Categories Screeners

While buying breakouts, your odds will improve a lot when you prefer the following:

1. Strong Relative Strength.

2. Tight price range on low Volume and a pattern which is easy on eyes. https://t.co/CprKpAfgtj

#BAJAJFINSV

— Ravi Sharma (@StocksNerd) August 14, 2021

Setting up in a tight base. Volume has been drying up.

Waiting for the breakout. pic.twitter.com/KWoGZAwkLO

On Scanners, Setups, Straddles, Strangles, Mitesh Patel Sir, Mark Minervini & more.

Collaborated on these with my awesome friend and business partner @niki_poojary.

🧵Here are my top threads of 2021:

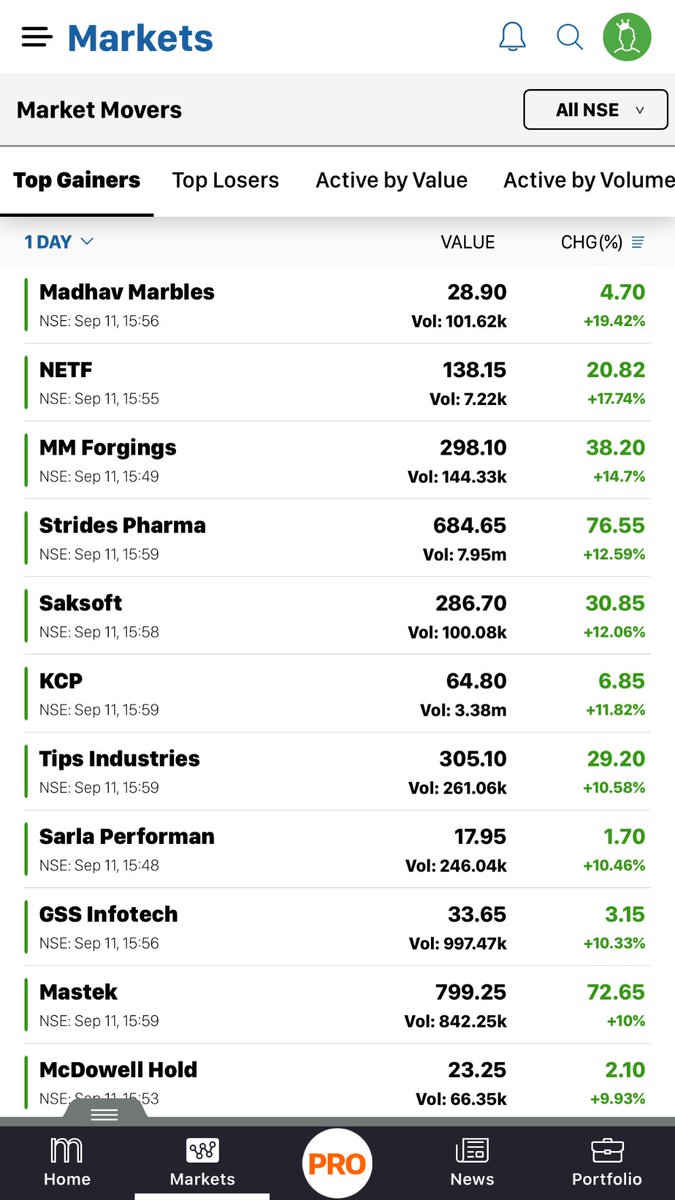

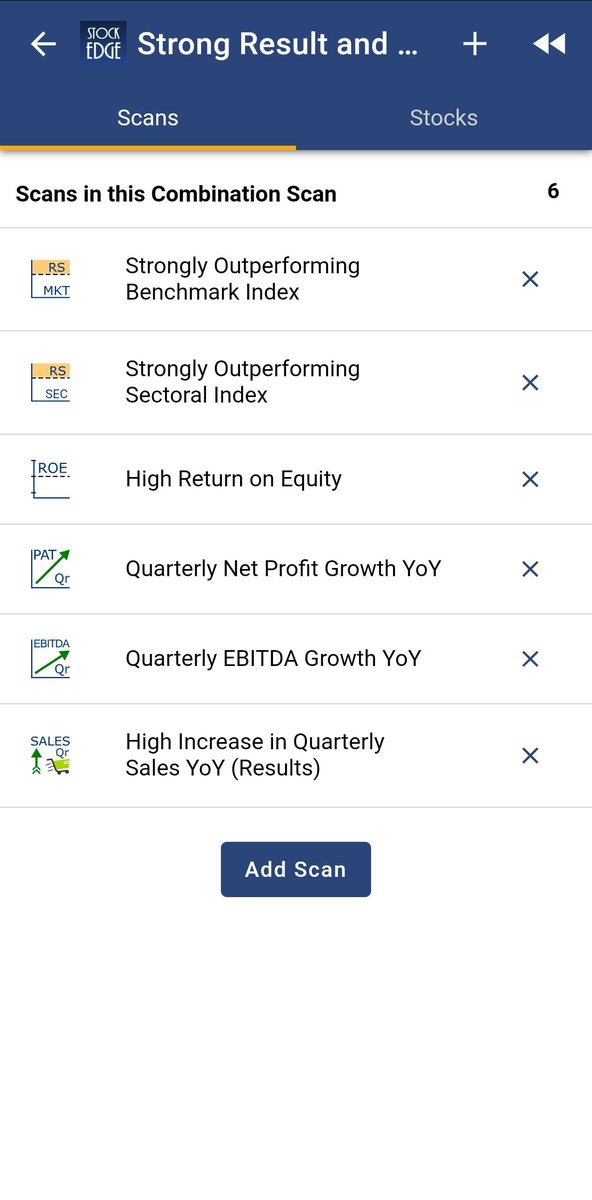

1. Best 15 scanners experts are using.

The absolute best 15 scanners which experts are using.

— Aditya Todmal (@AdityaTodmal) January 29, 2021

Got these scanners from the following accounts:

1. @Pathik_Trader

2. @sanjufunda

3. @sanstocktrader

4. @SouravSenguptaI

5. @Rishikesh_ADX

Share for the benefit of everyone.

2. 12 Trading Setups used by expert

12 TRADING SETUPS which experts are using.

— Aditya Todmal (@AdityaTodmal) February 7, 2021

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

3. How to Sell Straddles, different methods by different top traders.

Curated tweets on How to Sell Straddles

— Aditya Todmal (@AdityaTodmal) February 21, 2021

Everything covered in this thread.

1. Management

2. How to initiate

3. When to exit straddles

4. Examples

5. Videos on Straddles

Share if you find this knowledgeable for the benefit of others.

4. Option Wheel Strategy: Consistent income

A THREAD:

— Aditya Todmal (@AdityaTodmal) December 5, 2020

BEST OPTIONS STRATEGY FOR CONSISTENT INCOME -

OPTIONS WHEEL STRATEGY

Everything to know about this strategy I'm posting in this thread.

(1/12) pic.twitter.com/F0o4wIMjgf

Breakouts in the direction of the general trend

The longer the market is in a range, the stronger the breakout

Stock making higher lows near resistance zone

(lower highs near support zone is a sign of weakness)

Some ofthe biggest breakouts occur after Volatility Contraction, the analogy is that more a spring is pressed, higher it jumps whenever it gets released.

— Professor (@DillikiBiili) October 2, 2021

There is a VCP Scanner on chartink (Not mine). This may also be used to find potential Breakouts. pic.twitter.com/y1lmay7D4e

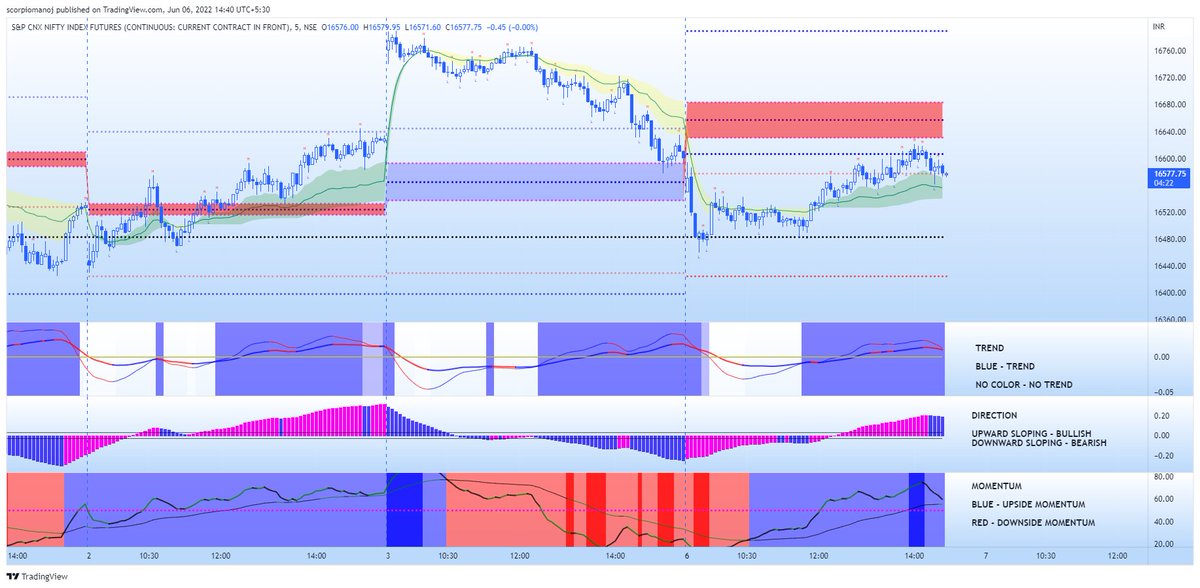

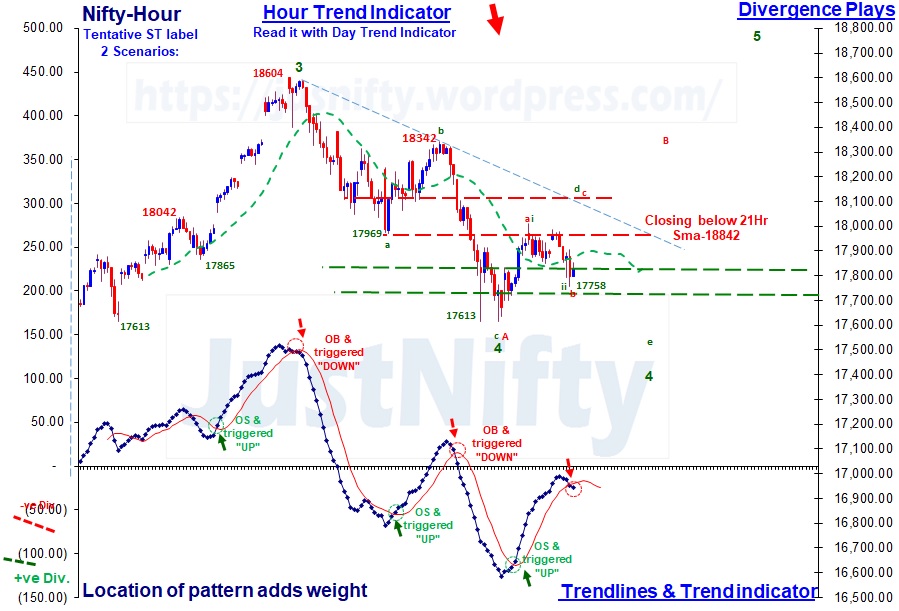

Task for weekend to those interested: Just research and check significance of TOP made on Friday. #markets #nifty #sensex

— Anand Rathi (@anandrathi12) September 17, 2021

You ask me or any other persons, they'll tell you their subjective view however unbiased they attempt to be.

It is their view and not necessarily the market's.

My subjective view is labelled in the charts.

Follow #Priceaction https://t.co/37iXFtWPzU

Currently reading the book you put on your website. Also, from this if we consider 18600 as 5 th wave end of Nifty ideally it's doing the 1st 12345 of downtrend, of which do e already 1234, currently going towards 5 which I believe should go below 100% of 4th retracement wave

— de soloist \U0001f1ee\U0001f1f3 (@ChakiArijit) November 4, 2021