1/ Why Silicon Valley Doesn't Get Bitcoin

Over the last 12 years of it’s existence, Bitcoin has been misunderstood by Silicon Valley which has led to many cringe worthy moments as they’ve endorsed silly ideas and even worse, scams.

More from Dan Held

Satoshi published the white paper on 10/31/2008. Right at the moment of peak despair during the 2008 financial crisis. Trust had been lost in a world that ran on trust.

2/ But why October 31st? It certainly wasn’t because Satoshi was a fan of halloween, it must have had a deeper meaning. With all of his actions, he demonstrated a careful precision.

He had been working on Bitcoin for at least a year and a half before publishing the white paper.

3/ “I believe I've worked through all those little details over the last year and a half while coding it, and there were a lot of them. The functional details are not covered in the paper, but the sourcecode is coming soon” - Satoshi Nakamoto

4/ On August 18, 2008 Satoshi registers registers https://t.co/rMWwiEwtxT through https://t.co/Uj8lMr10kB.

Satoshi was ready and waiting to hit the send button throughout 2008. What was so special about October 31st?

5/ I believe that Satoshi published the Bitcoin white paper on 10/31 as a hat tip to the ancient Gaelic festival of “Samhain” which was also the date in which Martin Luther nailed his 95 Theses to a church door. Both represent an end of the old and the beginning of the new.

More from Bitcoin

Exceptional listen on #Bitcoin.

— Joseph Skewes (@josephskewes) January 26, 2021

In particular Nic's responses to Mike's aggressive anti-BTC stance.

One dispute with Nic: Even if crypto mail list was best place to announce BTC, if Satoshi wanted fair distribution, surely creating 50% of the supply by Nov 2012 was too fast? https://t.co/e1Hpx4wWOu

#Bitcoin transaction is never really final, given the energy required to keep the network running, and obviously its scale issues will only grow over time. That said, I actually though @nic__carter "won" the debate as it were, and I was unconvinced by the threat to national 2/n

security or undermining Fed policy angles Mike put forward. Two areas that are super interesting to me. One is the issue of #Bitcoin ownership, and how concentrated it is in terms of a small % of addresses that own most of it (2% addresses > 95% of holdings I think). 3/n

made great point a lot of this is omnibus/exchange related - so exchange or fund - ie @Grayscale holds #bitcoin for multiple investors. That may well be true - but it brings up 2 other issues. One - it proves that #bitcoin doesn't really "work" without 4/n

centralisation - as this implies most people need exchanges or funds (or @Paypal) to buy it. If so, that kills off a major "bitcoin is better than gold argument" - as in reality, gold is way more decentralised (from mine supply to ownership distribution). It also brings up a 5/n

Oct. 8, 2020: The purpose of this thread is to document and timestamp when it first became clear that #Bitcoin was likely to become a major reserve asset for public corporations, and eventually states, with Square's purchase of $50M in BTC.

The purpose is to give something to cite when ppl later claim "But there was NO WAY OF KNOWING..."

h/t @ErikSTownsend who used the same format to call out the impact of Covid on Feb 8 and made me personally aware of the looming shutdown of the country https://t.co/opuiNgSeqC !

1/THREAD: WHEN WAS IT CLEAR?

— Erik Townsend \U0001f6e2\ufe0f (@ErikSTownsend) February 8, 2020

Feb. 8, 2020: The purpose of this thread is to document and timestamp when it first became clear that nCov was likely to lead to a global pandemic.

The purpose is to give something to cite when ppl later claim "But there was NO WAY OF KNOWING..."

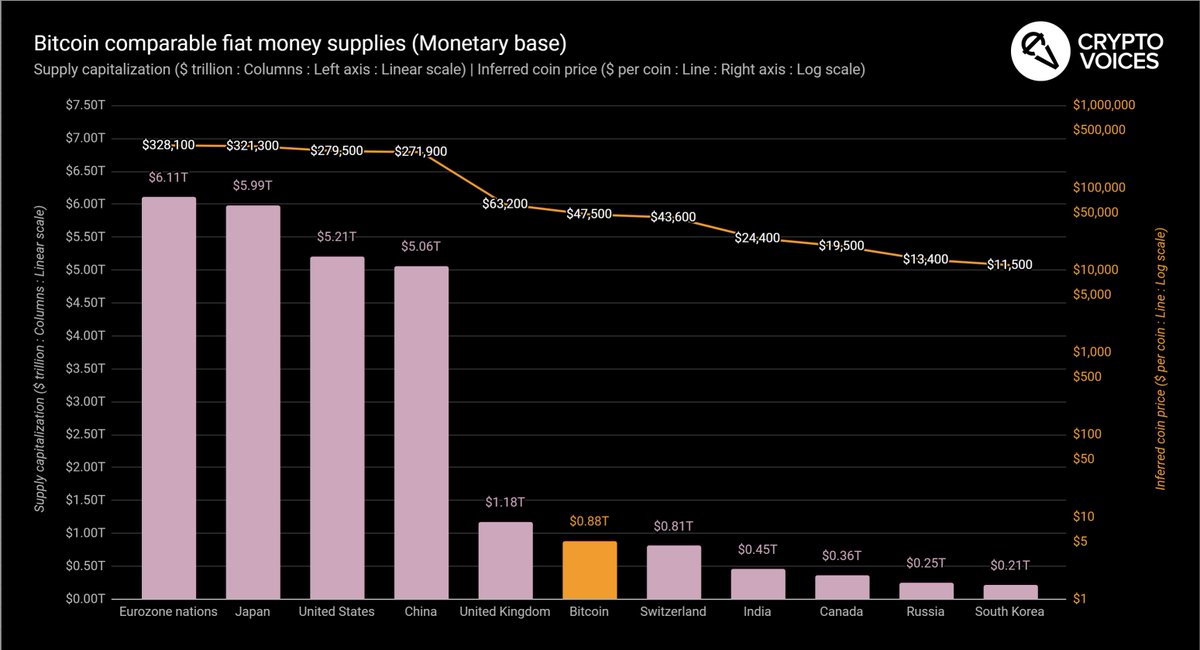

Bitcoiners smarter than me have been predicting the takeover of the dollar by Bitcoin for many years.

In 2014 with Bitcoin barely at $1B, @pierre_rochard wrote https://t.co/EGHa58KqHq, covering all the incorrect narratives of Bitcoin and stating it will overtake the dollar.

"[skeptics] misunderstand how strong currencies like bitcoin overtake weak currencies like the dollar: it is through speculative attacks and currency crises caused by investors, not through the careful evaluation of tech journalists and 'mainstream consumers'" - @pierre_rochard

I first became bullish on Bitcoin in the summer of 2016, around a $3B market cap, but it was still a toy project at that time in the eyes of most in the financial world, while many technologists thought of it as a v1 technology to be improved on.

Back with another #FreeLoveFriday. Last time, we covered how Mastercoin/@Omni_Layer pioneered digital asset issuance on blockchains. Today, let\u2019s discuss @Chainlink and the vital role it plays in connecting blockchains to the real world. https://t.co/0poYIBtGrt

— Emin G\xfcn Sirer (@el33th4xor) January 22, 2021

In my thread about Mastercoin, I briefly touched on the vital role fiat-backed stablecoins play in crypto markets, but there’s a catch with them:

The counterparty risk of a third-party holding fiat in reserves.

Enter MakerDAO, which set out to create a decentralized, collateral-backed cryptocurrency, DAI, that would be “soft-pegged” to the U.S. Dollar using the power of algorithms. In crypto tradition, its supporters said trust game theory, not operators.

In 2017, MakerDAO published a whitepaper describing a system where anyone could create DAI by leveraging ETH as collateral to create Collateralized Debt Positions. Essentially, you take out a digital USD loan against your crypto.

The game theory of the system is structured such that DAI issuance is controlled to keep the price pegged to $1.00. In essence, it buffers the fluctuations of the underlying collateral to create a synthetic dollar bill.