Categories Screeners

Wish to build a multi-year, resilient equity #portfolio? On #TheMoneyShow today, @vivbajaj, Co-founder of StockEdge & elearnmarkets shared set a of valuation metrics that can guide your right stock selection strategy@alexandermats pic.twitter.com/qMbNqxHG0M

— ET NOW (@ETNOWlive) January 13, 2022

🧵on

• Uses of RSI

• Rakesh Jhunjhunwala

• Volume Analysis

• Cash Investing Strategy

• How should new entrants learn quickly?

• How to use Nifty to beat its own returns?

• Compilations of many threads

🧵Superb Thread on RSI

1. Uses of RSI.

2. Investment strategy based on

#RSI is a common indicator which most of us use in the stock market.

— Yash Mehta (@YMehta_) October 22, 2021

This learning thread would be on

"\U0001d650\U0001d668\U0001d65a\U0001d668 \U0001d664\U0001d65b \U0001d64d\U0001d64e\U0001d644"

Like\U0001f44d & Retweet\U0001f504 for wider reach and for more such learning thread in the future.

Also, an investment strategy is shared using RSI in the end.

1/16

🧵How did Rakesh Jhunjhunwala make his money from trading? Covered very well.

Rakesh Jhunjhunwala became rich initially by Trading and not Investing.

— ARJUN BHATIA (@ArjunB9591) October 21, 2021

Thread on the same \U0001f9f5

It is called genius because Jhunjhunwala made Rs 20 lakh to Rs 15,000 crore in 30 years through the stock market. And that Rs 20 lakh was also borrowed money at 20% interest. pic.twitter.com/ZkGU4iG5UR

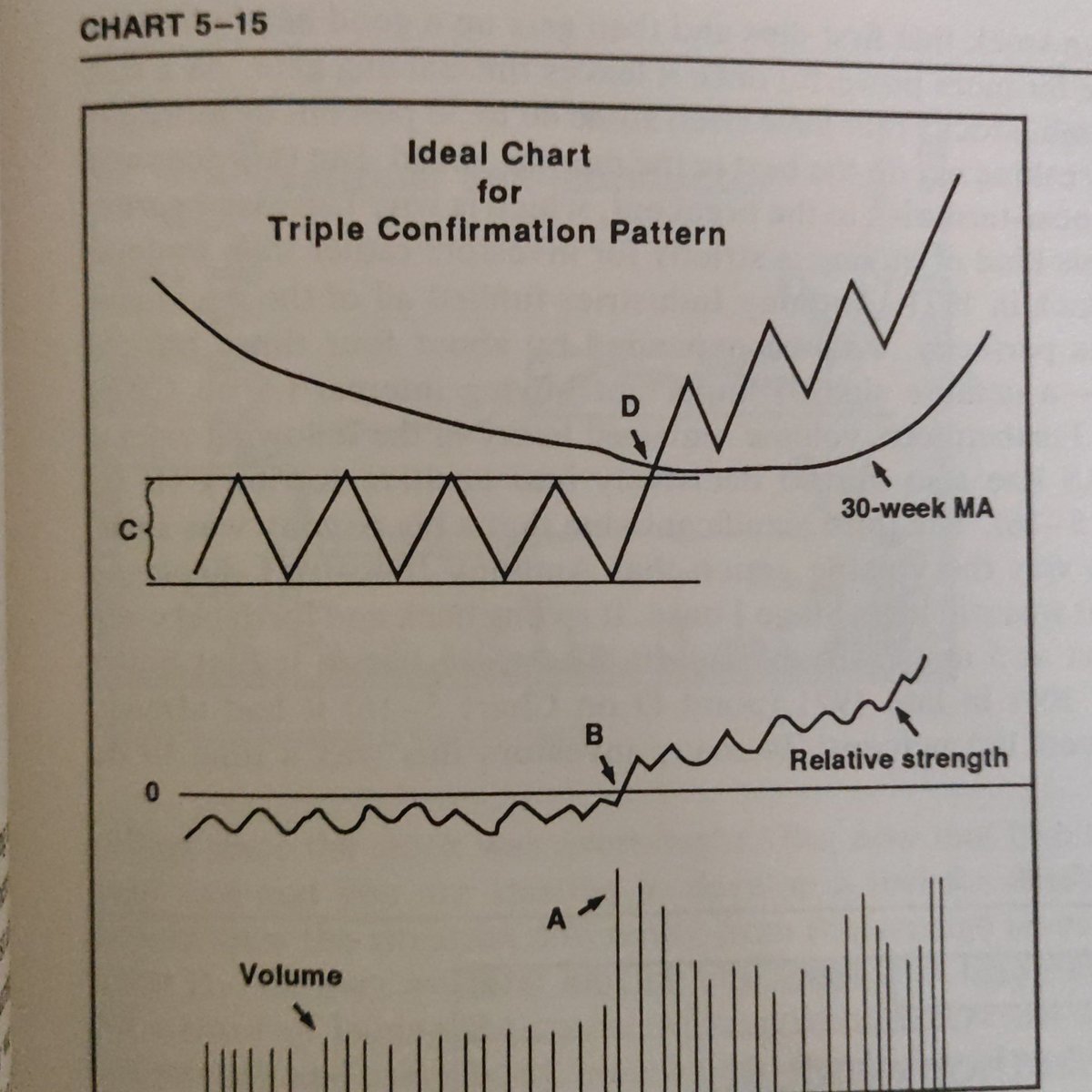

🧵Amazing thread on various indicators.

(@Prashantshah267)

This is not a thread from the current week but @ArjunB9591 brought this to my notice so I shared it.

Thread of threads I have written on the Twitter:

— Prashant Shah (@Prashantshah267) November 29, 2020

Link to my books, blogs and videos:https://t.co/yZjlVPpKs4

🧵on Volume

Full #volume anlaysis thread \U0001f9f5

— Vikrant (@Trading0secrets) October 20, 2021

One thing which big player can never hide - VOLUME https://t.co/MjtFq384N0

Awesome stuff .. take a bow @sahil_vi ji

Thank you for sharing and efforts !! 🙏🙏🙏🙏

A lot of people ask: how do you find companies to invest in? very good question.

— Sahil Sharma (@sahil_vi) July 6, 2021

How did you find RACL, Pix?

Creating this ad-hoc thread to share my process.

if you like it, please RT to benefit maximum investors. \U0001f64f

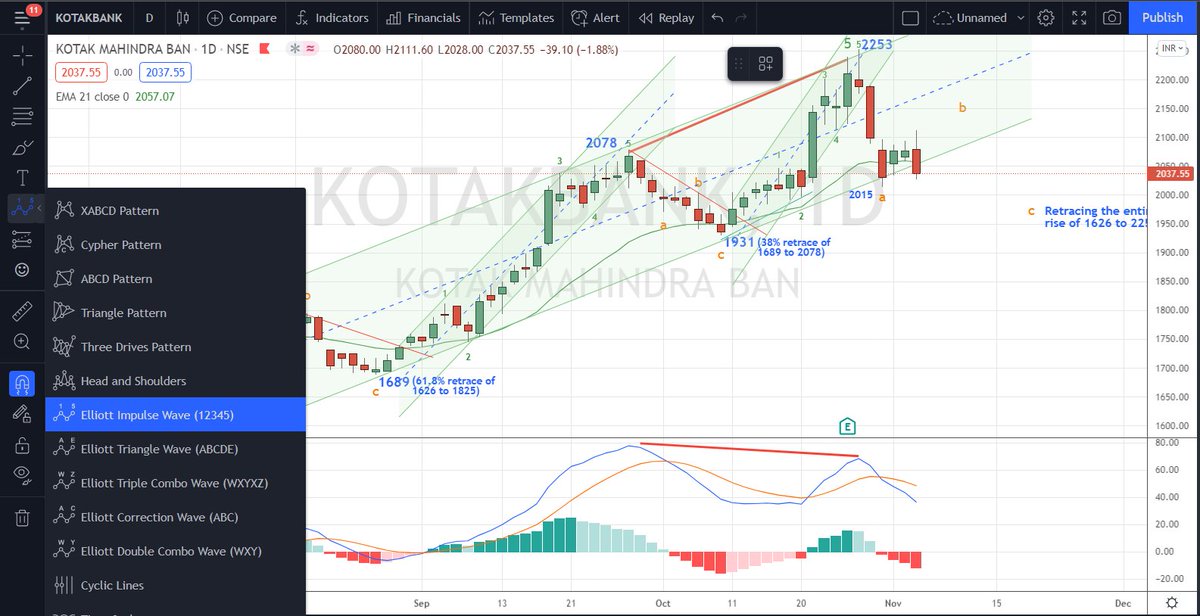

Selling candles big? No

Are they doji/spinning tops? Yes

Price in narrow range? Yes

Previous volumes while buying high? Yes, so if someone bought huge, he is still sitting

What's going on? Weak hands booking profits.

IEX - Updated chart https://t.co/GABkSthg5L

Indian Energy Exchange (IEX) - because you missed the 1st BO maybe at 200/300/400/500 therefore, your brain will keep on saying you - "now it is expensive" but it will keep on going up troubling you more. Perfect trait of a marathon runner. Follow the price with SL. pic.twitter.com/cKH3vnG05l

— The_Chartist \U0001f4c8 (@nison_steve) September 28, 2021

A thread🧵🧵🧵🧵

Like and Retweet

Stocks showing Relative Strength their

Shorter Period Moving Averages(say8,13)

would be either distancing away or Smallest period(8) MA line would be above or

converging towards a Smaller period(13) line but would be above it.

Example: See how they fared with CNX 500 #MRPL

#GSS(both running away defying market fall) while #Ghcl #Welcorp (resisting fall with market shown by converging ma but 8 ma line over 13 ma)

Compare it with stocks showing weakness

#Supriya #Intellect

Greater the difference b/w Moving Averages greater the Strength

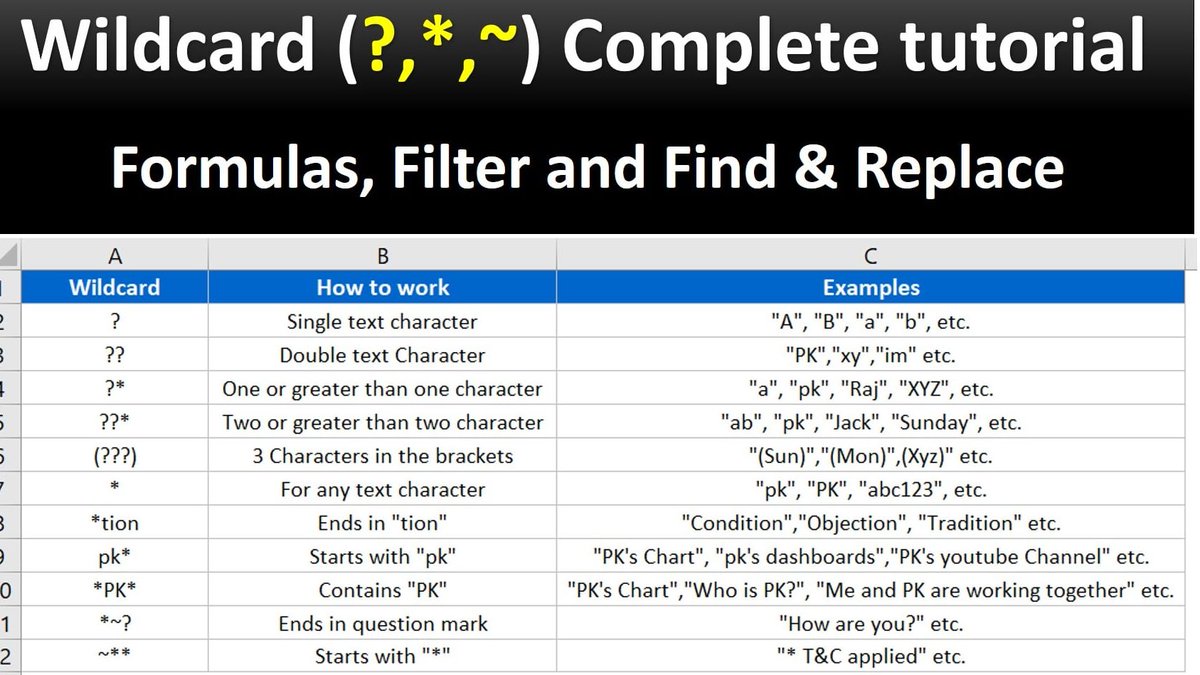

A scanner to find stocks with help of MAs showing Relative Strength

https://t.co/Dt6n7iX3PT

Adjust the settings in the below scanner with 1.02/1.03 to find stocks in Higher Momentum

@sarosijghosh @VCPSwing

I highly recommend this book to all the beginners in stock market.

Sir, if not wrong you taught MACD -H in your elearn webinar also? From where you have learned it?

— Prakhar (@Indiantrader101) August 23, 2021

* Trading for a Living