Authors BlueToothDDS

Will attempt to deep dives on each to build on some of my musings from earlier in the year on this topic 🤗 https://t.co/Amlnje1Qiq

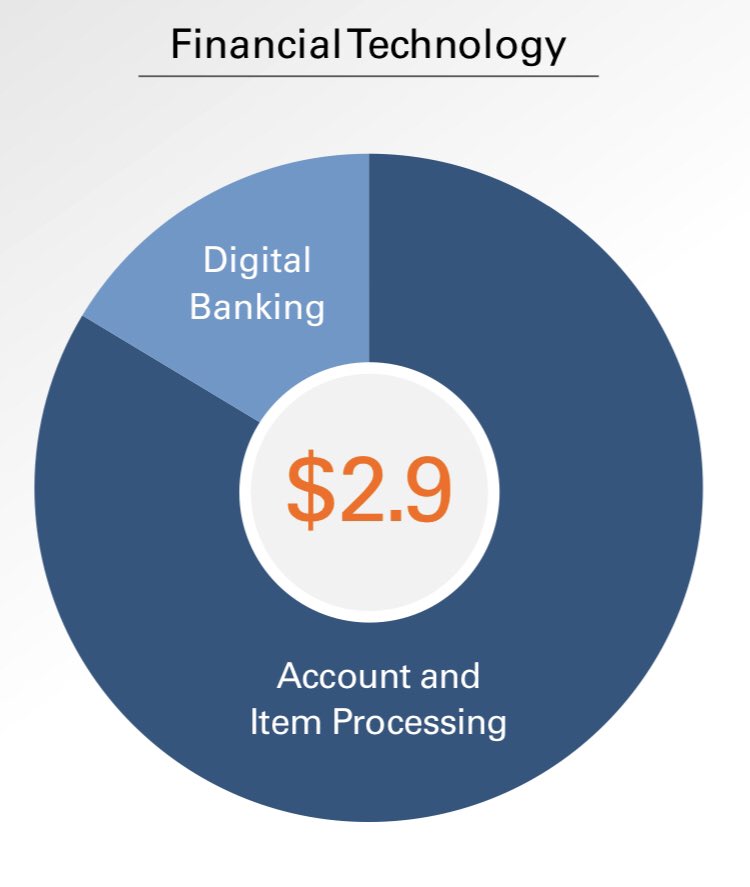

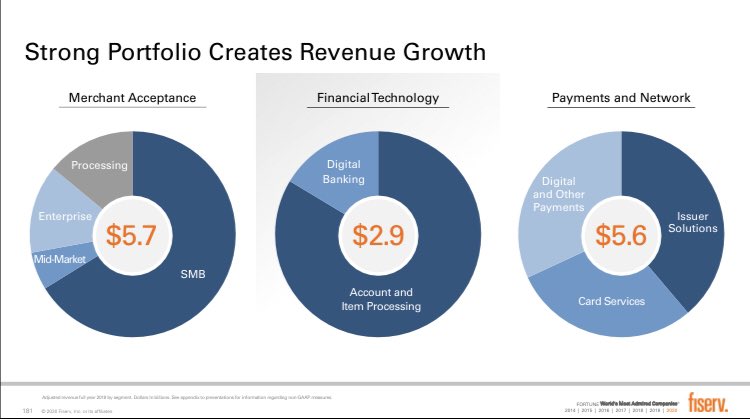

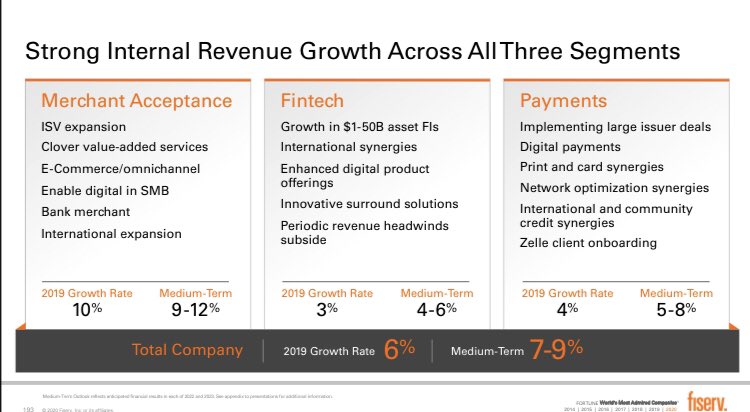

3) The revenue mix of $FISV today (post FDC merger) is roughly ~40% merchant acquiring, ~45% issuer processing and other payments related services, and ~15% core bank processing. Will take these in turn, then highlight growth levers I\u2019m most excited to watch in the coming years pic.twitter.com/yhvkCQrsF8

— BlueToothDDS (@BlueToothDDS) March 6, 2020

Will also try to bridge to an earlier thread laying out the $FISV growth algorithm and the operational/financial levers that support its medium-term outlook of 15-20% FCF/share growth

Here we focus on the top line, most notably the impressive acceleration across all 3 segments https://t.co/8HzMhEC5Bj

12) $FISV has both operational levers ($0.6B revenue synergies, $1.4B combined cost synergies + add\u2019l cost take out) and financial levers ($30B+ deployable FCF) to support its 15-20% compounded FCF/share growth

— BlueToothDDS (@BlueToothDDS) December 9, 2020

... and this is all before underlying business momentum (tomorrow) pic.twitter.com/JBtlGQIfBT

Let’s start with Merchant:

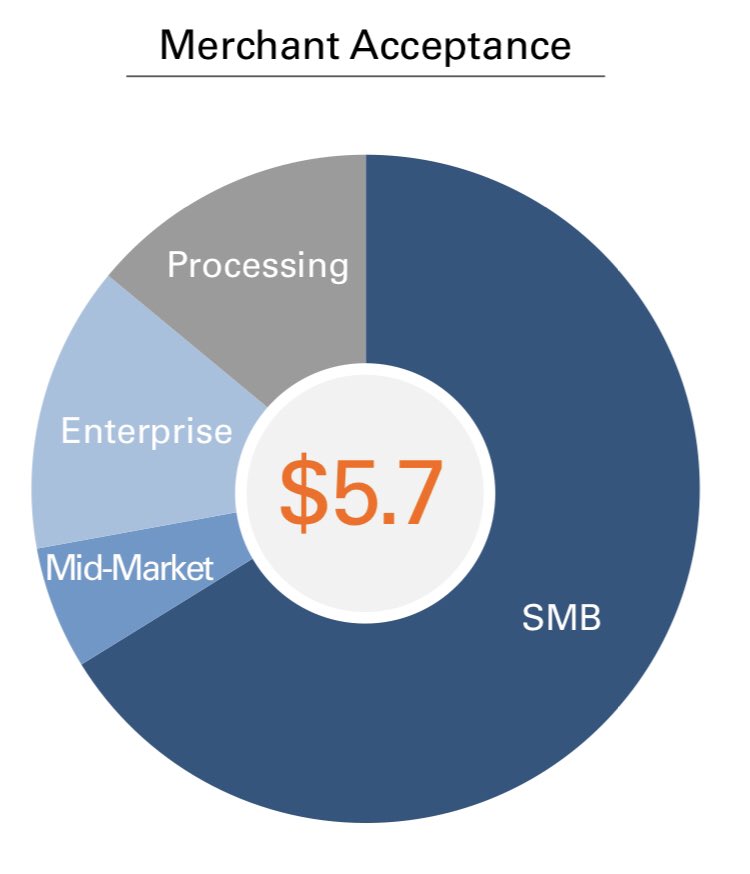

1) This segment, which ~40% of $FISV revenue today, is the #1 merchant acquirer globally processing $3T+ annually for 6M merchants worldwide

2/3 of revenue is from SMBs, ~20% from mid-to-enterprise merchants, remaining ~15% is wholesale processing

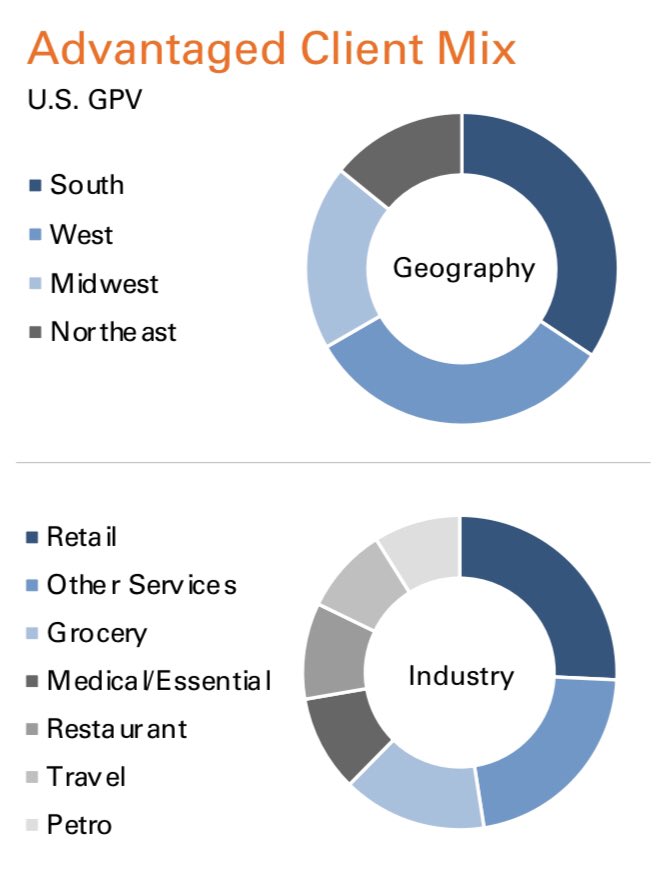

2) 🇺🇸 is 3/4 of the $FISV Merchant segment and the scale of this business is unmatched: it processes 40% of all in-person purchases in the US, covers 80% of all US zip codes and accounts for 10% of US GDP. This book of business is the most balanced in the industry https://t.co/Qlkk7lz3jQ

4) $FISV merchant business is the largest US acquirer processing $2.4 trillion of payments annually (including through JVs with BAC, WFC, PNC, C) accounting for 10% of \U0001f1fa\U0001f1f8 GDP. This segment includes Clover, which focuses on SMBs and is $105B runrate today growing at 40%+ annually pic.twitter.com/M5j4mbeiJX

— BlueToothDDS (@BlueToothDDS) March 6, 2020

3) Internationally, $FISV Merchant has strong position in EMEA (top 3 through various JVs and alliances) and several high growth countries, among others: India 🇮🇳 (top 3 with ~15% share), Argentina 🇦🇷 (~50% market share today), Brazil 🇧🇷 (routing ~30% of all electronic payments)

TLDR: Capturing % of GMV great for SHOP (already well appreciated), but perhaps even better for FB (still early days, unlikely to see impact until Q3 this year)

$SHOP Expands Its Checkout System to $FB and Instagramhttps://t.co/IsM1FNsFXV

— Jerry Capital (@JerryCap) February 9, 2021

1) $SHOP launched Shopify Payments in mid 2013 and this substantially changed the trajectory of its business, which previously didn’t scale (directly) with the GMV running through its platform

Shopify Payments today is ~75% of SHOP’s faster growing non-subscription revenue

2) Shopify Payments currently drives ~50% of $SHOP revenue and is enabled by 2/3+ of all SHOP merchants (in 🇺🇸 90%) accounting for nearly 1/2 of GMV generated on SHOP digital store fronts

As we all know, Shopify Payments is powered by Stripe, so not available where Stripe is not

3) Per filings, $SHOP charges ~275 bps gross yield (rack rate is 2.4-2.9% + $0.30 depending on which subscription plan a merchant chooses) and makes ~90-100 bps net yield on Shopify Payments, after interchange and processing fees paid to Stripe and downstream (WFC/FISV)

4) For the < 1/3 of $SHOP merchants and 1/2+ of GMV not on Shopify Payments, the merchant brings its own 3rd party payment processor

In this scenario, SHOP only captures a nominal transaction fee on the non-Shopify Payments GMV (~25bps on blended basis)

H/t @JerryCap