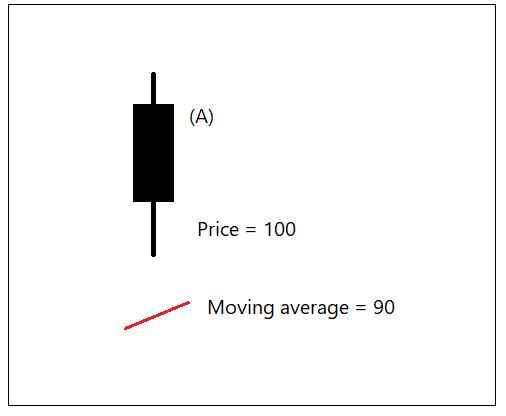

Before we discuss the indicator, let us understand an important concept.

Before we discuss the indicator, let us understand an important concept.

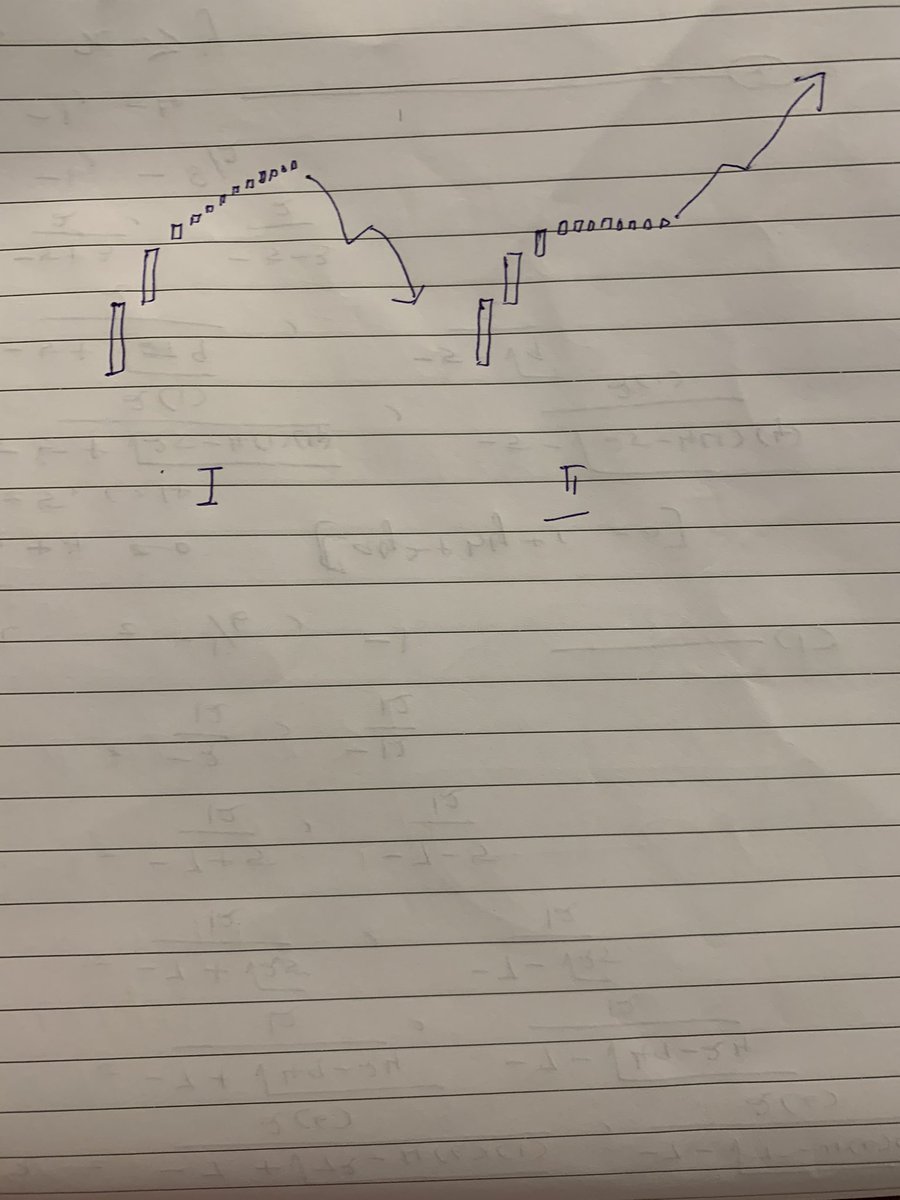

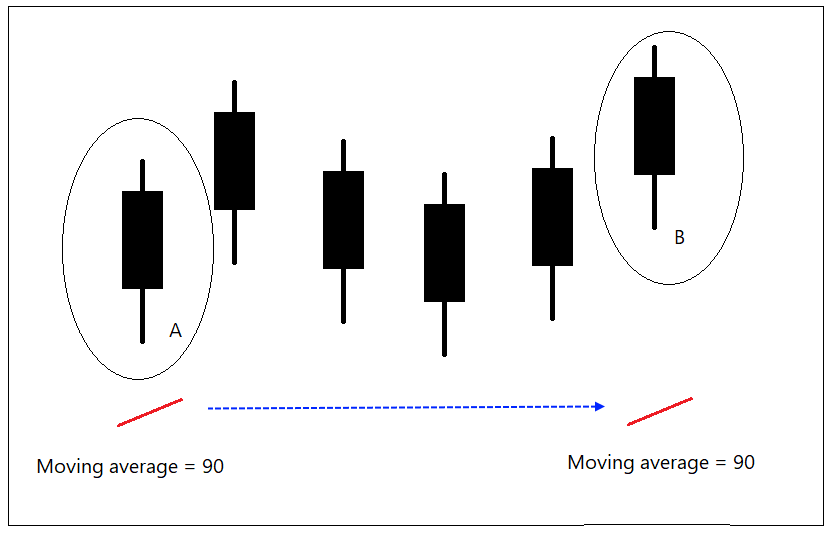

Moving average at bar B is moving average price of bar A (5 candles behind). This is shifting of moving average price. What does it mean?

https://t.co/WkNxKU9n8u

Let us discuss the Alligator indicator.

Thread:- How Ichimoku indicator is calculated. pic.twitter.com/pM7AZvJjMj

— Prashant Shah (@Prashantshah267) April 15, 2020

Williams suggested Fib numbers 13, 8 and 5 period averages.

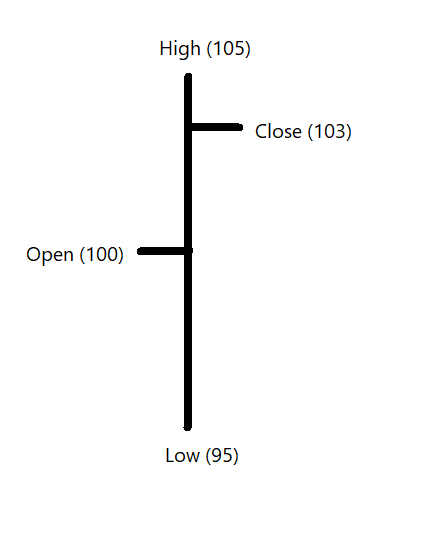

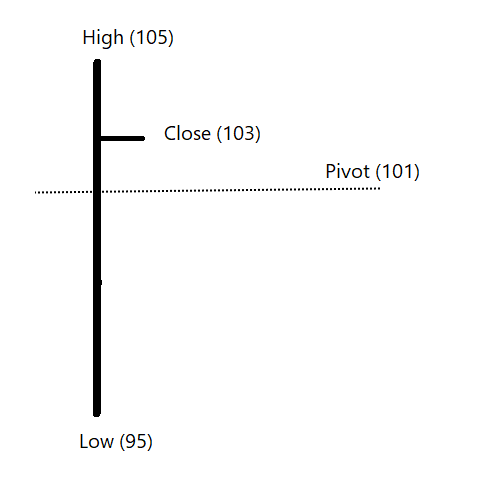

The averages are calculated on median price.

Median price = (High + low) / 2.

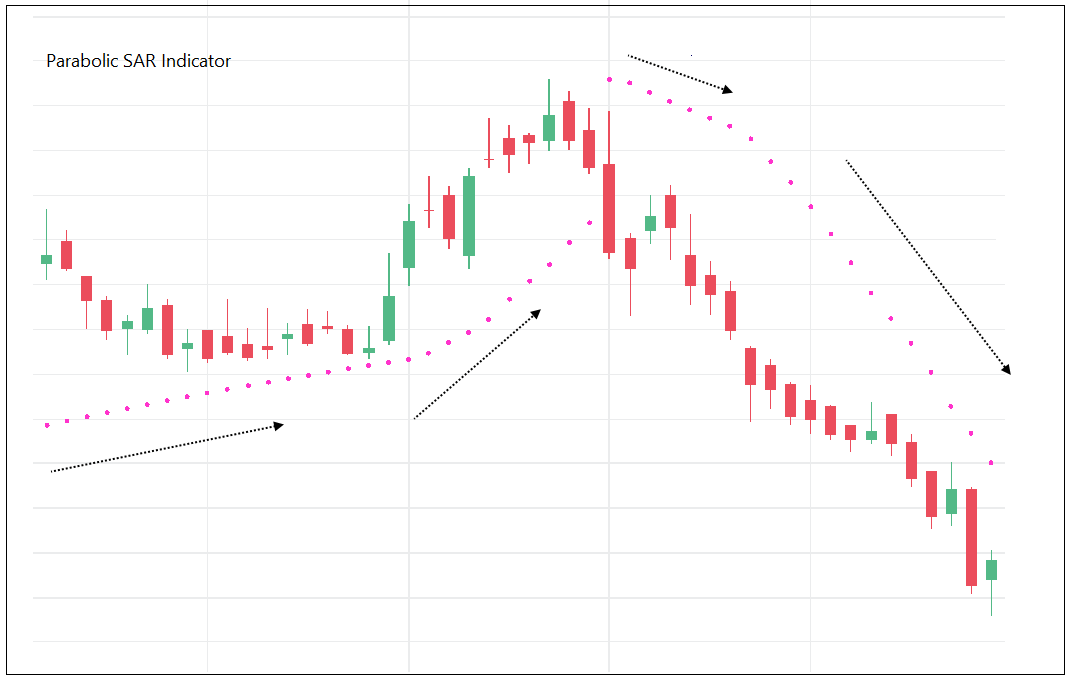

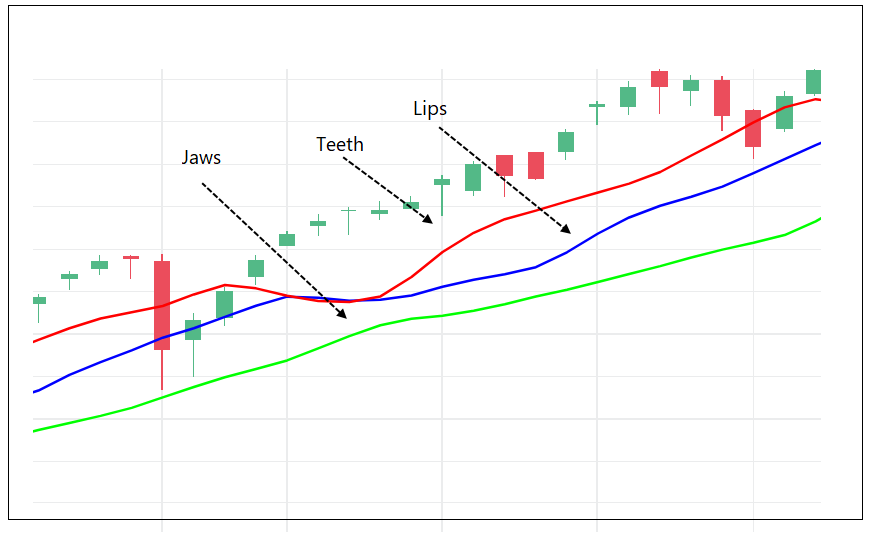

So, there are three lines plotted on the chart.

13-period MA is shifted by 8 bars

8-period MA is shifted by 5 bars

5-period MA is shifted by 3 bars

So, default parameters of Alligator indicator are 13,8,5 and 8,5,3.

The 13-period MA to 8 (13,8) is called as Alligator’s Jaws.

8-period MA to 5, the Teeth and

5-period MA to 3, the Lips.

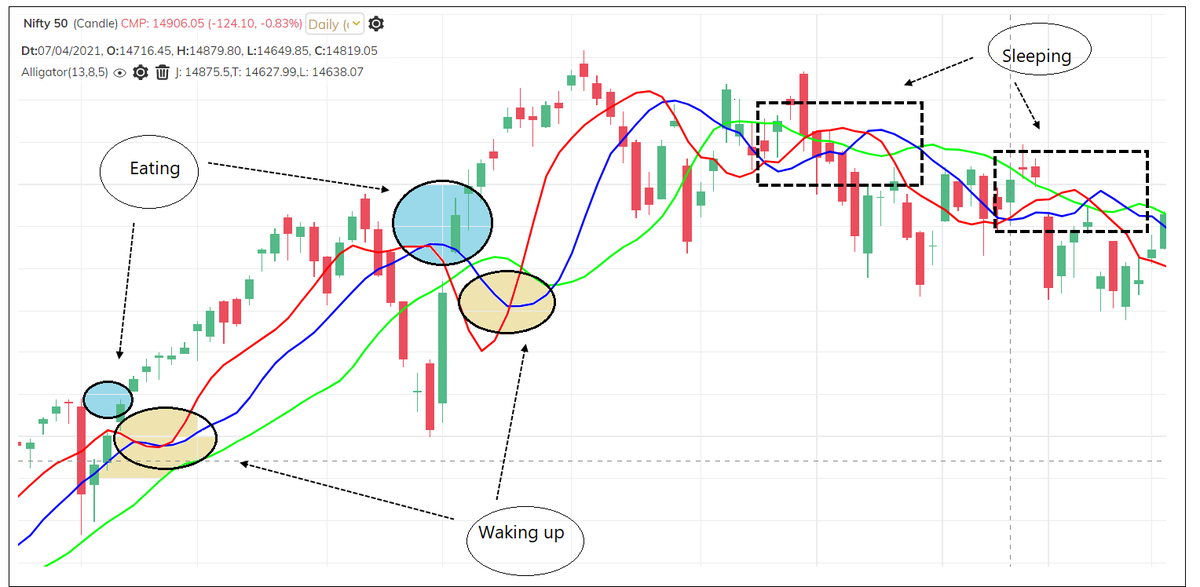

When three lines are close to each other, the Alligator is sleeping.

If the Lips crosses the Teeth and Jaws upward or downward, the Alligator is waking up.

If Price crosses above or below the three lines, the Alligator is eating.

When three lines are close to each other, there is no clear trend.

When short-term average crosses other two upward or downward, the trend might emerge.

When three lines are trending, and price is above them, then it indicates strong uptrend.

Over a period, market trends roughly 20% – 30% times, it remains in a range rest of the time.

If Alligator sleeps more (long consolidation), it will become hungrier and eat more (Strong trend).

There are two important observations on this indicator which I found useful:

2 – Price low is above three averages and all averages are rising = Strong up trend. Price high is below averages and all averages are falling = strong downtrend.

These readings are also possible using other indicators and charts. Idea was to talk about the concept.

More from Prashant Shah

Thread: P&F Super Pattern

An effective price pattern defined using properties of P&F charts.

#Superpattern #Pointandfigure #Definedge

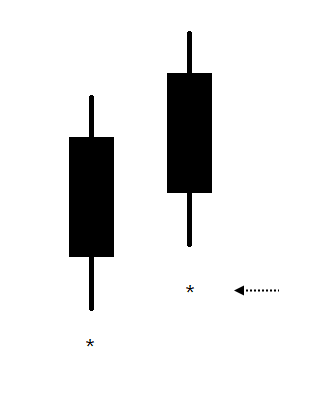

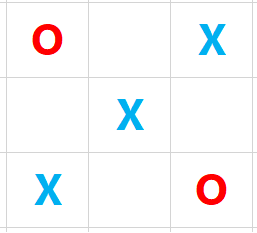

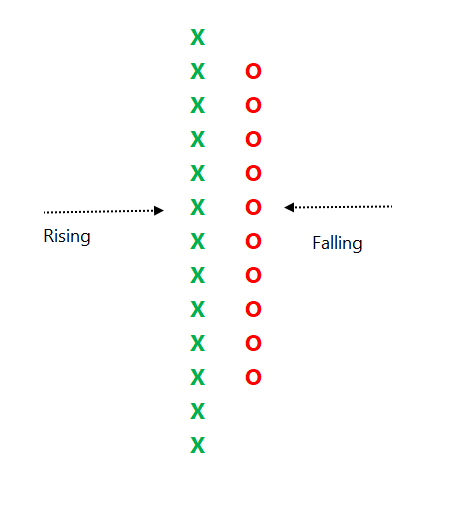

Point & Figure is an oldest charting method where price is plotted vertically, and the chart moves only when price moves. It is a different way of looking at the price, the objective box-value and reversal value offers advantage of identifying objective price patterns.

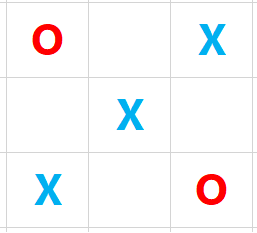

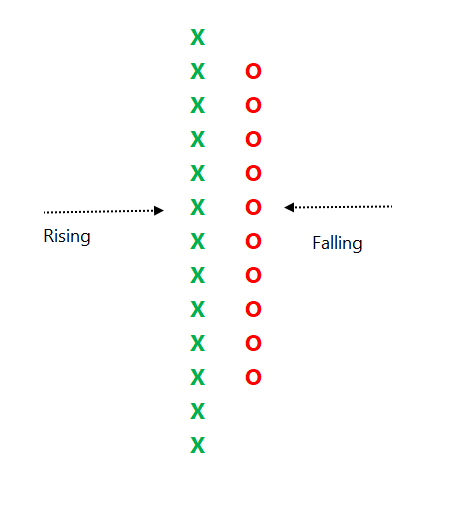

When price is moving up, it is plotted in a column of 'X'. When it is going down, it is plotted in a column of ‘O’. Normally, three-box reversal criteria is used to define the trend & reversal. Unlike a bar or candle, the P&F column can have multiple sessions in it.

Link to know more about the subject:

https://t.co/2xtLAVPBvm

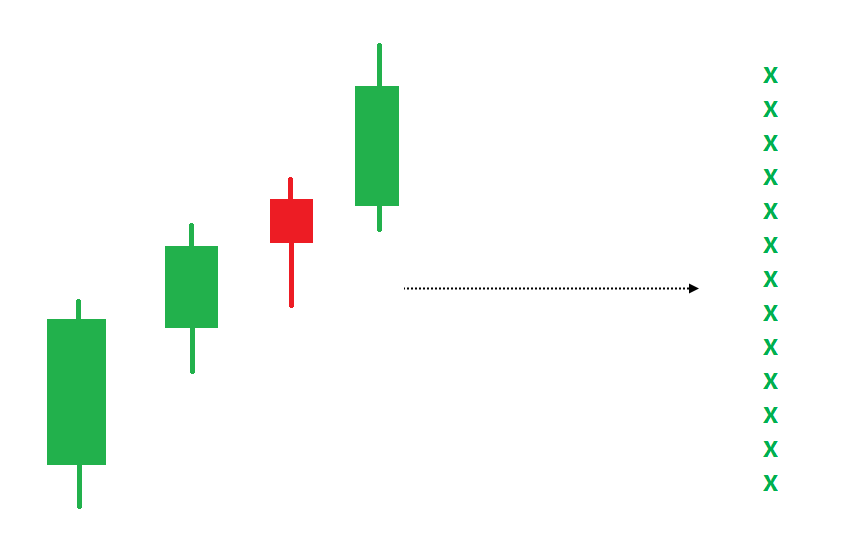

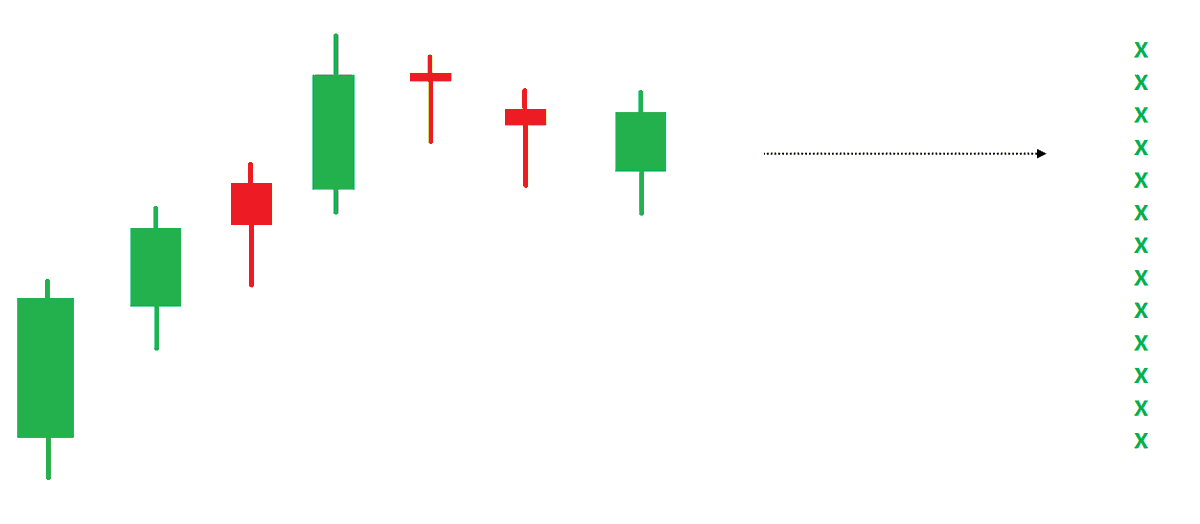

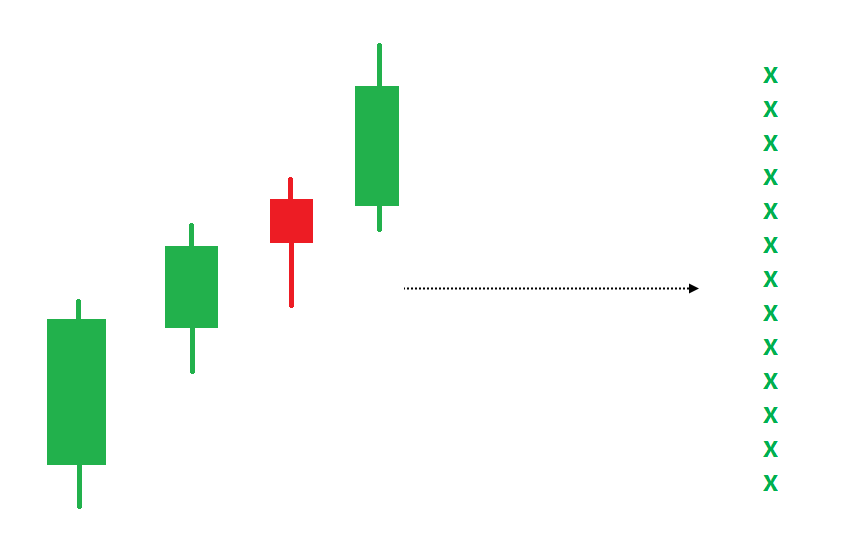

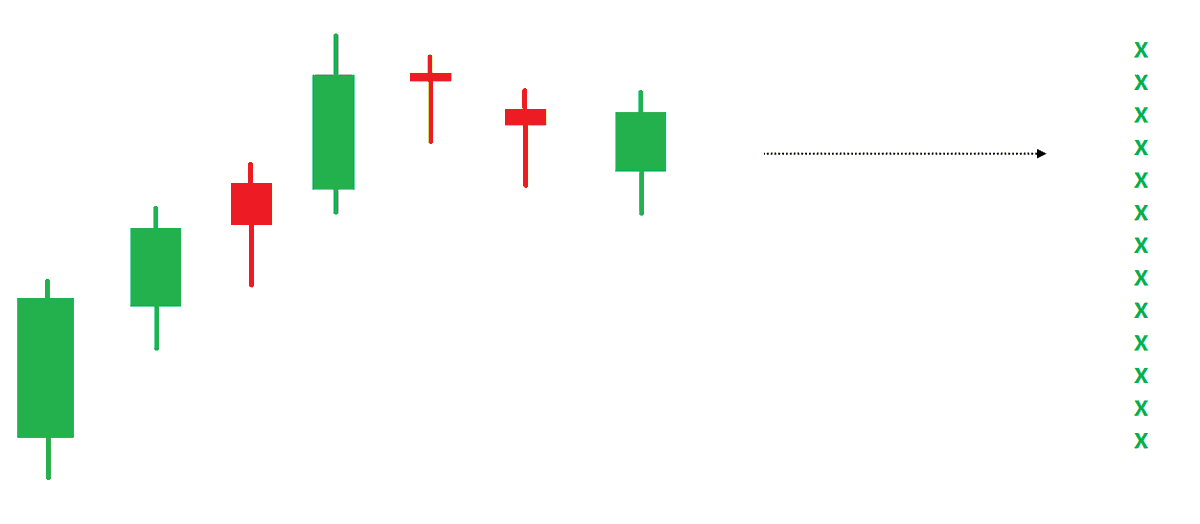

See below chart. Price is in a strong uptrend, P&F chart would produce a long of column of 'X' with more number of boxes in it.

If such a trend is followed by some time bars without meaningful price correct, P&F chart would not move, and it will remain in column of 'X' in such a scenario.

An effective price pattern defined using properties of P&F charts.

#Superpattern #Pointandfigure #Definedge

Point & Figure is an oldest charting method where price is plotted vertically, and the chart moves only when price moves. It is a different way of looking at the price, the objective box-value and reversal value offers advantage of identifying objective price patterns.

When price is moving up, it is plotted in a column of 'X'. When it is going down, it is plotted in a column of ‘O’. Normally, three-box reversal criteria is used to define the trend & reversal. Unlike a bar or candle, the P&F column can have multiple sessions in it.

Link to know more about the subject:

https://t.co/2xtLAVPBvm

See below chart. Price is in a strong uptrend, P&F chart would produce a long of column of 'X' with more number of boxes in it.

If such a trend is followed by some time bars without meaningful price correct, P&F chart would not move, and it will remain in column of 'X' in such a scenario.

More from Stockslearnings

In such a case, H&S can be either a continuation pattern or compound fulcrum.

This is how to differentiate:

• if right shoulder is smaller than left, most likely a continuation H&S

• if right is same or higher than left, and the price is not coming to neckline, most likely CF

This is how to differentiate:

• if right shoulder is smaller than left, most likely a continuation H&S

• if right is same or higher than left, and the price is not coming to neckline, most likely CF

sir a doubt does head & shoulders work in down trend ? pic.twitter.com/dytYmbzOfp

— Vega_Greek (@VegaGreek) May 13, 2021