https://t.co/Tie3orUZ1j

1/ If you're new, here are some must-read resources on bitcoin, ethereum, defi, web 3.0, and the future of crypto.

Tools to join the revolution. 👇

https://t.co/Tie3orUZ1j

+ ROI & fundamentals metrics by sector

+ Comprehensive asset profiles

+ Charting tools, screeners, watch lists

Free! (Though we have premium tools, too.)

https://t.co/0Z6v65NUcq

But it's a tight summary of all of our research team's epic work throughout the year.

Almost like 120 tear sheets or 12 sector research reports stapled together.

https://t.co/KxLqregkpA

@RyanWatkins_ and @WilsonWithiam wrote the must read primer on Ethereum, and its major new upgrade ETH2.

https://t.co/l3arQRoLfk

The best way to learn is through daily drips.

We write for nearly 45,000 crypto professionals each day, to keep them up to speed, and up the learning curve.

https://t.co/5Un46Sy5kg

https://t.co/sFSzxKPsG8

More from Bitcoin

I will be a buyer under 13800 levels, but depending upon the reversal on smaller timeframe.

#BITCOIN

— Mayank Narula (@Mayank_Narula1) March 5, 2022

Pending RSI divergence on monthly chart which requires a dip under 13805 to get resolved.

But monthly RSI divergences can go on for years before the resolution.

Best case scenario will be panic dump over next few months. pic.twitter.com/hi67hMg9sZ

Afternoon all,

I wanted to take some time to cover some resources I use in my daily $BTC trading. This will be a longer thread, so bear with it you will hopefully find something that will help you also. I will try to keep it concise so if there are any questions please DM me.

11. Portfolio Management & Trade Diary- https://t.co/KAig84dOsk

3Commas gives you the ability to see your full portfolio, mapping your balance and asset breakdown. You have access to all your trade history across all exchange in a single trade diary, saving time extracting taxes

I wanted to take some time to cover some resources I use in my daily $BTC trading. This will be a longer thread, so bear with it you will hopefully find something that will help you also. I will try to keep it concise so if there are any questions please DM me.

11. Portfolio Management & Trade Diary- https://t.co/KAig84dOsk

3Commas gives you the ability to see your full portfolio, mapping your balance and asset breakdown. You have access to all your trade history across all exchange in a single trade diary, saving time extracting taxes

1/ outlook for bitcoin: positive 🚀

in this thread, i'll quickly outline key data points on #bitcoin sentiment, demand, market structure, and macro conditions

disclosure: i own BTC, obvi. this is not investment advice. DYOR. further disclosures at

2/ let's start w sentiment ☺️

first, investor sentiment:

✅ @blackrock filed to add BTC to 2 funds, CIO has 400k price target

✅ @RayDalio's Bridgewater reportedly issuing BTC research report

✅JPM, Goldman, and other bulge brackets initiated research coverage

3/ next, trader sentiment:

🚨 most important indicator is the forward curve

normally BTC futures trade in backwardation after a price drop.

this time, the curve stayed in contango following drop, meaning market makers are bullish 🐂📈 despite funding rate increase!

4/ sentiment drives demand. so DEMAND next.

💸 let's talk fund flows

🤑 our research shows $359M of inflows into crypto products last week alone (https://t.co/6Kky96m3ob)

🤑 our @CoinSharesCo @xbtprovider ETPs saw $200M trading volume on jan

4/ let's talk bitcoin fundamentals

post-halving, 900 BTC mined per day, 312,000 this year.

👀 47M millionaires. 21M bitcoin.

🏆 collectibles selling at all time highs. bitcoin is the ultimate collector's item. (see

in this thread, i'll quickly outline key data points on #bitcoin sentiment, demand, market structure, and macro conditions

disclosure: i own BTC, obvi. this is not investment advice. DYOR. further disclosures at

2/ let's start w sentiment ☺️

first, investor sentiment:

✅ @blackrock filed to add BTC to 2 funds, CIO has 400k price target

✅ @RayDalio's Bridgewater reportedly issuing BTC research report

✅JPM, Goldman, and other bulge brackets initiated research coverage

3/ next, trader sentiment:

🚨 most important indicator is the forward curve

normally BTC futures trade in backwardation after a price drop.

this time, the curve stayed in contango following drop, meaning market makers are bullish 🐂📈 despite funding rate increase!

4/ sentiment drives demand. so DEMAND next.

💸 let's talk fund flows

🤑 our research shows $359M of inflows into crypto products last week alone (https://t.co/6Kky96m3ob)

🤑 our @CoinSharesCo @xbtprovider ETPs saw $200M trading volume on jan

4/ let's talk bitcoin fundamentals

post-halving, 900 BTC mined per day, 312,000 this year.

👀 47M millionaires. 21M bitcoin.

🏆 collectibles selling at all time highs. bitcoin is the ultimate collector's item. (see

You May Also Like

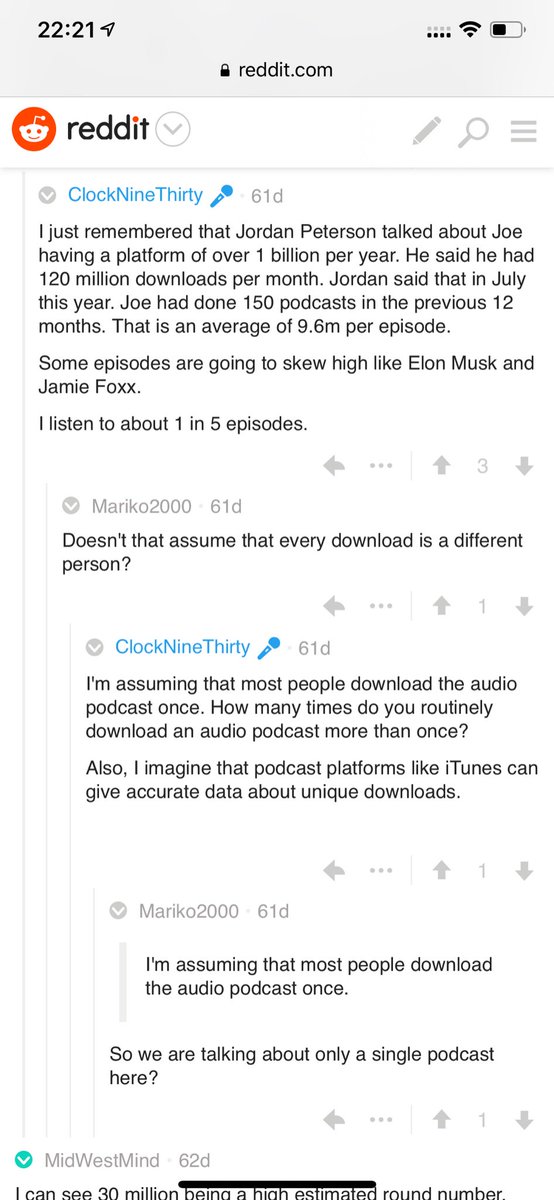

Joe Rogan's podcast is now is listened to 1.5+ billion times per year at around $50-100M/year revenue.

Independent and 100% owned by Joe, no networks, no middle men and a 100M+ people audience.

👏

https://t.co/RywAiBxA3s

Joe is the #1 / #2 podcast (depends per week) of all podcasts

120 million plays per month source https://t.co/k7L1LfDdcM

https://t.co/aGcYnVDpMu

Independent and 100% owned by Joe, no networks, no middle men and a 100M+ people audience.

👏

https://t.co/RywAiBxA3s

Joe is the #1 / #2 podcast (depends per week) of all podcasts

120 million plays per month source https://t.co/k7L1LfDdcM

https://t.co/aGcYnVDpMu