How to find out the expected targets and what should be the exit criteria when you enter a trade - 🧵

Possible ways to find out the target:

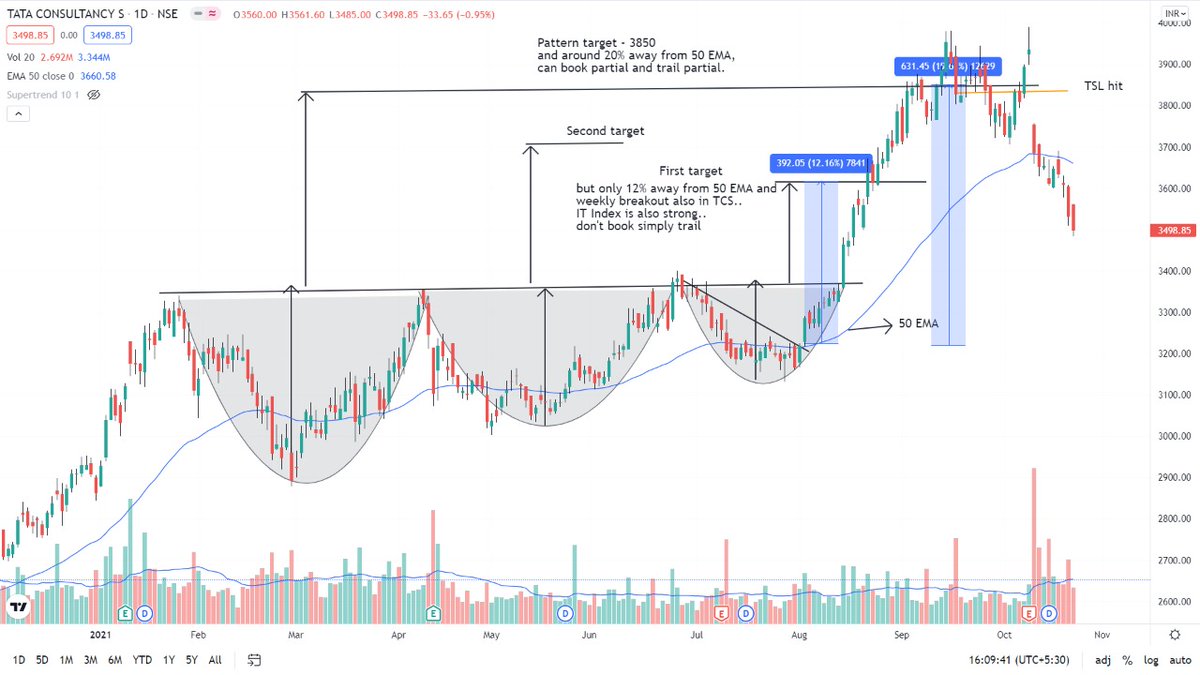

Check if any patterns forming - it gets quite easy to figure out the targets that way. (1/15)

Sometimes, after hitting the first target.. stock starts consolidating or take a retest of the breakout. On some occasions, stock gives one sided move non-stop.. without any pullback. (3/15)

Also, if stock gives weekly breakout and market is trending during that time.. even then it gives a one sided move. (4/15)

Other helpful thing I learned from @Traderknight007 about exit criteria is using volume expansion and DMA/EMA. I began using it and benefitted. This is recently observed in TCS, DLF & many others. (5/15)

In large caps, it's generally an extended move when stock is away 20-25% from 50 EMA and midcap/small cap give 30-35% move and then pause a little in trend. (6/15)

https://t.co/5N6hcW6SOm

(9/15)

How do find the best exits using Volume climax \U0001f447https://t.co/MMJfdvSGeW

— Trader knight (@Traderknight007) July 24, 2021

Trend followers prefer to trail their profits but you can do it as per your comfort. Just make sure you have an exit plan.

Trailing has many methods. Being a price action trader, I use swing lows and candlestick for trailing. (10/15)

There are many other ways too.

@Traderknight007 has written this one more amazing thread you can go through and put this information to use. (11/15)

https://t.co/Pysa6LDK4t

2. TRAILING METHODS-

— Trader knight (@Traderknight007) December 24, 2020

1. SWING POINT METHOD-

In this method we use the swing points or the HH- HL OR LH-LL points for placing sl,

In this method we trail our sl when the stock make a Higher low after our entry and keep Trailing the sl till it hits. pic.twitter.com/CqzCkLdWmC

If stock breaks last swing high, enter again and use same trailing SL method. It's difficult initially to enter same trade from higher price but good opportunity shouldn't be missed. (14/15)

More from Sheetal Rijhwani

Students of @Mitesh_Engr are real gems on twitter!

Nobody will give you this kind of knowledge in any paid webinar like they gave this in a thread! One more brilliant thread by @ITRADE191 @AdityaTodmal @niki_poojary

Nobody will give you this kind of knowledge in any paid webinar like they gave this in a thread! One more brilliant thread by @ITRADE191 @AdityaTodmal @niki_poojary

In this thread, I'll walk you through my set up, absorb it as much as you can.

— itrade(DJ) (@ITRADE191) June 27, 2021

The instrument that I trade in are Nifty (NF) options

Thanks to @AdityaTodmal @niki_poojary for contributing in making this pic.twitter.com/BrMrGydb1v

If you're a swing/positional/trend follower, then this thread is for you. In this one, I will be covering how to filter stocks, how to take entry and the exit plans. 🧵 (1/21)

It's practically impossible to check all charts. However, you can use multiple scanners as per your setups to make things easy.

In trending market, even junk stocks give a good move. But in sideways and falling markets, you have to be very selective. (2/21)

One imp. filter for me is trading in strong fundamental stocks. Every quarter, I check results of companies and filter the list. I keep checking the charts and set an alert on the levels. Many good handles on Twitter post good results lists, you can save that as well. (3/21)

This time, I did the same on my telegram channel.

https://t.co/C3eS9PSncG

Second filter for me is Current Performing Sectors/Themes. Keep your eyes and ears open. Being a good observer helps you big time. Make good use of news in your analysis. (4/21)

For Eg: Textiles are performing well for a while now. It has strong consumer interest due to many global retailers, diversifying their outsourcing and reducing their dependence on China. Order booking from India has increased rapidly. (5/21)

It's practically impossible to check all charts. However, you can use multiple scanners as per your setups to make things easy.

In trending market, even junk stocks give a good move. But in sideways and falling markets, you have to be very selective. (2/21)

One imp. filter for me is trading in strong fundamental stocks. Every quarter, I check results of companies and filter the list. I keep checking the charts and set an alert on the levels. Many good handles on Twitter post good results lists, you can save that as well. (3/21)

This time, I did the same on my telegram channel.

https://t.co/C3eS9PSncG

Second filter for me is Current Performing Sectors/Themes. Keep your eyes and ears open. Being a good observer helps you big time. Make good use of news in your analysis. (4/21)

For Eg: Textiles are performing well for a while now. It has strong consumer interest due to many global retailers, diversifying their outsourcing and reducing their dependence on China. Order booking from India has increased rapidly. (5/21)

More from Ta

25k webinar Done in a tweet

A sweet and simple BNF Setup i use

Alligator Setup

Retweet so that everyone can get benefited.

Check Full thread for full strategy.

1. You have to use 2 charts simultaneously , first chart of bank nifty spot 15 min time frame , candle used heikin ashi

Second chart 15 min bnf future normal candle.

2. Indicator used is alligator , in the indicator you have to only use the jaw of indicator.

3. Whenever spot and future candle closes simultaneously below the jaw line , short at the low of the candle which closed below the jawline.

4. Whenever spot and future candle closes simultaneously above the jaw line , buy at the high of the candle which closes above the jawline.

5. Target and Stoploss - Ideal target which i personally take is 100 points.

Stoploss also 100 points.

On trending days you can trail and take 200/300/400 points also.

I have personally made maximum 624 points in bank nifty in a single trade.

6. Precautions - never trade on sideways days.

7. Never trade on gap up or gapdown of more than 100 points .

I have made a detailed video on the same.

Link https://t.co/XMolGUKZPF

Thankyou for reading.

A sweet and simple BNF Setup i use

Alligator Setup

Retweet so that everyone can get benefited.

Check Full thread for full strategy.

1. You have to use 2 charts simultaneously , first chart of bank nifty spot 15 min time frame , candle used heikin ashi

Second chart 15 min bnf future normal candle.

2. Indicator used is alligator , in the indicator you have to only use the jaw of indicator.

3. Whenever spot and future candle closes simultaneously below the jaw line , short at the low of the candle which closed below the jawline.

4. Whenever spot and future candle closes simultaneously above the jaw line , buy at the high of the candle which closes above the jawline.

5. Target and Stoploss - Ideal target which i personally take is 100 points.

Stoploss also 100 points.

On trending days you can trail and take 200/300/400 points also.

I have personally made maximum 624 points in bank nifty in a single trade.

6. Precautions - never trade on sideways days.

7. Never trade on gap up or gapdown of more than 100 points .

I have made a detailed video on the same.

Link https://t.co/XMolGUKZPF

Thankyou for reading.