Alex1Powell Categories Trading

Will attempt to deep dives on each to build on some of my musings from earlier in the year on this topic 🤗 https://t.co/Amlnje1Qiq

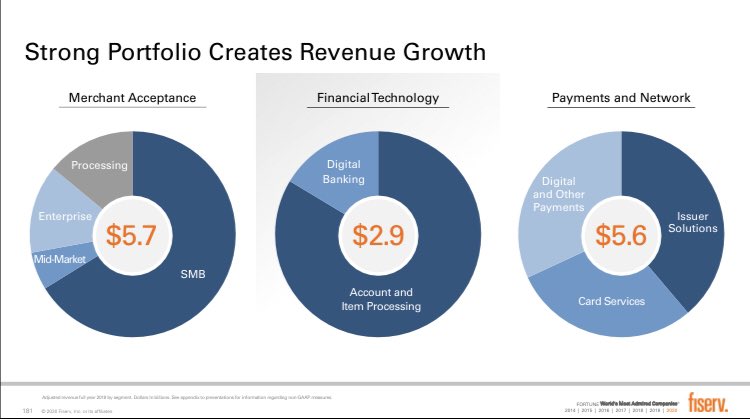

3) The revenue mix of $FISV today (post FDC merger) is roughly ~40% merchant acquiring, ~45% issuer processing and other payments related services, and ~15% core bank processing. Will take these in turn, then highlight growth levers I\u2019m most excited to watch in the coming years pic.twitter.com/yhvkCQrsF8

— BlueToothDDS (@BlueToothDDS) March 6, 2020

Will also try to bridge to an earlier thread laying out the $FISV growth algorithm and the operational/financial levers that support its medium-term outlook of 15-20% FCF/share growth

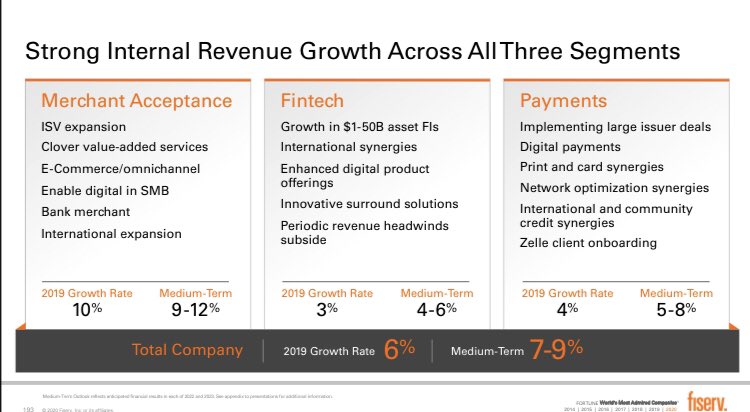

Here we focus on the top line, most notably the impressive acceleration across all 3 segments https://t.co/8HzMhEC5Bj

12) $FISV has both operational levers ($0.6B revenue synergies, $1.4B combined cost synergies + add\u2019l cost take out) and financial levers ($30B+ deployable FCF) to support its 15-20% compounded FCF/share growth

— BlueToothDDS (@BlueToothDDS) December 9, 2020

... and this is all before underlying business momentum (tomorrow) pic.twitter.com/JBtlGQIfBT

Let’s start with Merchant:

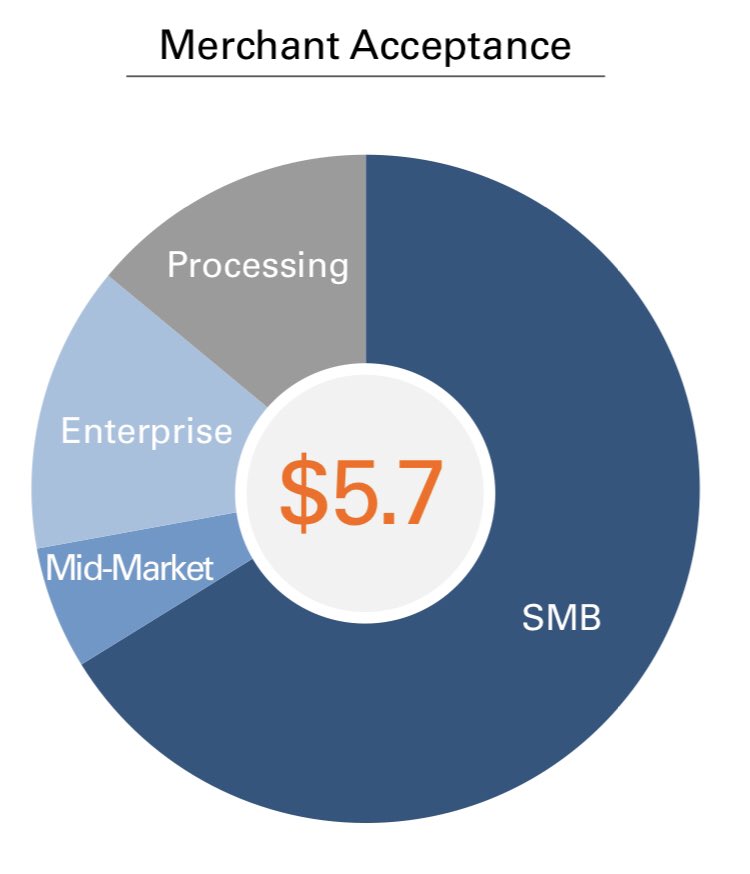

1) This segment, which ~40% of $FISV revenue today, is the #1 merchant acquirer globally processing $3T+ annually for 6M merchants worldwide

2/3 of revenue is from SMBs, ~20% from mid-to-enterprise merchants, remaining ~15% is wholesale processing

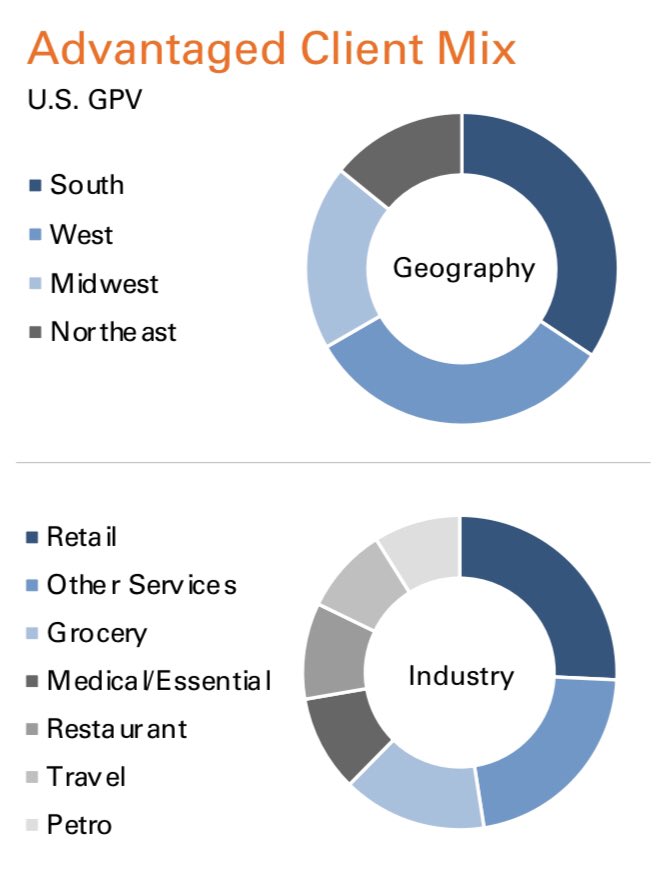

2) 🇺🇸 is 3/4 of the $FISV Merchant segment and the scale of this business is unmatched: it processes 40% of all in-person purchases in the US, covers 80% of all US zip codes and accounts for 10% of US GDP. This book of business is the most balanced in the industry https://t.co/Qlkk7lz3jQ

4) $FISV merchant business is the largest US acquirer processing $2.4 trillion of payments annually (including through JVs with BAC, WFC, PNC, C) accounting for 10% of \U0001f1fa\U0001f1f8 GDP. This segment includes Clover, which focuses on SMBs and is $105B runrate today growing at 40%+ annually pic.twitter.com/M5j4mbeiJX

— BlueToothDDS (@BlueToothDDS) March 6, 2020

3) Internationally, $FISV Merchant has strong position in EMEA (top 3 through various JVs and alliances) and several high growth countries, among others: India 🇮🇳 (top 3 with ~15% share), Argentina 🇦🇷 (~50% market share today), Brazil 🇧🇷 (routing ~30% of all electronic payments)

The short answer is NO. Of course this is not investment advice, DYODD, and I have no position in the stock either way but...

THREAD

Small follow-up: NOT involved anymore as degree of difficulty just too high now. But noticed that 1H update that was previously labeled as '11/20' for release on $UMDK website is now 'Q4 2020' - ie probably slipping to Dec.

— Jeremy Raper (@puppyeh1) October 19, 2020

Why further delays? Are auditors pushing back? \U0001f9d0\U0001f9d0 https://t.co/jlaeNY6ypq

I dumped this and moved on when the lack of disclosures + impossible to understand W/C moves made this simply a 'too hard' bucket for me. Post 1H, the qs remain...

I originally thought this biz was levered to rising adoption of Payback, through a licensing/low-touch take-rate type model. That apparently is not the case. Instead most of the growth is from the new 'consulting' segment - but there is no disclosure of what that entails...

...Nor is there disclosure of any clients; nor the revenue split b/w commerce/consulting and the legacy biz; nor any attempt at explanation for how the biz has suddenly exploded in growth...

...meanwhile of course receivables/payables improved HoH but keep in mind the AG (holdco/top level) entity still has essentially zero cash...and all the cash generated by the biz (apparently) sits in an (unaudited) sub...

I'm not casting aspersions but this is 🤔🤔

A few quick thoughts (although very much first

It seems like the bill contains a mix of some of the options outlined in our @instituteforgov explainer on UK ratification

https://t.co/WUa3MSkABL

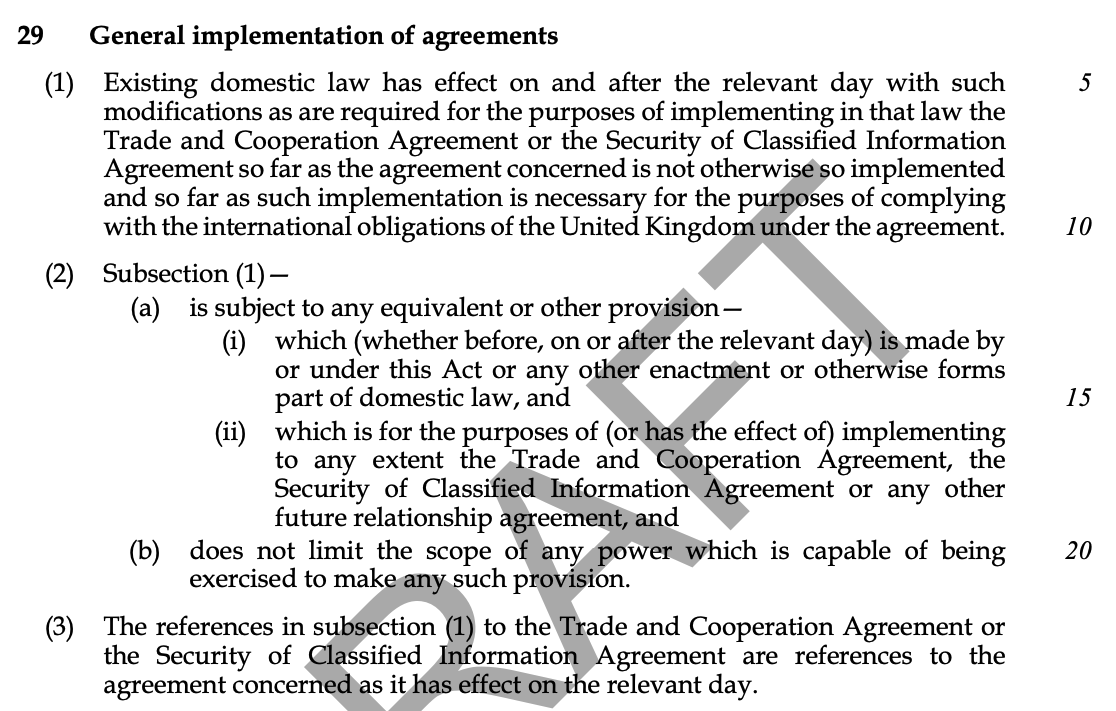

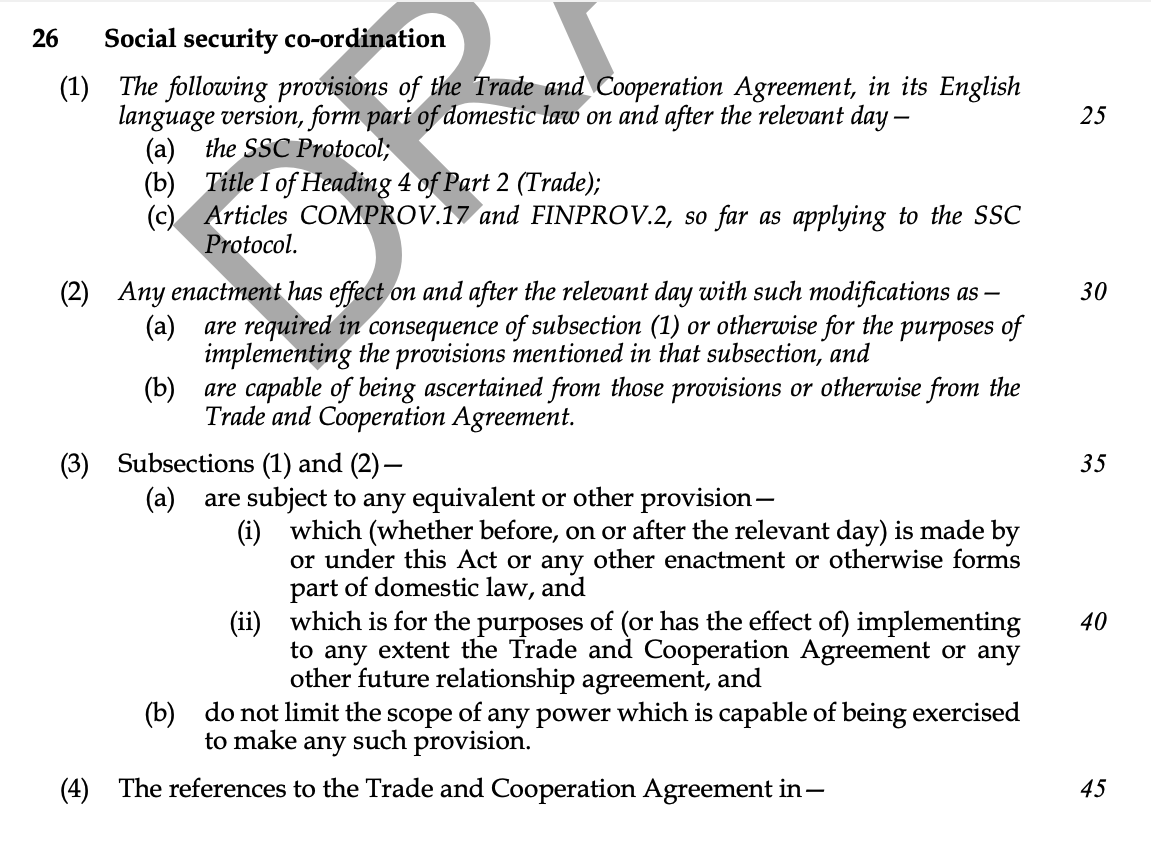

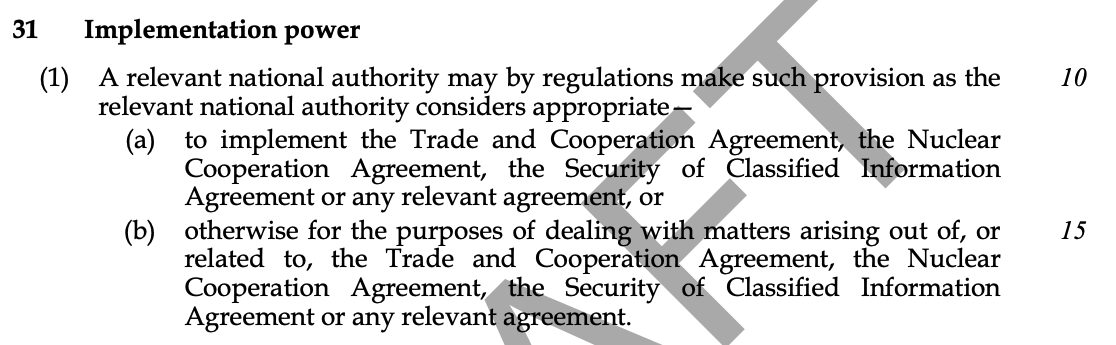

Clause 29 seems to be a catch all clause - so existing domestic law is treated as subject to the UK-EU deal where it has not been specifically amended to implement it (where this is required) (more from @ProfMarkElliott

https://t.co/FEBrdG09Cy)

Cl 29 of the Future Relationship Bill is certainly interesting. If I\u2019ve understood correctly, it is, in effect, an automatic Henry VIII clause that requires existing domestic law to be treated as subject to the Agreements to the extent that they have not been implemented. pic.twitter.com/nyL52YOslD

— Mark Elliott (@ProfMarkElliott) December 29, 2020

Also seem to be separate provisions for the social security coordination protocol to form part of domestic law (clause 26)

Clause 31 includes a general implementating power (a big Henry VIII power, that allows the use of secondary legislation to do anything an act of parliament could do). Seems to be affirmative. Exercisable by gov and also devolved administrations. Inevitable given short time.

$AMZN AWS NA instances CPU market share. $TSM which manufactures both for AWS (Graviton) and $AMD is the real winner pic.twitter.com/rVPec8TdQ6

— Lucid Capital (@LucidCap) December 13, 2020

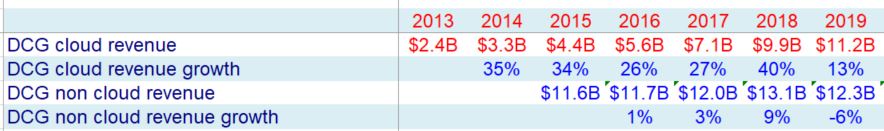

While Intel's CCG segment (the PC segment) is fairly stagnant, The Data center segment (henceforth DCG) has been growing nicely for years. 2019 revenue are ~50% above 2015 and the segment has shown nice growth 2020 so far

So what has enabled an old mature co like $INTC to suddenly grow so fast in a major segment?

It's kind of obvious, isn't it? the CLOUD.

The DCG segment actually contains 2 very different activities - Traditional data center and hyper cloud

And while it's hyper cloud business was booming, it's traditional data center business was stagnating.

We estimate that between 2014-2019, Hyper cloud grew at ~30% CAGR with Traditional data center operating without growth

So it's pretty easy do see that the future of $INTC lies in its hyper cloud business. We've established that it faces a bleak future in PC and traditional data center, well, let's just say it's not a growth business.