I will be a buyer under 13800 levels, but depending upon the reversal on smaller timeframe.

#BITCOIN

— Mayank Narula (@Mayank_Narula1) March 5, 2022

Pending RSI divergence on monthly chart which requires a dip under 13805 to get resolved.

But monthly RSI divergences can go on for years before the resolution.

Best case scenario will be panic dump over next few months. pic.twitter.com/hi67hMg9sZ

More from Mayank Narula

#Nifty

So now that Nifty has undergone ABC correction in the expected manner, what to expect next?

I think we have started larger degree wave 3, once 16800 was crossed.

16800 is the reference level now. We will get more sense by end of next week/ month. https://t.co/KsziuUpZxU

#NIFTY

If 17445 is taken out, then may be we are heading to fresh new all time on Nifty.

Things may pan out way faster than expected.

#NIFTY

Zoomed in cross-section of the chart above.

Wave 3 of 1 should have started today, which can take Nifty to fresh all time highs.

#NIFTY

So now Nifty is moving more clearly on the expected path, what's next?

Nifty has started longer term wave 3 advancement, pending final confirmation of HH by crossing 17800.

In Wave 1 of 3, can expect a move to 20k+.

In terms of longer term wave structure:

Wave 1: 7500 to 18600

Wave 3: 15700 to 35000+

And this can pan out over next 2 years or so.

Since wave 2 was a shallow correction, wave 4 can potentially be a deeper correction.

So now that Nifty has undergone ABC correction in the expected manner, what to expect next?

I think we have started larger degree wave 3, once 16800 was crossed.

16800 is the reference level now. We will get more sense by end of next week/ month. https://t.co/KsziuUpZxU

I am no expert in Wave Theory, but can this be a possible path over next few weeks/months?

— Mayank Narula (@Mayank_Narula1) December 6, 2021

Views requested. @idineshptl @indiacharts @nishkumar1977 pic.twitter.com/u3DjEeqoqB

#NIFTY

If 17445 is taken out, then may be we are heading to fresh new all time on Nifty.

Things may pan out way faster than expected.

#NIFTY

Zoomed in cross-section of the chart above.

Wave 3 of 1 should have started today, which can take Nifty to fresh all time highs.

#NIFTY

So now Nifty is moving more clearly on the expected path, what's next?

Nifty has started longer term wave 3 advancement, pending final confirmation of HH by crossing 17800.

In Wave 1 of 3, can expect a move to 20k+.

In terms of longer term wave structure:

Wave 1: 7500 to 18600

Wave 3: 15700 to 35000+

And this can pan out over next 2 years or so.

Since wave 2 was a shallow correction, wave 4 can potentially be a deeper correction.

More from Bitcoin

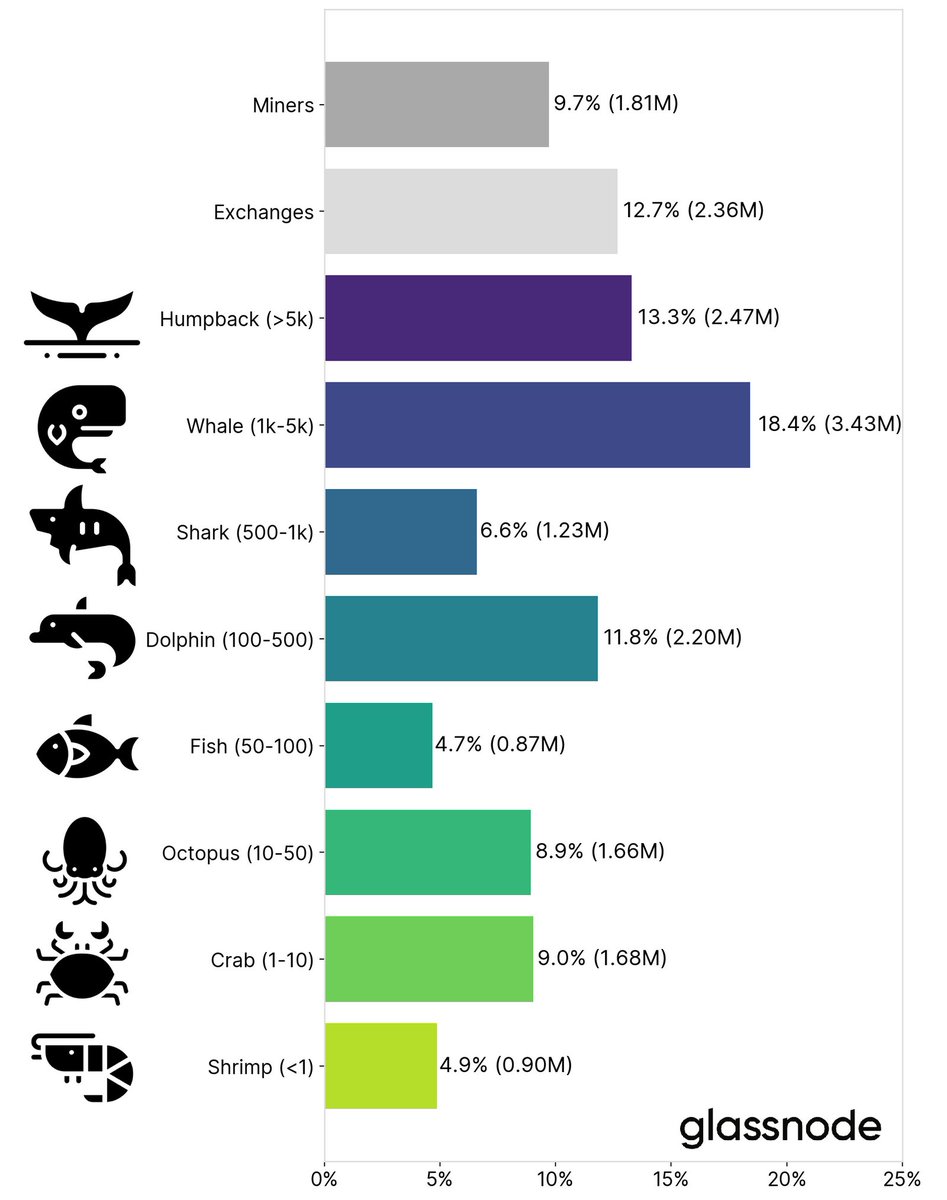

1/ #Bitcoin FUD-busting time!

claim: bitcoin ownership is heavily concentrated.

@business published an article claiming "2% of accounts control 95% of all Bitcoin" 🤣

truth: the facts, my friends, simple don't line up. let's dive in!

2/ interrogating on-chain addresses is tricky.

address =/ account.

one person can control multiple addresses.

one address can hold bitcoin belonging to multiple ppl.

exchanges and trading firms will have addresses with large balances that represent client funds.

3/ the fine folks @glassnode published an excellent analysis of on-chain address balances in January

the ownership distribution of bitcoin among wallets is actually much more diverse than one might expect.

full piece here:

https://t.co/n5IdIQdNoA

4/ 31% of BTC is held in addresses not identified as exchange wallets.

these are likely institutions, funds, custodians, and OTC desks.

our analysis at @CoinSharesCo indicates >15% of all bitcoin is held in third party custody, including @coinbase and our own @KomainuCustody

5/ in fact, between asset managers @Grayscale ($36B in BTC) and our @xbtprovider ($4B in BTC), 4% of bitcoin is locked up by fund providers and asset managers!

our @CoinSharesCo research team publishes an EXCELLENT weekly report on fund flows and AUMs -

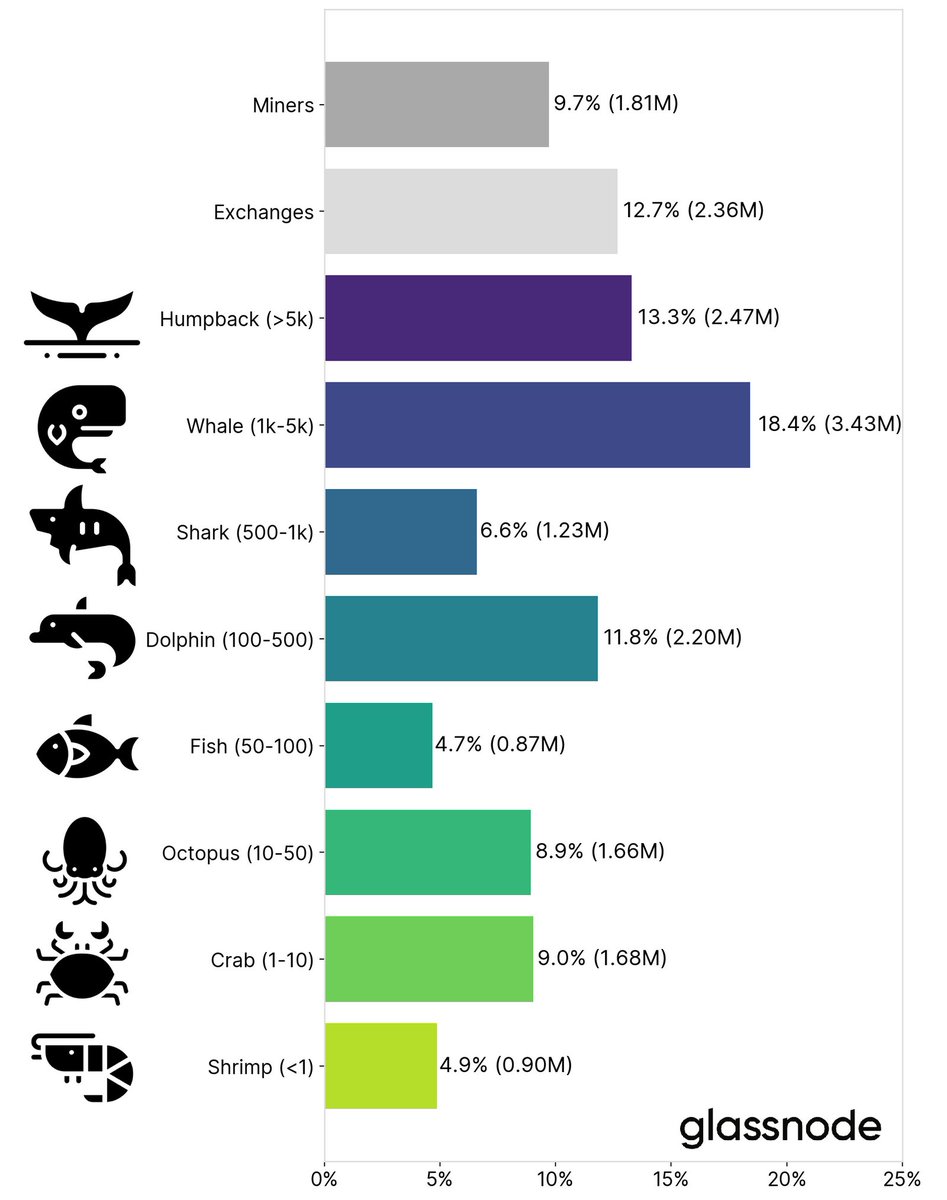

claim: bitcoin ownership is heavily concentrated.

@business published an article claiming "2% of accounts control 95% of all Bitcoin" 🤣

truth: the facts, my friends, simple don't line up. let's dive in!

2/ interrogating on-chain addresses is tricky.

address =/ account.

one person can control multiple addresses.

one address can hold bitcoin belonging to multiple ppl.

exchanges and trading firms will have addresses with large balances that represent client funds.

3/ the fine folks @glassnode published an excellent analysis of on-chain address balances in January

the ownership distribution of bitcoin among wallets is actually much more diverse than one might expect.

full piece here:

https://t.co/n5IdIQdNoA

4/ 31% of BTC is held in addresses not identified as exchange wallets.

these are likely institutions, funds, custodians, and OTC desks.

our analysis at @CoinSharesCo indicates >15% of all bitcoin is held in third party custody, including @coinbase and our own @KomainuCustody

5/ in fact, between asset managers @Grayscale ($36B in BTC) and our @xbtprovider ($4B in BTC), 4% of bitcoin is locked up by fund providers and asset managers!

our @CoinSharesCo research team publishes an EXCELLENT weekly report on fund flows and AUMs -

Another #FreeLoveFriday. So far, I’ve covered Bitcoin, Mastercoin/Omni, and last week ChainLink and the importance of decentralized oracles. Today, let’s talk about one of the most fascinating projects in crypto - @MakerDAO

In my thread about Mastercoin, I briefly touched on the vital role fiat-backed stablecoins play in crypto markets, but there’s a catch with them:

The counterparty risk of a third-party holding fiat in reserves.

Enter MakerDAO, which set out to create a decentralized, collateral-backed cryptocurrency, DAI, that would be “soft-pegged” to the U.S. Dollar using the power of algorithms. In crypto tradition, its supporters said trust game theory, not operators.

In 2017, MakerDAO published a whitepaper describing a system where anyone could create DAI by leveraging ETH as collateral to create Collateralized Debt Positions. Essentially, you take out a digital USD loan against your crypto.

The game theory of the system is structured such that DAI issuance is controlled to keep the price pegged to $1.00. In essence, it buffers the fluctuations of the underlying collateral to create a synthetic dollar bill.

Back with another #FreeLoveFriday. Last time, we covered how Mastercoin/@Omni_Layer pioneered digital asset issuance on blockchains. Today, let\u2019s discuss @Chainlink and the vital role it plays in connecting blockchains to the real world. https://t.co/0poYIBtGrt

— Emin G\xfcn Sirer (@el33th4xor) January 22, 2021

In my thread about Mastercoin, I briefly touched on the vital role fiat-backed stablecoins play in crypto markets, but there’s a catch with them:

The counterparty risk of a third-party holding fiat in reserves.

Enter MakerDAO, which set out to create a decentralized, collateral-backed cryptocurrency, DAI, that would be “soft-pegged” to the U.S. Dollar using the power of algorithms. In crypto tradition, its supporters said trust game theory, not operators.

In 2017, MakerDAO published a whitepaper describing a system where anyone could create DAI by leveraging ETH as collateral to create Collateralized Debt Positions. Essentially, you take out a digital USD loan against your crypto.

The game theory of the system is structured such that DAI issuance is controlled to keep the price pegged to $1.00. In essence, it buffers the fluctuations of the underlying collateral to create a synthetic dollar bill.