Authors J A C K I S

7 days

30 days

All time

Recent

Popular

All of my teachings in this thread:

At this point, I will just add them randomly but when they are complete I will structuralize them

The value you will find here is 🔥

1) Market

At this point, I will just add them randomly but when they are complete I will structuralize them

The value you will find here is 🔥

1) Market

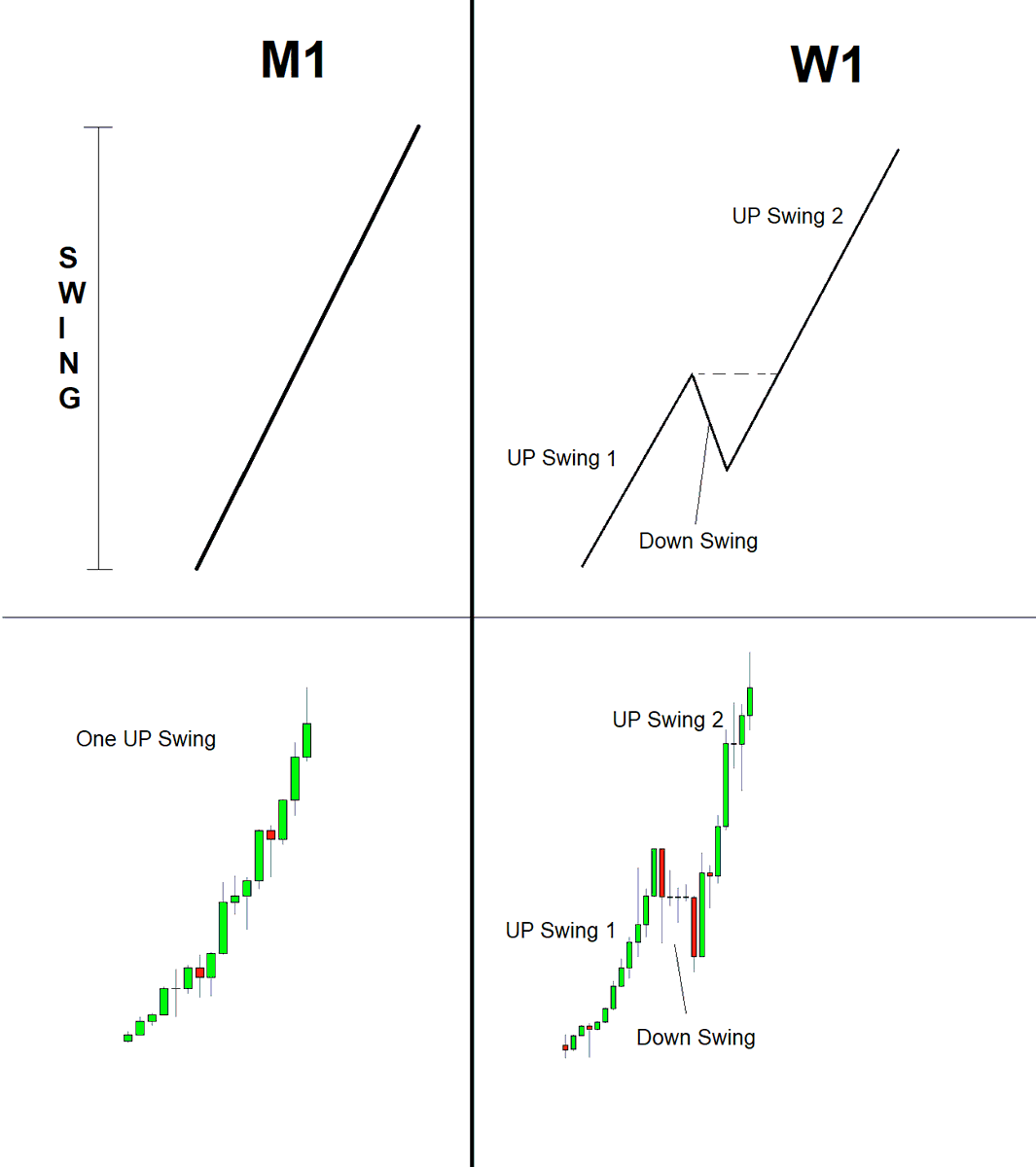

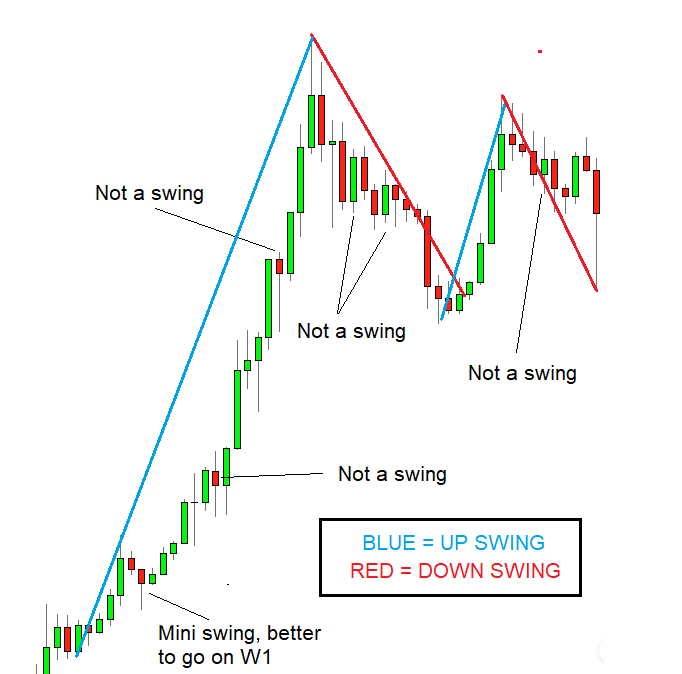

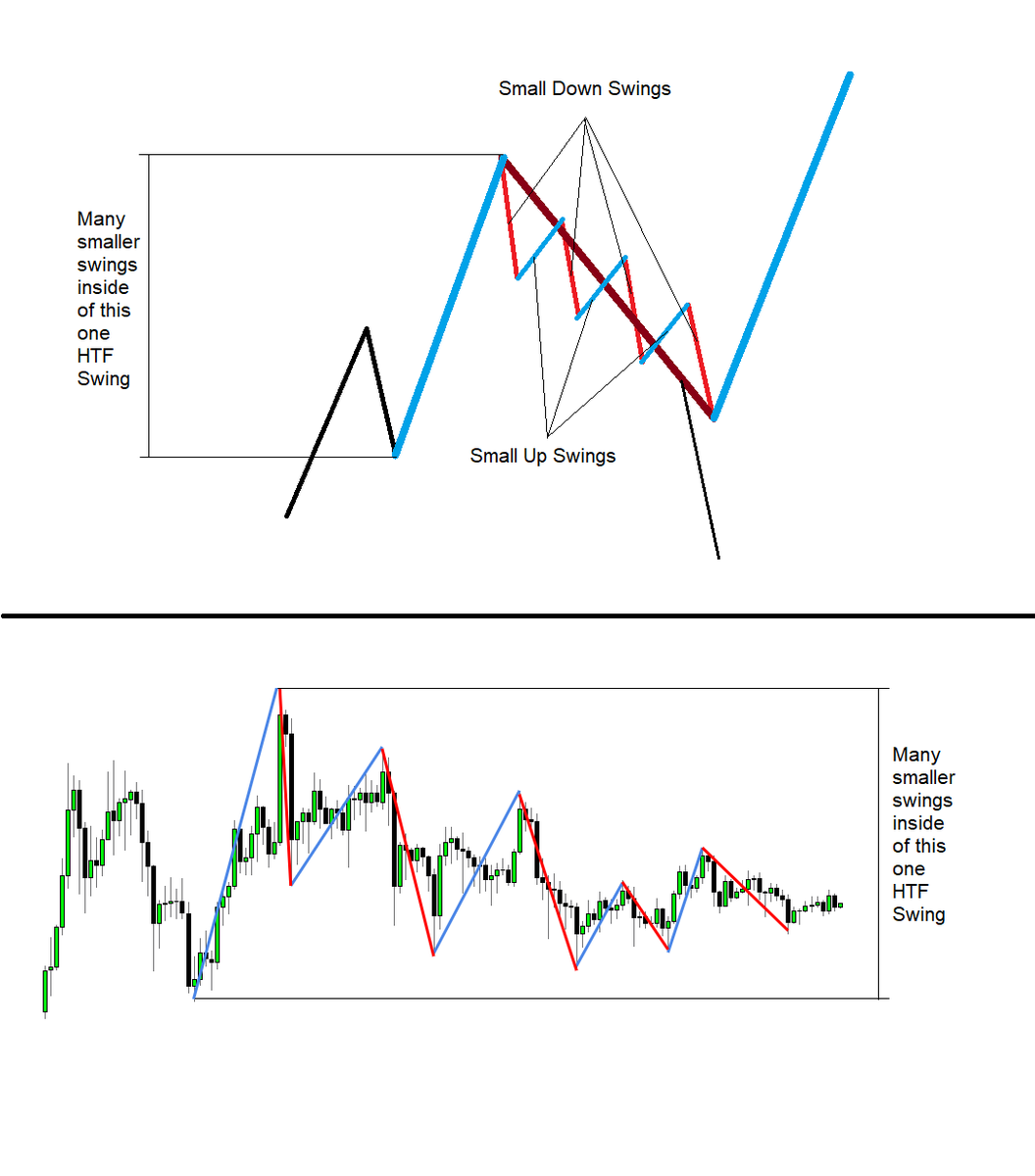

Market Structure (MS)

— J A C K I S (@jackis_trader) July 6, 2020

Understanding MS is the most important thing in TA

It rules above everything. TL's, MA's, Indicators. Everything.

While it's nothing more than looking at swings and seeing Higher Highs (HH), Highers Lows (HL), Lower Highs (LH), and Lower Lows (LL). pic.twitter.com/QbgOSHGkBr

Moving Averages 📚

💎SECRET INFO inside

🧠Great for both beginners & advanced traders

▪️ What are they?

▪️ Types of MAs

▪️ Why are they such a powerful tool?

▪️ How to properly use them?

▪️ My best SECRET EMA value?

▪️ Which Timeframe to use?

▪️ Advanced EMA technique?

1/20

▪️ What are they?

Moving average is nothing more than an average price of the last (value) of candles.

If we are gonna use an example of MA(50) it is gonna be the mean price of the last 50 candles

General rule:

Price above = Bullish 🐂

Price below = Bearish 🐻

2/20

▪️ Types of Moving Averages

1) Simple Moving Average - SMA

2) Exponential Moving Average - EMA

3) Smoothed Moving Average - SMMA

4) Volume Weighted Average Price - VWAP

There are a few more but these are the most important in my opinion.

3/20

I won't be going that much into detail about each of them in this thread but more so covering MAs in general.

The important takeaway is there are many methods of calculations and each offers bit different pros & cons

I'll leave experimenting with each of them up to you

4/20

▪️ Why are they such a powerful tool?

Because they help everyone, even newbies, that are just starting out, to easily & visually clearly identify trends without understanding the advanced Market Structure techniques.

Price above = 🐂

5/20

https://t.co/g5SneLNPh5

💎SECRET INFO inside

🧠Great for both beginners & advanced traders

▪️ What are they?

▪️ Types of MAs

▪️ Why are they such a powerful tool?

▪️ How to properly use them?

▪️ My best SECRET EMA value?

▪️ Which Timeframe to use?

▪️ Advanced EMA technique?

1/20

▪️ What are they?

Moving average is nothing more than an average price of the last (value) of candles.

If we are gonna use an example of MA(50) it is gonna be the mean price of the last 50 candles

General rule:

Price above = Bullish 🐂

Price below = Bearish 🐻

2/20

▪️ Types of Moving Averages

1) Simple Moving Average - SMA

2) Exponential Moving Average - EMA

3) Smoothed Moving Average - SMMA

4) Volume Weighted Average Price - VWAP

There are a few more but these are the most important in my opinion.

3/20

I won't be going that much into detail about each of them in this thread but more so covering MAs in general.

The important takeaway is there are many methods of calculations and each offers bit different pros & cons

I'll leave experimenting with each of them up to you

4/20

▪️ Why are they such a powerful tool?

Because they help everyone, even newbies, that are just starting out, to easily & visually clearly identify trends without understanding the advanced Market Structure techniques.

Price above = 🐂

5/20

https://t.co/g5SneLNPh5

Market Structure (MS)

— J A C K I S (@jackis_trader) July 6, 2020

Understanding MS is the most important thing in TA

It rules above everything. TL's, MA's, Indicators. Everything.

While it's nothing more than looking at swings and seeing Higher Highs (HH), Highers Lows (HL), Lower Highs (LH), and Lower Lows (LL). pic.twitter.com/QbgOSHGkBr