Authors Emilgold

7 days

30 days

All time

Recent

Popular

We've already established that $INTC is about to lose serious market share in the PC market but truth be told, Intel's most important segment is probably what it terms as the "Data Center Group", it's data center business. So what are Intel's prospects there? Let's do a deep dive

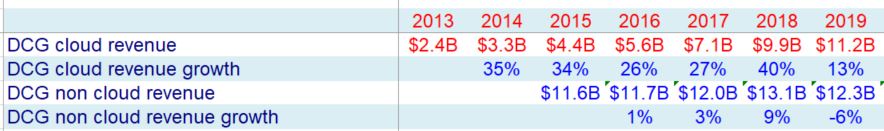

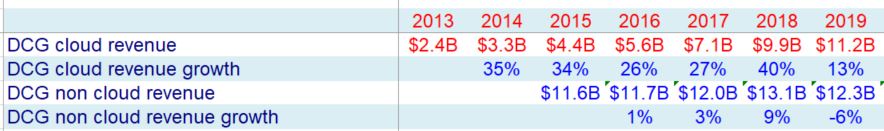

While Intel's CCG segment (the PC segment) is fairly stagnant, The Data center segment (henceforth DCG) has been growing nicely for years. 2019 revenue are ~50% above 2015 and the segment has shown nice growth 2020 so far

So what has enabled an old mature co like $INTC to suddenly grow so fast in a major segment?

It's kind of obvious, isn't it? the CLOUD.

The DCG segment actually contains 2 very different activities - Traditional data center and hyper cloud

And while it's hyper cloud business was booming, it's traditional data center business was stagnating.

We estimate that between 2014-2019, Hyper cloud grew at ~30% CAGR with Traditional data center operating without growth

So it's pretty easy do see that the future of $INTC lies in its hyper cloud business. We've established that it faces a bleak future in PC and traditional data center, well, let's just say it's not a growth business.

$AMZN AWS NA instances CPU market share. $TSM which manufactures both for AWS (Graviton) and $AMD is the real winner pic.twitter.com/rVPec8TdQ6

— Lucid Capital (@LucidCap) December 13, 2020

While Intel's CCG segment (the PC segment) is fairly stagnant, The Data center segment (henceforth DCG) has been growing nicely for years. 2019 revenue are ~50% above 2015 and the segment has shown nice growth 2020 so far

So what has enabled an old mature co like $INTC to suddenly grow so fast in a major segment?

It's kind of obvious, isn't it? the CLOUD.

The DCG segment actually contains 2 very different activities - Traditional data center and hyper cloud

And while it's hyper cloud business was booming, it's traditional data center business was stagnating.

We estimate that between 2014-2019, Hyper cloud grew at ~30% CAGR with Traditional data center operating without growth

So it's pretty easy do see that the future of $INTC lies in its hyper cloud business. We've established that it faces a bleak future in PC and traditional data center, well, let's just say it's not a growth business.