Here are key takeaways from the book 👇👇

Knowledge sharing initiative Book 4: "The interpretation of financial statements" by Benjamin Graham.

This book was published around 1937 by investing legend Ben Graham. Ben is also regarded as the guy under whom the great Warren Buffett started his investing journey.

Here are key takeaways from the book 👇👇

2.Assets=Tangible (PP&E, inventories, accounts receivable, cash)+intangible Assets (trademark, lease rights, goodwill)

4.Tangible assets are written down through depreciation & intangibles are written down through amortization or impairment

6. Depletion gets applied in commodity businesses like cement, mining, and crude oil.

As they inflated their asset value leading to inflated book value, which was later written off as one-time charges against earnings/profit

8.True value of a company’s assets may be different from the B/s total

10. It is not so essential to invest only in cos. with dominant size, as countless e.g of smaller cos. prospering more than larger ones can be seen in the mkts

High ratio indicates-co. will easily meet short-term obligations

14.Working capital(WC)=current assets–current liabilities

WC makes it easier for a co. to run daily operations & meet emergency needs without taking new financing

15. Quick Ratio = (Current Assets – Inventory)/Current Liabilities

Inventory turnover can be compared on a year-to-year basis. Measures how efficiently the company turns inventories into profits.

18.Valuing companies on book value is majorly applied in banks, insurance cos, & holding companies

23. Net Current Asset Value (NCAV)=Current assets–liabilities & preferred stock.

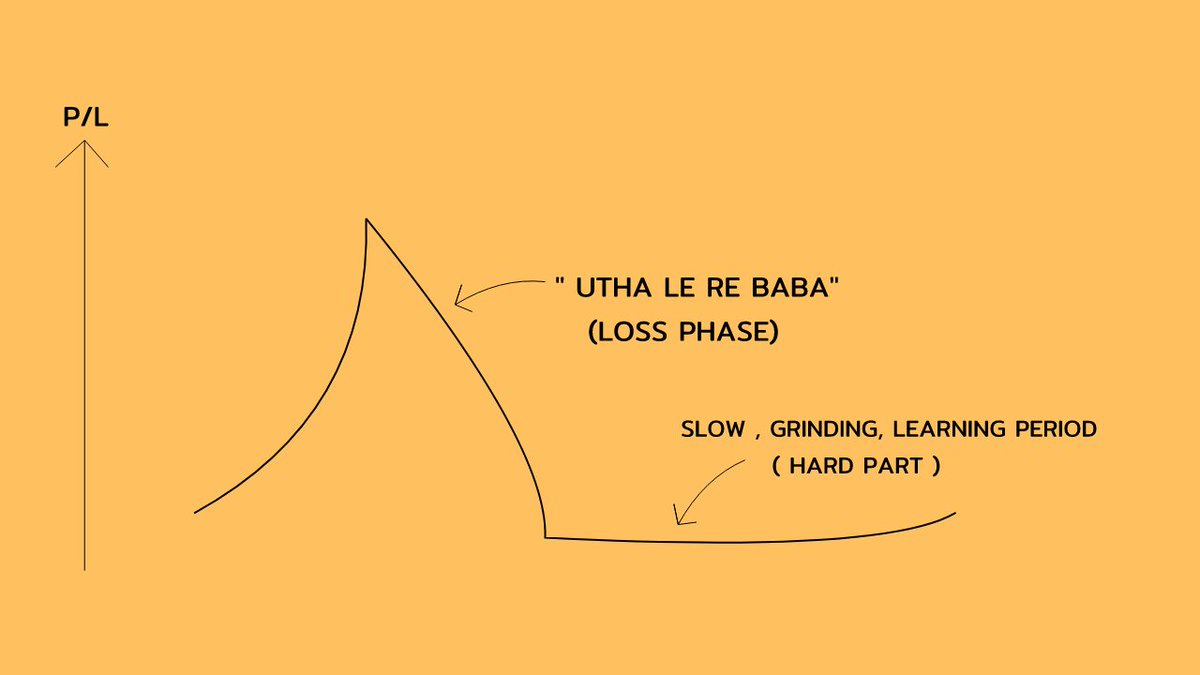

25. Earning Power of a company = Expected earnings in the future

26. We take current & past earnings as a guide to predict future earnings.

28.Investing requires a balance between facts of the past and possibilities of the future

a) How certain am I that this favorable trend will continue,&

b) How large a price am I paying in advance for the expected continuance of the trend?”

Credits @FinnacleAcademy

Here is the book link: https://t.co/fjfj11MKLf

More from Investment Books

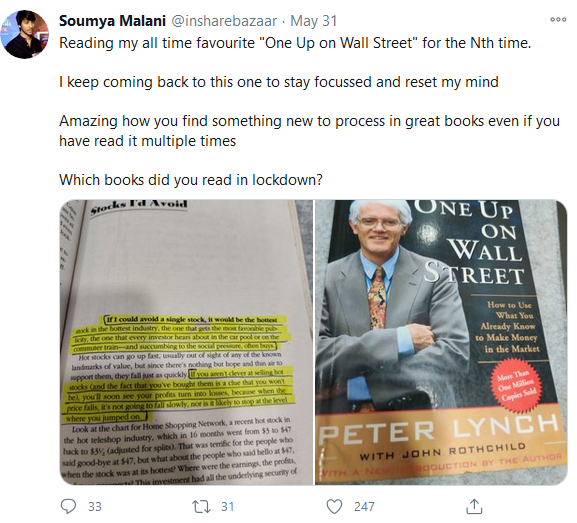

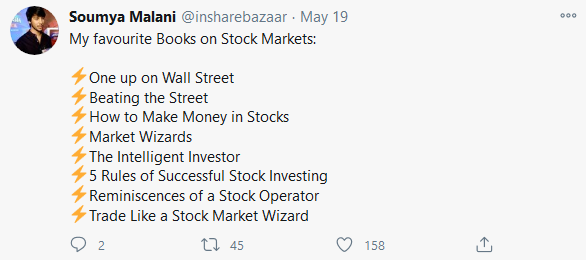

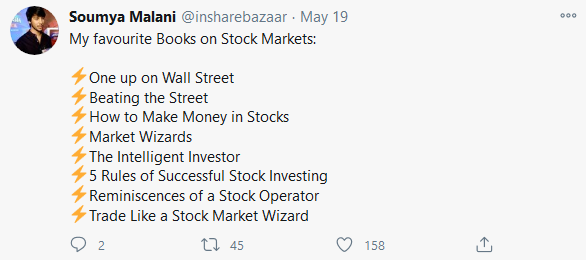

Thread Best books recommendation by one of best investor I knew @insharebazaar (Virtually)

He grab many multibagger stocks and His style also unique(1st Seen interview in @TraderHarneet's YT Channel)

He follow Simple process

Young Intelligent Investor who also appeared in ET

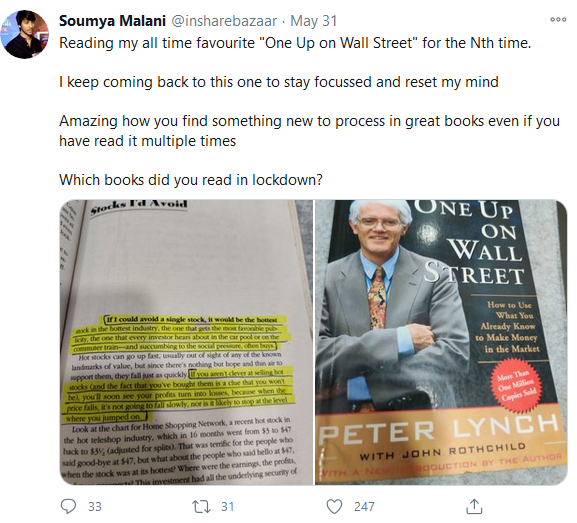

1. One Up On Wall Street

2. Rich Dad Poor Dad

Access here : https://t.co/UWOCF732z6

3. The Unusual Billionaires

4. Trading in the Zone

https://t.co/G7mqVPtEM0

5. Market Wizards

6. The Intelligent Investor

https://t.co/yPKBzYyPAl

7. The Five Rules for Successful Stock Investing

8. Reminiscences of a Stock Operator

https://t.co/PiioB3hdHP

He grab many multibagger stocks and His style also unique(1st Seen interview in @TraderHarneet's YT Channel)

He follow Simple process

Young Intelligent Investor who also appeared in ET

1. One Up On Wall Street

2. Rich Dad Poor Dad

Access here : https://t.co/UWOCF732z6

3. The Unusual Billionaires

4. Trading in the Zone

https://t.co/G7mqVPtEM0

5. Market Wizards

6. The Intelligent Investor

https://t.co/yPKBzYyPAl

7. The Five Rules for Successful Stock Investing

8. Reminiscences of a Stock Operator

https://t.co/PiioB3hdHP