TraderYogi999's Categories

TraderYogi999's Authors

Latest Saves

his content from the playlist start with "how to read stock charts". It's precise and on point and short enough for you to get through this week even if you did one video tonight .. I like his teaching method .. he's slow and very easy to understand

As for DD. It comes from many factors. Mainly the trading platform itself has updated news posted on the ticker you want to trade.

https://t.co/1f8wQs1LcA

Really liking this website it has breakdown of the financials & summary of SEC filings. (con'd)

Also a whole bunch of other stuff that it focuses on the companies that you search. As for what I look for?

10-K & 10-Q.

Read 8Ks ..company updates

Also look to see if they did an recent Offerings (S-4 filings)

Also look to see S-3 filings for upcoming dilutions.

cont'd

https://t.co/nxP0hAJ4UH (Great place for quick articles on many stocks that are posted by analysts who do very good work digging info)

https://t.co/KsYqlmTlQ8 for quick news info

https://t.co/v5xGZqWhbn For constant world news

1 - open trading view in your browser and select stock scanner in left corner down side .

2 - touch the percentage% gain change ( and u can see higest gainer of today)

Making thread \U0001f9f5 on trading view scanner by which you can select intraday and btst stocks .

— Vikrant (@Trading0secrets) October 22, 2021

In just few hours (Without any watchlist)

Some manual efforts u have to put on it.

Soon going to share the process with u whenever it will be ready .

"How's the josh?"guys \U0001f57a\U0001f3b7\U0001f483

3. Then, start with 6% gainer to 20% gainer and look charts of everyone in daily Timeframe . (For fno selection u can choose 1% to 4% )

4. Then manually select the stocks which are going to give all time high BO or 52 high BO or already given.

5. U can also select those stocks which are going to give range breakout or already given range BO

6 . If in 15 min chart📊 any stock sustaing near BO zone or after BO then select it on your watchlist

7 . Now next day if any stock show momentum u can take trade in it with RM

This looks very easy & simple but,

U will amazed to see it's result if you follow proper risk management.

I did 4x my capital by trading in only momentum stocks.

I will keep sharing such learning thread 🧵 for you 🙏💞🙏

Keep learning / keep sharing 🙏

@AdityaTodmal

I'll link new threads to this post as I tweet them. Don't go off my work alone, use content by others as well!

🟥 Support/Resistance Flips -

Here\u2019s a little thread on my bread and butter in trading $ETH and $BTC. I base 80% of my trades around simple S/R flips.

— Jelle (@CryptoJelleNL) February 5, 2021

Many traders and investors on here use all kinds of complicated methods, I use a few horizontal lines. pic.twitter.com/Av1Fgdop6L

🟥 Divergences - CHEAT

Morning gents, here's a quick cheat sheet to help you spot divergences while trading $BTC, $ETH and other $ALTS.

— Jelle (@CryptoJelleNL) February 6, 2021

Enjoy, let me know if you want cheat sheets on anything else in the comments below \u2b07\ufe0f\u2b07\ufe0f pic.twitter.com/yjZ43CTHkJ

🟥 BTC Pairs -

Here's a little infographic on why $BTC pairs matter in a bull market.

— Jelle (@CryptoJelleNL) January 16, 2021

Grow your BTC holdings by simply re-balancing spot $ETH and $BTC.

Example below: pic.twitter.com/8JbK6sqjVD

🟥 Funding - THREAD + CHEAT

I've seen many people talk $BTC, $ETH and $ALTS funding and its implications without fully understanding the concept. Here's a quick thread that explains what funding is, how it works and what it can tell you, along with a simple cheat sheet. pic.twitter.com/Hil815E99q

— Jelle (@CryptoJelleNL) February 7, 2021

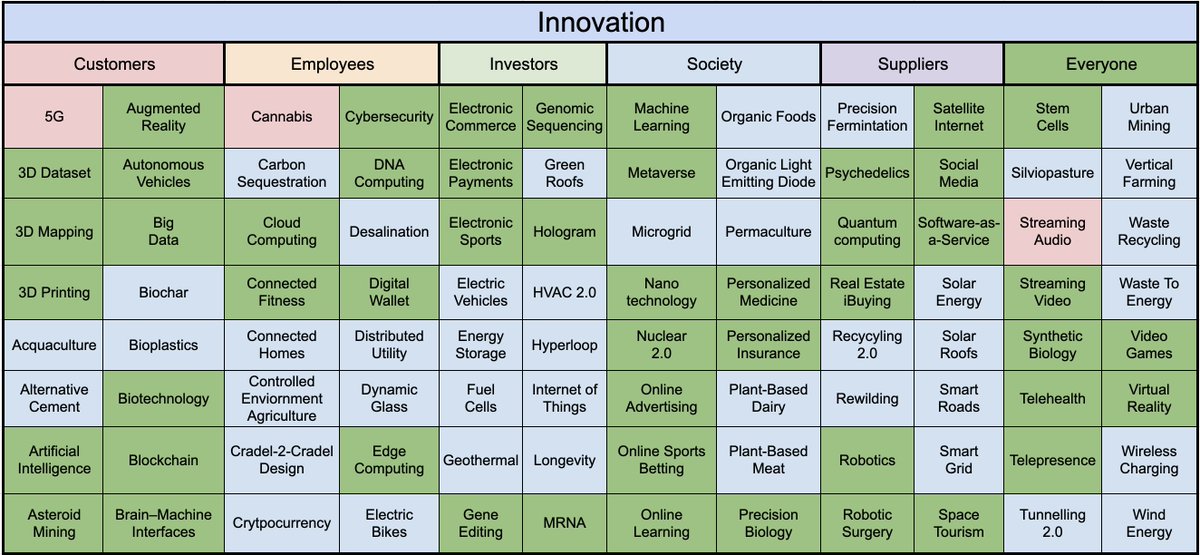

But how do you find the next $AFRM, $PLTR, or $USPT early?

Here are 9 GREAT resources for finding stock ideas (8 of them are FREE):

1: ETFs

Look through the holdings of high-growth ETFs

Google the ETF symbol and “holdings”

These are worth cracking open:

▪️ $ARKF / $ARKG / $ARKK / $ARKW

▪️ $FFTY

▪️ $HACK

▪️ $IZRL

▪️ $TMFC

2: Fund Managers

Type a fund you respect into @Whalewisdom

You can see all their holding and get emails of any changes

These funds are worth tracking:

▪️AKre Capital

▪️AKO Capital

▪️Dorsey Asset

▪️Fundsmith

▪️Polen Capital

More

Here are some of the big investors that track:

— Brian Feroldi (@BrianFeroldi) February 17, 2021

Altarock Partners

AKO Capital

Appaloosa

Akre Capital

Broad Run

Dorsey Asset

Duquense

Ensemble

Fundsmith

Polen Capital

Third Point

Here are their current top 10 holdings (in order) and links to their latest buys/sells \u2b07\ufe0f

3: Newly Public Companies

▪️Direct Listings

▪️IPOs

▪️SPACs

Are a great idea source

Helpful resources:

▪️ https://t.co/jJW01WpJQh

▪️

4. Screeners

@Finviz is great for screening by sector/industry

@Stockcard is great for screening by themes (like the mega-trends listed below)

1. https://t.co/cWGjheFrdL

I\u2019m going to do a thread on \u201cDD\u201d. Due diligence is everything about investing. There\u2019s no wrong way to do DD, but I\u2019m going to show a few things I do in order to finding a company that I believe in. Also mix in what others do as well!

— Yates Investing (@yatesinvesting) May 16, 2020

2. https://t.co/tgJO7riEYH

Tonight I want to discuss \u201cGap Fills\u201d I was asked the other day what I meant, so I decided to do this thread.

— Yates Investing (@yatesinvesting) May 14, 2020

3. OFFERINGS

Alright, so tonight i\u2019m going to discuss offerings. I\u2019m also going to discuss why I think offerings are easy money makers. It\u2019s one of my trading strategies, but don\u2019t think that means you need to go buy every stock that has an offering. This might be long. Let\u2019s get started....

— Yates Investing (@yatesinvesting) May 12, 2020

4. OPTIONS and WARRANTS

Let\u2019s learn the difference between stock options and stock warrants real quick.

— Yates Investing (@yatesinvesting) May 12, 2020

Also want to go over option trading more.

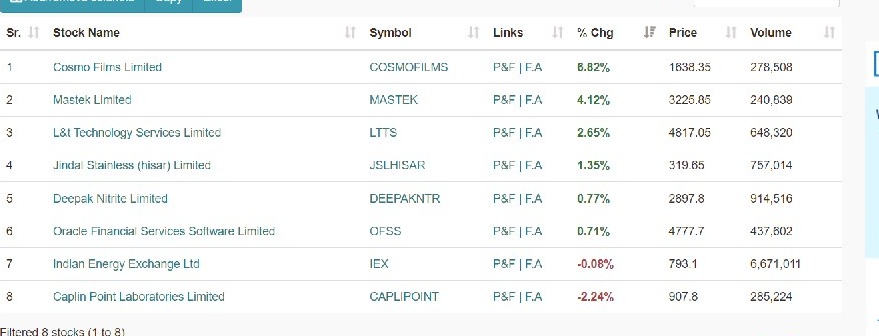

Criteria

Screener to Find Swing Stocks.

1. 15% Range of Near 52 week high

2. Avg Volume > 1 lakh

3. Market Cap > 2000 Cr

4. Roe Roce > 20%

5. Eps Increasing Qtr on Qtr

6. Above 50 ema

1/

How to use This Screener

1. Basically we are screening Fundamentally strong stock

2. These are Technically Strong also as stocks are near 52 week high and above 50 ema

3. Below is the list For the screened Stocks.

4. Target should be on RR

@StocksNerd @MarketScientist

2/

When to Enter

1. When 52 week High is Broken

2. Filter Stocks Select Stock With High Relative Strength

Example : #CosmoFilms , #Mastek

3. Keep Sl Below 21 ema

4. Keep Trailing Using 21 ema

5. Enter stocks on high volume breakout

6.Look for Price Range Contraction

3.

Your Most work is done by the screener

The most important task is filtering out manually and that's where your Returns will differ

As we are screening TechnoFunda stocks these can used for momentum investing

Join telegram https://t.co/b4N4oPAto9

@AmitabhJha3 @chartians