1/ Now that the election has been called and voter fraud dismissed, it’s time to search for other frauds. Let’s look at $TSLA Full Self Drive. About 3 weeks ago, Tesla released its Beta version to a limited audience of Tesla influencers.

More from Tech

Energy system models love NETs, particularly for very rapid mitigation scenarios like 1.5C (where the alternative is zero global emissions by 2040)! More problematically, they also like tons of NETs in 2C scenarios where NETs are less essential. https://t.co/M3ACyD4cv7 2/10

There is a lot of confusion about carbon budgets and how quickly emissions need to fall to zero to meet various warming targets. To cut through some of this morass, we can use some very simple emission pathways to explore what various targets would entail. 1/11 pic.twitter.com/Kriedtf0Ec

— Zeke Hausfather (@hausfath) September 24, 2020

In model world the math is simple: very rapid mitigation is expensive today, particularly once you get outside the power sector, and technological advancement may make later NETs cheaper than near-term mitigation after a point. 3/10

This is, of course, problematic if the aim is to ensure that particular targets (such as well-below 2C) are met; betting that a "backstop" technology that does not exist today at any meaningful scale will save the day is a hell of a moral hazard. 4/10

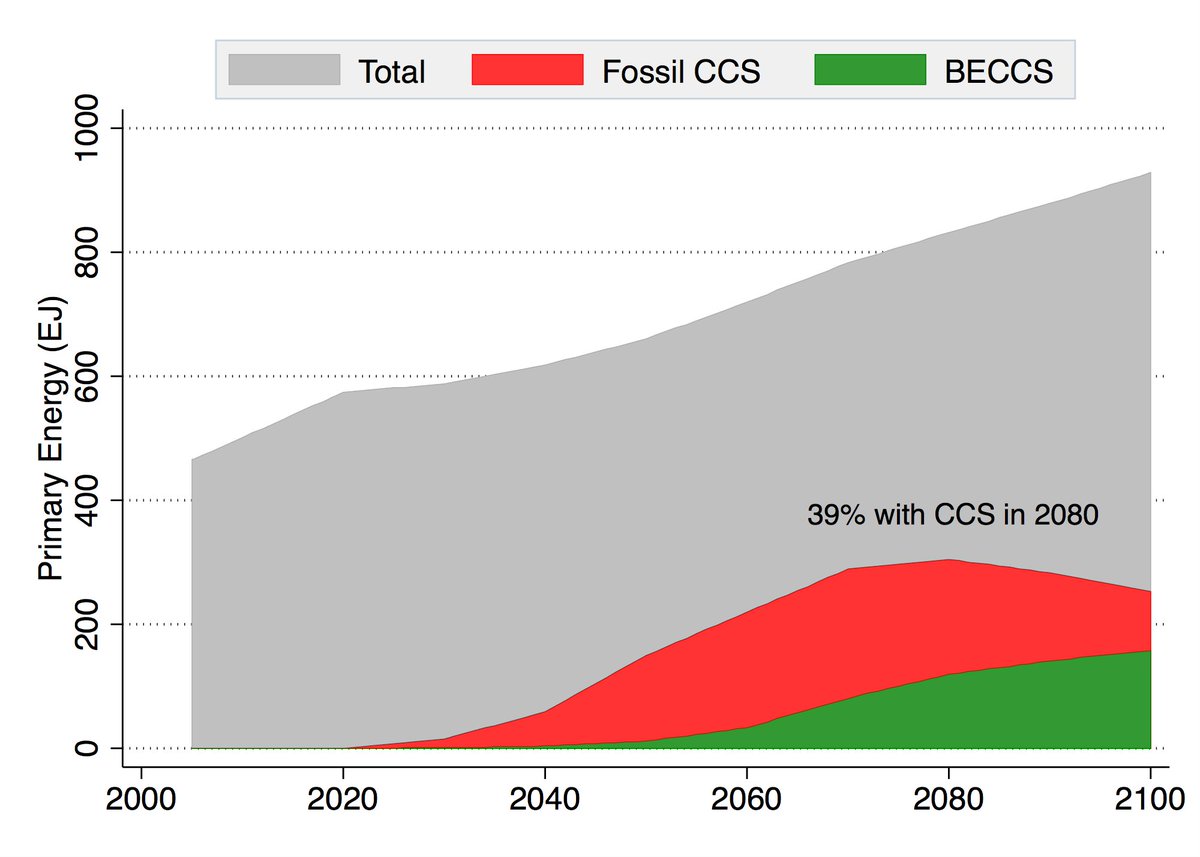

Many models go completely overboard with CCS, seeing a future resurgence of coal and a large part of global primary energy occurring with carbon capture. For example, here is what the MESSAGE SSP2-1.9 scenario shows: 5/10

2. And @RepKenBuck, who offered a thoughtful Third Way report on antitrust law in 2020, weighed in quite reasonably on Biden antitrust frameworks.

3. I believe this change is sincere because it's so pervasive and beginning to result in real policy changes. Example: The North Dakota GOP is taking on Apple's app store.

Republican North Dakota legislators have introduced #SB2333, a bill that prohibits large tech companies from locking their users into a single app store or payment processor.https://t.co/PgyhgOhFAl

— Cory Doctorow #BLM (@doctorow) February 11, 2021

1/ pic.twitter.com/KZ8BMFQoPO

4. And yet there's a problem. The GOP establishment is still pro-big tech. Trump, despite some of his instincts, appointed pro-monopoly antitrust enforcers. Antitrust chief Makan Delrahim helped big tech, and the antitrust case happened bc he was recused.

5. At the other sleepy antitrust agency, the Federal Trade Commission, Trump appointed commissioners

@FTCPhillips and @CSWilsonFTC are both pro-monopoly. Both voted *against* the antitrust case on FB. That case was 3-2, with a GOP Chair and 2 Dems teaming up against 2 Rs.

You May Also Like

1) UCAS School of physical sciences Professor

https://t.co/9X8OheIvRw

2) UCAS School of mathematical sciences Professor

3) UCAS School of nuclear sciences and technology

https://t.co/nQH8JnewcJ

4) UCAS School of astronomy and space sciences

https://t.co/7Ikc6CuKHZ

5) UCAS School of engineering

6) Geotechnical Engineering Teaching and Research Office

https://t.co/jBCJW7UKlQ

7) Multi-scale Mechanics Teaching and Research Section

https://t.co/eqfQnX1LEQ

😎 Microgravity Science Teaching and Research

9) High temperature gas dynamics teaching and research section

https://t.co/tVIdKgTPl3

10) Department of Biomechanics and Medical Engineering

https://t.co/ubW4xhZY2R

11) Ocean Engineering Teaching and Research

12) Department of Dynamics and Advanced Manufacturing

https://t.co/42BKXEugGv

13) Refrigeration and Cryogenic Engineering Teaching and Research Office

https://t.co/pZdUXFTvw3

14) Power Machinery and Engineering Teaching and Research

Hello!! 👋

• I have curated some of the best tweets from the best traders we know of.

• Making one master thread and will keep posting all my threads under this.

• Go through this for super learning/value totally free of cost! 😃

1. 7 FREE OPTION TRADING COURSES FOR

A THREAD:

— Aditya Todmal (@AdityaTodmal) November 28, 2020

7 FREE OPTION TRADING COURSES FOR BEGINNERS.

Been getting lot of dm's from people telling me they want to learn option trading and need some recommendations.

Here I'm listing the resources every beginner should go through to shorten their learning curve.

(1/10)

2. THE ABSOLUTE BEST 15 SCANNERS EXPERTS ARE USING

Got these scanners from the following accounts:

1. @Pathik_Trader

2. @sanjufunda

3. @sanstocktrader

4. @SouravSenguptaI

5. @Rishikesh_ADX

The absolute best 15 scanners which experts are using.

— Aditya Todmal (@AdityaTodmal) January 29, 2021

Got these scanners from the following accounts:

1. @Pathik_Trader

2. @sanjufunda

3. @sanstocktrader

4. @SouravSenguptaI

5. @Rishikesh_ADX

Share for the benefit of everyone.

3. 12 TRADING SETUPS which experts are using.

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4.

12 TRADING SETUPS which experts are using.

— Aditya Todmal (@AdityaTodmal) February 7, 2021

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

4. Curated tweets on HOW TO SELL STRADDLES.

Everything covered in this thread.

1. Management

2. How to initiate

3. When to exit straddles

4. Examples

5. Videos on

Curated tweets on How to Sell Straddles

— Aditya Todmal (@AdityaTodmal) February 21, 2021

Everything covered in this thread.

1. Management

2. How to initiate

3. When to exit straddles

4. Examples

5. Videos on Straddles

Share if you find this knowledgeable for the benefit of others.

Why is this the most powerful question you can ask when attempting to reach an agreement with another human being or organization?

A thread, co-written by @deanmbrody:

Next level tactic when closing a sale, candidate, or investment:

— Erik Torenberg (@eriktorenberg) February 27, 2018

Ask: \u201cWhat needs to be true for you to be all in?\u201d

You'll usually get an explicit answer that you might not get otherwise. It also holds them accountable once the thing they need becomes true.

2/ First, “X” could be lots of things. Examples: What would need to be true for you to

- “Feel it's in our best interest for me to be CMO"

- “Feel that we’re in a good place as a company”

- “Feel that we’re on the same page”

- “Feel that we both got what we wanted from this deal

3/ Normally, we aren’t that direct. Example from startup/VC land:

Founders leave VC meetings thinking that every VC will invest, but they rarely do.

Worse over, the founders don’t know what they need to do in order to be fundable.

4/ So why should you ask the magic Q?

To get clarity.

You want to know where you stand, and what it takes to get what you want in a way that also gets them what they want.

It also holds them (mentally) accountable once the thing they need becomes true.

5/ Staying in the context of soliciting investors, the question is “what would need to be true for you to want to invest (or partner with us on this journey, etc)?”

Multiple responses to this question are likely to deliver a positive result.