CodyyyGardner Categories Finance

7 days

30 days

All time

Recent

Popular

Ivor Cummins has been wrong (or lying) almost entirely throughout this pandemic and got paid handsomly for it.

He has been wrong (or lying) so often that it will be nearly impossible for me to track every grift, lie, deceit, manipulation he has pulled. I will use...

... other sources who have been trying to shine on light on this grifter (as I have tried to do, time and again:

Example #1: "Still not seeing Sweden signal versus Denmark really"... There it was (Images attached).

19 to 80 is an over 300% difference.

Tweet: https://t.co/36FnYnsRT9

Example #2 - "Yes, I'm comparing the Noridcs / No, you cannot compare the Nordics."

I wonder why...

Tweets: https://t.co/XLfoX4rpck / https://t.co/vjE1ctLU5x

Example #3 - "I'm only looking at what makes the data fit in my favour" a.k.a moving the goalposts.

Tweets: https://t.co/vcDpTu3qyj / https://t.co/CA3N6hC2Lq

He has been wrong (or lying) so often that it will be nearly impossible for me to track every grift, lie, deceit, manipulation he has pulled. I will use...

... other sources who have been trying to shine on light on this grifter (as I have tried to do, time and again:

Ivor Cummins BE (Chem) is a former R&D Manager at HP (sourcre: https://t.co/Wbf5scf7gn), turned Content Creator/Podcast Host/YouTube personality. (Call it what you will.)

— Steve (@braidedmanga) November 17, 2020

Example #1: "Still not seeing Sweden signal versus Denmark really"... There it was (Images attached).

19 to 80 is an over 300% difference.

Tweet: https://t.co/36FnYnsRT9

Example #2 - "Yes, I'm comparing the Noridcs / No, you cannot compare the Nordics."

I wonder why...

Tweets: https://t.co/XLfoX4rpck / https://t.co/vjE1ctLU5x

Example #3 - "I'm only looking at what makes the data fit in my favour" a.k.a moving the goalposts.

Tweets: https://t.co/vcDpTu3qyj / https://t.co/CA3N6hC2Lq

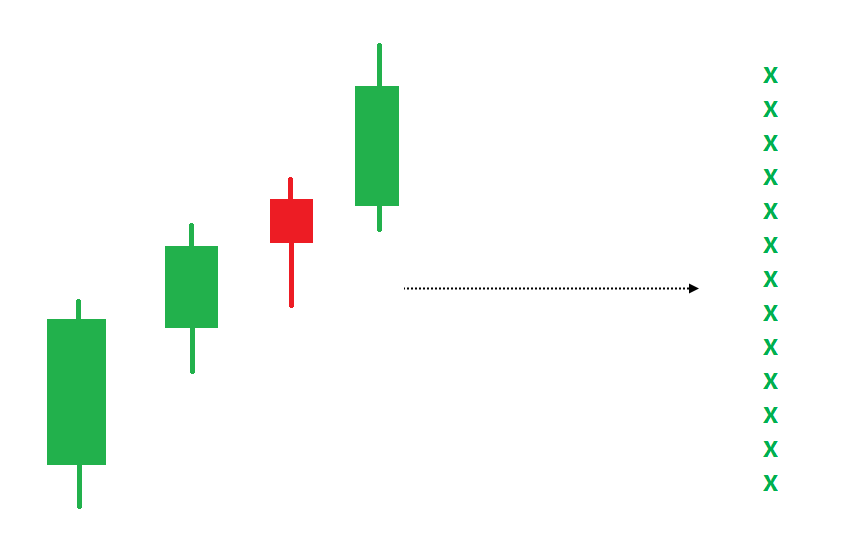

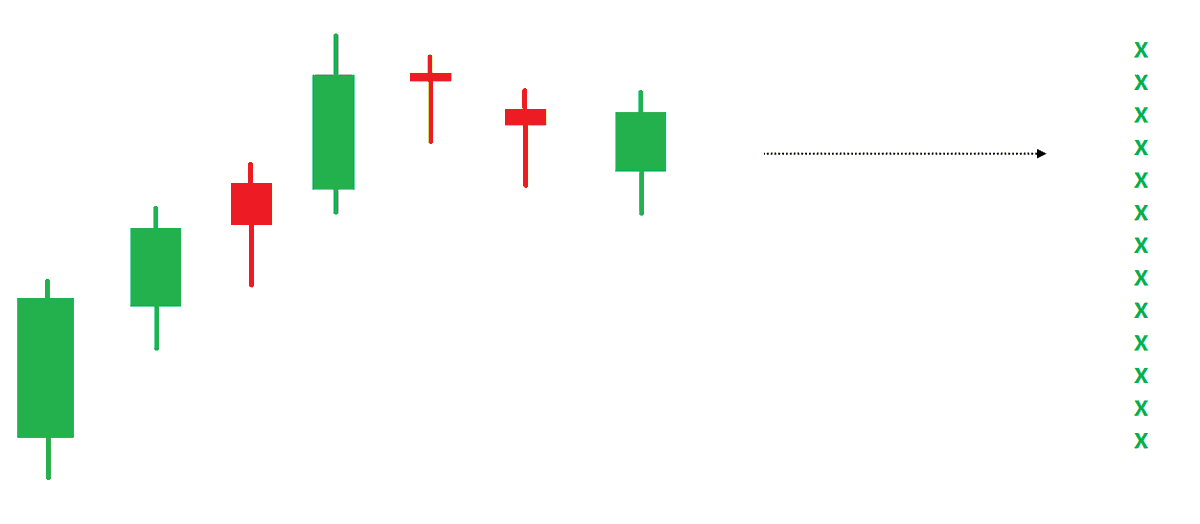

Thread: P&F Super Pattern

An effective price pattern defined using properties of P&F charts.

#Superpattern #Pointandfigure #Definedge

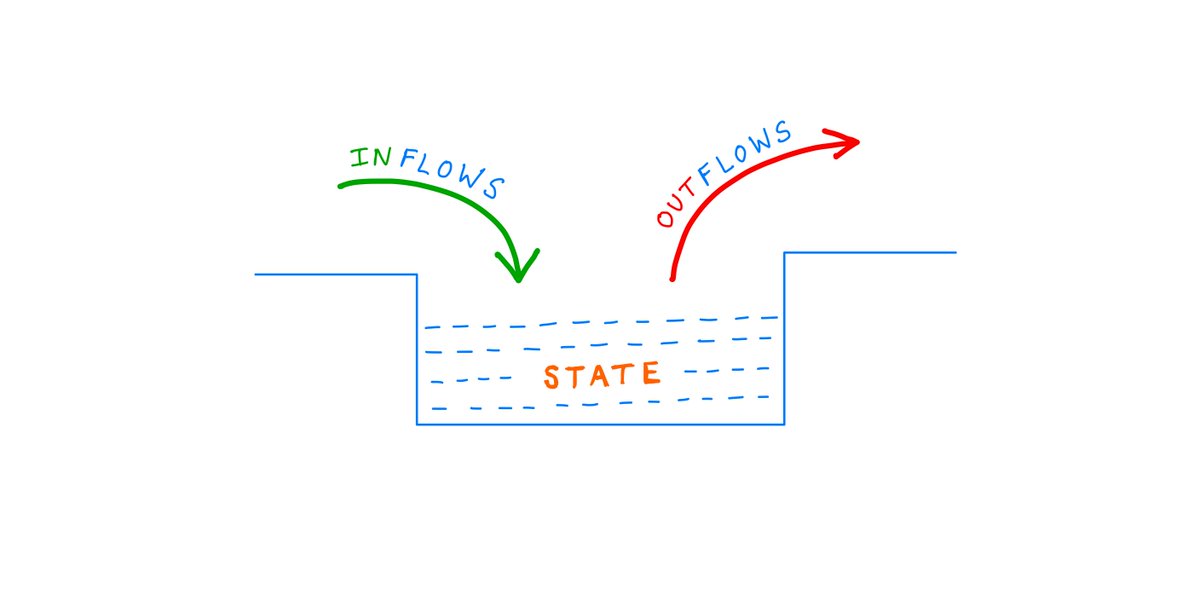

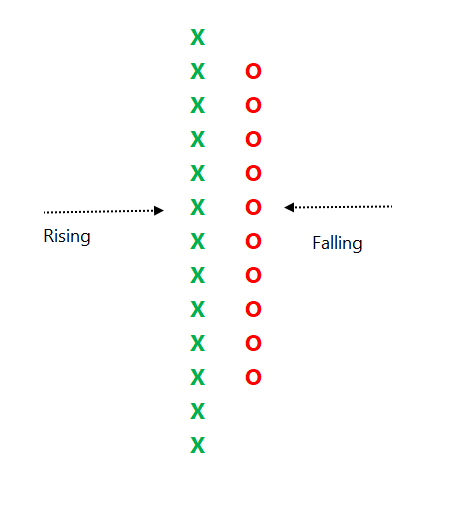

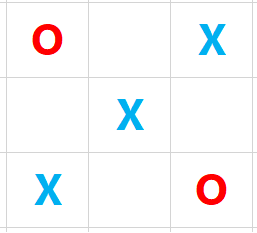

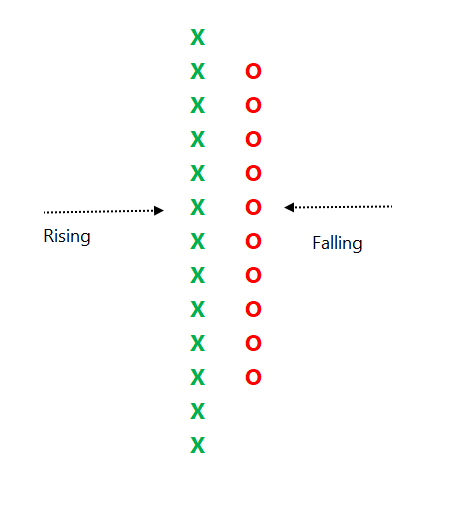

Point & Figure is an oldest charting method where price is plotted vertically, and the chart moves only when price moves. It is a different way of looking at the price, the objective box-value and reversal value offers advantage of identifying objective price patterns.

When price is moving up, it is plotted in a column of 'X'. When it is going down, it is plotted in a column of ‘O’. Normally, three-box reversal criteria is used to define the trend & reversal. Unlike a bar or candle, the P&F column can have multiple sessions in it.

Link to know more about the subject:

https://t.co/2xtLAVPBvm

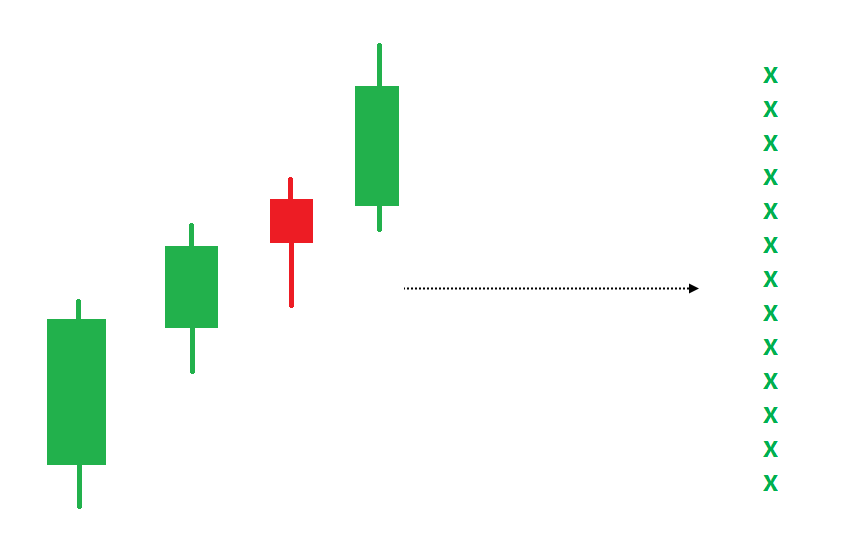

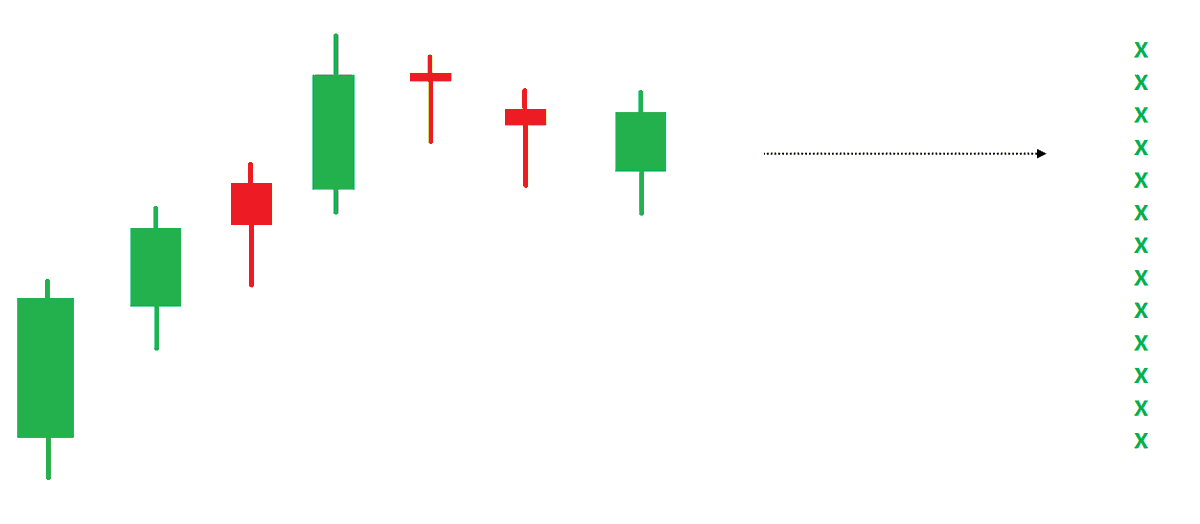

See below chart. Price is in a strong uptrend, P&F chart would produce a long of column of 'X' with more number of boxes in it.

If such a trend is followed by some time bars without meaningful price correct, P&F chart would not move, and it will remain in column of 'X' in such a scenario.

An effective price pattern defined using properties of P&F charts.

#Superpattern #Pointandfigure #Definedge

Point & Figure is an oldest charting method where price is plotted vertically, and the chart moves only when price moves. It is a different way of looking at the price, the objective box-value and reversal value offers advantage of identifying objective price patterns.

When price is moving up, it is plotted in a column of 'X'. When it is going down, it is plotted in a column of ‘O’. Normally, three-box reversal criteria is used to define the trend & reversal. Unlike a bar or candle, the P&F column can have multiple sessions in it.

Link to know more about the subject:

https://t.co/2xtLAVPBvm

See below chart. Price is in a strong uptrend, P&F chart would produce a long of column of 'X' with more number of boxes in it.

If such a trend is followed by some time bars without meaningful price correct, P&F chart would not move, and it will remain in column of 'X' in such a scenario.

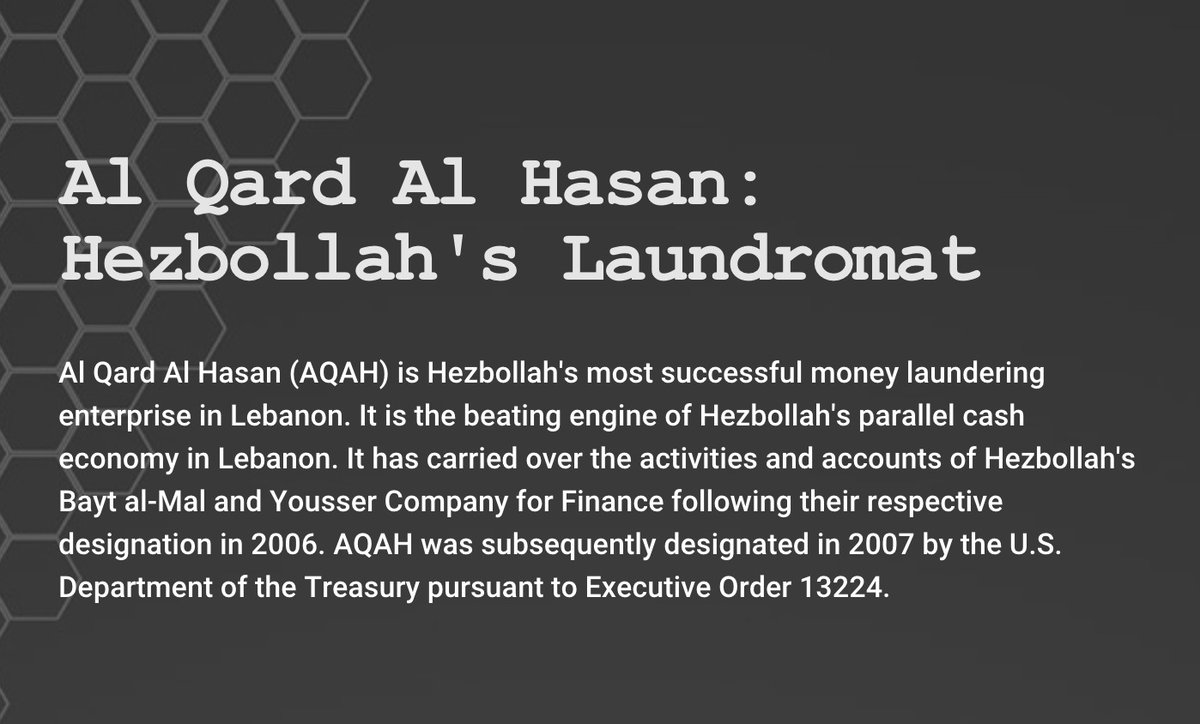

Last week Hizbollah's finance institution Al Qard el Hasan was hacked by Spiderz. A group of people took that Data and tried to make sense out of it. Below are the findings

https://t.co/eGLqvb28o5

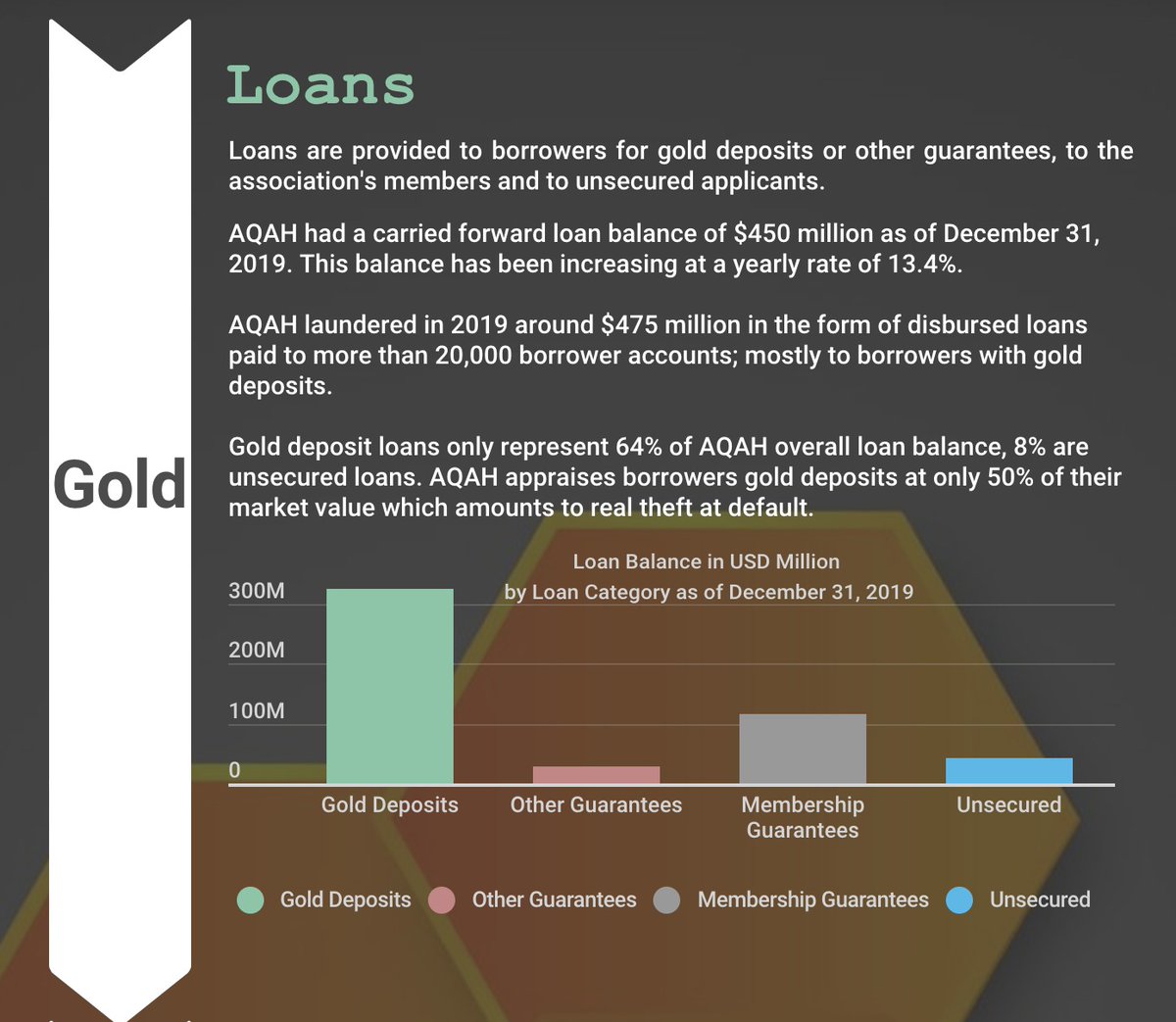

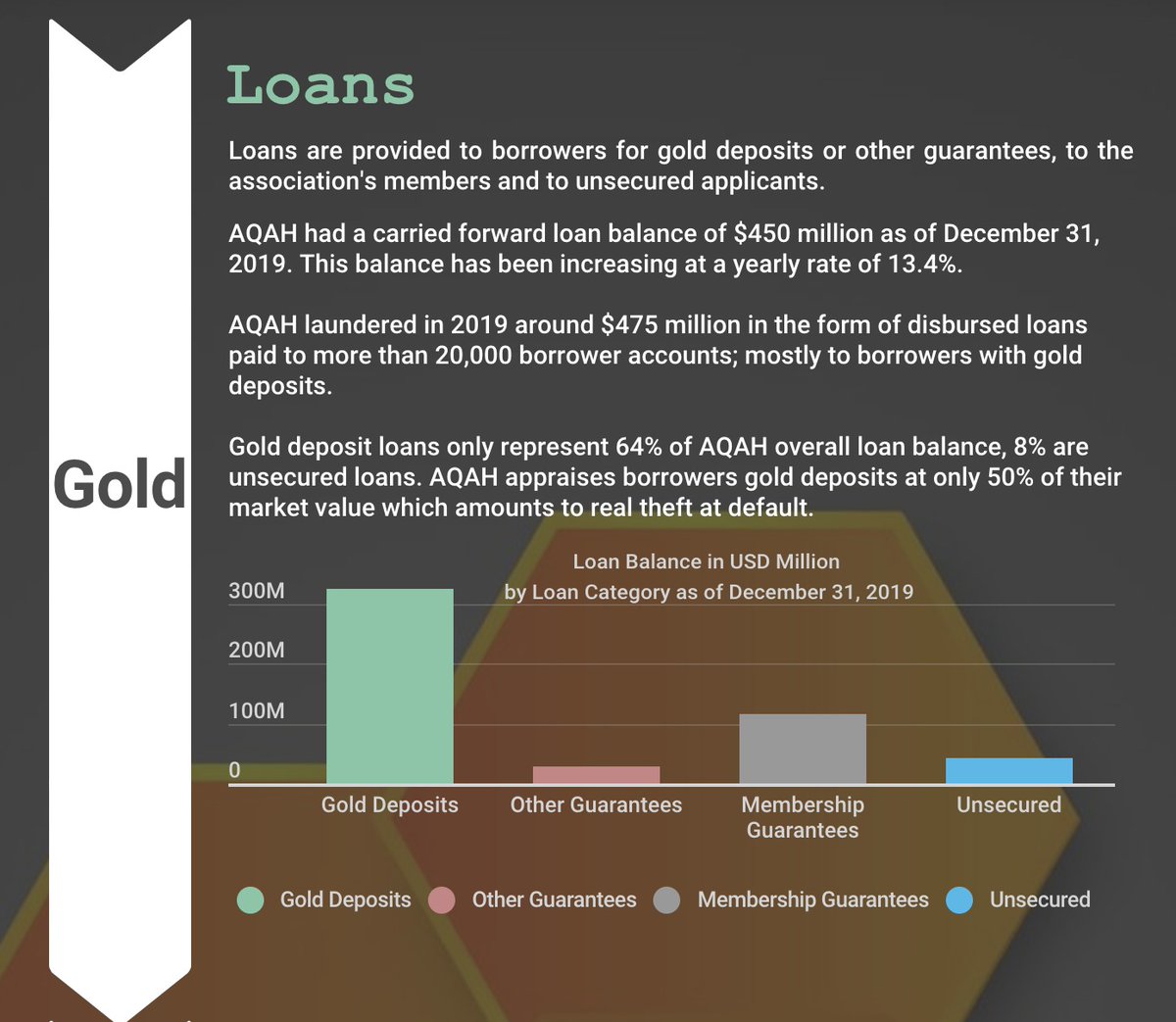

Loans are provided to borrowers for gold deposits or other guarantees, to the association's members and to unsecured applicants.

AQAH had a carried forward loan balance of $450 million as of December 31, 2019. This balance has been increasing at a yearly rate of 13.4%.

AQAH laundered around $475 million in 2019 in the form of disbursed loans paid to more than 20,000 borrower accounts; mostly to borrowers with gold deposits.

Deposits accounts have been offered to 307,000 members of the association, 83,000 contributors as well as to 600 companies. AQAH closed 2019 with an overall depositors accounts balance of around $500 million.

https://t.co/eGLqvb28o5

Loans are provided to borrowers for gold deposits or other guarantees, to the association's members and to unsecured applicants.

AQAH had a carried forward loan balance of $450 million as of December 31, 2019. This balance has been increasing at a yearly rate of 13.4%.

AQAH laundered around $475 million in 2019 in the form of disbursed loans paid to more than 20,000 borrower accounts; mostly to borrowers with gold deposits.

Deposits accounts have been offered to 307,000 members of the association, 83,000 contributors as well as to 600 companies. AQAH closed 2019 with an overall depositors accounts balance of around $500 million.

Why do so many South Africans receive a social grant and why has it increased so rapidly over time? THREAD (because I had to tweet about my MA eventually)

1/ Of the 18m grant recipients, around 12m (so 2/3) are children. Caregivers (overwhelmingly women) receive the grant on the child's behalf. The child support grant was only introduced in 1998, so not sure why DA asks for data since 1994. Other grants have not increased hugely.

2/ My uncontroversial opinion: it is good for the state to provide social assistance, as it is constitutionally obliged, to children in poor households. Public opinion data suggests most SAns agree with this sentiment:

3/ Receiving a social grant is associated with numerous developmental improvements for children - e.g. food security; school attendance - and eases some of the financial burden of carers.

4/ The CSG replaced an earlier cash transfer programme, the State Maintenance Grant, because the SMG discriminated against black women. Only citizens of the Republic - not bantustan residents - could receive it. The SMG failed to provide assistance to the poorest rural children.

\U0001f4c8| Over 18 million people receive some form of grant payment. Data proves South Africans are increasingly going into poverty due to a failing ANC government and its policies.

— Democratic Alliance (@Our_DA) January 5, 2021

The first sharp increase in these numbers started in the 2004/05 financial year.https://t.co/F06VnnAzbx

1/ Of the 18m grant recipients, around 12m (so 2/3) are children. Caregivers (overwhelmingly women) receive the grant on the child's behalf. The child support grant was only introduced in 1998, so not sure why DA asks for data since 1994. Other grants have not increased hugely.

2/ My uncontroversial opinion: it is good for the state to provide social assistance, as it is constitutionally obliged, to children in poor households. Public opinion data suggests most SAns agree with this sentiment:

3/ Receiving a social grant is associated with numerous developmental improvements for children - e.g. food security; school attendance - and eases some of the financial burden of carers.

4/ The CSG replaced an earlier cash transfer programme, the State Maintenance Grant, because the SMG discriminated against black women. Only citizens of the Republic - not bantustan residents - could receive it. The SMG failed to provide assistance to the poorest rural children.