Alex1Powell Categories Trading

https://t.co/zsc2eBVI4e Tons of great preclinical work on TIE2 MOA showing clear correlation to SC integrity, adult-onset glaucoma, and disease-modifying effects. See mosaic if interested

can you share the preclinical work you describe along with the papers?

— James Brandt (@jmsbrandt) November 20, 2020

What do KOL's think of the new MOA: Special session held at ARVO 2019 to discuss Tie2 for Glaucoma. $ARPO then completed a closely watched P1b with a topical formulation. Now, a P2b trial in 195 pts enrolled within 3 mos, a month ahead of schedule, in the middle of a pandemic.

SOC is PG (-7 mm Hg IOP) +/- adjunct (-1 to -1.5 mm delta). Best efficacy adjunct is Rocklatan (-1.5), but AE profile: hyperemia (60 vs 15%), pruritus (8 vs 2%) site pain (20 vs 7%) vs PG , + other AE’s not seen with PG: 10% conjunctival hemorrhage, 15% verticillata. Almost DOA

But, sells $80 to $100M/yr US (same as $ARPO MC ha!). Every 0.3 mm reduction critical towards delaying vision loss. Rocklatan MOA was projected to make it a $1B drug, until AE profile (& payor delays) killed launch. $ARPO thesis: Raz efficacy >/= Rocklatan, without AE baggage.

Once y\u2019all get off social media y\u2019all gonna realize the average millionaire doesn\u2019t dress in designer. A lot of y\u2019all don\u2019t realize how many you encounter in your life because they don\u2019t ever dress or appear like one. Real estate changed my whole perspective of that.

— J (@J_realbidness) December 26, 2020

The other thing a lot of them do? They have bespoke casual wear. So handmade t-shirts. Custom fit track suits. Hoodies that are designed specifically for them. Mostly a very specific kind of new money wears well known labels, but they all wear designer. Stop blaming clothes

The real difference between rich people and poor people is generational wealth. That's it. Your parents can afford to pay for your education. Leg up. You inherit property? Leg up. Your family can invest 6 figures in your start up? Leg up. Rich people in America have help.

They have help from before birth tbh. Because their grandparents contribute to college funds. They buy rental property & gift it to their grandkids. They had more than enough money for their own expenses so they left money. And the parents of rich people? Rich too.

It's not the Gucci belt that's a barrier to economic stability for people now. It's not having a time machine to undo the impact of 5 generations of poverty. Even the best "rags to riches, by my bootstraps" stories have generational wealth hidden in them. Usually a friend's.

CMP:30

Technically given breakout at 19 only. I am posting this note after I got my own conviction.

Dont buy at one go, buy on DIP’s

Till now you have seen Hero or Zero calls in F&O.

— CA Surendra Doki (@surendradoki) December 12, 2020

Let me give same call in Investment.\U0001f4b8

Who all are ready.

Based on your response only will post call along with detailed notes.

Hero or Zero in Investment \U0001f3af\U0001f9b8\u200d\u2642\ufe0f

-Positive points to be considered

SUBEX plans to foray into emerging verticals like Fintech&E-commerce by expanding digital trust business beyond its core area of Telecom sector

SUBEX is literally Zero /negligible debt company,hence it can focus on growth in new verticals

SUBEX main advantage is 75% of telecom companies are their clients

SUBEX now focusing on internet of things (IOT) , security and analytics and management expecting 140n to 200 crores additional revenue from new verticals

1/5 th of the global teleco’s tariff goes through company,counts British Telecom,Airtel,JIO,VI,T-Mobile,AT & T,Orannge and Swisscom and etc.

SUBEX has increased its employees by 15%

Key possitive factor for SUBEX is new and promising Management

SUBEX has massive leverage with the existing teleco customers thhey can take major advantage out of it to enhance their business in new areas such as IOT security,FinTech,Digital Trust, Cyber security & 5G.

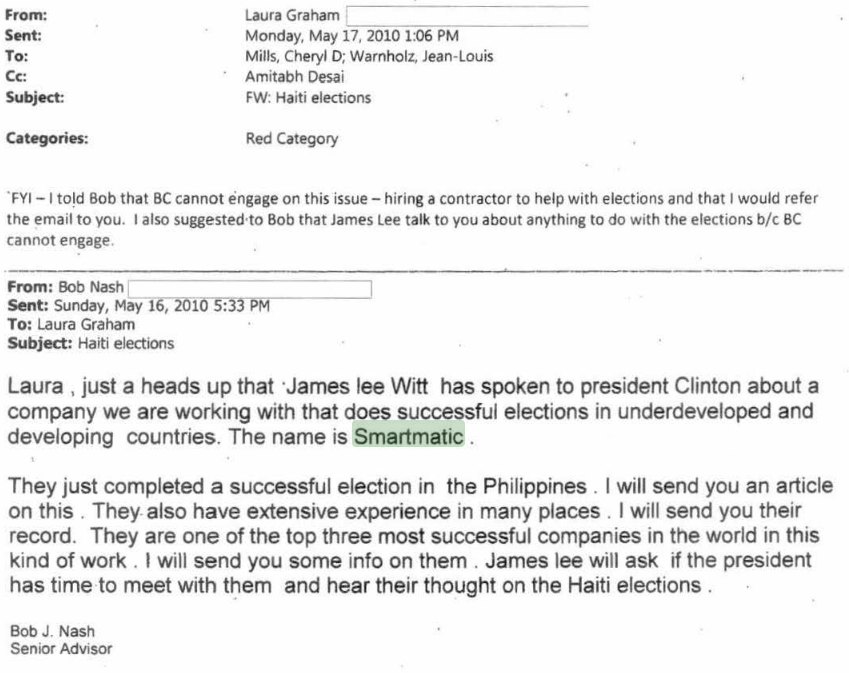

My take: the economics aren't very good, but the political economy may make such checks necessary 2/ https://t.co/XY7d9E8SDY

The key economic argument, which @crampell picks up on, is that given a slump that has affected people very unevenly, aid should concentrate on those actually suffering 3/

So if you have a fixed amount to spend, unemployment benefits and maybe small-business aid should be priorities, not checks that will in many cases go to people who are doing OK 4/

But is there a fixed amount to spend? No binding budget constraint for the feds, so this is all about politics. And my sense is that broad issuance of checks is actually kind of a loss leader, helping to sell a package that includes UI 5/

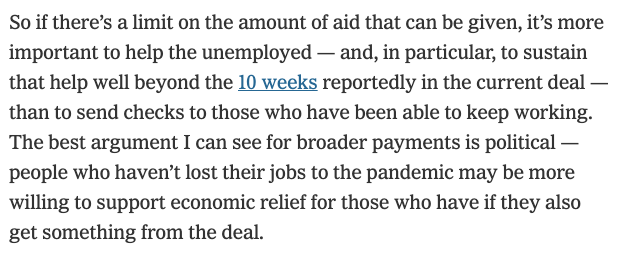

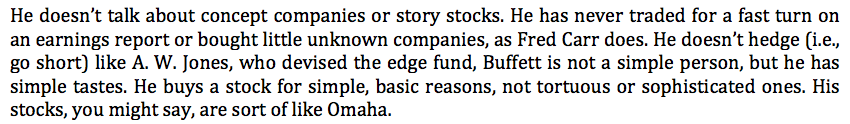

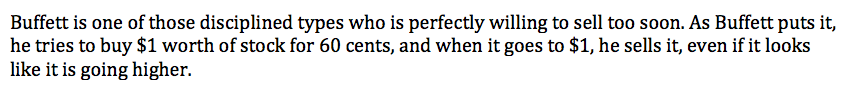

"Buy a company because you want to own it, not because you want the stock to go up."

Some excerpts:

👇

Excellent compilation of Forbes articles on Warren Buffet from 1969 to 2000s. h/t @valuewalk \U0001f44f@dmuthuk @Gautam__Baidhttps://t.co/V7uTYjwSrn pic.twitter.com/GPDyuk7WGB

— Ram Bhupatiraju (@RamBhupatiraju) December 5, 2020

"Buy stocks for simple reasons, not torturous & sophisticated ones".

Eventually the thesis for a good investment boils down to 2-3 simple points. You have to do a lot of work to figure out what those are & why.

2/

Even Buffett has struggled with & changed his exit decisions. This I believe is a much tougher problem than the buy decision.

3/

1969 article: He has made a fortune and is no longer motivated to count boxcars and read statistical manuals. He comes close to the truth when he says: “You shouldn’t be doing at 60 what you did at 20.”

90 & still counting box-cars.

4/

He attributes his problem to a market that no longer lends itself to his kind of analysis, where real values are hard to find. - 1969

It has been 50 years since we are debating whether the market values "this kind of analysis".

"This kind of analysis" is all that there is.

5/

-

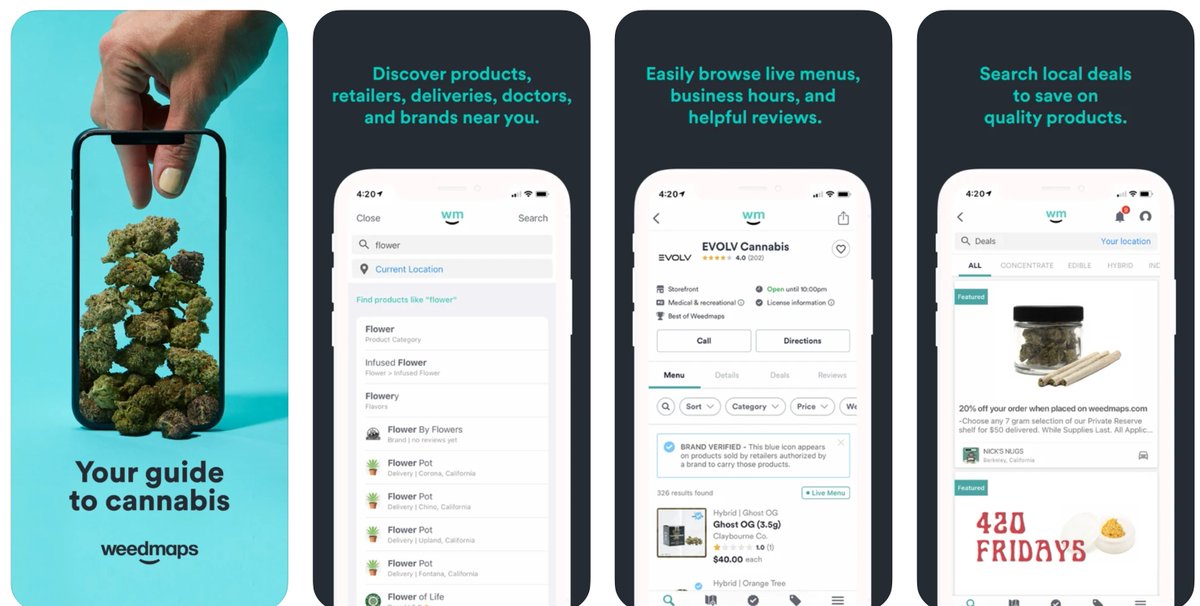

SPAC - $SSPK Silver Spike Acquisition Comp

They are merging with WM Holdings, Inc who owns Weedmaps. Founded in 2008. Lead by CEO Chris Beals. Former life-sciences attorney (important - will come in later).

Started a new position today. Will be working on my first in-depth write-up.

— Plant (@plantmath1) December 16, 2020

Basic Description:

The business is a two-sided marketplace which serves customers and sellers of marijuana products.

Who are they?

On the consumer side, https://t.co/sHZKPFCY7I which is a marketplace for standardized marijuana products.

Weed Maps is the world’s largest base of cannabis users with over 10M MAUs, 90% of which are cannabis users, and a stunning 70% are DAILY users.

A key part of the marketplace is the differentiation between alcohol/tobacco and cannabis. Cannabis is *not* a standardized product so Weedmaps compiles millions of data points from strain traits, user feedback, effects, etc., to suggest the best products for the user.

Weedmaps is operating at a 1.5B GMV run rate. With cannabis illegal on the Federal level, they do not currently take a percentage of this GMW but stated that they plan to with Federal legalization.