SAnngeri's Categories

SAnngeri's Authors

Latest Saves

1. Core setup

2. Pivot points trades

3. PDH/PDL trades

4. Open interest addictions combined with rejections on charts.

5. Website to confirm bias

Very quick read.

Share if you liked for the benefit of everyone.

•Main setup of @ITRADE191

He used this setup daily for all trades.

1. EMA crossover 10/20

2. Supertrend 10/3

3. Vwap

4. RSI >

@MiteshFan @Mitesh_Engr @Abhishekkar_ MY TRADING SETUP .... I've been using it for a long time .. result good try it \U0001f607 pic.twitter.com/XThUD0ftbl

— itrade(DJ) (@ITRADE191) June 13, 2020

•Volume always greater than

Volume Should always be above 20 pic.twitter.com/CPgxLgpPKF

— itrade(DJ) (@ITRADE191) June 13, 2020

•Candle Rejecting from

— itrade(DJ) (@ITRADE191) August 25, 2020

•Pivot settings

— itrade(DJ) (@ITRADE191) October 20, 2020

Have compiled his:

1. Expiry day trading.

2. Trade logics.

3. Multiple Charts analysis.

3. BTST criteria for stocks.

Share if you find it helpful so that everyone can benefit.

A pdf of his moneycontrol article where you can read about his journey and how he trades.

— Harsh (@HarshAsserts) September 11, 2020

Advice on how to not let your mood influence your decisions.

When trading,moods will want to influence ur decisions

— Banknifty Addict (Gaurav) (@BankniftyA) December 29, 2019

How to minimize:

-Have a backtested plan/system

-Know yourself(emotion and panic levels)

So trade size is important to keep ur emotions in check

-dont focus too much on pnl

-have a back up plan ready

& last stay positive!!

Expiry day Trading:

How to become better?

When I had spoken to him on phone he advised me to backtest all expiries and rigorously practice them again and again to develop conviction. Superb advice!

Backtest the complete expiry and practice again and again till u develop conviction

— Banknifty Addict (Gaurav) (@BankniftyA) November 5, 2020

Acts based on support and resistance levels from charts

Support and resistance levels based on technical charts on various time frames.

— Banknifty Addict (Gaurav) (@BankniftyA) December 19, 2019

Breaking any of the above, leads to a direction

and then only directional play.

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

Here are the setups from @Pathik_Trader Sir first.

1. Open Drive (Intraday Setup explained)

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

Bactesting results of Open Drive

Already explained strategy of #opendrive

— Pathik (@Pathik_Trader) May 27, 2020

Backtested results in 30 stocks and nifty, banknifty.

Success ratio : approx 40-45%

RR average 1:2

Entry as per strategy

Stoploss = Open level

Exit 3:15 PM Or SL

39 months 14 months -ve, 25 +ve

Yearly all 4 years +ve performance. pic.twitter.com/nGqhzMKGVy

2. Two Price Action setups to get good long side trade for intraday.

1. PDC Acts as Support

2. PDH Acts as

So today we will discuss two more price action setups to get good long side trade for intraday.

— Pathik (@Pathik_Trader) June 20, 2020

1. PDC Acts as Support

2. PDH Acts as Support

Example of PDC/PDH Setup given

#nifty

— Pathik (@Pathik_Trader) June 23, 2020

This is how it created long setup by taking support at PDC.

hopefully shared setup on last weekend helped. pic.twitter.com/2mduSUpMn5

At this point, I will just add them randomly but when they are complete I will structuralize them

The value you will find here is 🔥

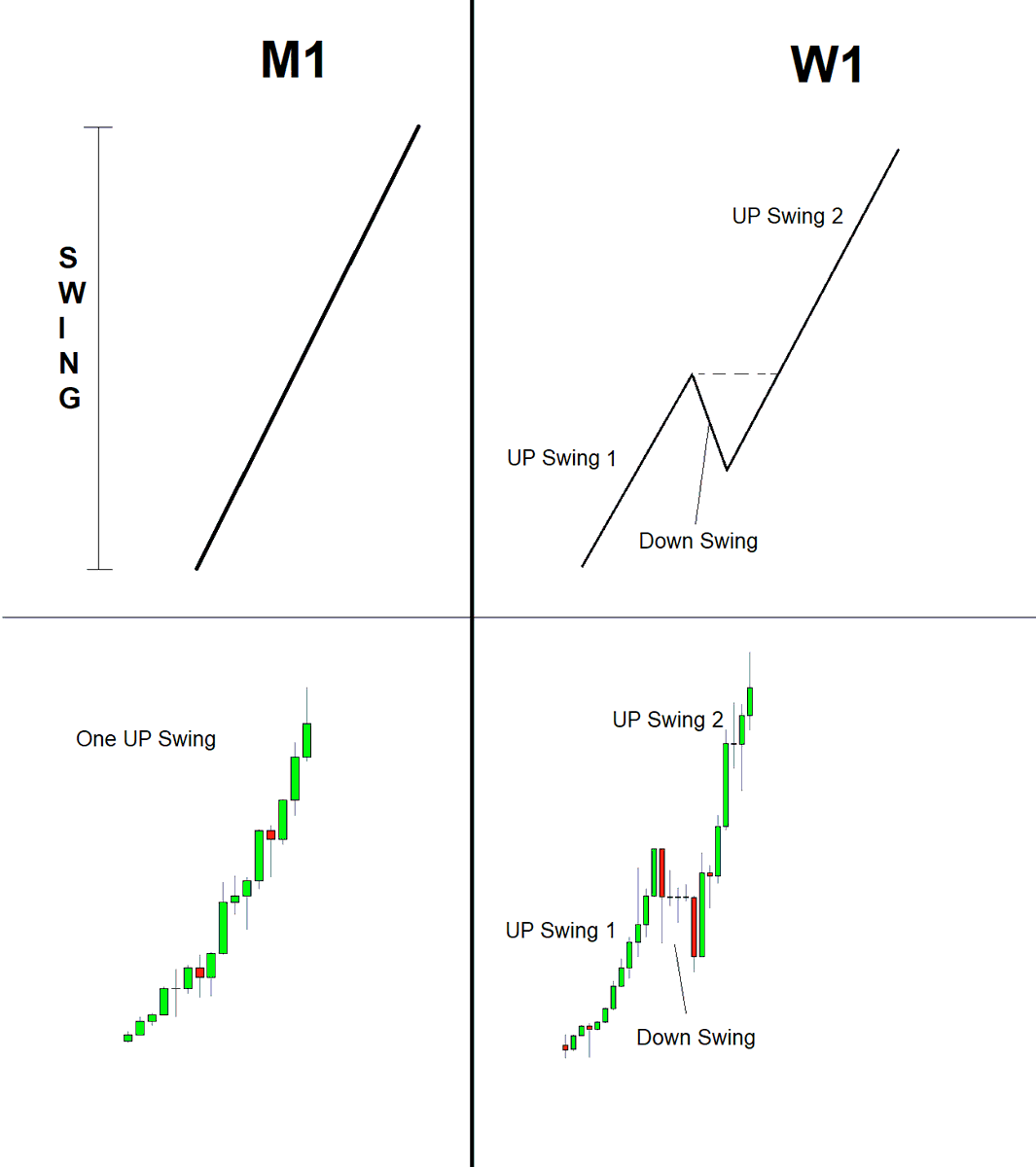

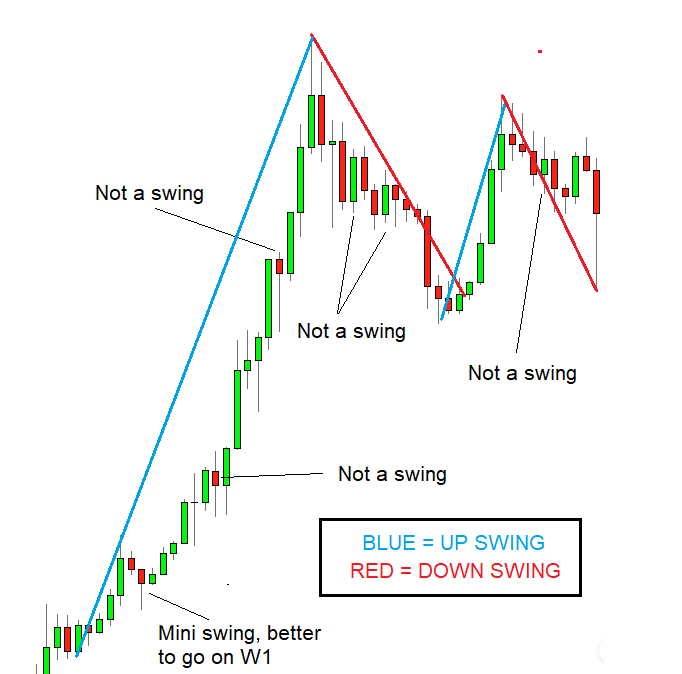

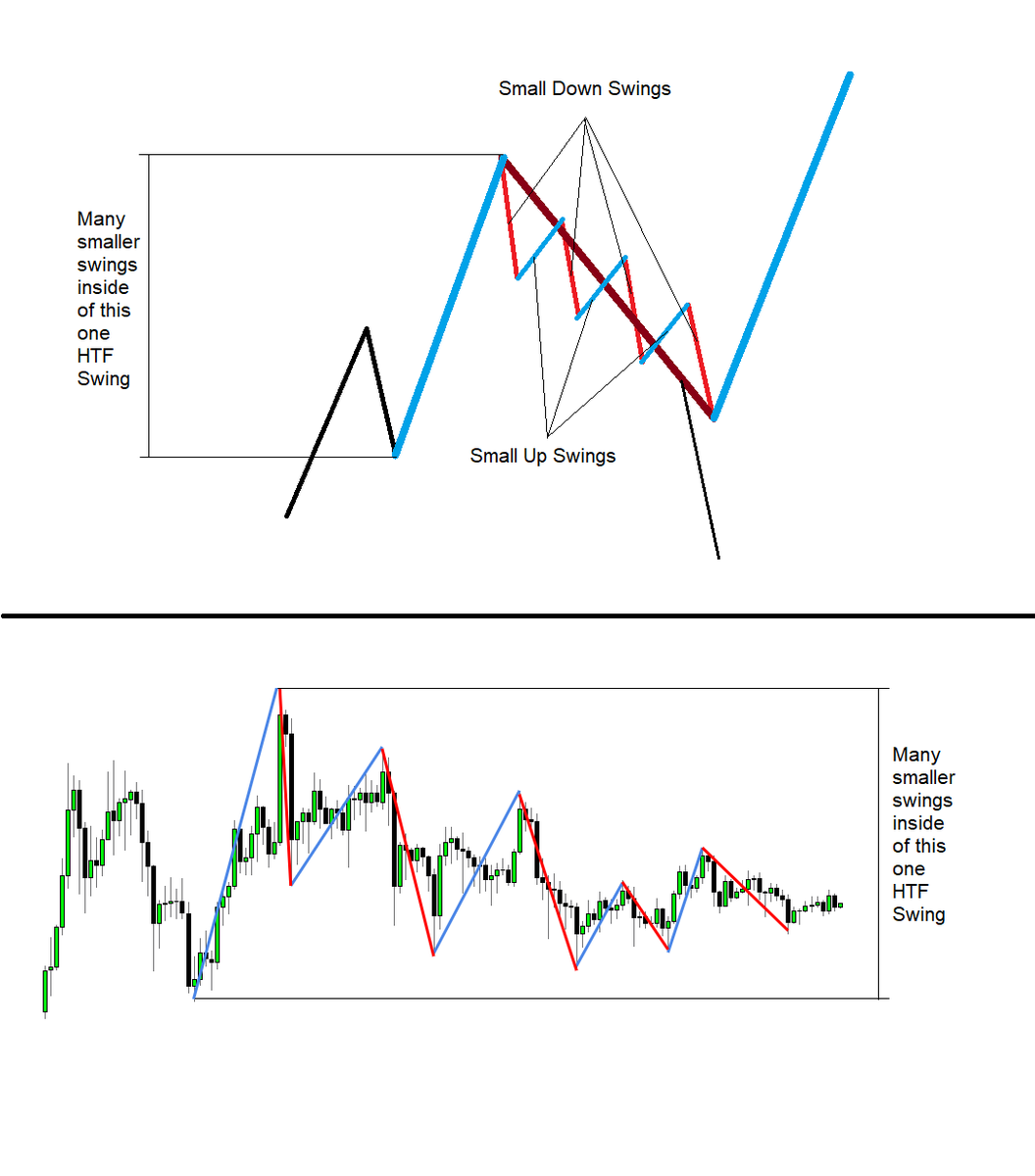

1) Market

Market Structure (MS)

— J A C K I S (@jackis_trader) July 6, 2020

Understanding MS is the most important thing in TA

It rules above everything. TL's, MA's, Indicators. Everything.

While it's nothing more than looking at swings and seeing Higher Highs (HH), Highers Lows (HL), Lower Highs (LH), and Lower Lows (LL). pic.twitter.com/QbgOSHGkBr

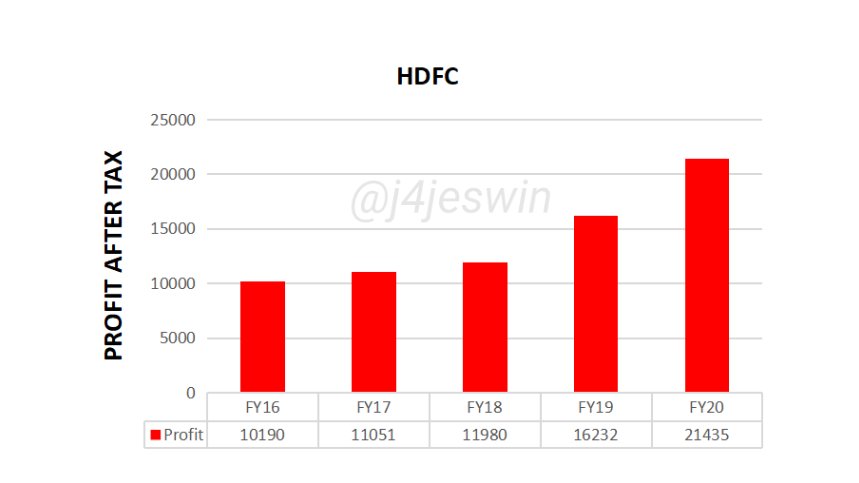

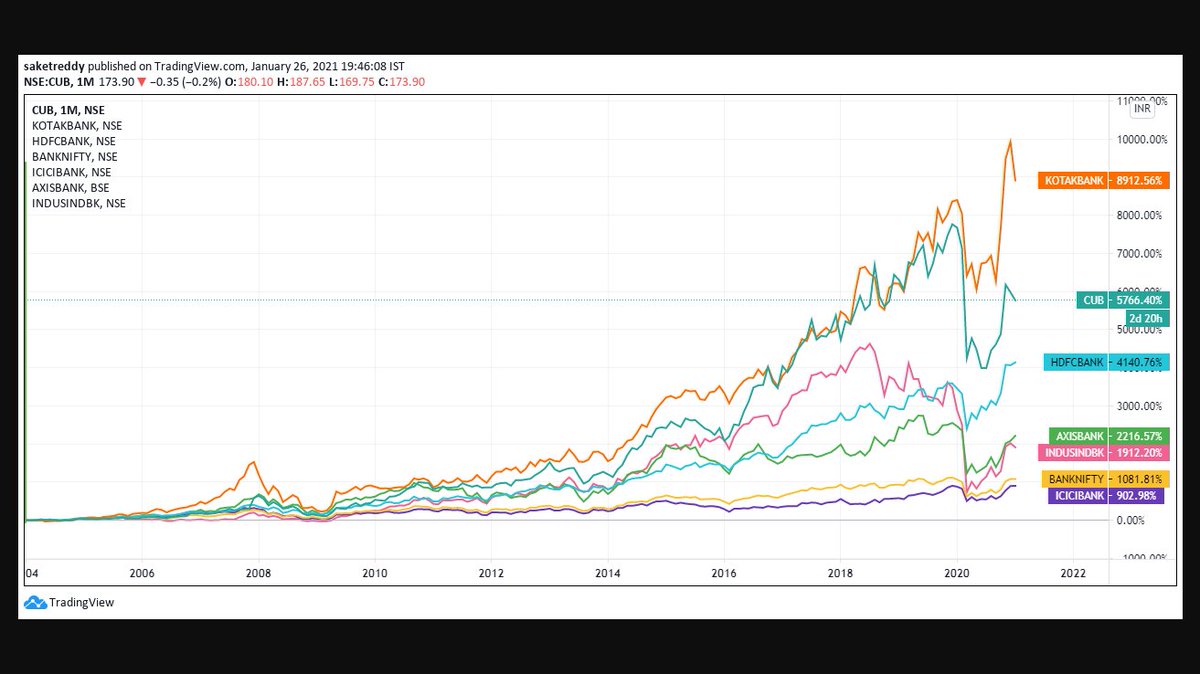

They are the real compounders, they've created massive wealth compared to others! https://t.co/PluVwU5OXG

Hope Everyone saw BANDHANBNK Numbers. I feel many such banks will go through a massive NPA Cycle followed by depleted Tier 1.

— Saket Reddy (@saketreddy) January 24, 2021

Hence, stay with the Top 3 banks :-

HDFCBANK

KOTAKBANK

CUB

They've low cost of funding, well provisioned Moratorium book, high ROEs & high Tier 1 CAR.