THE WAIT IS OVER🏆

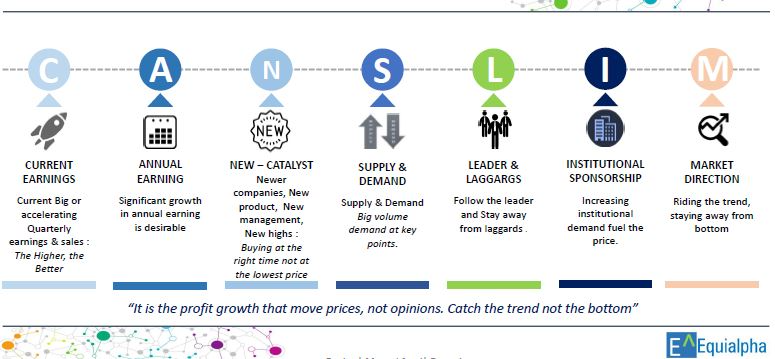

FREE course on Momentum Trading Basics 🔥

Link - https://t.co/byW2cPH1xY

Note - This is a compilation of my all best strategy content out there on various platforms in Hindi + English

Do retweet for max benefit ✅

More from EquiAlpha -MidTerm Momentum🐎🐎

Har stock turn down hota hai ! Exiting helps beating markets & catching new ones

Without rules you cannot conquer markets !

— EquiAlpha -MidTerm Momentum\U0001f40e\U0001f40e (@equialpha) May 3, 2022

These are my 9 sell warriors to conquer markets !

Selling is the toughest part..Some or the other sell rule always get me out !

Learn fully - https://t.co/iDlVff5KoU pic.twitter.com/u2vQvpGzEs

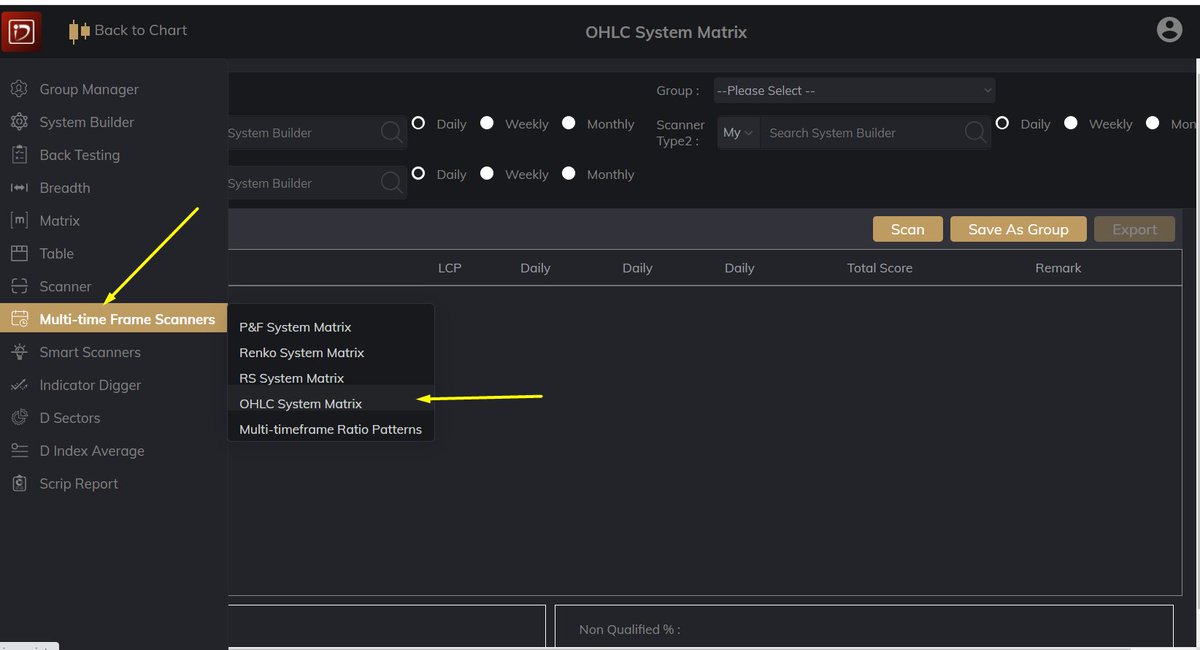

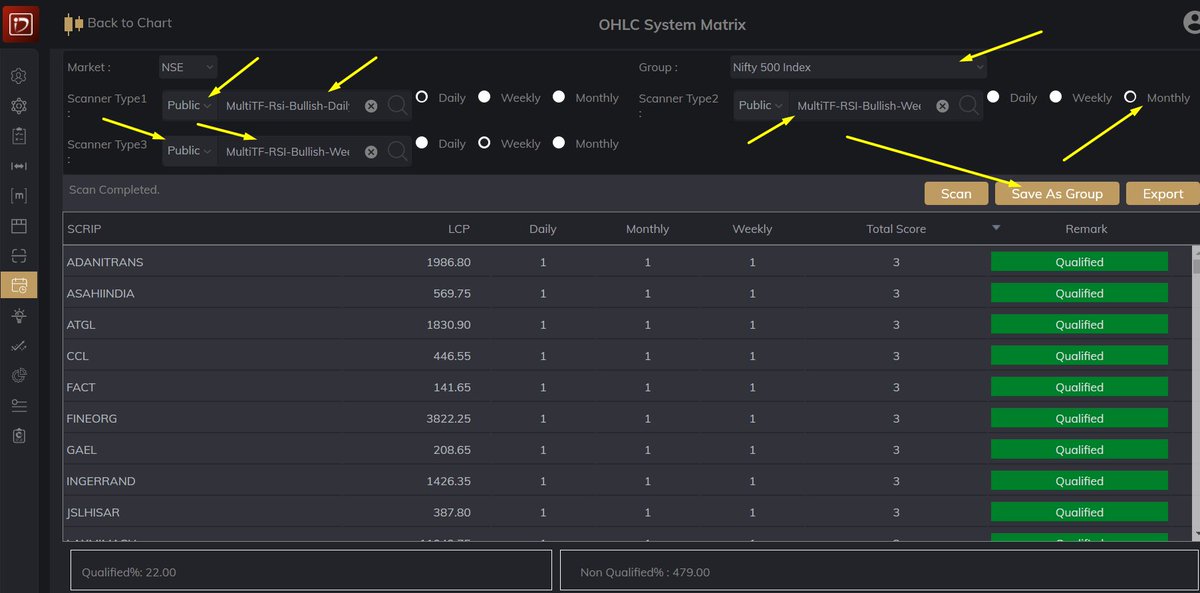

More from Screeners

#BroTip

If you want to trade only stocks with established trend/momentum, then you can look for stocks which have never(or barely did) closed below a certain MA (say 50MA) in the last say 50 days.

— Manas Arora (@iManasArora) November 8, 2021

There are countless ways to run scans. Just have to get creative. #BroTip

Covering one of the most unique set ups: Extended moves & Reversal plays

Time for a 🧵 to learn the above from @iManasArora

What qualifies for an extended move?

30-40% move in just 5-6 days is one example of extended move

How Manas used this info to book

The stock exploded & went up as much as 63% from my price.

— Manas Arora (@iManasArora) June 22, 2020

Closed my position entirely today!#BroTip pic.twitter.com/CRbQh3kvMM

Post that the plight of the

What an extended (away from averages) move looks like!!

— Manas Arora (@iManasArora) June 24, 2020

If you don't learn to sell into strength, be ready to give away the majority of your gains.#GLENMARK pic.twitter.com/5DsRTUaGO2

Example 2: Booking profits when the stock is extended from 10WMA

10WMA =

#HIKAL

— Manas Arora (@iManasArora) July 2, 2021

Closed remaining at 560

Reason: It is 40+% from 10wma. Super extended

Total revenue: 11R * 0.25 (size) = 2.75% on portfolio

Trade closed pic.twitter.com/YDDvhz8swT

Another hack to identify extended move in a stock:

Too many green days!

Read

When you see 15 green weeks in a row, that's the end of the move. *Extended*

— Manas Arora (@iManasArora) August 26, 2019

Simple price action analysis.#Seamecltd https://t.co/gR9xzgeb9K

Sir Edwards & Magee discussed sloping necklines in H&S in their classical work. I am considering this breakdown by Affle as an H&S top breakdown with a target open of 770.

— The_Chartist \U0001f4c8 (@charts_zone) May 25, 2022

The target also coincides with support at the exact same level. pic.twitter.com/n84kSgkg4q