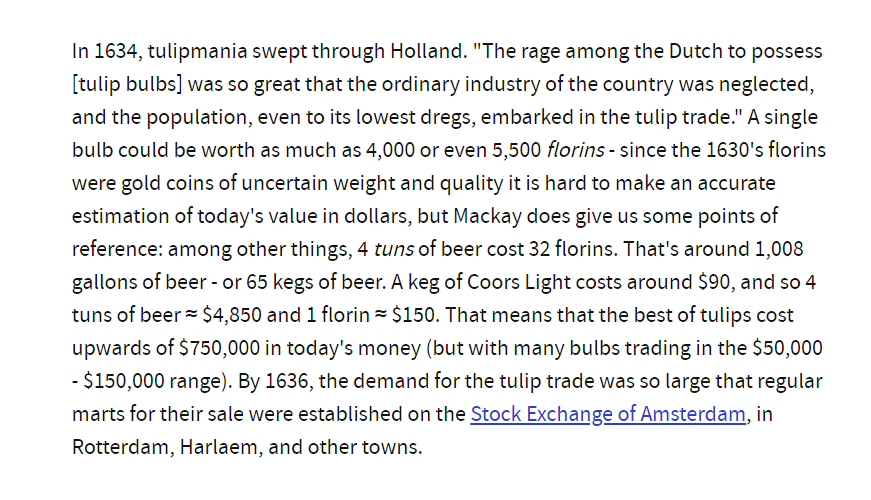

Ok here is the explanation. Grab a cup of coffee and read on. If you have not read/noticed this, you will see intraday options movement in a new light.

In a high IV environment or when the market is very volatile

— Subhadip Nandy (@SubhadipNandy16) January 21, 2022

" OTM options will behave like ATM options", one will get almost the same delta movement

https://t.co/3X8lCYDetq

More from Subhadip Nandy

My presentation on Money Management was based on a lot of sources as I mentioned. For traders interested on those sources , here they are

#OptimalF

Portfolio Management Formulas: Mathematical Trading Methods for the Futures, Options, and Stock Markets by Ralph Vince

The Mathematics of Money Management: Risk Analysis Techniques for Traders by Ralph Vince

#SecureF

#FixedRatio

The Trading Game: Playing by the Numbers to Make Millions by Ryan Jones

https://t.co/U0c65EbEog.

#OptimalF

Portfolio Management Formulas: Mathematical Trading Methods for the Futures, Options, and Stock Markets by Ralph Vince

The Mathematics of Money Management: Risk Analysis Techniques for Traders by Ralph Vince

#SecureF

#FixedRatio

The Trading Game: Playing by the Numbers to Make Millions by Ryan Jones

https://t.co/U0c65EbEog.

This is actually an interesting question and a correct observation. Many people before you also have made this observation, so I am going to explain this the best I can

I am trading since badla days. There being long meant you had to pay badla / interest and being short meant you received badla. Similar to an options buyer having theta burn and an options seller being theta positive. So the bias among pros were being short bit

Now, as of now I am an options buyer. All my strategies are geared towards options buying, so I have a theta burn continuosly. I do use strategies to cover that a bit, but still the burn is there

Now, let's consider how an options buyer makes money. His enemy is theta, vega can be friend or enemy ( coming to this in next tweet) , Delta is whether his view is right or wrong

Now say I am bullish on BNF and I buy calls and I am directionally correct . As BNF goes up, generally IV will decrease. This leads to a double whammy.

1. Vega hurts me

2. Theta decay increases.

So, the position does give money, but slowly

Ek baat to hai dada, u like mandi over teji.. Don't u... I mean u play both sides bt still... Im ryt \U0001f911\U0001f911

— VaibhavSharma (@vaibhav2631) September 23, 2022

I am trading since badla days. There being long meant you had to pay badla / interest and being short meant you received badla. Similar to an options buyer having theta burn and an options seller being theta positive. So the bias among pros were being short bit

Now, as of now I am an options buyer. All my strategies are geared towards options buying, so I have a theta burn continuosly. I do use strategies to cover that a bit, but still the burn is there

Now, let's consider how an options buyer makes money. His enemy is theta, vega can be friend or enemy ( coming to this in next tweet) , Delta is whether his view is right or wrong

Now say I am bullish on BNF and I buy calls and I am directionally correct . As BNF goes up, generally IV will decrease. This leads to a double whammy.

1. Vega hurts me

2. Theta decay increases.

So, the position does give money, but slowly