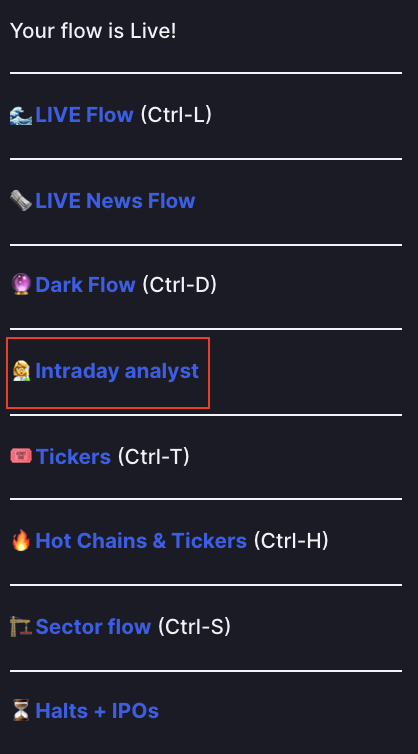

Start with the "Hot Chains & Tickers" page. Not only does this display the tickers with the most option volume, but it also shows the most active chains. Better yet, you can filter by sector and market cap.

Below are some specific filter examples:

I interviewed 5 billionaires this week

— GREG ISENBERG (@gregisenberg) January 23, 2021

I asked them to share their lessons learned on startups, life and entrepreneurship:

Here's what they told me:

To outperform, you need serious competitive advantages.

— Sahil Bloom (@SahilBloom) March 20, 2021

But contrary to what you have been told, most of them don't require talent.

10 competitive advantages that you can start developing today:

I\u2019ve gotten a lot of bad advice in my career and I see even more of it here on Twitter.

— Nick Huber (@sweatystartup) January 3, 2021

Time for a stiff drink and some truth you probably dont want to hear.

\U0001f447\U0001f447

THREAD: 10 significant lies you're told about the world.

— Julian Shapiro (@Julian) January 9, 2021

On startups, writing, and your career:

Tomorrow again same thing happens bcoz fudus like you are creating a narrative oh Khalistan. when farmers are asking MSP. (RSS ki tatti khane wale Kerni sena ke kutte).

— Ancient Economist (@_stock_tips) December 5, 2020

U kill sikhs in 1984 just politics. To BC low IQ fudu Saale entire history was politics.