Reason and pre-analysis for #BAJAJFINSV before buy-

While buying breakouts, your odds will improve a lot when you prefer the following:

1. Strong Relative Strength.

2. Tight price range on low Volume and a pattern which is easy on eyes. https://t.co/CprKpAfgtj

#BAJAJFINSV

— Ravi Sharma (@StocksNerd) August 14, 2021

Setting up in a tight base. Volume has been drying up.

Waiting for the breakout. pic.twitter.com/KWoGZAwkLO

More from Ravi Sharma

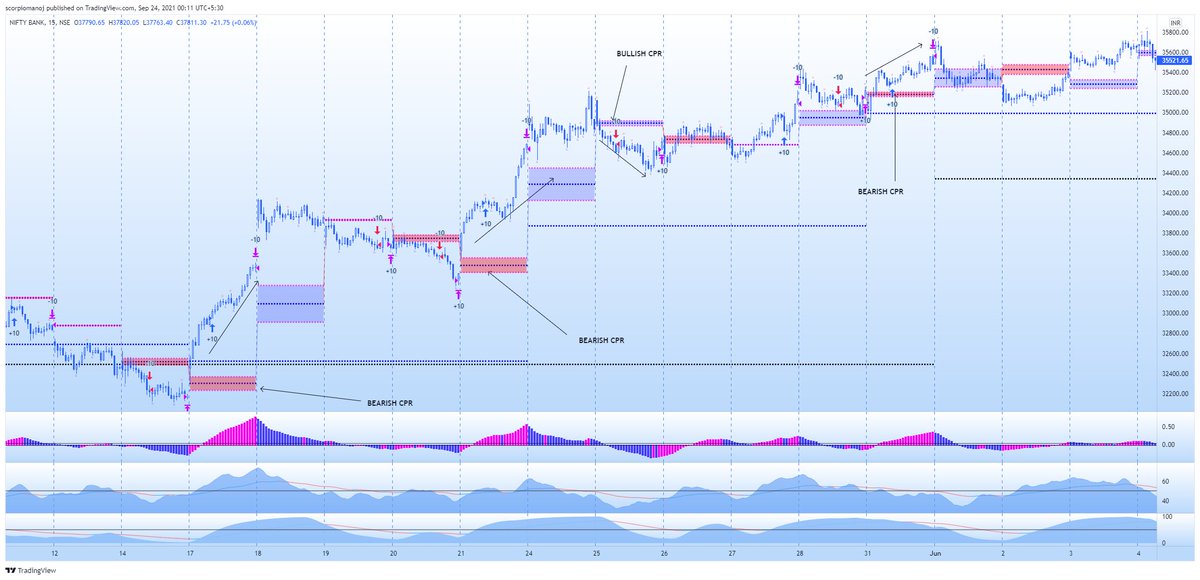

These are long term Moving Averages, which in my view are irrelevant for short term positional trades.

For my trading strategy, 13-day & 22-day EMAs are more suitable.

If SmallCap dips below these MAs & they get into the bearish sync, I get cautious & reduce my position size.

For my trading strategy, 13-day & 22-day EMAs are more suitable.

If SmallCap dips below these MAs & they get into the bearish sync, I get cautious & reduce my position size.

Sir as you follow the smallcap index,do you take full positions when it\u2019s trading below its key moving averages or wait for some confirmation? pic.twitter.com/ph6HTJ9rbD

— Dhanesh Gianani (@dhanesh500) November 30, 2021

I read about it in 'Trading for a Loving written by Dr. Alexander Elder.

I highly recommend this book to all the beginners in stock market.

* Trading for a Living

I highly recommend this book to all the beginners in stock market.

Sir, if not wrong you taught MACD -H in your elearn webinar also? From where you have learned it?

— Prakhar (@Indiantrader101) August 23, 2021

* Trading for a Living

More from Screeners

I use 4 scanners:

1) Volatility, Volume & daily range compression scanner

2) Punch-Drunk-Love

3) GE Ratio - to track fundamentally strong stocks

4) Recently created one to track Power Play setups.

I get around 150-200 stocks daily & choose the ones with the most potential.

1) Volatility, Volume & daily range compression scanner

2) Punch-Drunk-Love

3) GE Ratio - to track fundamentally strong stocks

4) Recently created one to track Power Play setups.

I get around 150-200 stocks daily & choose the ones with the most potential.

Sir, How do u find a set up - Do you track chart of each stock daily ? Or do u have filters , that lead you to a number of stocks , after which you scan them.

— AKASH GUPTA (@lockdownmurti) August 25, 2021