2/

Understanding HIGH & LOW VIX

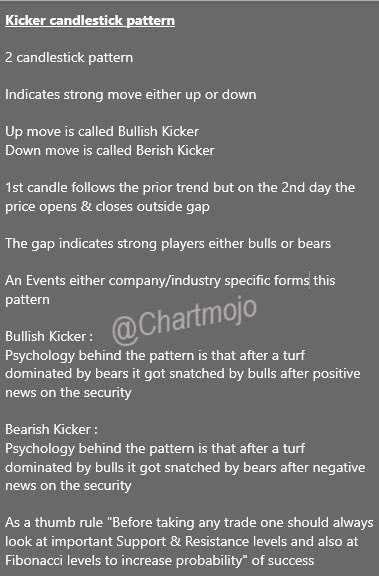

VIX at 16: If you check today's IV behaviour, they were not spiking much even with decent delta move in BNF. The movement was subtle, giving some time to adjust. So someone having good adjustment mechanism can stay in the game longer.

1/

2/

3/

4/

5/

More from Sarang Sood

P.S. No one specifically invented ironfly & it's adjustments. A good trader can figure it out on his own. I've been doing it on & off for yrs.

THREAD ON IRONFLY

— Sarang Sood (@SarangSood) December 12, 2020

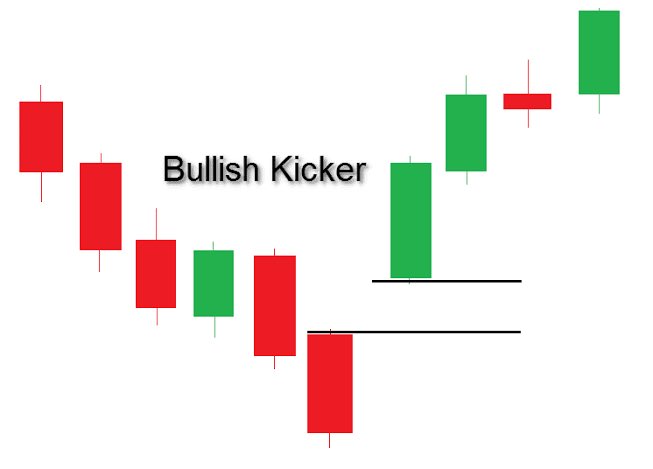

These days the most preferred strategy for option sellers due to improved margins is IRONFLY. It's essentially a short straddle with long strangle. Long strangle acting as 'WINGS', which help in capping the unlimited risk associated with a short straddle.(1/n)

@SarangSood Sarang bhai according to you what number of vix is ideal for option buyers and what is that for option sellers? And is there any common number which is ideal for both?

— Dhaval bhatt (@Dhavalb55011726) July 14, 2021

More from Stockslearnings

U can guage the strength in the trend once u know how to measure the direction.

This trend strength is infact signals the trend continuity or the potetnial for sustanining the trend.

Thats great assurace to hav https://t.co/HanLvlXkjQ

Before making ur trade entry or even before making a bias of trend as either bullish or bearish, do u use any objective measures to define the trend based on price, volume and momentum?

— Aneesh Philomina Antony (@ProdigalTrader) May 15, 2021

Price will always go back and forth move no matter how strong the trend is.

1/4 pic.twitter.com/qqizh2JO3J

10% more gains to 127.75 !! 🍻🔥🚀

Expecting it to consolidate now in coming days before a final move to 145-150 levels. #Copper RSI is overheated and needs to cool down.

Negative divergence building up on hourly charts. https://t.co/sBU4O6QZsq

#HindCopper

— Anchit Goel (@anchitsays) February 23, 2021

20% Upper Circuit at 118.05 now!! \U0001f389\U0001fa85\U0001f525\U0001f680\U0001f973\U0001f37b\U0001f60d

Conviction and patience has given excellent results. https://t.co/T5y2CBY9Lt pic.twitter.com/xvDeR91PkL

You May Also Like

Funny there are those who think these migrant caravans were a FANTASTIC idea that's going to take the immigration issue away from you.

— Brian Cates (@drawandstrike) November 26, 2018

Like several weeks watching a rampaging horde storm the fences & throw rocks at our border patrol agents & getting gassed = great optics!

This media manipulation effort was inspired by the success of the "kids in cages" freakout, a 100% Stalinist propaganda drive that required people to forget about Obama putting migrant children in cells. It worked, so now they want pics of Trump "gassing children on the border."

There's a heavy air of Pallywood around the whole thing as well. If the Palestinians can stage huge theatrical performances of victimhood with the willing cooperation of Western media, why shouldn't the migrant caravan organizers expect the same?

It's business as usual for Anarchy, Inc. - the worldwide shredding of national sovereignty to increase the power of transnational organizations and left-wing ideology. Many in the media are true believers. Others just cannot resist the narrative of "change" and "social justice."

The product sold by Anarchy, Inc. is victimhood. It always boils down to the same formula: once the existing order can be painted as oppressors and children as their victims, chaos wins and order loses. Look at the lefties shrieking in unison about "Trump gassing children" today.