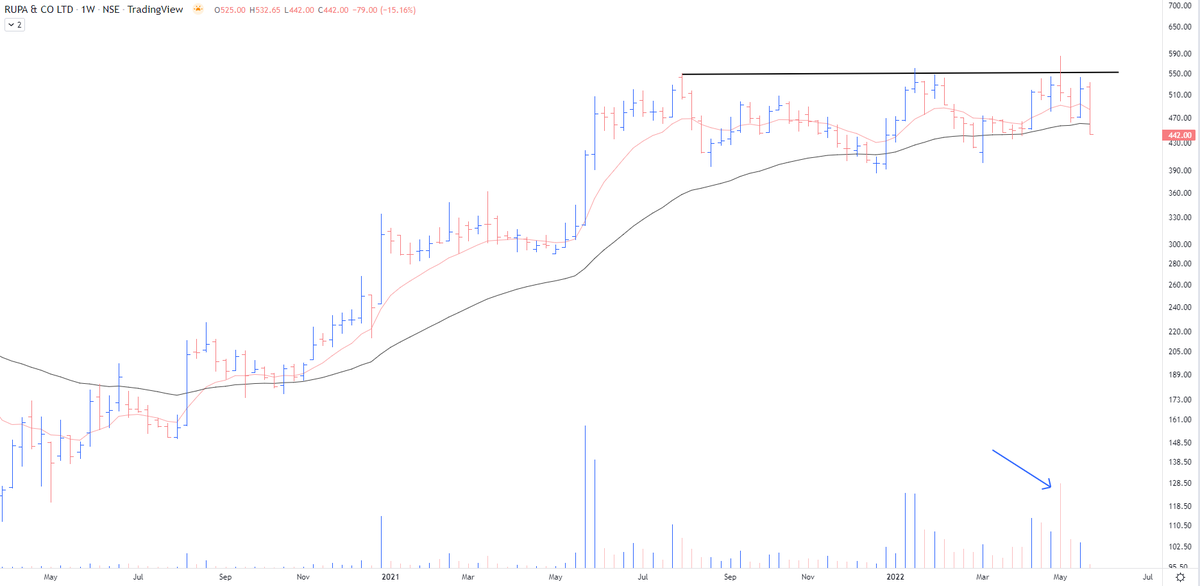

Fresh case - RUPA https://t.co/nqq5nI1wLU

Respect your stop losses in the stocks that have gone down today with heavy volumes even on a strong day.

— The_Chartist \U0001f4c8 (@charts_zone) March 17, 2022

VTL pic.twitter.com/3pJ9XngCDL

~ capitulation move

~ no further selling left

~ a major TL validated on a weekly scale

~ highest R:R ratio

With such capitulation & tight SL = capital put in was 30%

Risk = 50, Reward = 350

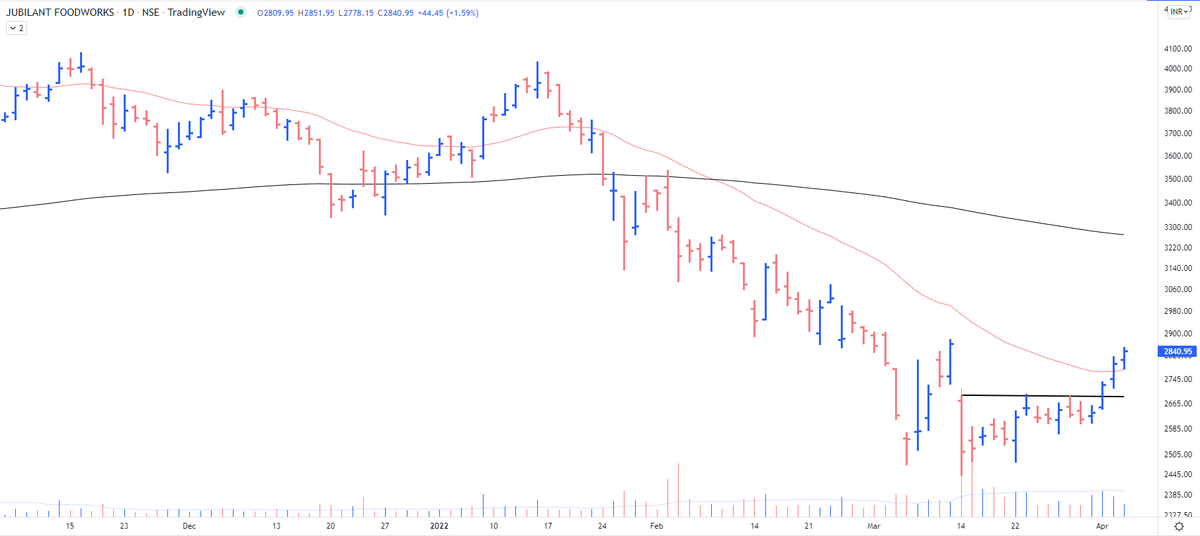

Jubilant Food https://t.co/M1vLYEsngf

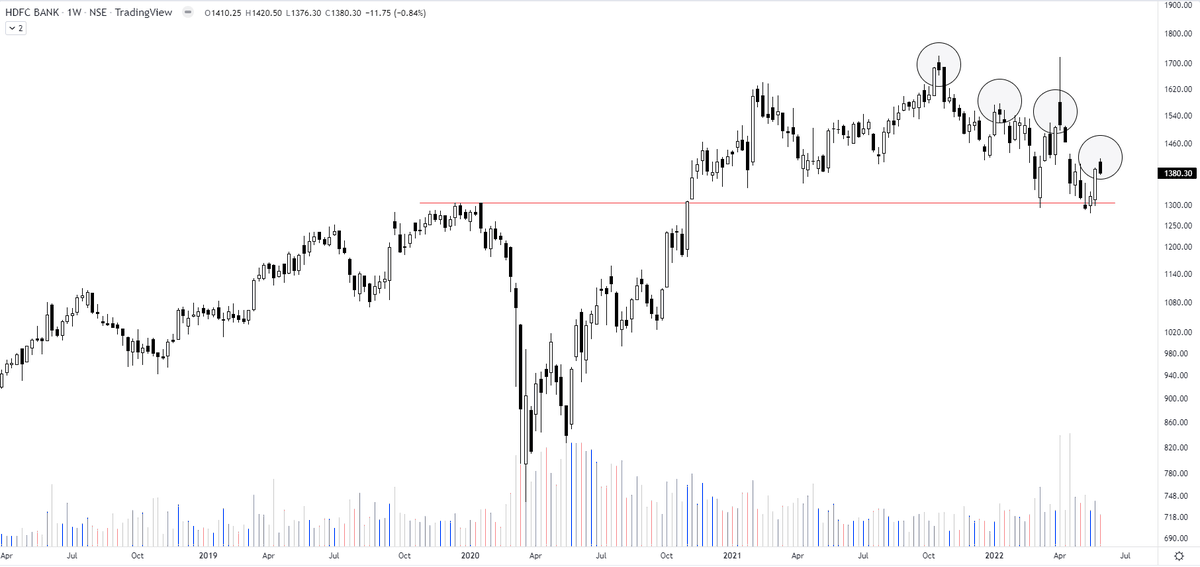

The selling climax is accompanied by volume bars of such magnitude that I highlighted in the chart. In almost all cases, they signify that even the last bull has thrown in the towel & there is no further selling left. Will observe in this case.

— The_Chartist \U0001f4c8 (@charts_zone) March 15, 2022

Jubilant Food pic.twitter.com/j7bGSdhkRW

So far doing good. 2000 is the level I would be looking for. https://t.co/j1kiKRSx0y

GOLD - 1 9 2 7 from 1 8 5 0

— The_Chartist \U0001f4c8 (@charts_zone) February 24, 2022

No indicators, nothing. Understand the language of the price. https://t.co/l6pEGD7r6D pic.twitter.com/JWZjlTLSBF

Russell 2000

It is better if you spend considerable time learning these concepts. https://t.co/caBHOO4Owa

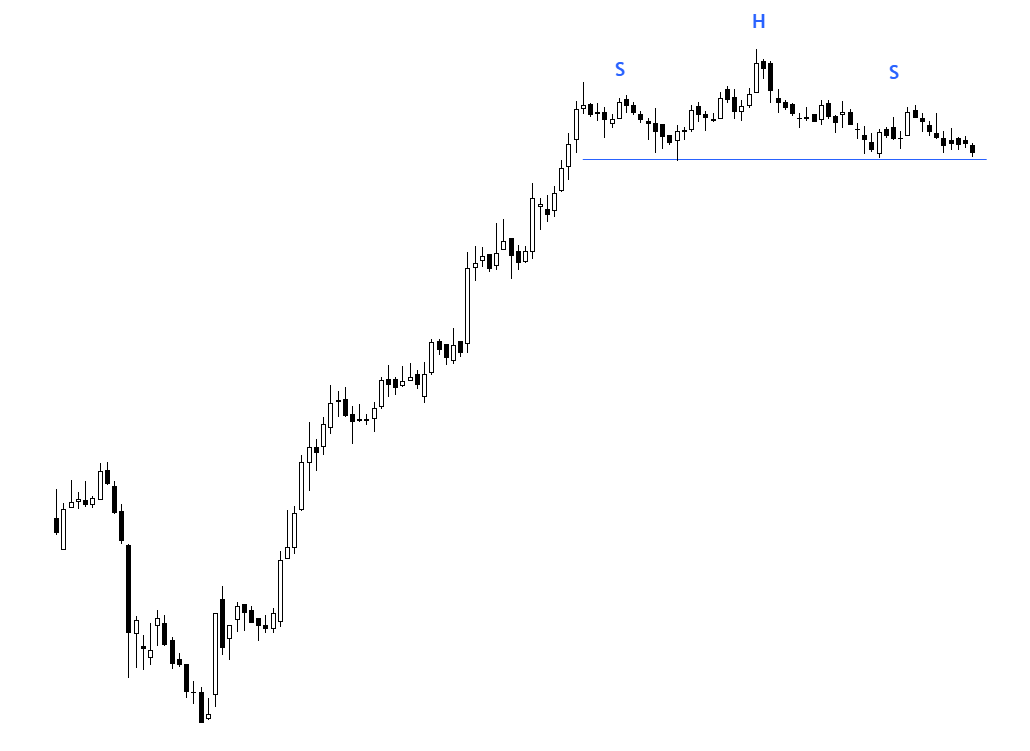

TRAPS? In a false breakout, the price breaks out of the range & comes back within the range. A trap is one step ahead, price not only comes back within the range but breaks down in the opposite direction. It traps the initial longs who didn't close their positions

— The_Chartist \U0001f4c8 (@charts_zone) January 22, 2022

Russell 2000 pic.twitter.com/txzjdnStzc