Categories Screeners

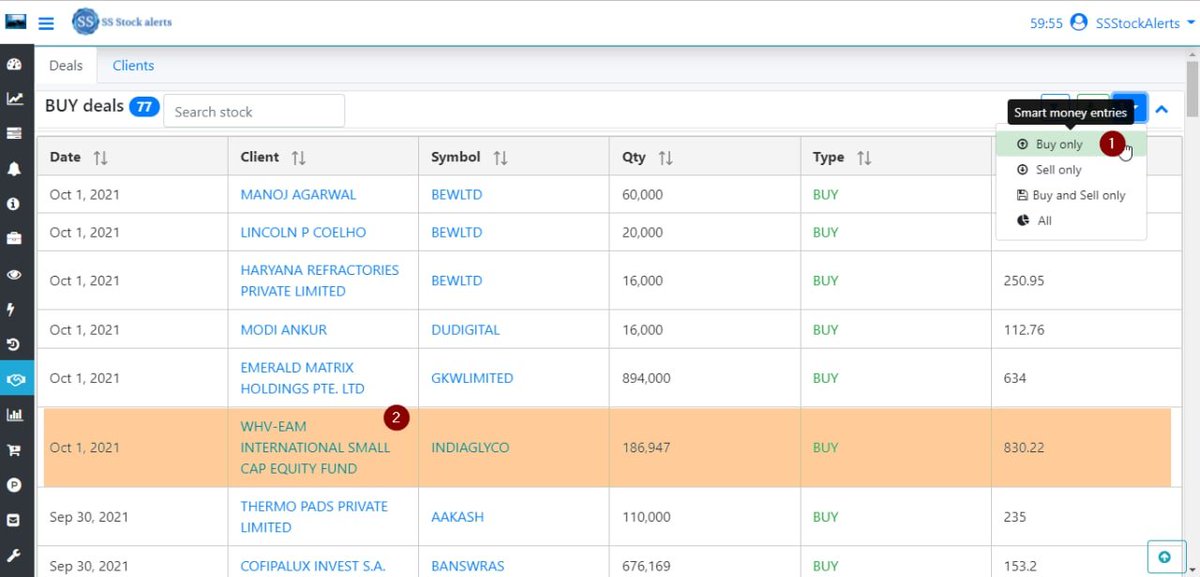

The day you will start thinking from the perspective of "what smart hands are doing" you will start making a lot of money.

They run the market, not your and mine minor orders. Follow their footsteps.

Method of Tape Reading by Richard Demille Wyckoff https://t.co/YDKP7gMp6D

Selling volumes high? NO

— The_Chartist \U0001f4c8 (@nison_steve) October 18, 2021

Selling candles big? No

Are they doji/spinning tops? Yes

Price in narrow range? Yes

Previous volumes while buying high? Yes, so if someone bought huge, he is still sitting

What's going on? Weak hands booking profits.

IEX - Updated chart https://t.co/GABkSthg5L pic.twitter.com/hmjBtM2GQK

But 98.8% missed out on the best content on this platform.

Here are the best threads from Q1 2022:

Collaborated with @niki_poojary

Topic: Mistakes in trading as an option

10 mistakes in my 14 years of trading as an option seller \U0001f9f5

— Sarang Sood (@SarangSood) March 19, 2022

Topic: How to filter stocks with their entry and exit

If you're a swing/positional/trend follower, then this thread is for you. In this one, I will be covering how to filter stocks, how to take entry and the exit plans. \U0001f9f5 (1/21)

— Sheetal Rijhwani (@RijhwaniSheetal) February 27, 2022

Topic: Myth of an "edge" in overnight option

A thread addressing the myth of "Edge" in overnight option selling, got many questions around this after the F2f scession!

— Bandi Shreyas (@BandiShreyas) January 9, 2022

Assume you sell a 0.05 delta call option every month at the beginning of the month (basically an option that is 0.05 probability

Topic: Best threads on Investing and

Here are the\U0001f51fbest threads you can ever read on investing and trading -

— Anshika Sharma\u26a1 (@Anshi_________) March 5, 2022

A thread\U0001f498

In any activity the distribution of outcomes follows bell curve (Gaussian).

Those that are willing to put in effort reap the benefits. 😀

Otherwise we always have option to go for hard working PM's/etf/mf

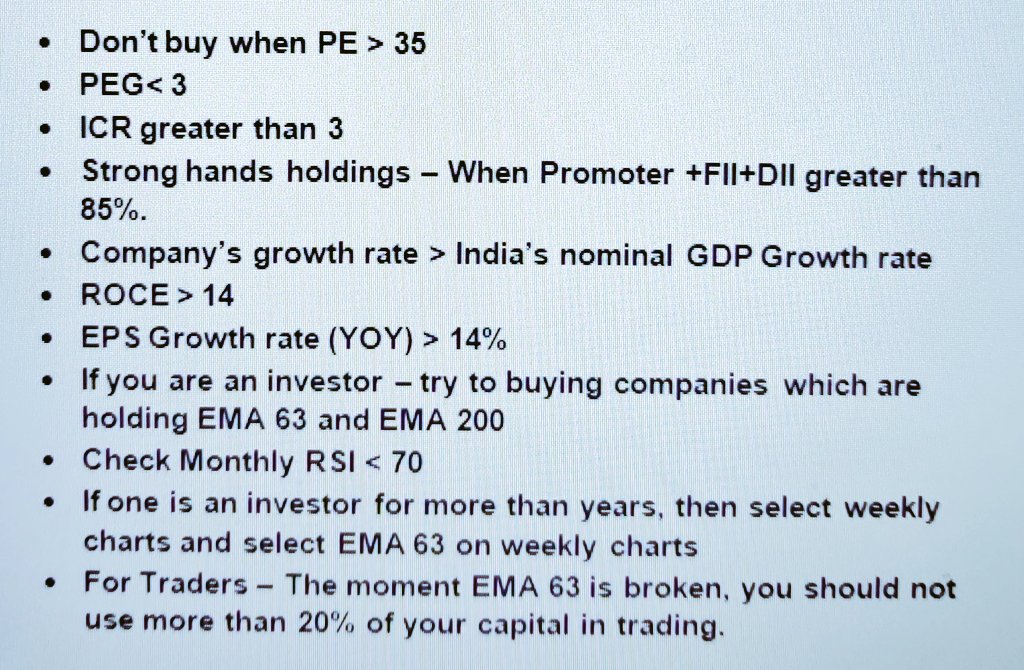

Things to need to do before you buy a stock. I wonder though how many investors have the ability for item numbers 5, 6 & 7. I don't pic.twitter.com/E5AMVxbpNb

— Prashanth (@Prashanth_Krish) August 16, 2021

For lot of consumer facing cos scuttlebutt is actually not that hard. We find reviews online (eg: app reviews on playstore, or reviews of products on social media)

B2B is hard to scuttlebutt, need to reach out to people in co and hope that are willing to talk. Connections help

#KPITTECH https://t.co/qPLH3li2Yy

Charts for reference. During a downtrend, news based buying is an opportunity to make an exit in most of the cases. #KPITTECH #Hikal https://t.co/63WBMFZ6BT pic.twitter.com/OgWzulTXiD

— Aakash Gangwar (@akashgngwr823) April 27, 2022

#Elliottwave puts #PriceAction in it's context

— Van Ilango (JustNifty) (@JustNifty) December 2, 2021

You're 1 undisputed expert on prime source of everything, #PriceAction

Let beginner start with #PriceAction & then step up to 12345 & ABC

Baby steps alone will take to maturity

Read this book months ago - "Rich Experience shared"\U0001f64f https://t.co/VUbG6F5Ems pic.twitter.com/PProaFsMsV