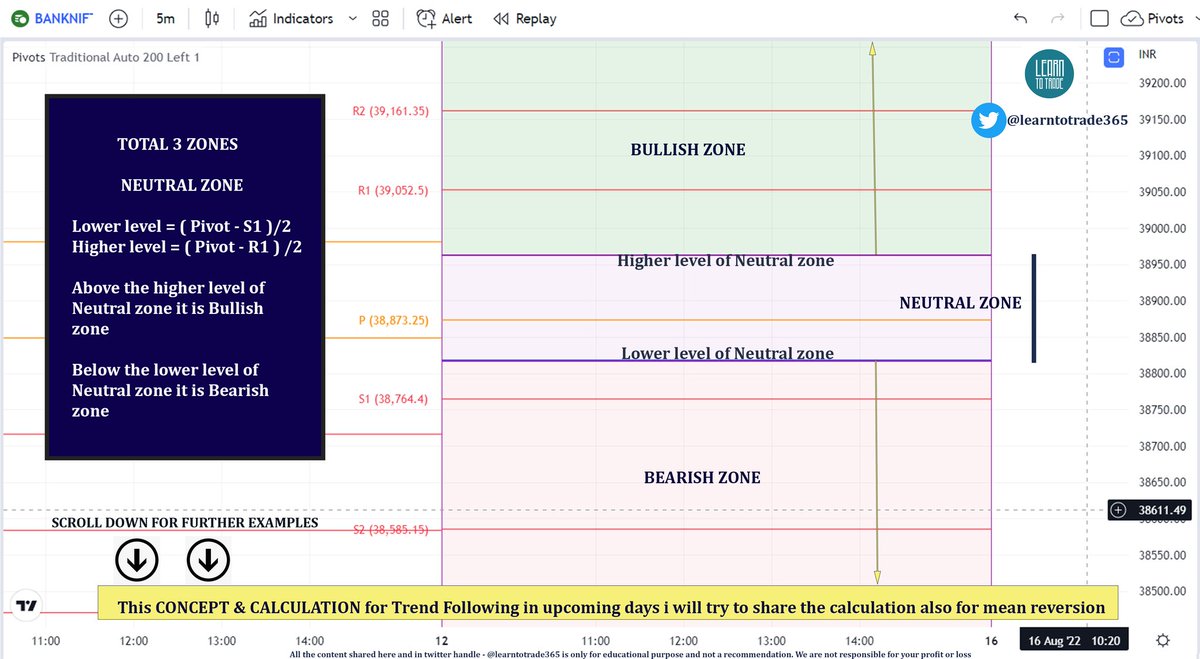

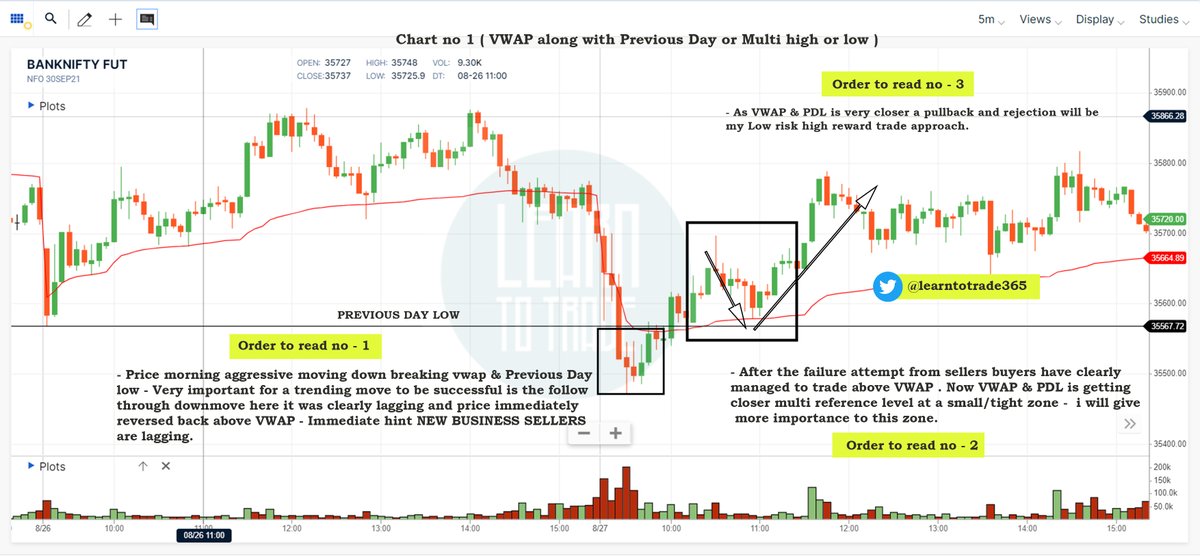

VWAP for intraday Trading Part -2

A small thread.

PART 1 - https://t.co/ooxepHpYKL

Traders show your support by like & retweet to benefit all

@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @RajarshitaS @Puretechnicals9 @AnandableAnand @Anshi_________ @ca_mehtaravi

VWAP for intraday Trading Part -1

— Learn to Trade (@learntotrade365) August 28, 2021

A small thread PART -2 will be released tomorrow

Traders show your support by like & retweet to benefit all@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @ArjunB9591 @CAPratik_INDIAN @RajarshitaS @Stockstudy8 @vivbajaj @Prakashplutus pic.twitter.com/y8bwisM4hB

More from Learn to Trade

Here in this Thread 🧵 a effective technique i use to trade both breakout & false breakout

It will take 5 minutes to read

Kindly RETWEET this tweet if you find the content useful so it can reach and benefit many traders

Scroll down 👇

I do daily Live Market session via Youtube Live ( Monday to Friday morning 9:00 a.m to 01:00 p.m.

Follow us @learntotrade365 . Join the Telegram Channel for live market updates

https://t.co/VU0bCGjU7s

Scroll down 👇

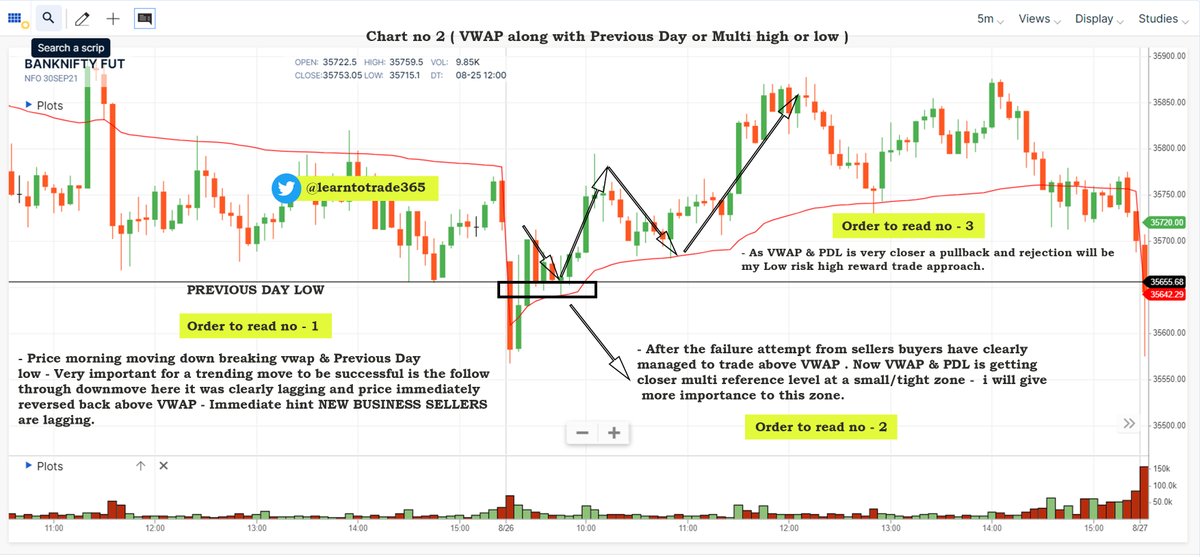

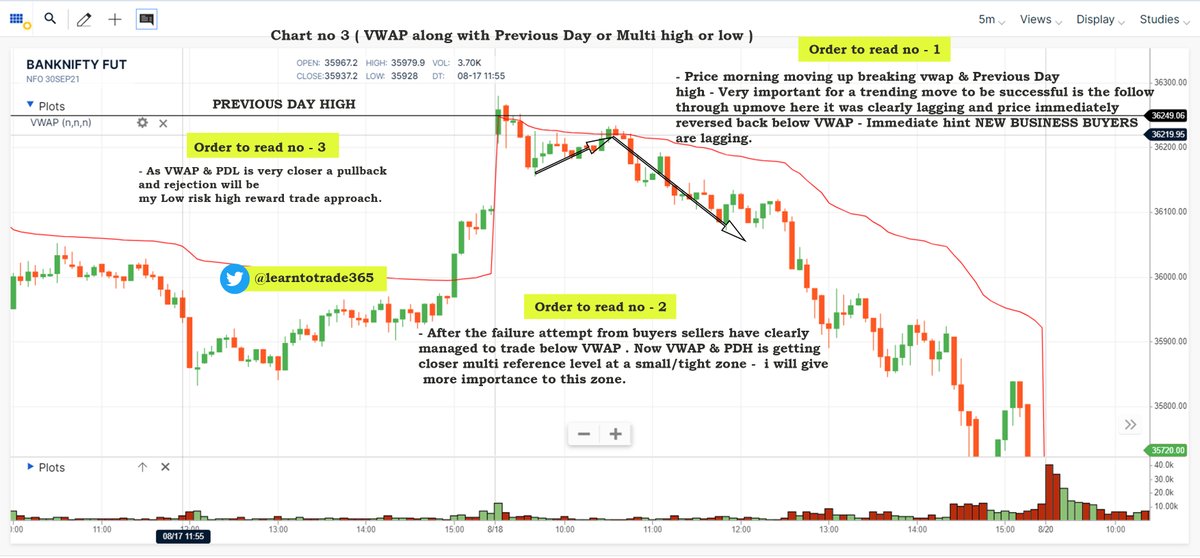

Main problem most breakout traders face is false breakout. So if we understand other side of breakout trading false breakout can also be used as a trading opportunity . Read this thread i have shared few examples.

Chart example - 1

Scroll down👇

Rather getting confused whether the breakout will be a success or failure - look in perspective of double opportunity

Chart example -2

Scroll down 👇

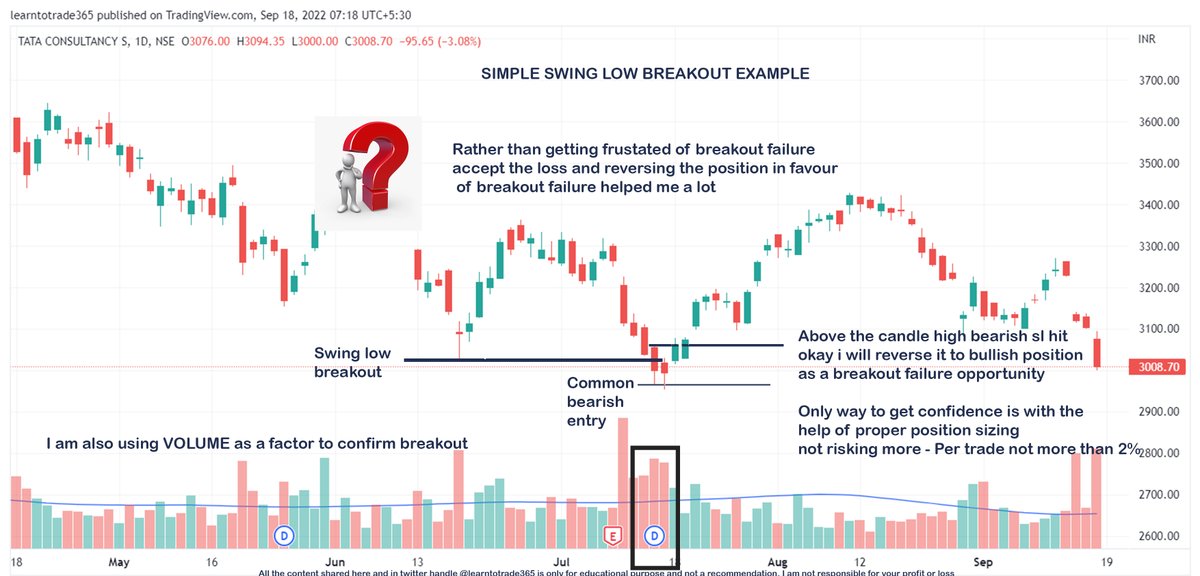

Breakout trading using simple Swing levels. Below example is about making use of false breakout as a trade opportunity. Controlled position sizing can only help a trader to become profitable

Chart example 3

Scroll down 👇

Very important thread for all option buyers 🧵

Just 5 to 10 minutes to read but it can change your trading a lot.

Support us by RETWEET this tweet to help more option buyers to gain knowledge & to avoid getting trapped from big players https://t.co/yBZ6Y7BaGx

Option Buying Simplified

— Learn to Trade (@learntotrade365) August 31, 2022

Very important thread for all option buyers \U0001f9f5

Just 5 minutes to read but it can change your trading a lot.

Support us by RETWEET this tweet to help most option buyers to gain knowledge & to avoid getting trapped from big players pic.twitter.com/BaaTjJix7F

I do Intraday Live Market session via Youtube Live on all trading days - Follow us on twitter @learntotrade365

Join the Telegram channel for Live Market updates and more free content.

Scroll down

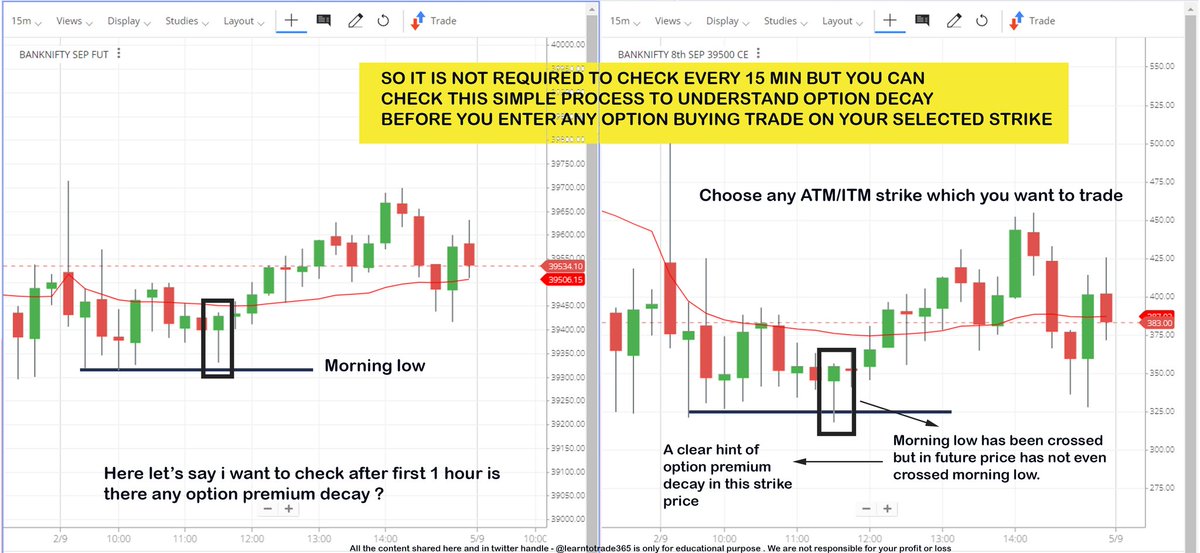

Main problem which most option buyers face is Option Premium erosion ( Theta Decay ). So I have shared a simple & effective process to understand the option decay during Live Market before entering option buying trades

Scroll down 👇

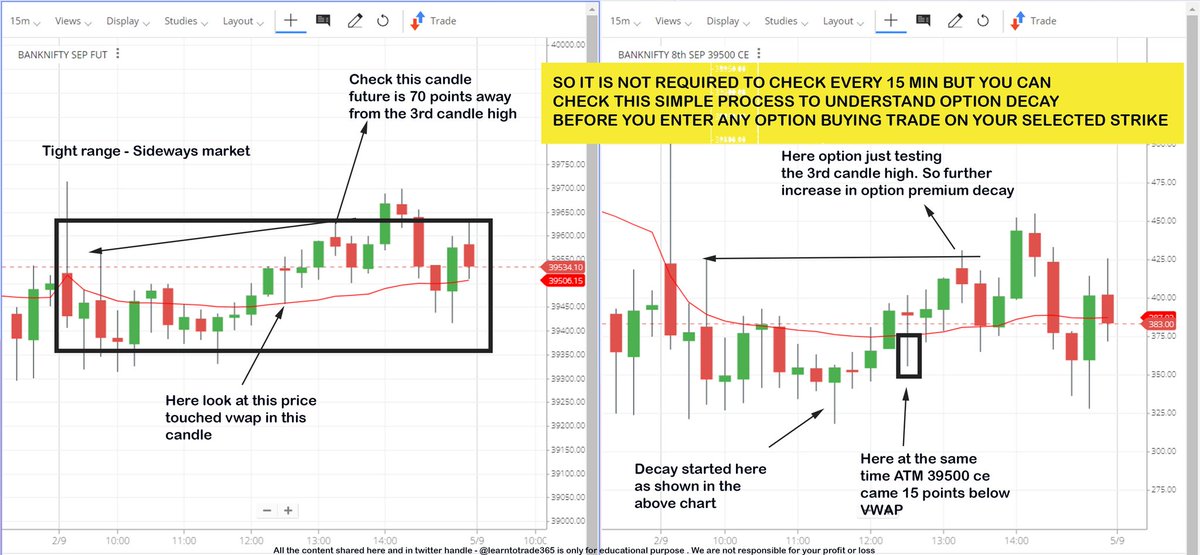

Follow up example from the above chart about Option premium decay during sideways market. In general most option premium erosion (theta decay) happens during sideways market.

Theta is option buyers ENEMY

Scroll down 👇

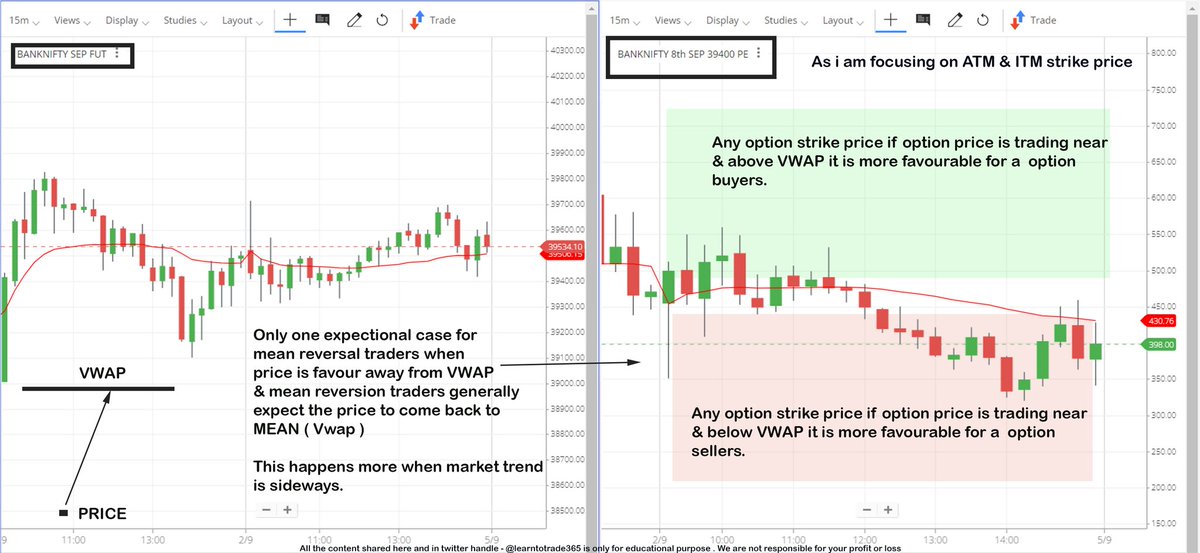

Option Buyers high probability zones while trading ATM & ITM strike prices.

VWAP helps a lot in providing data during Live Market

Scroll down 👇

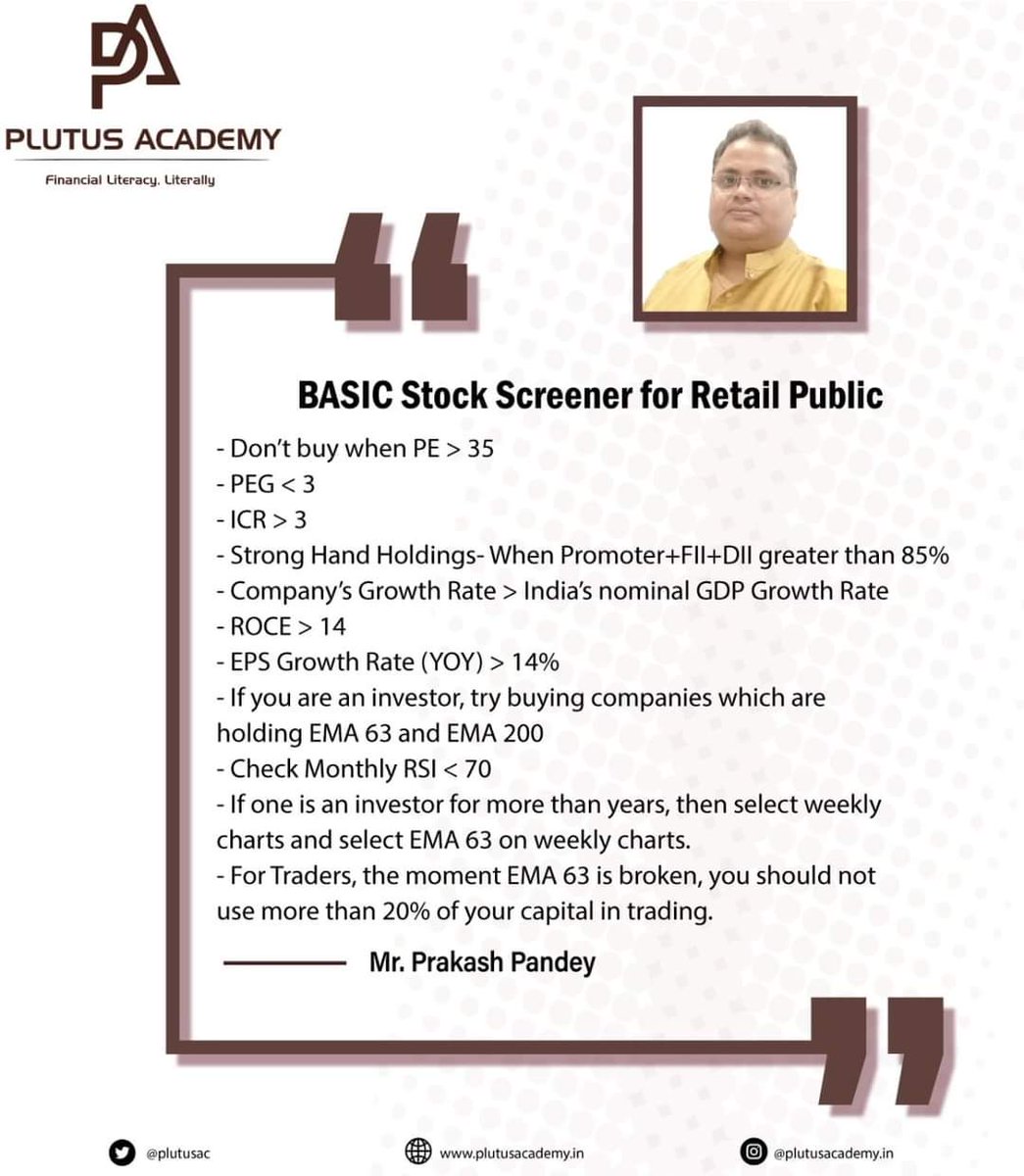

More from Screeners

A small tribute/gift to members

Screeners

technical screeners - intraday and positional both

before proceeding - i have helped you , can i ask you so that it can help someone else too

thank you

positional one

run - find #stock - draw chart - find levels

1- Stocks closing daily 2% up from 5 days

https://t.co/gTZrYY3Nht

2- Weekly breakout

https://t.co/1f4ahEolYB

3- Breakouts in short term

https://t.co/BI4h0CdgO2

4- Bullish from last 5

intraday screeners

5- 15 minute Stock Breakouts

https://t.co/9eAo82iuNv

6- Intraday Buying seen in the past 15 minutes

https://t.co/XqAJKhLB5G

7- Stocks trading near day's high on 5 min chart with volume BO intraday

https://t.co/flHmm6QXmo

Thank you

It's much more powerful than you think

9 things TradingView can do, you'll wish you knew yesterday: 🧵

Collaborated with @niki_poojary

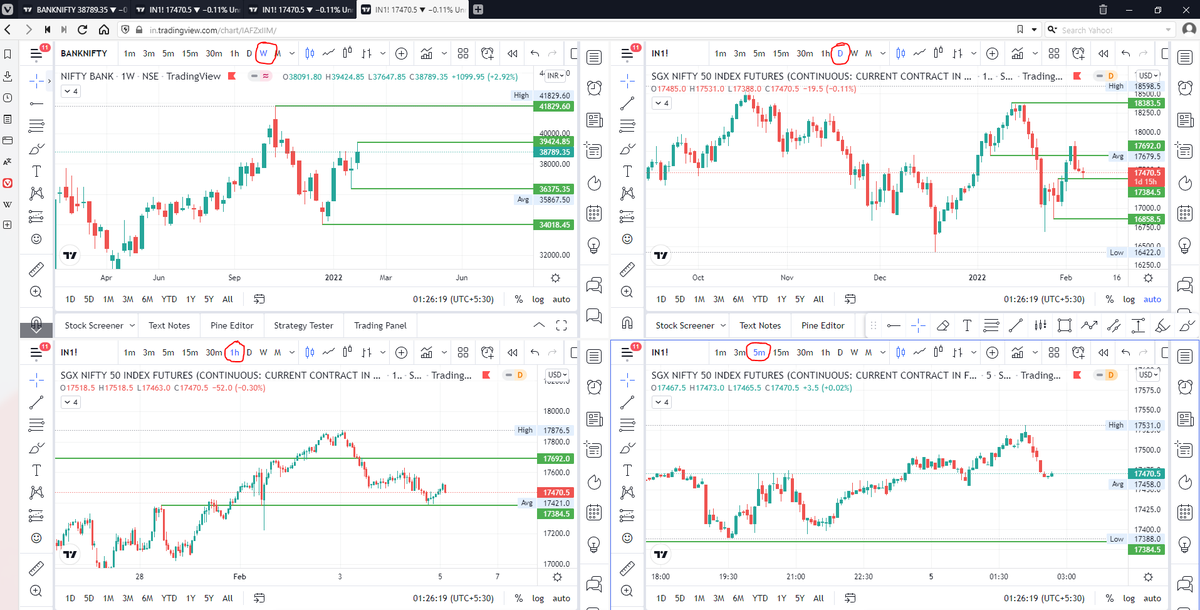

1/ Free Multi Timeframe Analysis

Step 1. Download Vivaldi Browser

Step 2. Login to trading view

Step 3. Open bank nifty chart in 4 separate windows

Step 4. Click on the first tab and shift + click by mouse on the last tab.

Step 5. Select "Tile all 4 tabs"

What happens is you get 4 charts joint on one screen.

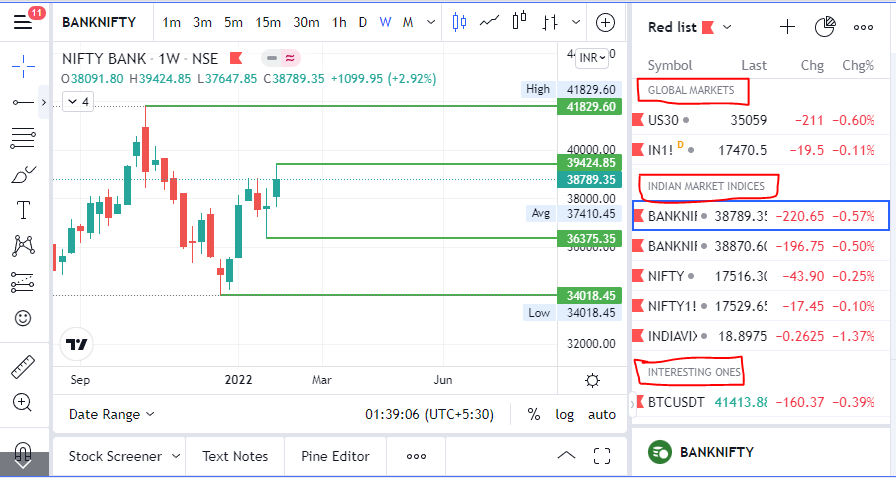

Refer to the attached picture.

The best part about this is this is absolutely free to do.

Also, do note:

I do not have the paid version of trading view.

2/ Free Multiple Watchlists

Go through this informative thread where @sarosijghosh teaches you how to create multiple free watchlists in the free

\U0001d5e0\U0001d602\U0001d5f9\U0001d601\U0001d5f6\U0001d5fd\U0001d5f9\U0001d5f2 \U0001d600\U0001d5f2\U0001d5f0\U0001d601\U0001d5fc\U0001d5ff \U0001d604\U0001d5ee\U0001d601\U0001d5f0\U0001d5f5\U0001d5f9\U0001d5f6\U0001d600\U0001d601 \U0001d5fc\U0001d5fb \U0001d5e7\U0001d5ff\U0001d5ee\U0001d5f1\U0001d5f6\U0001d5fb\U0001d5f4\U0001d603\U0001d5f6\U0001d5f2\U0001d604 \U0001d602\U0001d600\U0001d5f6\U0001d5fb\U0001d5f4 \U0001d601\U0001d5f5\U0001d5f2 \U0001d5d9\U0001d5e5\U0001d5d8\U0001d5d8 \U0001d603\U0001d5f2\U0001d5ff\U0001d600\U0001d5f6\U0001d5fc\U0001d5fb!

— Sarosij Ghosh (@sarosijghosh) September 18, 2021

A THREAD \U0001f9f5

Please Like and Re-Tweet. It took a lot of effort to put this together. #StockMarket #TradingView #trading #watchlist #Nifty500 #stockstowatch

3/ Free Segregation into different headers/sectors

You can create multiple sections sector-wise for free.

1. Long tap on any index/stock and click on "Add section above."

2. Secgregate the stocks/indices based on where they belong.

Kinda like how I did in the picture below.