Categories Screeners

7 days

30 days

All time

Recent

Popular

BASIC stock screener for retail public

EPS Growth ( YOY ) > 14 %

PE< 35

PEG < 3

ROCE > 14

ICR > 3

Stong hand holdings ( P+ F+ D ) > 85 %

Ideal Tech setup

EMA-63 > EMA-200

Monthly RSI below 70.

Stock has to trade above EMA-63 & EMA-200.

@chokhani_manish

@safiranand

EPS Growth ( YOY ) > 14 %

PE< 35

PEG < 3

ROCE > 14

ICR > 3

Stong hand holdings ( P+ F+ D ) > 85 %

Ideal Tech setup

EMA-63 > EMA-200

Monthly RSI below 70.

Stock has to trade above EMA-63 & EMA-200.

@chokhani_manish

@safiranand

Yess, please share your stock screening rules/parameters... Thanks in advance

— Prad33sh (@Prad33sh1) February 15, 2022

Instead of Simple Moving Averages, I use Weighted Moving Averages. I use the following signals to identify Stage 2-

1) 50 WMA > 100 WMA > 150 WMA > 200 WMA

2) Price is within 25% range of its 52-Week High and above 30% or more from its 52-Week Low.

1) 50 WMA > 100 WMA > 150 WMA > 200 WMA

2) Price is within 25% range of its 52-Week High and above 30% or more from its 52-Week Low.

Just one question , how do u differentiate stage 2 from 1 , apart from volume , what else do u look ?

— Priyanshu (@Priyans48107837) August 6, 2021

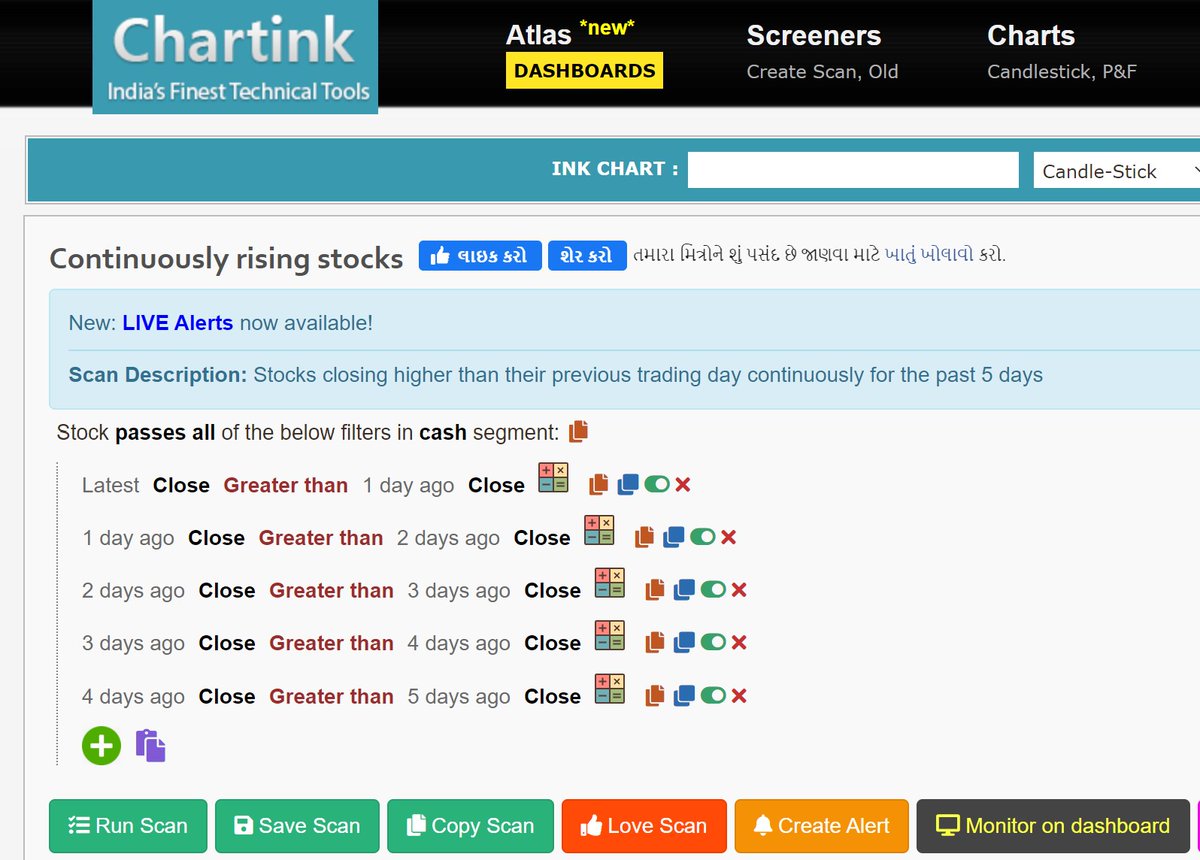

For finding potential breakout candidates, you may run this scanner daily EOD, whenever any new candidate props up, check its chart for signs of breakout.

You may modify & fine tune this as per your own criteria like adding RSI or ADX or other indicators. https://t.co/FdiPG1c4s0

You may modify & fine tune this as per your own criteria like adding RSI or ADX or other indicators. https://t.co/FdiPG1c4s0

Bhai, can you please educate us, how do you find the breakout stocks? I mean which scanner? Any inputs would be much helpful.

— Loyalty Respect (@Novicetrader99) October 1, 2021

#CDSL

- Stock rallied to 986 from 789(25%) in just 23days.

- Able to catch the momentum stock near its area of value.

- Find out the stocks which respect which moving average using our AOV analysis and know this type of stocks earlier before bigger move.

- Stock rallied to 986 from 789(25%) in just 23days.

- Able to catch the momentum stock near its area of value.

- Find out the stocks which respect which moving average using our AOV analysis and know this type of stocks earlier before bigger move.

#Areaofvalue analysis#CDSL

— SSStockAlerts (@ssstockalerts) May 6, 2021

Buy near 21 SMA support. This stock respects 21 SMA for 84% time. Backtested for last 1 year.

Candle size is getting smaller and volume also less then avg volume.

Any time it can reverse from here.

Help/Supporthttps://t.co/rRCfjf3KIi pic.twitter.com/KGyyAAQ1tV