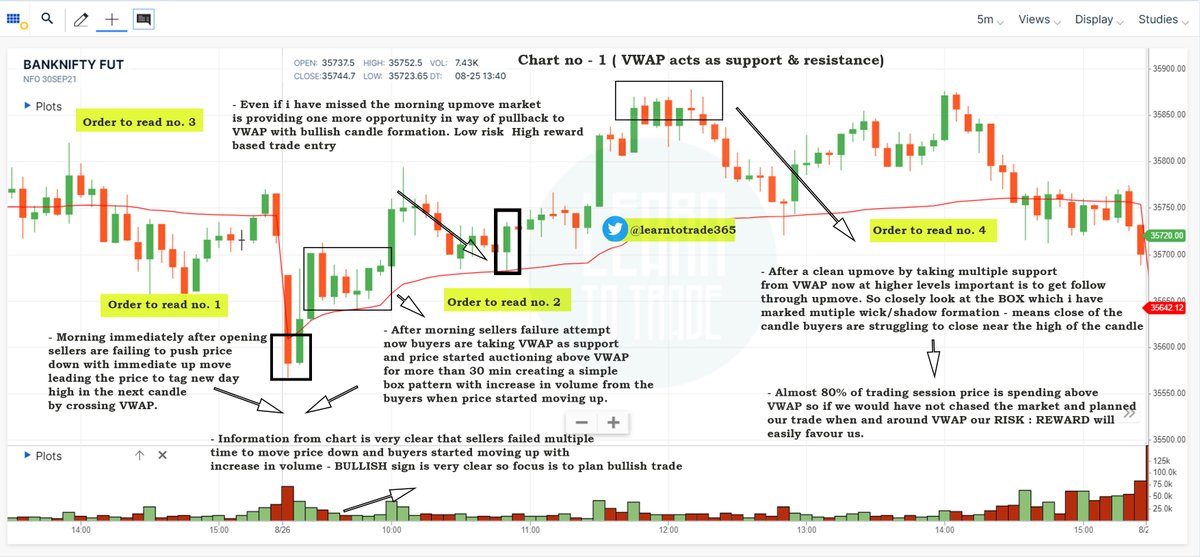

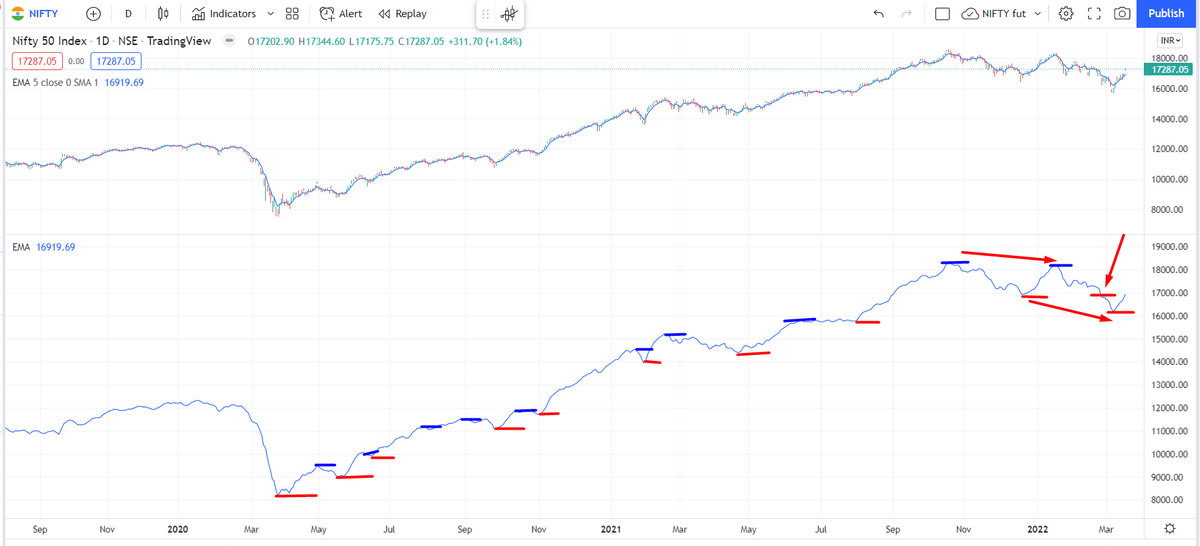

The most important question now on the mind of all analysts and traders. Is this a bear market rally or is this the start of a bull move. Retweeting this as I will need a few tweets to explain my view

Is Nifty bullish, or bearish?

— AP (@ap_pune) March 19, 2022

Replies MUST be ONLY with charts, not just 'views', no Russia Ukraine, crude, gold etc.

Can be levels....abv/below

Just technicals....maybe with trend lines, indicators or any other study (EW, harmonics etc)

Charts can be daily, weekly or monthly.

That is not the case now, which holds me back from calling this a clean bull market

More from Subhadip Nandy

IV - A thread

— Subhadip Nandy (@SubhadipNandy16) September 20, 2018

In financial mathematics, implied volatility of an option contract is

that value of the volatility of the underlying instrument which, when

input in an option pricing model ) will return a theoretical value equal to the current market price of the option (1/n)

What do you think/use as the most robust leading indicator if following technical analysis ? Please answer with reason , I will provide my answer after 2 hours

— Subhadip Nandy (@SubhadipNandy16) August 12, 2019

( At Delhi airport , bored as hell )

This thread actually had some great answers , one can learn a lot about the thought processes of different traders from the answers. Please go thru them

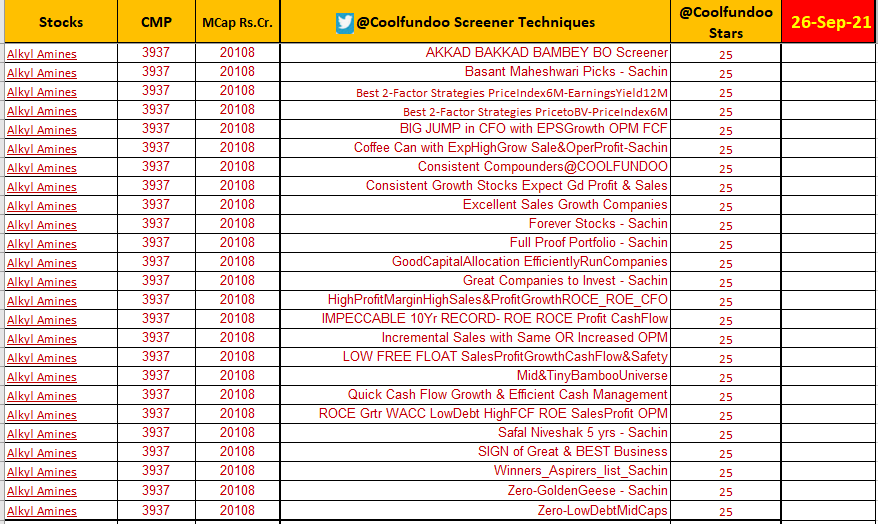

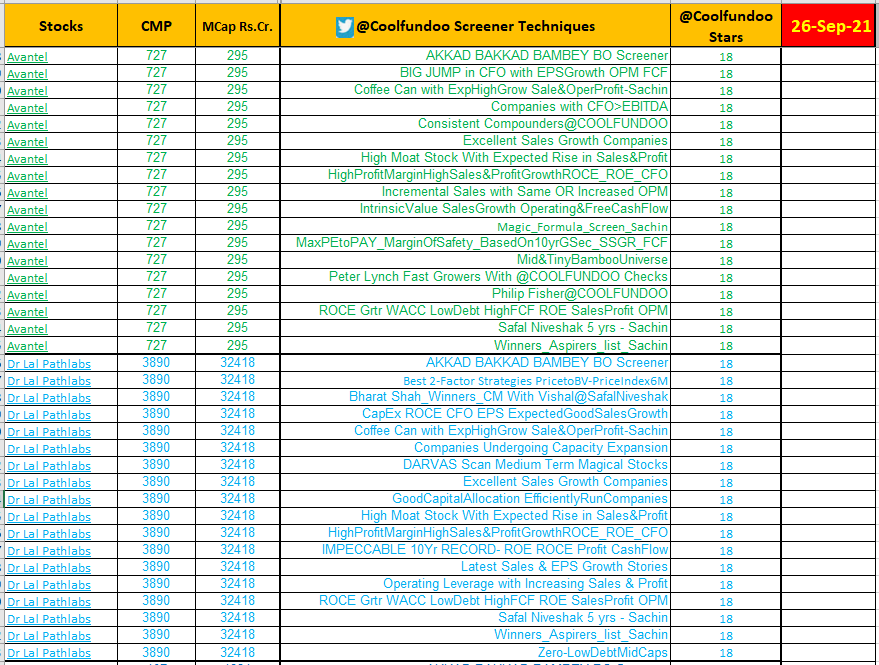

More from Screeners

1) Volatility, Volume & daily range compression scanner

2) Punch-Drunk-Love

3) GE Ratio - to track fundamentally strong stocks

4) Recently created one to track Power Play setups.

I get around 150-200 stocks daily & choose the ones with the most potential.

Sir, How do u find a set up - Do you track chart of each stock daily ? Or do u have filters , that lead you to a number of stocks , after which you scan them.

— AKASH GUPTA (@lockdownmurti) August 25, 2021