Categories Crypto

Not financial advice

2) Overview

- LTO Network (https://t.co/LJUDzLMCb5) is a hybrid blockchain solution that connects to existing systems enabling efficient collaboration on complex and multi stakeholder processes. It is led by a great team of serial entrepreneurs.

3) - In other words, LTO gives institutions access to blockchain without requiring them to overhaul legacy systems.

- Businesses don’t want an IT overhaul, but want communication with existing systems that only share process data and updates users via their own systems.

4) - This is the power of LTO network – changing unstructured communications into structured communications and driving efficiency for traditional businesses and institutions.

5) - On December 17, 2020 LTO Network and VIDT Datalink merged sales, marketing and development resources to form a “larger organization…better positioned to serve multinationals around the globe…”

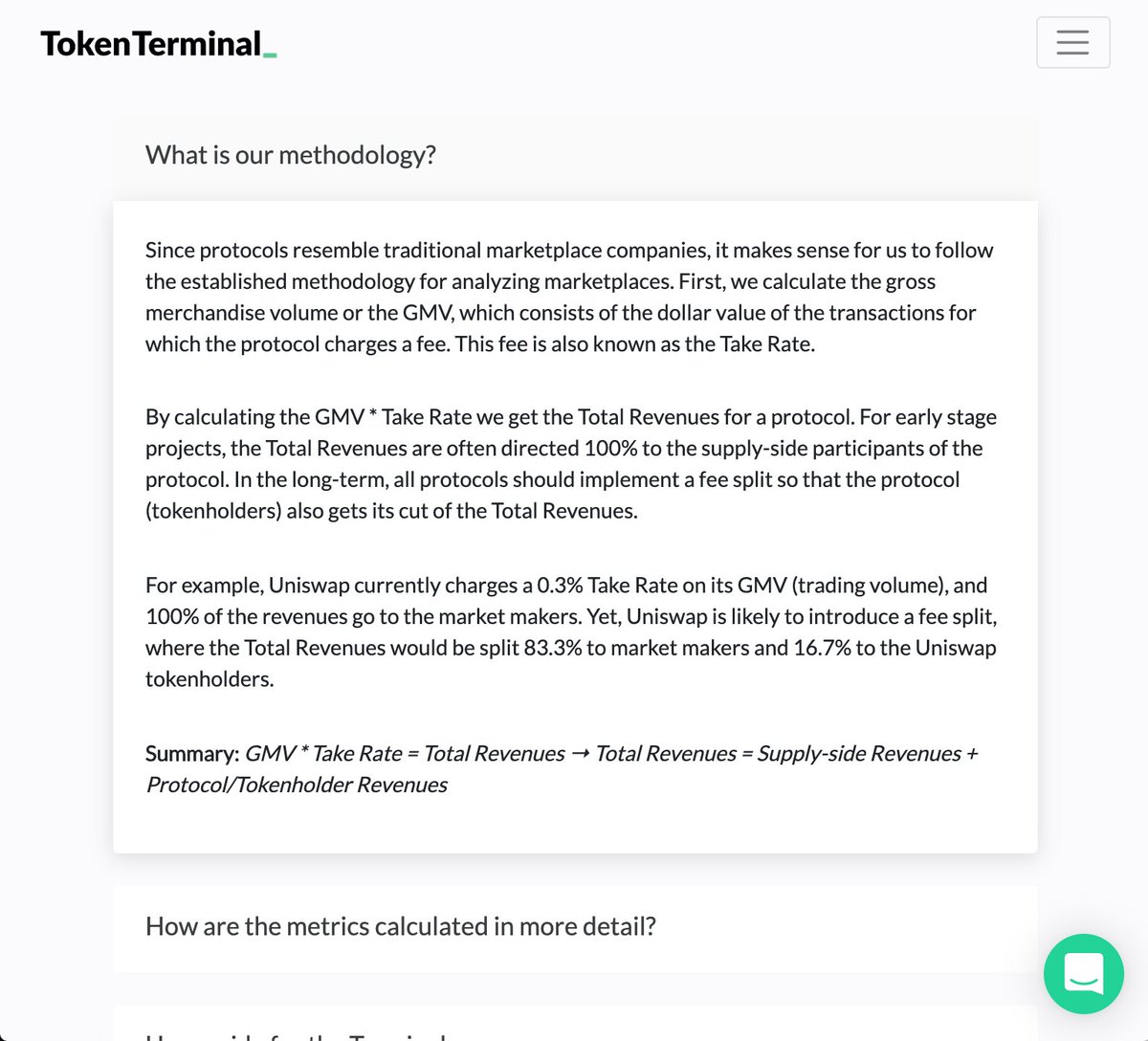

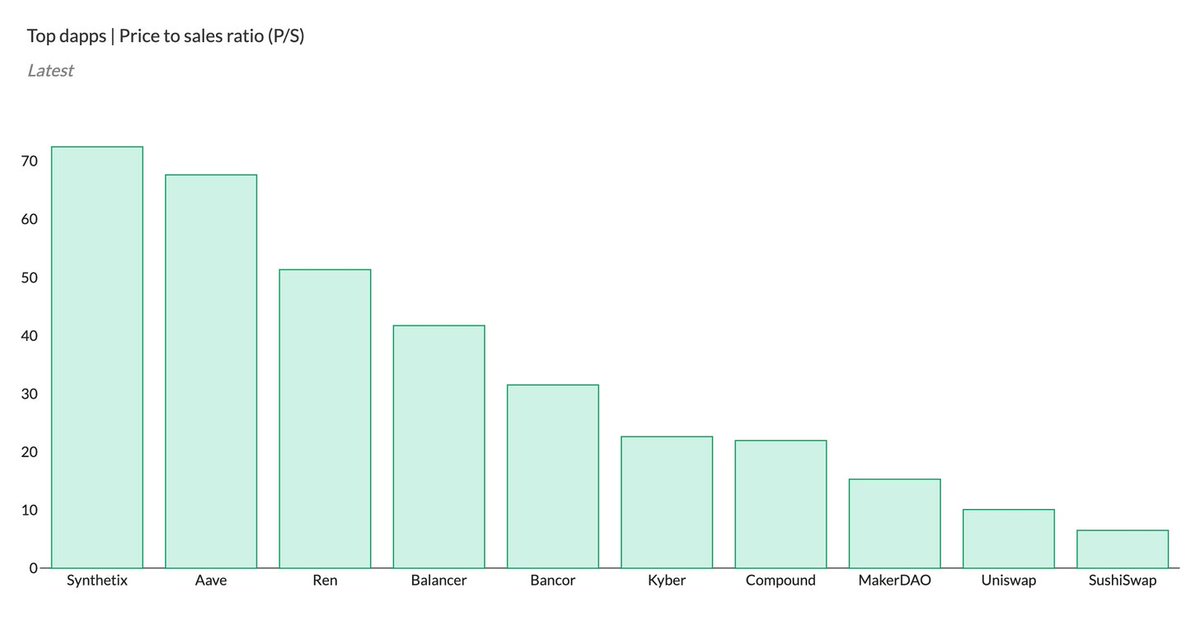

The price to sales ratio compares a protocol’s market cap to its revenues. A low ratio could imply that the protocol is undervalued and vice versa.

2/ The P/S ratio is an ideal valuation method for early-stage protocols, which often have little or no net income.

Instead, the P/S ratio focuses on the usage of a protocol, by tracking the total fees paid (revenue) by the users of its service. More info: https://t.co/XlHI7XPTvI

3/ We’re in a historically unique position, with early-stage & high-growth startups operating transparently on-chain.

This transparency makes it possible to find protocols with high usage relative to market cap.

4/ Top dapps from Token Terminal sorted based on the price to sales (P/S) ratio.

Note: Maker has gone from a high P/S ratio to #3 in a matter of months after raising the stability fees for DAI.

Also, two currently similar AMMs (Uniswap & SushiSwap) have the lowest P/S ratios.

5/ Let's look at the P/S ratios from a historical perspective.

The P/S ratio is calculated by dividing a project’s fully-diluted market cap by its annualized revenues.

The metric itself does not tell us about the growth patterns in a protocol’s market cap or revenues.

Ah yes, New Year's Eve. A time to reflect, look forward, celebrate, and throwback Long Reads Sunday style with the BEST BITCOIN TWEETS OF 2020.

Strap TF in, it's time for a thread!

👇👇👇👇

2) Let's start by going back to February.

Even before the full impact of COVID-19 kicked in, bitcoiners were thinking big about the epoch shifts we were in the midst

Welcome to the Fourth Turning. At this time, we have entered the "crisis stage" as defined by the generational shift currently in progress. Boomers are retiring, handing the reins to Gen-X, and Millennials are entering their wage-earning years. Let's look at some data.

— Hans HODL (@hansthered) February 22, 2020

3) When the markets DID start to finally react, bitcoiners were quick off the draw to point out that, whatever the risk the virus posed, the economic threat was significantly predetermined by fragility borne of decades of decisions.

THIS ISN\u2019T #coronavirus!!! \U0001f62cThis is result of ~50 yrs of Western economies consuming more than they produced, finally coming home to roost. The virus was just the pin that pricked the debt bubble & revealed the magnitude of the solvency problem. Stay safe out there \U0001f64f

— Caitlin Long \U0001f511 (@CaitlinLong_) March 9, 2020

4) Focus quickly shifted to a global dollar shortage and what it might mean across industries - The "Dollar Wrecking Ball" as @RaoulGMI put it.

Just an update from me, in case you are interested...

— Raoul Pal (@RaoulGMI) March 18, 2020

Ive just closed all short positions in equities, oil and HYG and had closed bonds a while ago. I am now 100% focussed on the on the US dollar, which is a wrecking ball.

1/

5) As every market (including BTC) crashed on the infamous March "Black Thursday," Coinbase buying told a story that would be persistent throughout the year - the bitcoin community scooping underpriced corn as others fled to

HUGELY bullish dynamics for Bitcoin right now:

— Hunter Horsley (@HHorsley) March 18, 2020

- BTC flat during HISTORIC risk-off days in markets.

- 72% on Coinbase buying.

- The Halvening is 50 days away.

- Billions in buys coming when levered longs return.

- And if 1% of >$2T+ of stimulus finds its way to Bitcoin...

Olivier, I tried to reach out, and proposed to meet in person pre-fork to collaboratively discuss and write notes, on the economic & tech case for bitcoin with you, @rogerkver & a few others. You suddenly stopped responding. I think you'd be a lot richer if you had gone ahead.

— Adam Back (@adam3us) January 10, 2021

@tyler @Blockstream @rogerkver Once we establish the fact that non-mining full nudes are not required, which I have discussed with you for years (and you still fail to recognize), we can talk about the effects you caused and will cause by refusing to increase the blocksize limit.

@tyler @Blockstream @rogerkver Ridiculous transaction fees: - Noone will use Bitcoin as a currency for payments. Those who did, ditched it (Steam, etc). Bitcoin is a P2P electronic cash system (title of whitepaper), not just a atore of value. - People now have to resort to using centralized exchanges.

@tyler @Blockstream @rogerkver - Bitcoin was designed to simply and easily increase the blocksize limit. It was actually 1 line in the code and was absurdly easily changed (compared to Segwit, dont get me started). Satoshi put the limit in place as a temporary fix for a ddos issue (prove me wrong, I was there)

@tyler @Blockstream @rogerkver - You and a couple of co-conspirators wanted the limit to stay in place. From Blockstreams business perspective, that makes total sense. From an end-useds perspective, you screwed everyone. I fought and convinced miners/companies to remove the limit. They agreed. You stopped it.