Categories Crypto

2/ 4th Amendment. In theory any government search and seizure of personal information should occur only after government obtains a warrant from a judge. To get a warrant they'll need to specifically describe the thing to be searched and explain why they've suspicion of crime.

3/ The Bank Secrecy Act is a bulk financial record surveillance law that forces banks and other financial institutions (crypto exchanges included) to collect personal information from customers and report it to government without any warrant or individual suspicion.

4/ The BSA's constitutionality as a warrantless search was challenged in the 1970s and the court narrowly upheld the law (and this is important) as it was applied by Treasury at the time. Since then its application has been significantly expanded and that's been unchallenged.

5/ the cases were Shultz https://t.co/BtAfdXMSBh and Miller https://t.co/nngic7231N. The Court said that warrants are not required if government searches information bank customers have already handed over to a third party (bank). This became known as the third party doctrine.

A thread about man vs. machine.

https://t.co/mGRJ852xVb

Alameda won't be participating in this, but it does present a chance to explain how we think about the value of man vs. machine in our trading. https://t.co/62yGWAS1C3

— Sam Trabucco (@AlamedaTrabucco) May 26, 2020

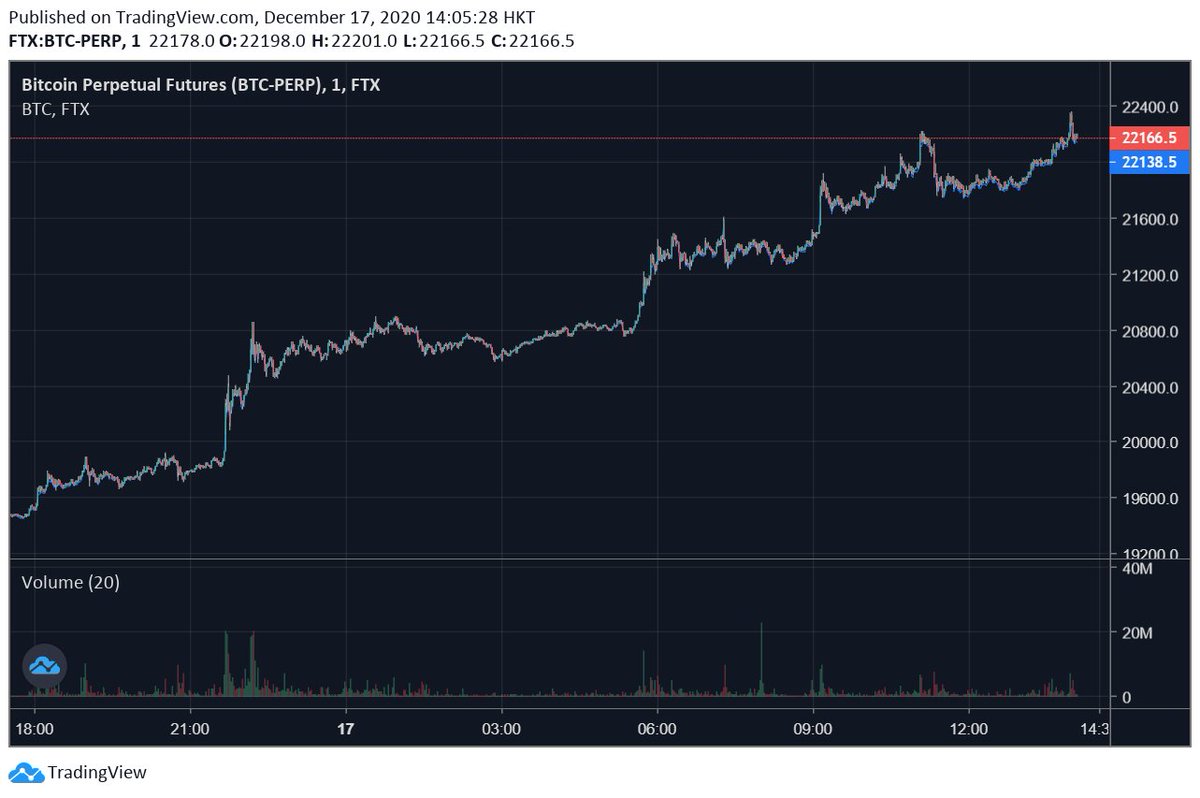

As has been pointed out, I've been adamant that the rallies in the past month or so have been heavily fueled by rampant liquidations on both BitMEX and Binance. And they have! But they were also fueled by organic buying among U.S. investors, as has been a popular narrative.

If anything, the narratives surrounding various U.S. funds and other companies buying BTC have gotten *stronger* in the past week or two than they were around Thanksgiving. More and more funds have announced their crypto holdings or plans to acquire them.

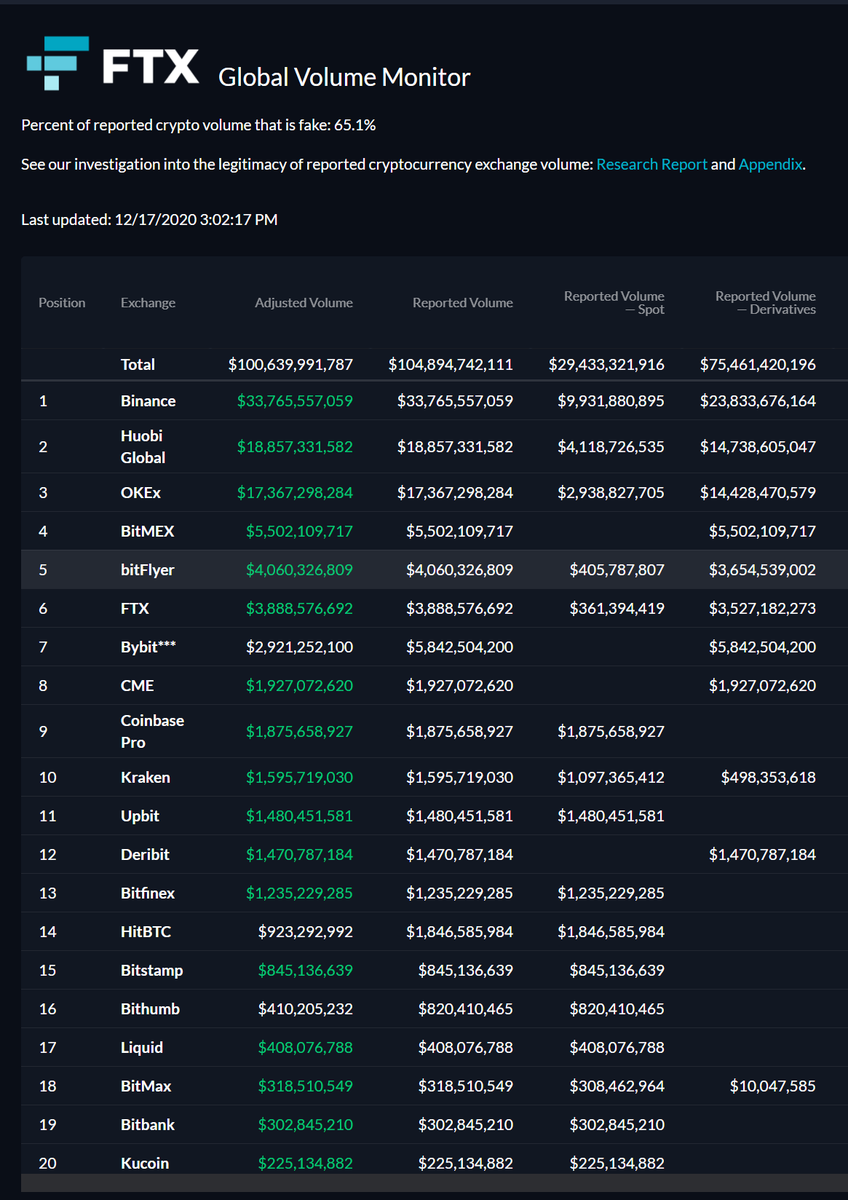

And direct signs of all this exist. Take a look at FTX's volume monitor: U.S. trading hubs like Coinbase having more volume than normal *is* a signal that U.S. customers are doing *something*, and when BTC is going up ...

(Coinbase even crashed from "heightened activity :P).

The DOW recently announced their new crypto indices, CME is listing ETH futures, Microstrategy putting $650M into BTC, GBTC AUM continuing to balloon, these all point in the same direction, and that direction is a resounding "up" for the crypto markets.

On #Bitcoin\u2018s 12th birthday, Satoshi Nakamoto just became the 40th richest person in the world.

— Ryan Watkins (@RyanWatkins_) January 3, 2021

$34 billion and counting \U0001f680 pic.twitter.com/hIE0he9O93

I remember the polite discussion about liquidity, clearing, custody, spreads, etc. By the end, they were laughing at us. There is something about *institutional* ridicule that allows those who had just blown up the world to deride others even when the institutions are disgraced.

Bitcoin at the time felt totally sketchy as a financial instrument as it was tied to contraband. But I didn’t see it as money. If I did, I would be unimaginably wealthy if I didn’t lose it all to digital theft, accidental loss or spending it . But I am an idiot in these matters.

The reason I was interested in it was more complex. If Bitcoin was digital gold, and gold was a quantum mechanical wave, then some group had created a:

1) Novel

2) Locally enforced

3) Digital

4) Conservation law

Called the blockchain. And money was but one thing it could be.

Can you imagine. Some group was creating as-if physics inside the network. Bitcoins to me were ‘waves’ propagating not in vector bundles, but on networked computers as substrate.

This was genius. I reasoned at the time that it didn’t make sense to me as a medium of exchange.

I came across a few posts which I found immensely thought-provoking by @cburniske @RaoulGMI @DegenSpartan (see below):

2/

https://t.co/xztuB0Tfd5

https://t.co/670x6ErykB

https://t.co/1xEba2Usjk

I think the general CT community / retail are super bullish on crypto in general right now and rightfully so. The narratives I hear are: 1) Institutions are coming in, 2) money printing goes brrrr and

1/ The euphoria is intoxicating, but #crypto is in need of a pullback and consolidation if $BTC wants to reach into the $100Ks and $ETH into the mid-to-high thousands.

— Chris Burniske (@cburniske) January 6, 2021

3/ 3) US gov transition is +ve for crypto.

While I agree in general with these 3 narratives, I want to also be mindful of time horizons of those narratives and the scale / magnitude / speed of which those play out.

4/ 1st - let's look at @cburniske post on the concerns of the over-frothy sentiment in the last several weeks in crypto. I share that same concern and try to balance this out ongoingly with Wall Street's famous phrase "climbing the wall of worry".

5/ Crypto is generally a pretty illiquid market (from an institutional perspective), whale traders pump and dump all the time on a day-to-day / week-by-week basis

This thread is as predictable as you\u2019d expect: lots of replies handwaving about \u201cinnovation\u201d and \u201cblockchain\u201d, while ignoring that \u2018stablecoin\u2019 is just another word for payments infra.

— Angus Champion de Crespigny (@anguschampion) December 4, 2020

People get so caught up in the tech they don\u2019t realise the ultimate result is the same. https://t.co/OC2auSh0uX

Posing the question that way implies that there are only two options: (1) Fintech PSPs aren't banks, and therefore shouldn't have to get stnd. bank charters or abide by the reg's that go w/ such to gain access to public settlement facilities. That's what many stablecoin fans say.

(2) fintech PSPs are banks; and therefore must be get bank charters and be subject to the same regulations ordinary banks must abide by. That's the answer offered by the STABLE Act

The second answer relies, not unreasonably, on the standard regulatory definition of a bank as a "deposit taking" institution. But IMHO it's that definition that's problematic, and that renders the conventional bank-nonbank dichotomy so.

For conventional banks aren't just "deposit taking institutions." They combine deposit taking with lending. It's this combined set of activities, not deposit taking per se, that (rightly or wrongly) supplies the rationale for many bank regulations, including deposit insurance.

Since then, he has been following it for more than 10-years through three distinct periods he calls; “Ealy stages (2009–2013)”, “Becoming Mainstream (2014–2017)”, and “#Altcoin Explosion (2018 -2020)”

Although the value of #Bitcoin and other #Cryptos have increased, they did not become as successful as he thought they could...

The technology behind #Bitcoin, #Blockchain, is a great #innovation but has some significant issues. Below, we provide our CEO’s analysis of these issues across 3 categories; https://t.co/7OTtWyDep9 2.Governance and 3.Scalability

The lack of #security in #Blockchains is almost there by design: a hack, a password loss, or hard disk crash is permanent, and the transaction cannot be reversed. You need to make backups, but not too many and you can never really trust a third-party with them...