TraderYogi999's Categories

TraderYogi999's Authors

Latest Saves

How to play mine and other traders’ trigger watchlists.

\U0001f3b2 How to play trigger watchlists \U0001f3b2

— Adam Sliver \U0001f3c0 (@AdamSliverTrade) October 10, 2021

1. How/When to enter:

This is NOT an exact science, there is no way to avoid fakeouts. These are KEY levels, and for that reason, provide strong moves. However, they can be hard to break due to their significance. You must manage risk.

How I select stocks to build a watchlist & Insight on my trading style.

\U0001f4daThread: How I Make Watchlists\U0001f4dd

— Adam Sliver \U0001f3c0 (@AdamSliverTrade) September 2, 2021

There are countless ways to make watchlists. Each trader looks for particular things in a setup that fits their style. There is no science here. My goal is to share a simplistic strategy on how to become SELF-SUFFICIENT with watchlists. \U0001f91d

How to use FinTwit as a resource.

\U0001f4c8How to use FinTwit to your advantage\U0001f4c8

— Adam Sliver \U0001f3c0 (@AdamSliverTrade) September 8, 2021

There\u2019s a lot of people that post great content on here. So I\u2019d like to share some of the best, and how you can use their strategies to add to your own playbook. \u2705

Small Account Crypto Strategy:

\U0001f4b8 Small Account Crypto Strategy \U0001f4b8 pic.twitter.com/4ULhsqsHxw

— Adam Sliver \U0001f3c0 (@AdamSliverTrade) September 20, 2021

12 solid videos each 1 HR long teaching you all I know on #Options and day trading 🚀

This is my gift to the world ❤️

All of your questions have been answered here 👇👇👇

Help me with a❤️so we can share the TRUTH with the

TradingWarz FREE Indicators TOS

Holy Grail by Rich

https://t.co/yi7xeIsSTX

Inside Power by Rich

https://t.co/J6J8wOMRj6

Doubles by Rich

https://t.co/Tb6RyFjBTd

Outside Power by Rich

https://t.co/Wpr9OlCjid

Leave a ❤️ to help me out

https://t.co/MVK4lV4ZmK

https://t.co/33PH8ILV9C

https://t.co/MjP7Dtzqkm

@unusual_whales @snorlax_support

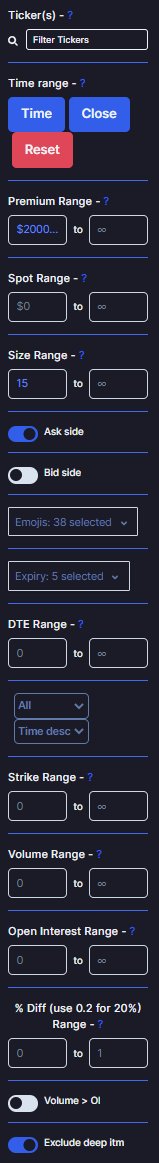

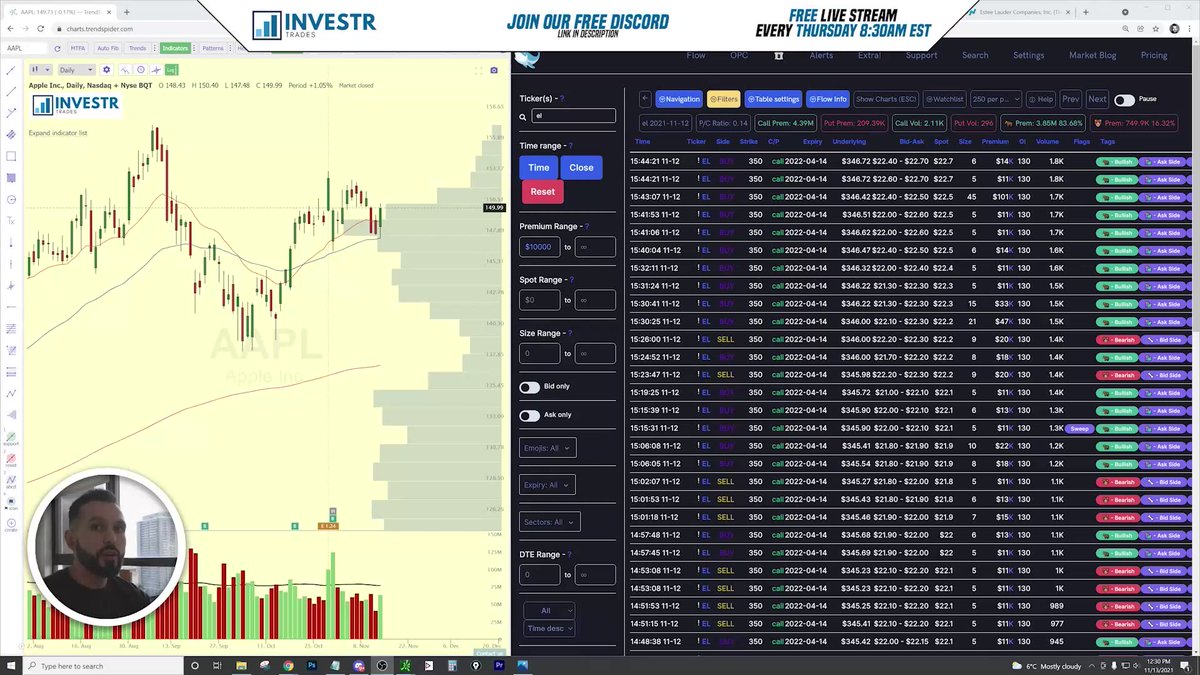

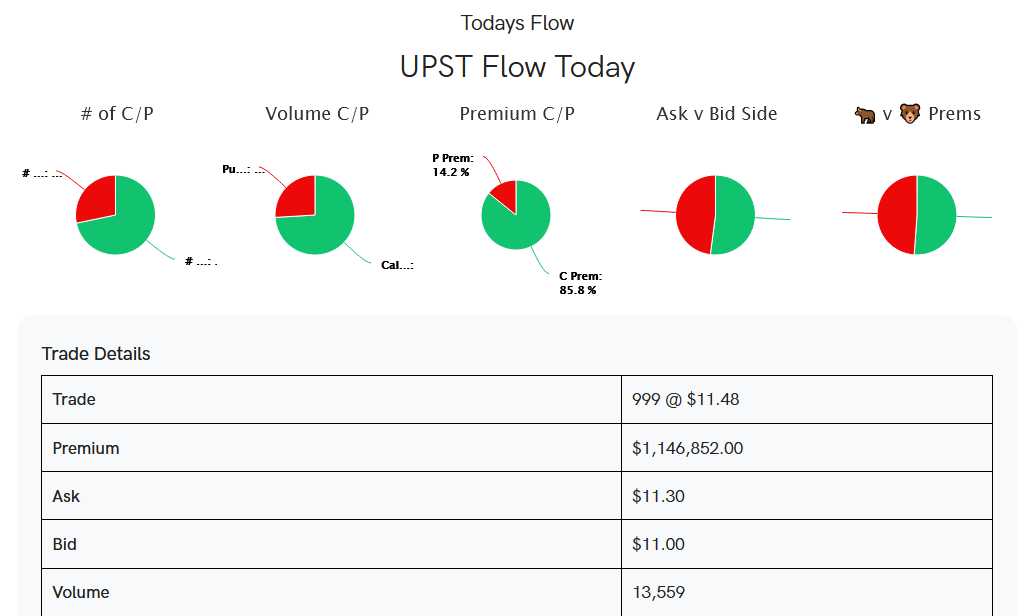

As promised, here is a thread on how I use @unusual_whales to help me find actionable plays.

— SpyGuy \U0001f575\ufe0f\U0001f3fb\u200d\u2642\ufe0f (@SpyGuyTrading) August 26, 2021

Please note that these are TOOLS, they are not a magic perfect tool for you to get rich quick. There will be winners, there will be losers.

@snorlax_support

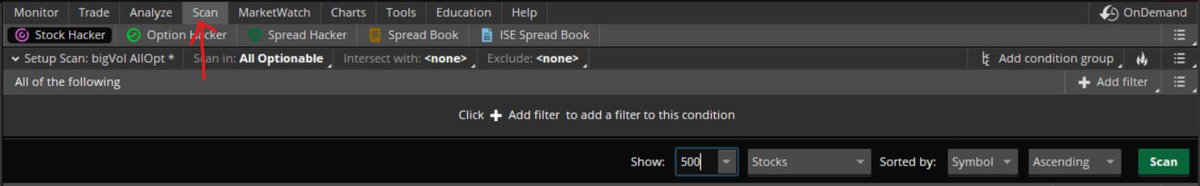

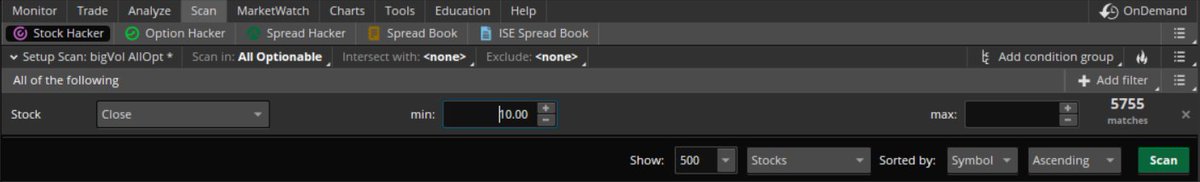

In this thread I will be revealing to you guys my step by step process on how I do my due diligence on any ticker along with the process of how I find good setups and what resources and websites do I use to do it.

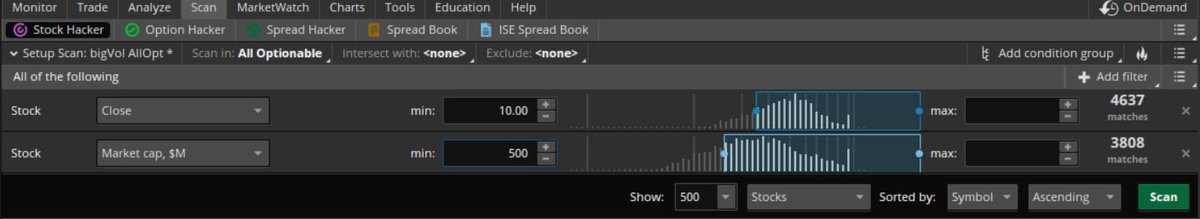

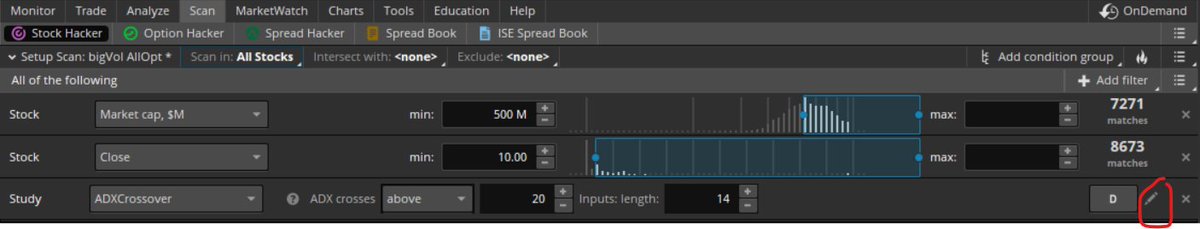

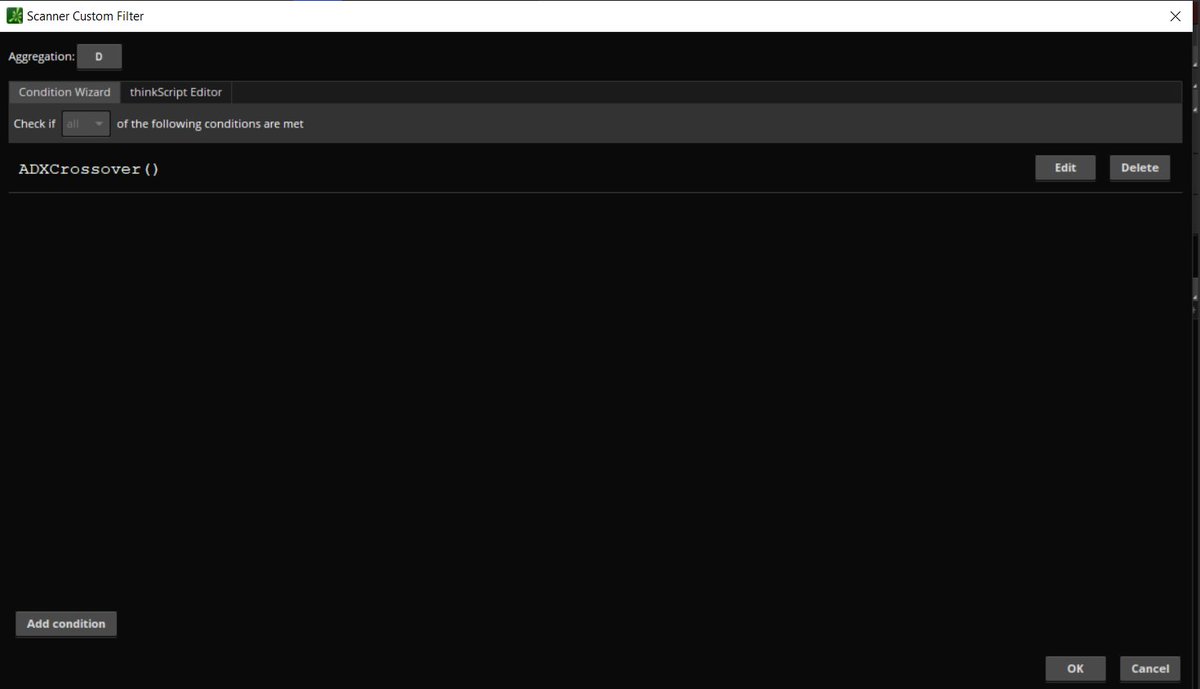

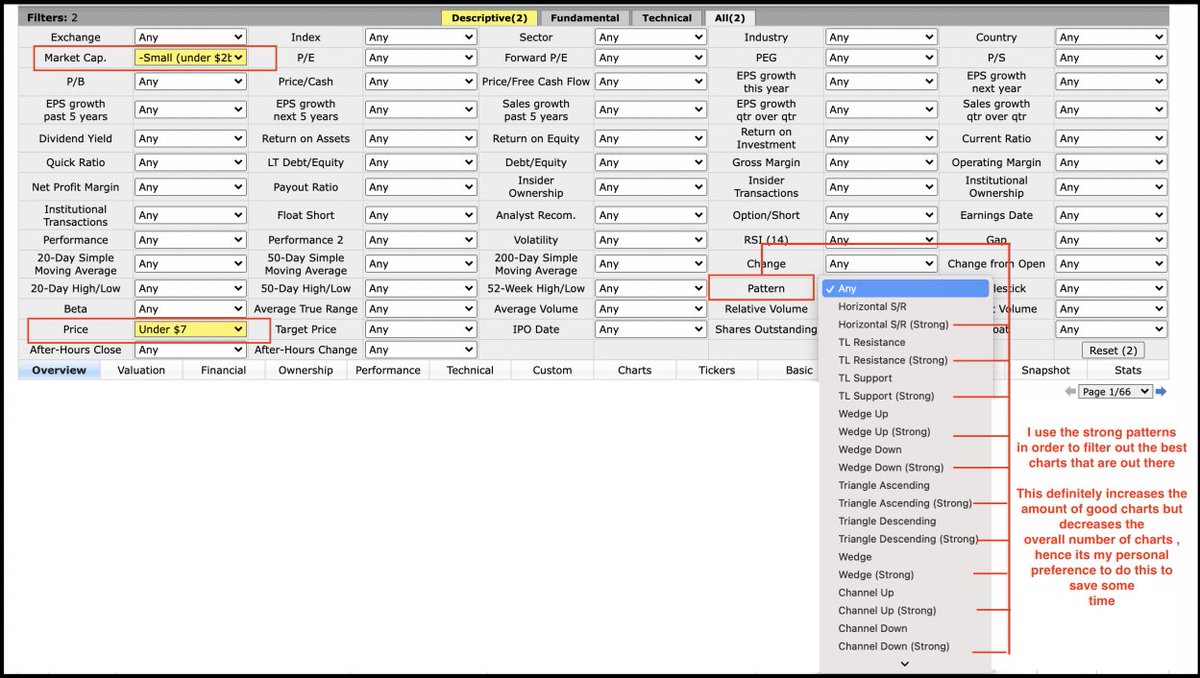

Step 1: Finding Good Chart Setups (continued)

Attached below is my personal finviz screener settings which I use to look at charts and how I

change some of the settings to my own preferences.

Site Reference: https://t.co/liI2ktnHhz

PS: Sometimes I don't even select any pattern

My favorite bullish chart setups that I personally look out for initiating swing positions:

1-) Falling Wedge Pattern

2-) Ascending Triangle Pattern

3-) Fish Hook / Oversold Bounce Pattern

4-) Channel Up Pattern

5-) Descending Triangle Breakout Pattern ( Towards Upside)

Step 2: Checking for Offerings

Once I have found a good chart, with a high risk reward ratio, the immediate first thing that I

do is to look out for any signs of upcoming offering. Since I don’t want to get caught in

offerings , these are the two things that I lookout for.

Step 2: Checking for Offerings (continued)

1-) Firstly, I look for whether the company had made any recent offerings in the last two months, if yes then there are less chances of new offerings.

Wave theory resources:

https://t.co/zMLJx0Posg

Recommend checking out @StockDweebs newsletter. I don’t practice wave theory myself but have found his picks highly accurate and like to correlate them with my own.

YouTube channels:

TrendSpider @TrendSpider

smithsintheblack @RobInTheBlack

Sara Sabatino @ssabatino84

_ms_izzy @_ms_izzy

Learn to Day Trade @TrueBubbleHead

StockDweebs @StockDweebs

watchjoshtrade @watchjoshtrade

BullTradeFinder @BullTradeFinder

MagicMike @magicmiketrader

"Reading the Tape" / Level 2 / Time and

Thread on "Reading the Tape" / Level 2 / Time and Sales

— Ace (@LunarAces) May 29, 2021

EMAs /

No one explains EMAs either, so here are my 9/20 EMA rules. I have to give credit to @MullinsMomentum for introducing me to these. I adopted some stuff from him, and the rest I developed my own way of using them. Here's a thread of how I use them:

— Ace (@LunarAces) May 30, 2021

Supply and

Why and how 90% of retail traders lose and how you can join the 10% that win. This is by far the most important thread I've made. I truly hope this helps change your lives.

— Ace (@LunarAces) June 14, 2021

Position sizing, risk management and trading around your

Position sizing, risk management, and trading around your core thread:

— Ace (@LunarAces) June 28, 2021

https://t.co/7DjG8ElT7d

Trading Lessons for total beginners.

— making sales \uea00 (@making_sales) February 3, 2021

Thanks to @ripster47, @Brady_Atlas @MullinsMomentum, @SDHILLON97, @MrZackMorris, @PJ_Matlock, @notoriousalerts, @Hugh_Henne, @bear_fuker, @Trogdaddy, @atrhodes00 and many more for teaching me all that I know about the stocks.

[THREAD]

https://t.co/n4bAh3w1MC

If you\u2019re in the process of blowing up your account\u2026

— making sales \uea00 (@making_sales) February 26, 2021

STOP AND READ THIS NOW!

[THREAD]

https://t.co/jy7Ud7aAM1

Stop losses are your friend.

— making sales \uea00 (@making_sales) February 26, 2021

Stop losses help you to follow your rules and respect your plan.

Stop losses help keep the size of your losses minimal and recoverable.

Personally, I recommend using a hard stop loss (especially if you\u2019re new) instead of having a mental one.

https://t.co/227pi3f1cw

People often ask me what is meant by \u201chave your own plan.\u201d

— making sales \uea00 (@making_sales) March 7, 2021

What does a plan consist of and how do you go about creating one?

That\u2019s what I\u2019m here to discuss\u2026

[THREAD]