Categories Trading

7 days

30 days

All time

Recent

Popular

Want to master Option Selling for free?

Here are the best resources.

A thread 🧵👇

Collaborated with @niki_poojary

1. Best book of knowledge for a beginner?

Zerodha Varsity from @Nithin0dha's team is the best book for a newcomer to read and increase his basic knowledge about options, especially for the Indian markets.

Link:

2. Best Youtube channel on Options Trading?

The @tastytrade financial network. It's a foreign channel that focuses mostly on selling options.

They teach all strategies for free with their backtests.

Big on Straddle/Strangles selling.

Links:

3. Top Indian YouTube Channel for Options?

Power of Stocks - Subhasish Pani

What you'll learn:

1. How to form a trading plan.

2. How to scale an account with risk-reward in option selling.

3. Technical analysis logics you can use daily.

15

4. What are the preconditions to start option Selling:

You should know technical Analysis basics like:

- Support/Resistance

- Chart Patterns

- Candle Patterns

- Dow Theory (HH, LL)

This will help you start taking high-probability trades.

Here are the best resources.

A thread 🧵👇

Collaborated with @niki_poojary

1. Best book of knowledge for a beginner?

Zerodha Varsity from @Nithin0dha's team is the best book for a newcomer to read and increase his basic knowledge about options, especially for the Indian markets.

Link:

2. Best Youtube channel on Options Trading?

The @tastytrade financial network. It's a foreign channel that focuses mostly on selling options.

They teach all strategies for free with their backtests.

Big on Straddle/Strangles selling.

Links:

3. Top Indian YouTube Channel for Options?

Power of Stocks - Subhasish Pani

What you'll learn:

1. How to form a trading plan.

2. How to scale an account with risk-reward in option selling.

3. Technical analysis logics you can use daily.

15

15 Learnings from Power of Stocks: \U0001f9f5

— Aditya Todmal (@AdityaTodmal) January 23, 2022

Collaborated with @niki_poojary

4. What are the preconditions to start option Selling:

You should know technical Analysis basics like:

- Support/Resistance

- Chart Patterns

- Candle Patterns

- Dow Theory (HH, LL)

This will help you start taking high-probability trades.

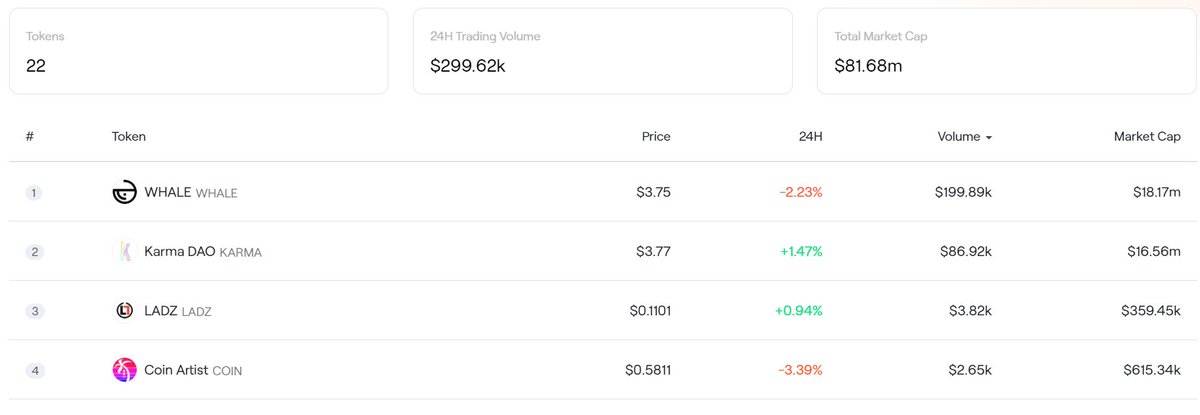

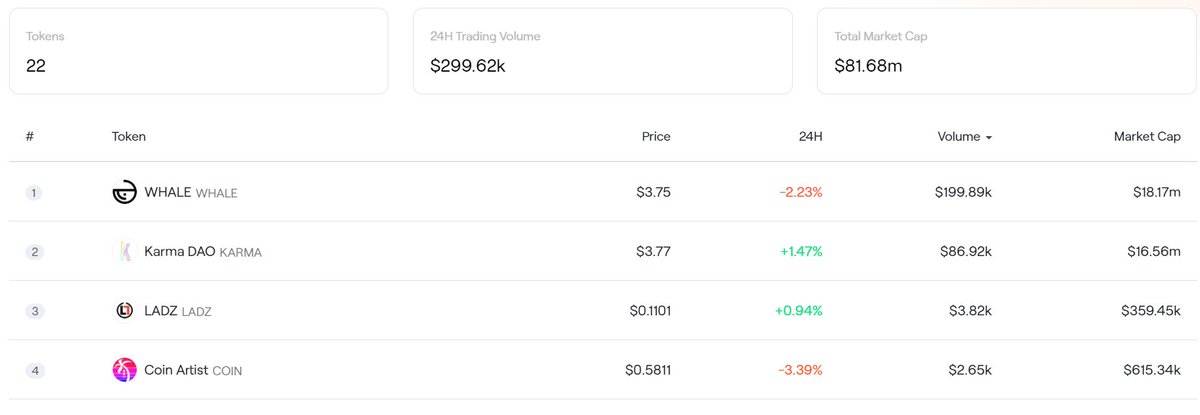

12 Pivotal Moments that took the #NFT Industry exponential.

Not just money - we're talking Industry Progress & WTF Moments.

1/ Thread 👇

2/ #Decentraland goes public - Feb 20th

First impressions were, empty, lonely, buggy, crashes, not much to do, etc.

Now there's HQ's, Top DJ Events, 100+ Galleries and

December so far had over 5k weekly visitors.

I wrote a post-launch

3/ $WHALE Launches May 3rd - A social currency backed by $2M+ of #NFT assets by @WhaleShark_Pro & @whale_community.

People across all NFT projects & platforms were incentivized to work together.

A top social currency by market cap, volume AND community.

https://t.co/7RZ4QyNu8N

4/ @trevorjonesart Picasso's Bull sells for $55k on @niftygateway.

A record sale at the time for a single Art NFT. Many in the broader NFT space started to pay attention from here.

The drop totalled ~ $75k with a Silver /10 recently going for $19.5k! on 8th Dec, (from $750)

5/ Eth fees Sky rocket - Mid 2020

With Activity on ETH going berserk, ETH fees went from average $0.20 per transaction to now ~$5.4. More with NFTs.

This forced NFT projects, (especially gaming), to prioritize scaling/L2 while it was still 'ok' to trade Art as most are $300+

Not just money - we're talking Industry Progress & WTF Moments.

1/ Thread 👇

2/ #Decentraland goes public - Feb 20th

First impressions were, empty, lonely, buggy, crashes, not much to do, etc.

Now there's HQ's, Top DJ Events, 100+ Galleries and

December so far had over 5k weekly visitors.

I wrote a post-launch

3/ $WHALE Launches May 3rd - A social currency backed by $2M+ of #NFT assets by @WhaleShark_Pro & @whale_community.

People across all NFT projects & platforms were incentivized to work together.

A top social currency by market cap, volume AND community.

https://t.co/7RZ4QyNu8N

$WHALE ENTERS NFT & CRYPTO LAND

— WhaleShark.Pro (@WhaleShark_Pro) May 2, 2020

A revolutionary Social Currency that is backed by over 2,900 of the most valuable NFT assets in the World.

Read our Whitepaper: https://t.co/gfqdDoAv2g

Visit our Website: https://t.co/27cP5MNyM5

Join our Discord: https://t.co/lvLi5Vc5gR

4/ @trevorjonesart Picasso's Bull sells for $55k on @niftygateway.

A record sale at the time for a single Art NFT. Many in the broader NFT space started to pay attention from here.

The drop totalled ~ $75k with a Silver /10 recently going for $19.5k! on 8th Dec, (from $750)

5/ Eth fees Sky rocket - Mid 2020

With Activity on ETH going berserk, ETH fees went from average $0.20 per transaction to now ~$5.4. More with NFTs.

This forced NFT projects, (especially gaming), to prioritize scaling/L2 while it was still 'ok' to trade Art as most are $300+

1/5

2020 Predictions Report Card

Item 1 - Tesla will lose more money in 2020 than 2019.

❌

I missed this one clearly. Didn't realize that they could recognize three years of credits in a single year, because I was using GAAP. Tesla does not appear to be conforming to GAAP here.

Doubt the auditors make a stink about it but who knows.

Also note that the total net income for the first nine months of 2020 ($451M) matches almost exactly the increase in A/R balance ($433M). A/R balance is now 1.76B, dwarfing their reported profits of $451M.

Item 2 - Model S will be discontinued.

✔️❌

They didn't discontinue. They dropped the price $10,000 instead. Combining this will the price cuts in 2019, including free EAP, gross margins for the Model S are now decisively negative. Giving myself partial credit on this one. (:

Item 3 - Model Y price will be cut $2K after initial orders are filled.

✔️

Ding ding ding. Prices were cut $3K right after initial backlog was filled.

Item 4 - MY SR+ will be released

❌

Missed this one. My best guess is that M3 SR+ are so low, they don't want to offer a similar MY variant.

2020 Predictions Report Card

Item 1 - Tesla will lose more money in 2020 than 2019.

❌

I missed this one clearly. Didn't realize that they could recognize three years of credits in a single year, because I was using GAAP. Tesla does not appear to be conforming to GAAP here.

2020 Predictions:

— Dean Sheikh (@DeanSheikh1) January 19, 2020

Tesla will lose more money in 2020 than in 2019.

The Model S will be discontinued.

MY prices will be cut $2K+ after the first batch of suckers make their purchase.

MY SR+ will come out this year to hide lack of growth from the weakest retail investors.

Doubt the auditors make a stink about it but who knows.

Also note that the total net income for the first nine months of 2020 ($451M) matches almost exactly the increase in A/R balance ($433M). A/R balance is now 1.76B, dwarfing their reported profits of $451M.

Item 2 - Model S will be discontinued.

✔️❌

They didn't discontinue. They dropped the price $10,000 instead. Combining this will the price cuts in 2019, including free EAP, gross margins for the Model S are now decisively negative. Giving myself partial credit on this one. (:

Item 3 - Model Y price will be cut $2K after initial orders are filled.

✔️

Ding ding ding. Prices were cut $3K right after initial backlog was filled.

Item 4 - MY SR+ will be released

❌

Missed this one. My best guess is that M3 SR+ are so low, they don't want to offer a similar MY variant.