

Morning trading window from 8:45 AM to 9:00 AM.

Afternoon trading window from 2:05 PM to 2:20 PM

Block deals happen in different windows to reduce volatility and sudden price movements. Given that they are traded in a separate window, they do not show up on the volume charts.

Brokers facilitating the transaction are required to inform the exchange. You can track bulk and block deals on NSE & BSE:

https://t.co/pwTyzWTnUL

https://t.co/g9BbHiEag3

Block and bulk deals are large purchases of stocks by investment banks, mutual funds, hedge funds, pension funds, FIIs, and promoters. Tracking block and bulk deals can help give you a sense of what these large players are thinking.

A single transaction where shares more than Rs 10 crores or the number of shares traded are more than 5 lakh is considered a block deal.

Block deals are carried out in separate trading windows. This trading window operates in two shifts of 15 minutes each:

Morning trading window from 8:45 AM to 9:00 AM.

Afternoon trading window from 2:05 PM to 2:20 PM

Block deals happen in different windows to reduce volatility and sudden price movements. Given that they are traded in a separate window, they do not show up on the volume charts.

Brokers facilitating the transaction are required to inform the exchange. You can track bulk and block deals on NSE & BSE:

https://t.co/pwTyzWTnUL

https://t.co/g9BbHiEag3

You May Also Like

Stan Lee’s fictional superheroes lived in the real New York. Here’s where they lived, and why. https://t.co/oV1IGGN8R6

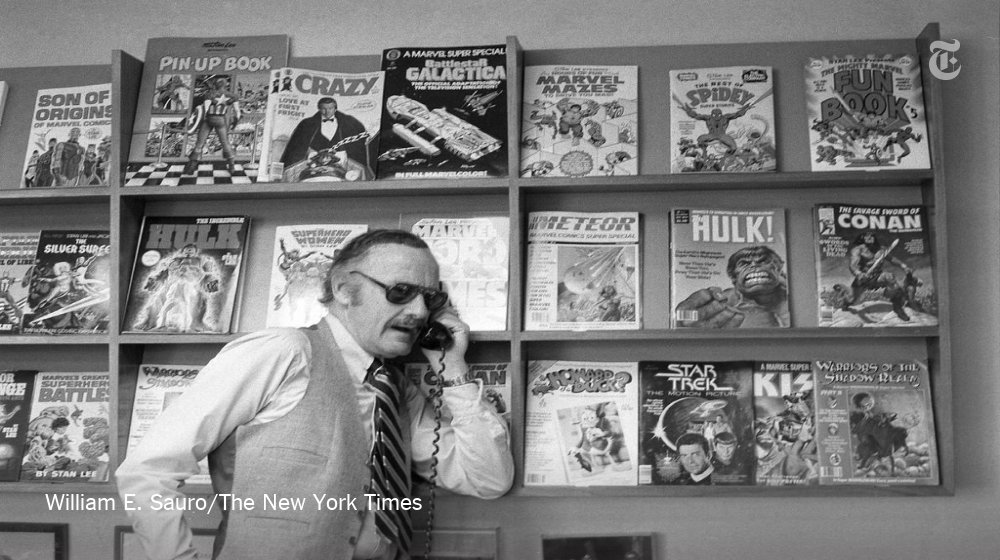

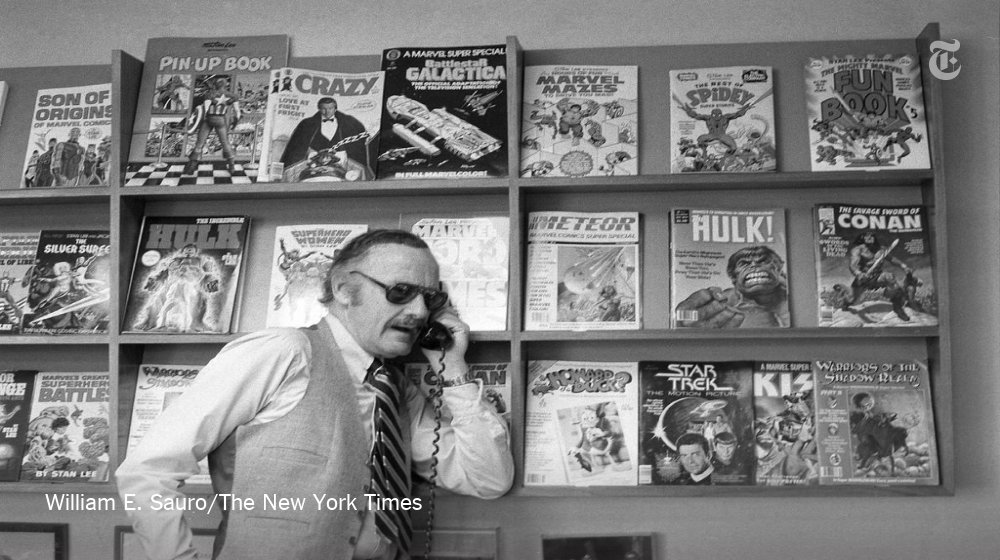

Stan Lee, who died Monday at 95, was born in Manhattan and graduated from DeWitt Clinton High School in the Bronx. His pulp-fiction heroes have come to define much of popular culture in the early 21st century.

Tying Marvel’s stable of pulp-fiction heroes to a real place — New York — served a counterbalance to the sometimes gravity-challenged action and the improbability of the stories. That was just what Stan Lee wanted. https://t.co/rDosqzpP8i

The New York universe hooked readers. And the artists drew what they were familiar with, which made the Marvel universe authentic-looking, down to the water towers atop many of the buildings. https://t.co/rDosqzpP8i

The Avengers Mansion was a Beaux-Arts palace. Fans know it as 890 Fifth Avenue. The Frick Collection, which now occupies the place, uses the address of the front door: 1 East 70th Street.

Stan Lee, who died Monday at 95, was born in Manhattan and graduated from DeWitt Clinton High School in the Bronx. His pulp-fiction heroes have come to define much of popular culture in the early 21st century.

Tying Marvel’s stable of pulp-fiction heroes to a real place — New York — served a counterbalance to the sometimes gravity-challenged action and the improbability of the stories. That was just what Stan Lee wanted. https://t.co/rDosqzpP8i

The New York universe hooked readers. And the artists drew what they were familiar with, which made the Marvel universe authentic-looking, down to the water towers atop many of the buildings. https://t.co/rDosqzpP8i

The Avengers Mansion was a Beaux-Arts palace. Fans know it as 890 Fifth Avenue. The Frick Collection, which now occupies the place, uses the address of the front door: 1 East 70th Street.