A nobody cares thread.

Nobody cares about the things that matter - getting investors in, helping new distributors advisors, making things (Slightly) easier for investors, honest mis-selling etc.

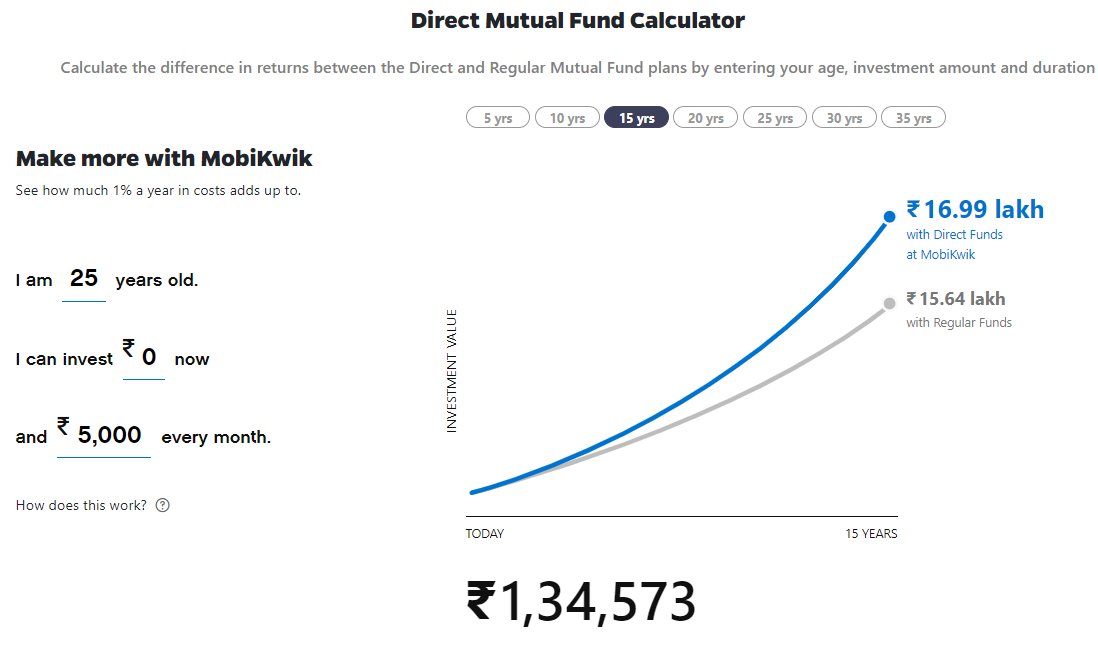

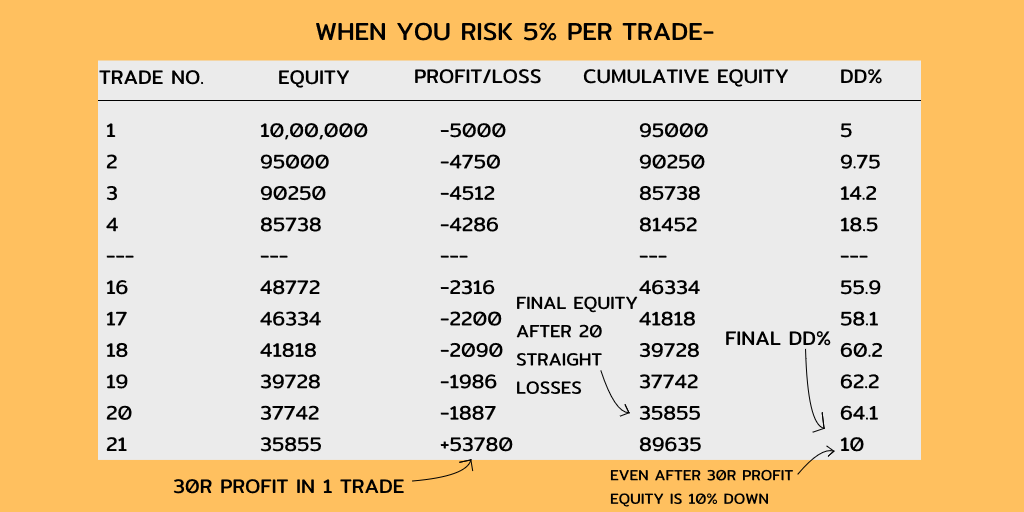

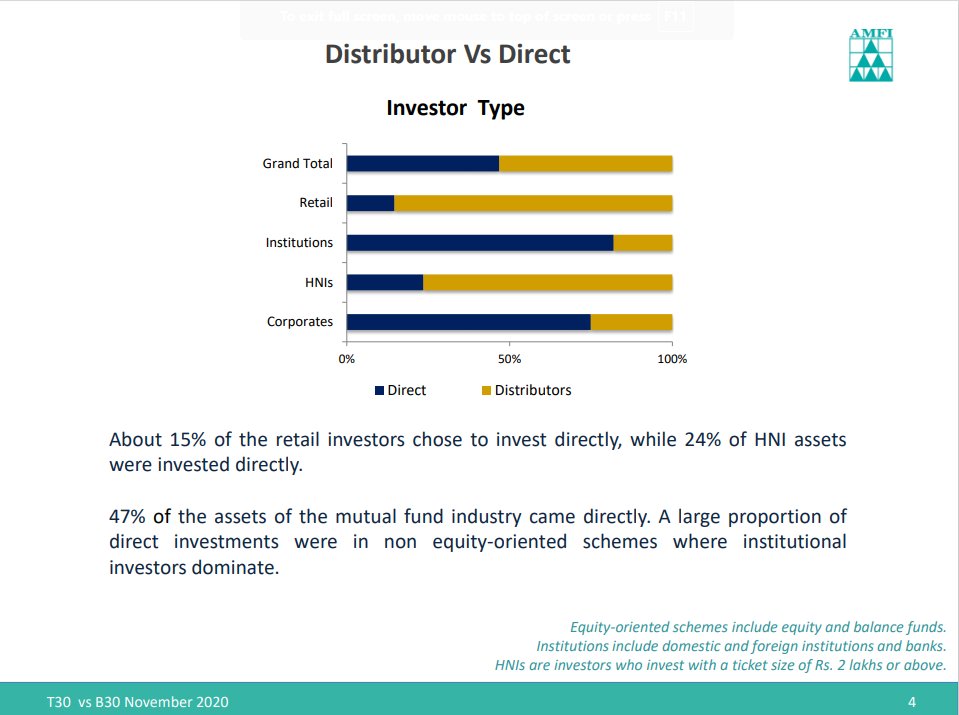

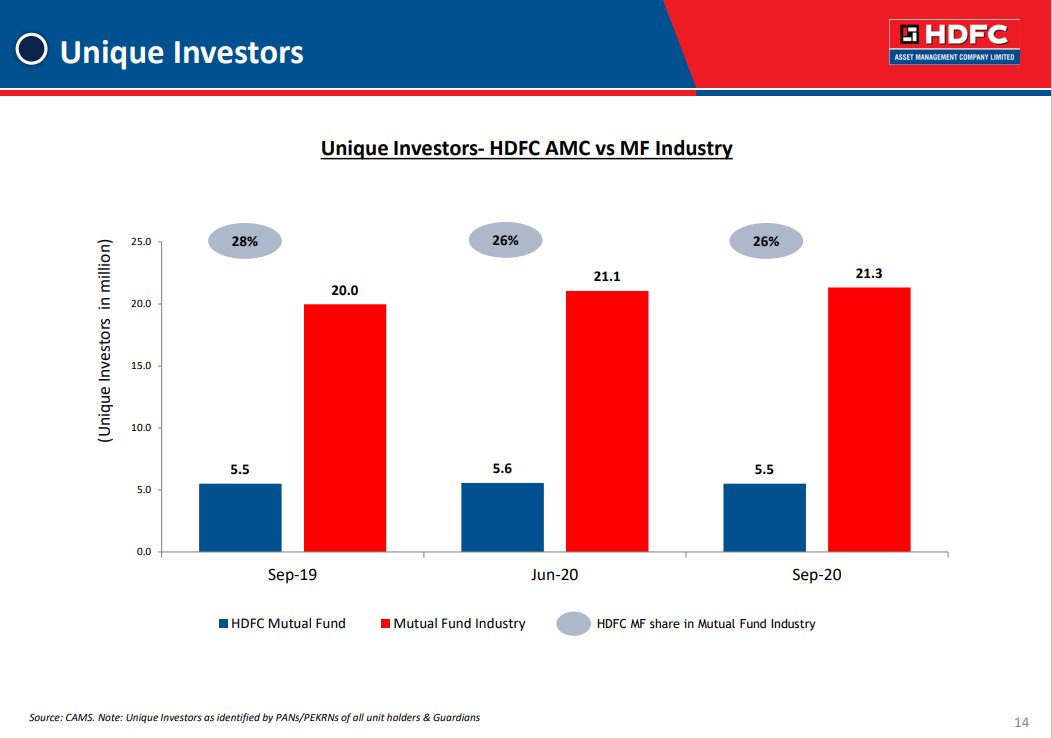

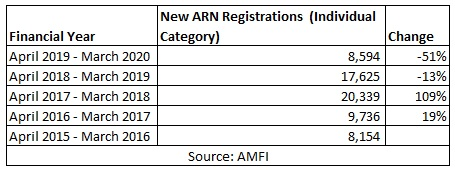

Very few care about mutual funds. Just 2.1 crore unique investors. If you probably take out HNIs/institutions in this, that's maybe 20-30%, what's left are the common gareeb folks.

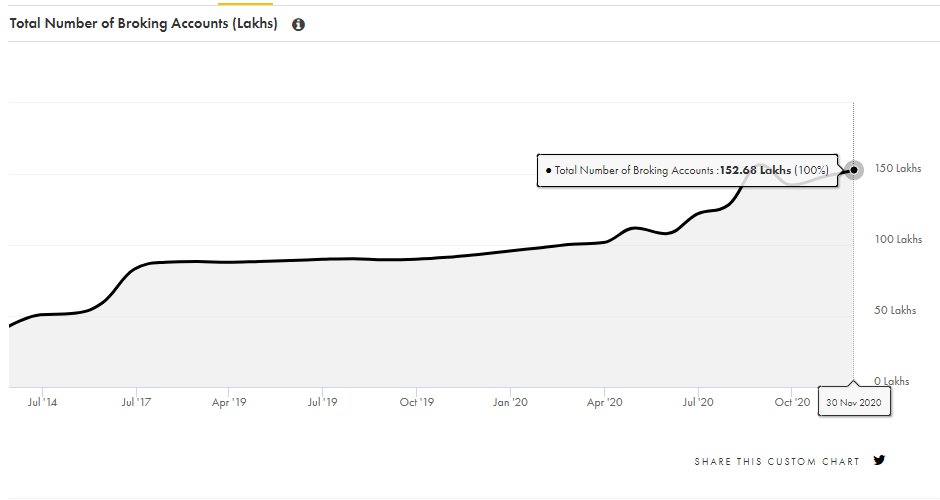

Next time when someone says, people are moving away from mutual funds to direct equities, show them this and punch them in the throat.

Only 1.5 cr active demat accounts. If you remove duplicates, maybe 60% of this?

Nobody seems to be bothered about about bringing the next 1-2 crore Indians who invest something into the markets.

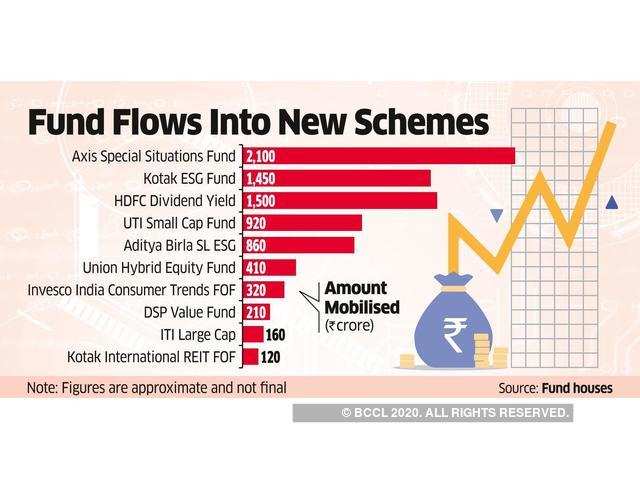

1. Launching 100 NFOs instead of fixing performance including garbage like ESG

2. Tweeting pointless #Tags

3. Raising expense ratios to protect margins due to outflows

4. 27 "New Normal" and "India growth story" webinars

1. Bringing new investors into the markets. It's just milking the existing whales

2. Bringing new distributors and advisors into the market. Why do that when we can tweet #Advice something random

More from ESG compliant gyani

More from Trading

You May Also Like

Like company moats, your personal moat should be a competitive advantage that is not only durable—it should also compound over time.

Characteristics of a personal moat below:

I'm increasingly interested in the idea of "personal moats" in the context of careers.

— Erik Torenberg (@eriktorenberg) November 22, 2018

Moats should be:

- Hard to learn and hard to do (but perhaps easier for you)

- Skills that are rare and valuable

- Legible

- Compounding over time

- Unique to your own talents & interests https://t.co/bB3k1YcH5b

2/ Like a company moat, you want to build career capital while you sleep.

As Andrew Chen noted:

People talk about \u201cpassive income\u201d a lot but not about \u201cpassive social capital\u201d or \u201cpassive networking\u201d or \u201cpassive knowledge gaining\u201d but that\u2019s what you can architect if you have a thing and it grows over time without intensive constant effort to sustain it

— Andrew Chen (@andrewchen) November 22, 2018

3/ You don’t want to build a competitive advantage that is fleeting or that will get commoditized

Things that might get commoditized over time (some longer than

Things that look like moats but likely aren\u2019t or may fade:

— Erik Torenberg (@eriktorenberg) November 22, 2018

- Proprietary networks

- Being something other than one of the best at any tournament style-game

- Many "awards"

- Twitter followers or general reach without "respect"

- Anything that depends on information asymmetry https://t.co/abjxesVIh9

4/ Before the arrival of recorded music, what used to be scarce was the actual music itself — required an in-person artist.

After recorded music, the music itself became abundant and what became scarce was curation, distribution, and self space.

5/ Similarly, in careers, what used to be (more) scarce were things like ideas, money, and exclusive relationships.

In the internet economy, what has become scarce are things like specific knowledge, rare & valuable skills, and great reputations.