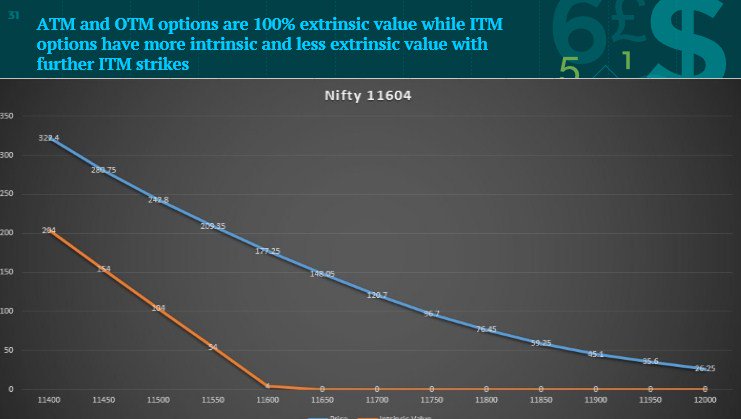

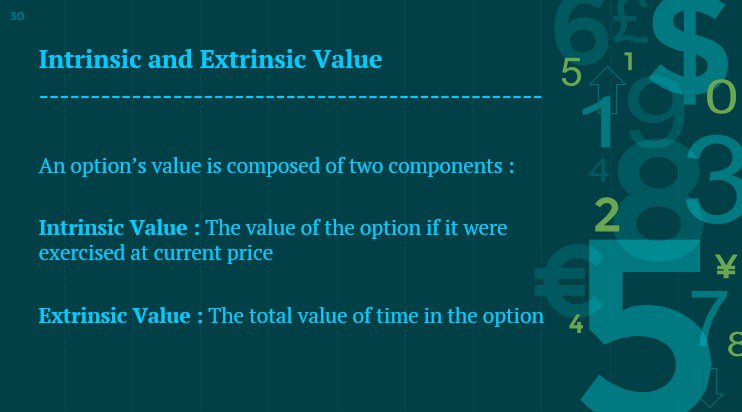

This friend had trouble making money in options though he was directionally right. Let us see how a basic understanding of greeks would have helped him, This thread will be about two attributes of option pricing, extrinsic value and theta

Sir, today #niftybank was continue making new high, but 31700 CE was struggling to go up. I bought at 140, some how managed to sell it at 200. I m ok, in identifying directional edge but options behave differently.

— Vikash Shrivastava\U0001f1ee\U0001f1f3 (@VikashS28) May 27, 2019

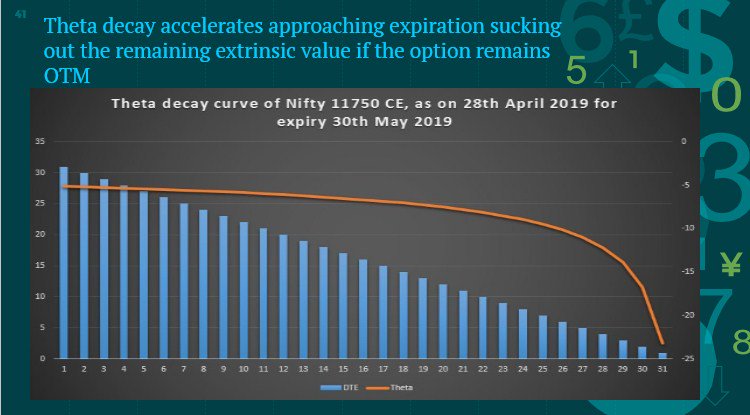

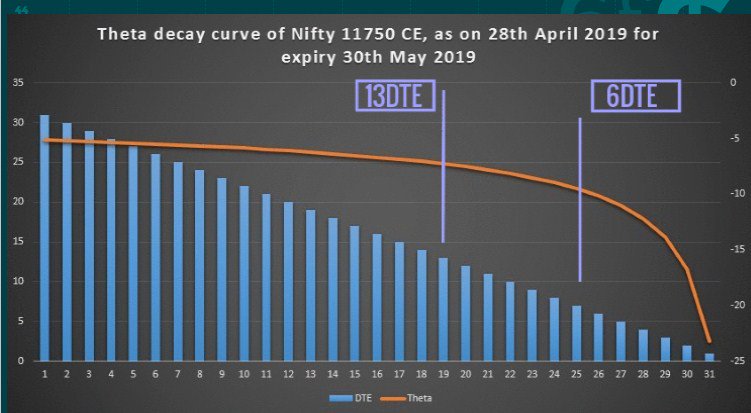

1. He was playing pure extrinsic value

2. He has a high theta burn rate so close to expiry, the highest

THIS IS HOW GREEKS HELP YOU !

1. https://t.co/LpbzrgqvaH ( web based)

2. https://t.co/5AHY0EmfH9 ( software)

BOTH FREE, use them

More from Subhadip Nandy

#OptimalF

Portfolio Management Formulas: Mathematical Trading Methods for the Futures, Options, and Stock Markets by Ralph Vince

The Mathematics of Money Management: Risk Analysis Techniques for Traders by Ralph Vince

#SecureF

#FixedRatio

The Trading Game: Playing by the Numbers to Make Millions by Ryan Jones

https://t.co/U0c65EbEog.

This is what I think happens . A thread.

Market is highly volatile but vix is down by 4%

— Jegathesan Durairaj (Jegan) (@itjegan) May 13, 2022

What is VIX ?

https://t.co/VOkAwGRsHL

What is IV ( implied volatility ) ?

Now my explanations. IV is simply demand and supply. IV is back calculated from option prices and not given by the BSM model. When demand for options ( by buyers) are high, IVs will be high. When supply of options ( by sellers) are high, IV will be low.

Now look at this chart. Nifty fut and VIX are plotted together ( red line is the VIX). Yesterday's massive breakdown forced traders to hedge their positions by buying puts ( could be cash holdings, could be future longs, could be sold puts). This excess demand spiked up IVs /VIX

More from Trading

If you wish to learn abt trading,psychology,options,business etc

You can go through this thread.

Other than this I do post videos on my YT channel : -Abhishek Kar & Tradiostation

-Intraday views on FREE telegram : Abhishek Kar Official

RT will be appreciated

1. Threads to learn Options

https://t.co/wabkek43I8

2. https://t.co/OIDenHKdWN

3. Some core rules to investing

https://t.co/37d1pygp7P

4.Summing up 2020 Trading lessons

https://t.co/jSUb1lSGbQ

5.Effects of margin change on

\U0001d413\U0001d421\U0001d42b\U0001d41e\U0001d41a\U0001d41d \U0001d41f\U0001d428\U0001d42b \U0001d40e\U0001d429\U0001d42d\U0001d422\U0001d428\U0001d427\U0001d42c

— Abhishek Kar (@Abhishekkar_) December 29, 2020

The entire thread will have some quick pointers on options trading. These bullet points are based on experience and learning and even if you are completely new,will help you to build some perspective. So,lets go :

6. Exciting story about a trader who destroyed a Bank

https://t.co/CsEEhIsD3q

7. Some Thought Provoking facts about stock markets

https://t.co/IjxpX5Wx24

8. A dose on Trading and investing

\U0001d413\U0001d42b\U0001d41a\U0001d41d\U0001d41e\U0001d42b \U0001d430\U0001d421\U0001d428 \U0001d41d\U0001d41e\U0001d42c\U0001d42d\U0001d42b\U0001d428\U0001d432\U0001d41e\U0001d41d \U0001d401\U0001d41a\U0001d42b\U0001d422\U0001d427\U0001d420\U0001d42c \U0001d401\U0001d41a\U0001d427\U0001d424

— Abhishek Kar (@Abhishekkar_) October 11, 2020

This thread is about the trader who with his reckless trading destroyed the entire Barings bank. In case you would like to read more such informative threads,do not forget to retweet and share as acts as encouragement

9. Top 5 resources to learn everything about stocks

https://t.co/6KnIySBGIG

10. Some Pro Tips on Trading

https://t.co/EiSGikt7jv

11. Wisdom on stuffs you should not do

https://t.co/bI2dH0XTSS

12. Reasons why you are losing the

\U0001d5e7\U0001d5db\U0001d5d8 \U0001d5e7\U0001d5e2\U0001d5e3 \U0001d7f1 \U0001d5e7\U0001d5db\U0001d5e5\U0001d5d8\U0001d5d4\U0001d5d7

— Abhishek Kar (@Abhishekkar_) July 21, 2020

The following thread will have top 5 for everything you need in the world of stock market and as learner who wants to REALLY grow. Make sure you #retweet the thread and let it reach the maximum number of people as sharing is caring.

13. The DARK side of stock market

https://t.co/qsteGcbquI

14. Stocks where you should NOT invest

https://t.co/2tD5q0K3UQ

15. Lessons from MILLIONAIRE trader

https://t.co/Pec6LmUtGa

16. Lessons from my

\U0001d5e7\U0001d5db\U0001d5d8 \U0001d5d7\U0001d5d4\U0001d5e5\U0001d5de \U0001d5e6\U0001d5dc\U0001d5d7\U0001d5d8 \U0001d5e2\U0001d5d9 \U0001d5e6\U0001d5e7\U0001d5e2\U0001d5d6\U0001d5de \U0001d5e7\U0001d5e5\U0001d5d4\U0001d5d7\U0001d5dc\U0001d5e1\U0001d5da

— Abhishek Kar (@Abhishekkar_) July 6, 2020

In the following thread you will understand a few dark truths about stock trading as a profession.

Sadly everyone touches the only green side but there has to be a balance. Don't forget to #retweet for wider reach.

You May Also Like

As a dean of a major academic institution, I could not have said this. But I will now. Requiring such statements in applications for appointments and promotions is an affront to academic freedom, and diminishes the true value of diversity, equity of inclusion by trivializing it. https://t.co/NfcI5VLODi

— Jeffrey Flier (@jflier) November 10, 2018

We know that elite institutions like the one Flier was in (partial) charge of rely on irrelevant status markers like private school education, whiteness, legacy, and ability to charm an old white guy at an interview.

Harvard's discriminatory policies are becoming increasingly well known, across the political spectrum (see, e.g., the recent lawsuit on discrimination against East Asian applications.)

It's refreshing to hear a senior administrator admits to personally opposing policies that attempt to remedy these basic flaws. These are flaws that harm his institution's ability to do cutting-edge research and to serve the public.

Harvard is being eclipsed by institutions that have different ideas about how to run a 21st Century institution. Stanford, for one; the UC system; the "public Ivys".