Vsamk's Categories

Vsamk's Authors

Latest Saves

It's much more powerful than you think

9 things TradingView can do, you'll wish you knew yesterday: 🧵

Collaborated with @niki_poojary

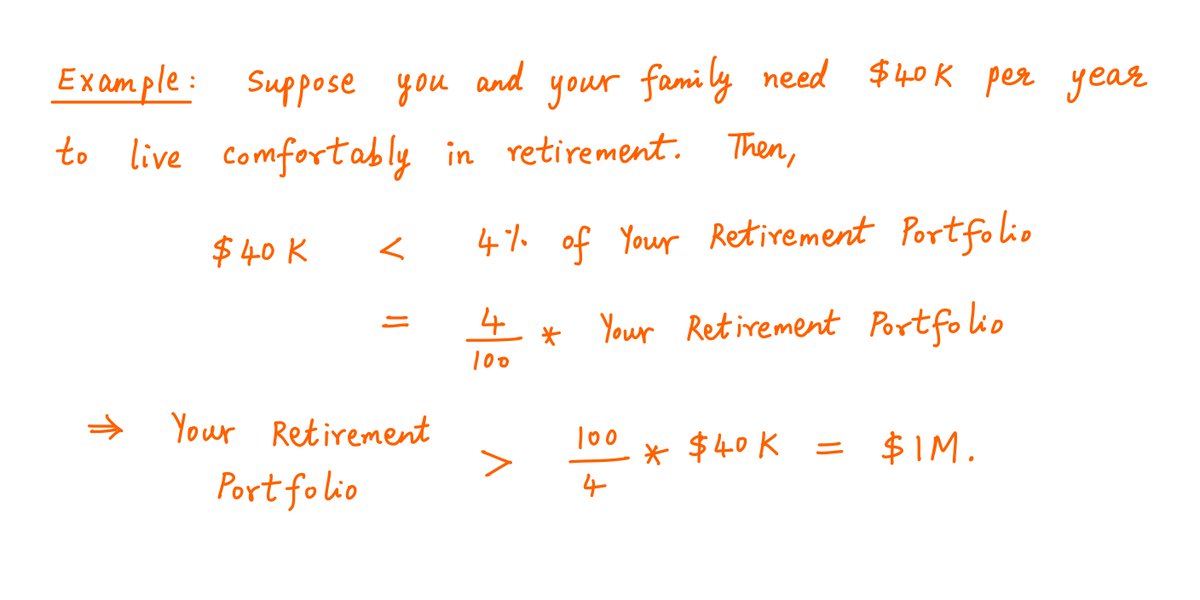

1/ Free Multi Timeframe Analysis

Step 1. Download Vivaldi Browser

Step 2. Login to trading view

Step 3. Open bank nifty chart in 4 separate windows

Step 4. Click on the first tab and shift + click by mouse on the last tab.

Step 5. Select "Tile all 4 tabs"

What happens is you get 4 charts joint on one screen.

Refer to the attached picture.

The best part about this is this is absolutely free to do.

Also, do note:

I do not have the paid version of trading view.

2/ Free Multiple Watchlists

Go through this informative thread where @sarosijghosh teaches you how to create multiple free watchlists in the free

\U0001d5e0\U0001d602\U0001d5f9\U0001d601\U0001d5f6\U0001d5fd\U0001d5f9\U0001d5f2 \U0001d600\U0001d5f2\U0001d5f0\U0001d601\U0001d5fc\U0001d5ff \U0001d604\U0001d5ee\U0001d601\U0001d5f0\U0001d5f5\U0001d5f9\U0001d5f6\U0001d600\U0001d601 \U0001d5fc\U0001d5fb \U0001d5e7\U0001d5ff\U0001d5ee\U0001d5f1\U0001d5f6\U0001d5fb\U0001d5f4\U0001d603\U0001d5f6\U0001d5f2\U0001d604 \U0001d602\U0001d600\U0001d5f6\U0001d5fb\U0001d5f4 \U0001d601\U0001d5f5\U0001d5f2 \U0001d5d9\U0001d5e5\U0001d5d8\U0001d5d8 \U0001d603\U0001d5f2\U0001d5ff\U0001d600\U0001d5f6\U0001d5fc\U0001d5fb!

— Sarosij Ghosh (@sarosijghosh) September 18, 2021

A THREAD \U0001f9f5

Please Like and Re-Tweet. It took a lot of effort to put this together. #StockMarket #TradingView #trading #watchlist #Nifty500 #stockstowatch

3/ Free Segregation into different headers/sectors

You can create multiple sections sector-wise for free.

1. Long tap on any index/stock and click on "Add section above."

2. Secgregate the stocks/indices based on where they belong.

Kinda like how I did in the picture below.

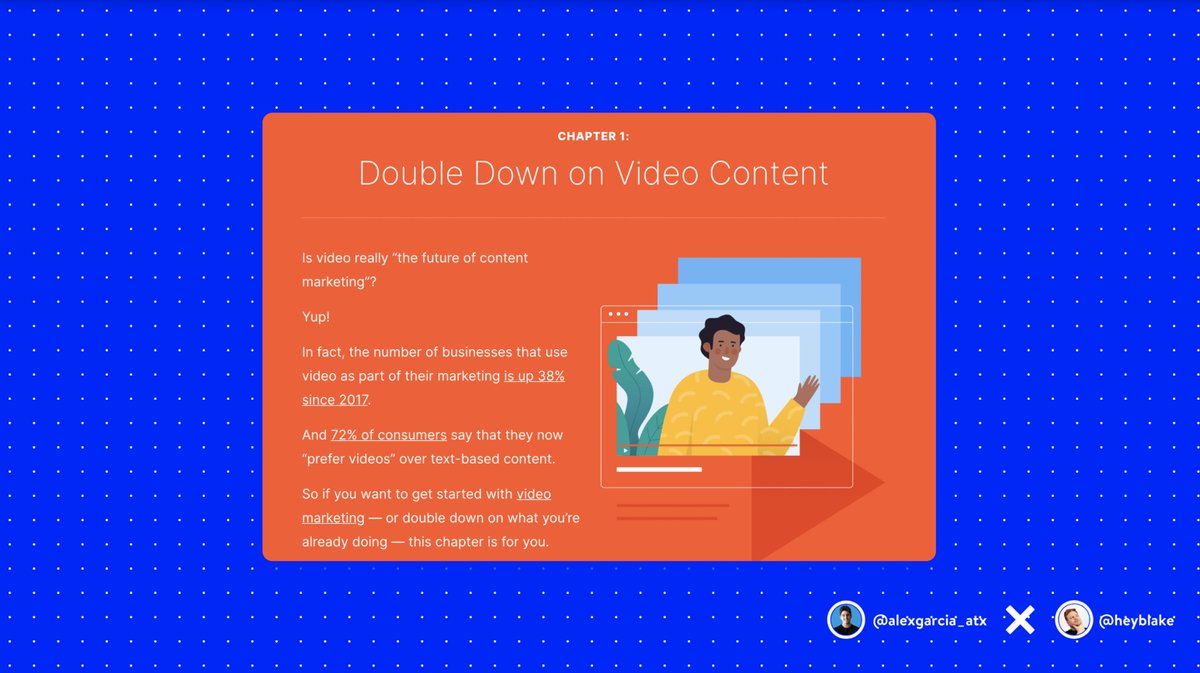

Use these 30 copywriting tips to convert readers into customers 🧵

Tip from Alex: Repeat Yourself

Reason: Your main benefit shouldn’t be expressed subtly. Repeat it three times. Make it known.

Example: Apple’s M1 Chip

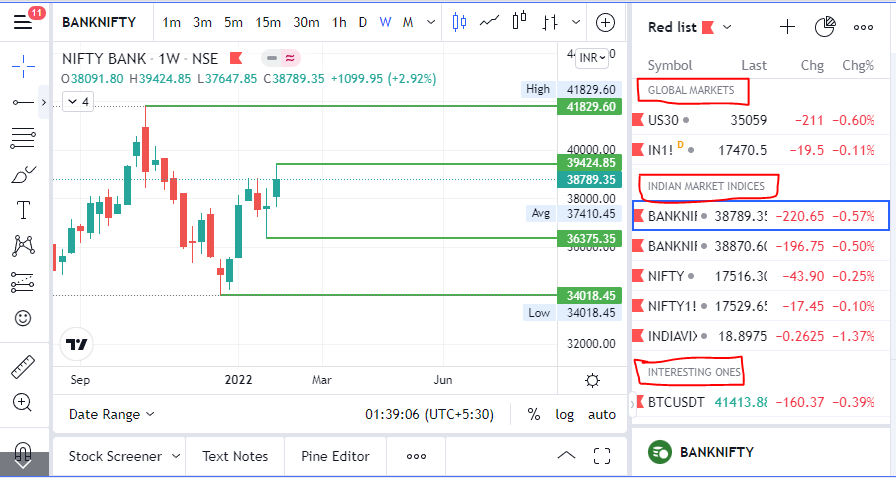

Tip from Blake: Start with goals for the copy.

Reason: You need to know what you are writing, for whom, and what action it should lead to. No guesswork.

Example: My content engine at https://t.co/jYMMlbgFCw

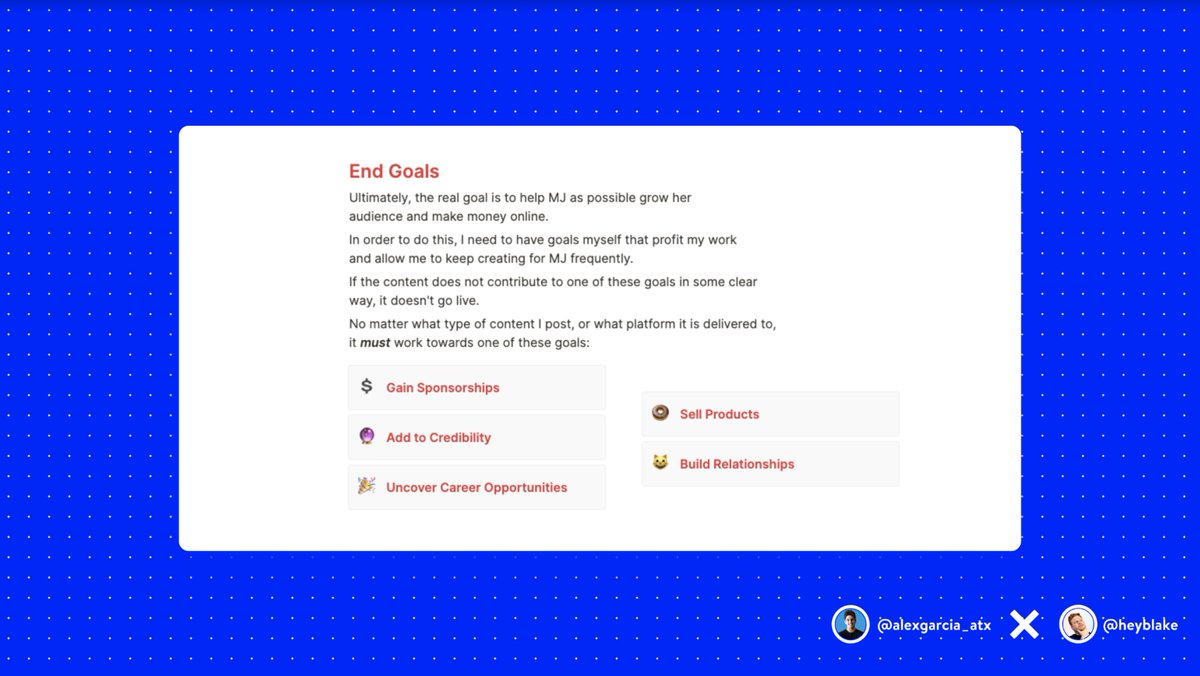

Tip from Alex: Use Open Loops

Reason: Open loops peak a reader's interest by presenting an unsolved mystery to the reader. Our brains are hardwired to find closure. Make your product the final closure. Example: Woody Justice

Tip from Blake: Write short, snappy sentences.

Reason: People have short attention spans. And big blocks of text are super hard to read. Make it

Example: Every blog from @Backlinko

50. Fastest-growing companies use growth loops

What was the common denominator in the fastest growing companies like Dropbox, Netflix, Yelp, and Instagram?

— Alex Garcia \U0001f50d (@alexgarcia_atx) May 9, 2021

Growth loops.

Not funnels.

Here are 6 examples of growth loops that will help you acquire and retain users \U0001f9f5 pic.twitter.com/Wu4i8ReQ62

49. 7 Proven growth hacking strategies (pt.1)

I've studied hundreds of growth-hacking strategies.

— Alex Garcia \U0001f50d (@alexgarcia_atx) May 7, 2021

These 7 are proven to work \U0001f9f5

48. Steal These 7 growth hacks (pt.2)

How did Facebook, Zapier, and Tinder drive growth early on?

— Alex Garcia \U0001f50d (@alexgarcia_atx) May 7, 2021

Growth-Hacking.

PayPal growth-hacked its way to 5M users in 3 months.

Tinder used sororities and frats to 3x their user base.

Steal these 7 growth-hacking strategies that led to millions of users\U0001f9f5

47. 15 Lessons to write viral Twitter threads

Twitter threads are the new blogs.

— Alex Garcia \U0001f50d (@alexgarcia_atx) May 6, 2021

Over the last 5 weeks, I've 32x my Twitter following posting a thread a day.

These 15 learnings will help your threads go viral \U0001f9f5

The good news is: You can learn to write high-converting copy.

Whether you want to start writing copy professionally or for your own business, check out these 6 resources.

Links below 👇

1. https://t.co/CqyKeArKHL by @copyhackers

2. https://t.co/YIqii2bxPQ by @nevmed

3. https://t.co/OrEJwaHts3

4. https://t.co/JuJD4lxTJ4

5. https://t.co/DHFh3WGnbg by @kirahug

6. https://t.co/BGftfwejeN by @GoodMarketingHQ

[Part 1 of 2]

First, some context:

- Loom was founded in 2015 by @yoyo_thomas, @vhmth, and myself

- Fascinated by video in the workplace and wanted to build use cases against it.

- We built a user testing marketplace (failed) → pivoted to SaaS (failed) → Loom ($325M valuation 5/'20)

Launch (0-3K users)

- Launched on @ProductHunt, social media, etc

- Launch week growth was a result of us being the #1 product of the day on PH

- If you want to learn how we converted our launch traffic into real users, @vhmth wrote an excellent piece:

https://t.co/VDxG5lDa5U

Understanding early growth (3-10K users)

- Given the product was entirely horizontal, we needed to understand our key personas.

- We emailed *all* users a short survey and asked respondents for a 10 min call to talk through their use cases.

Personas we identified:

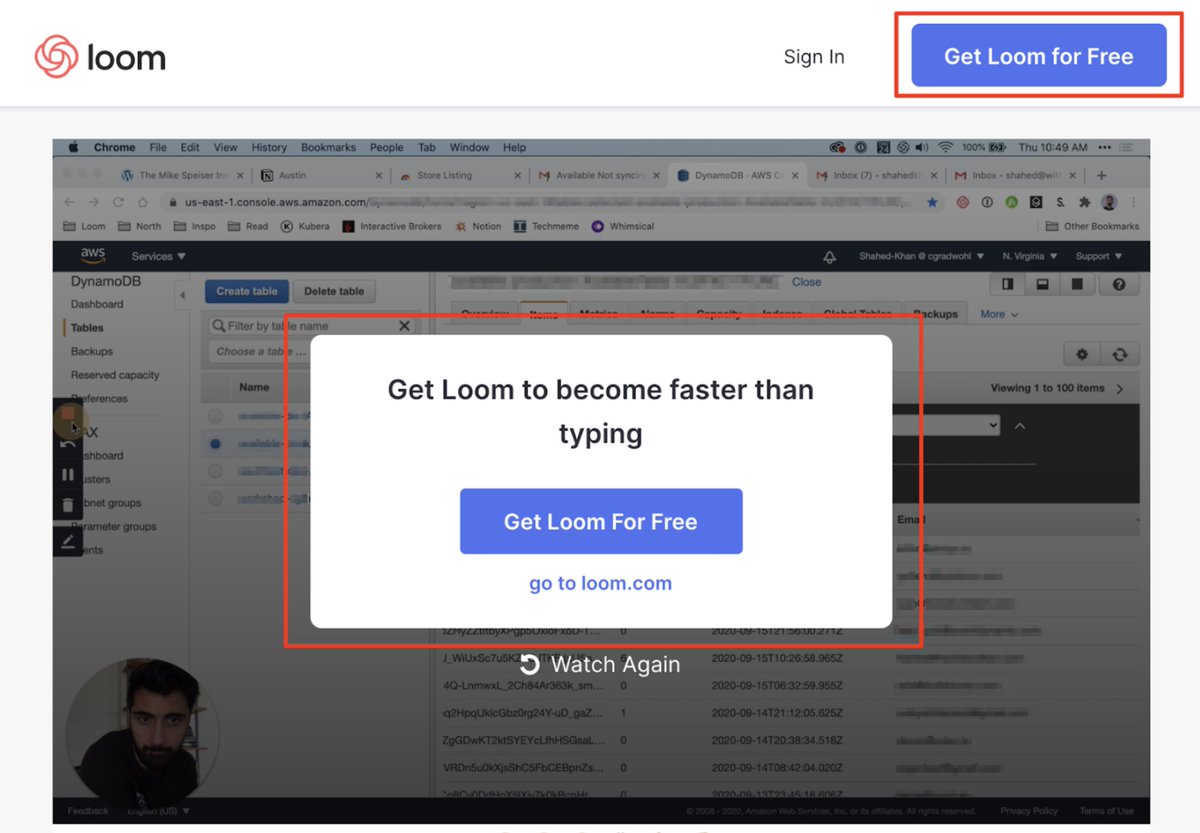

Building & testing early experiments (10-25K users)

- In parallel, we started to introduce early growth levers to drive more users to the product.

- 1st experiment: Video player watermark (for embeds, downloads, etc)

- 2nd experiment: End of Video CTA (still live today)

Get a cup of coffee.

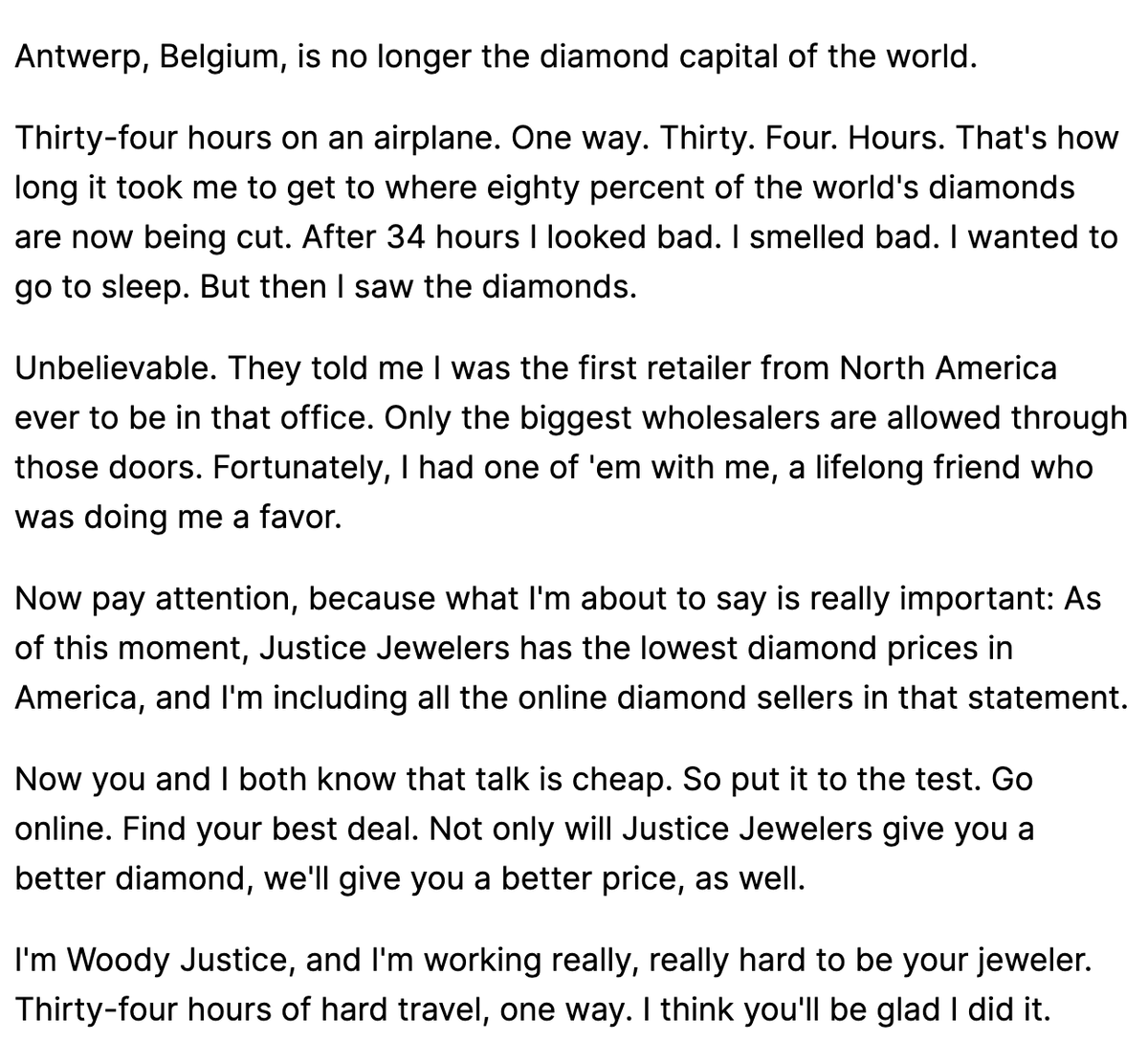

In this thread, I'd like to share with you a simple way to measure and track your progress towards financial independence.

2/

Financial independence is an end goal.

To define this goal properly, you need to answer 2 key questions.

(i) When would you consider yourself financially independent? And,

(ii) In how much time do you want to get there?

3/

Typically, financial independence means:

a) You won't have to work another day in your life for money, and

b) You and your family will still be able to live comfortably to the end of your days.

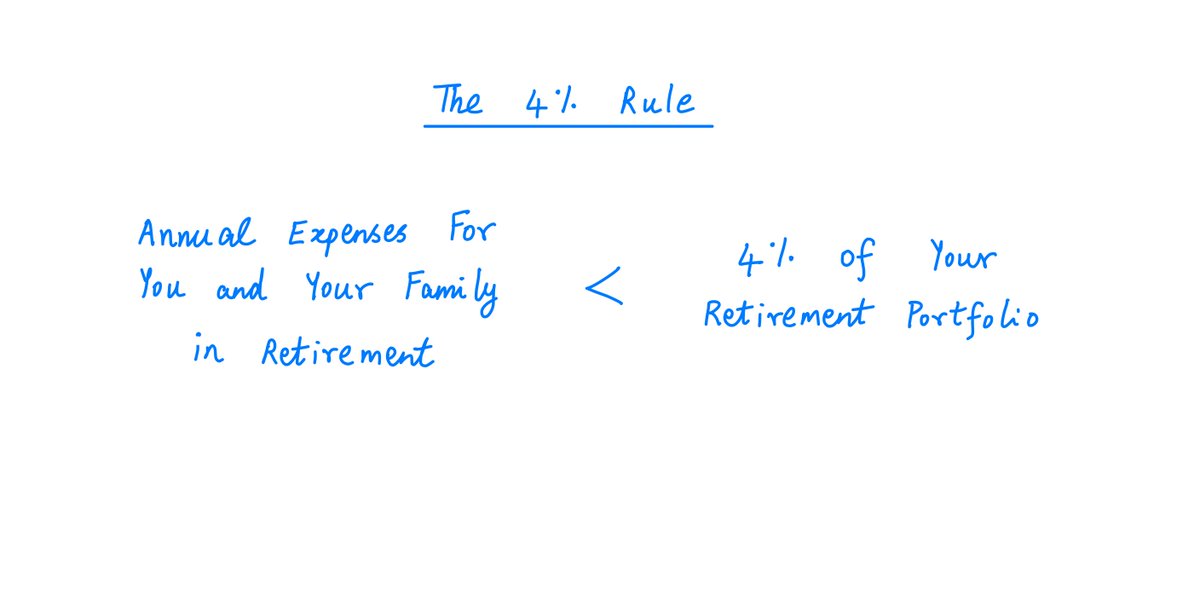

4/

Let's say you want to reach financial independence in the next 10 years.

How much money do you need to amass by that time?

Well, suppose your family's expenses are ~$60K per year now.

If inflation runs at ~2% per year, 10 years from now, your annual expenses will be ~$75K.

5/

Let's say you want your expenses to be under 3% of your portfolio at that time.

This is called the "3% Rule".

It means your portfolio's size should be about $2.5M (as 3% of $2.5M = $75K).

For more on the 3% Rule and such:

1/

— 10-K Diver (@10kdiver) July 25, 2020

Get a cup of coffee.

In this thread, I'll help you work out how much money you need to retire.